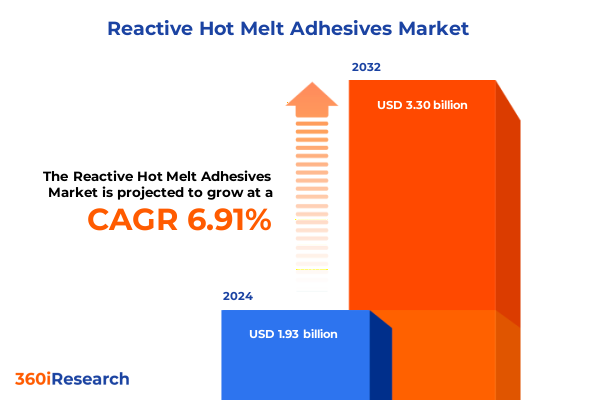

The Reactive Hot Melt Adhesives Market size was estimated at USD 2.06 billion in 2025 and expected to reach USD 2.19 billion in 2026, at a CAGR of 6.96% to reach USD 3.30 billion by 2032.

Pioneering the Future of Bonding with Reactive Hot Melt Adhesives Shaping Innovative Applications Across Diverse Industrial Landscapes

Reactive hot melt adhesives represent a class of solvent-free thermoplastic formulations that cure through moisture or chemical reactions, forming bonds with exceptional strength, durability, and environmental resistance. These adhesives combine the rapid set speed and ease of application of traditional hot melts with secondary curing mechanisms that deliver enhanced green strength and high-temperature tolerance. Dual-cure systems that integrate hot melt and ultraviolet technologies are further expanding the performance envelope, enabling secure bonding of diverse substrates under extreme conditions relevant to automotive and aerospace industries.

Against a backdrop of rising demands for faster assembly cycles, reduced volatile organic compound emissions, and sustainable material solutions, reactive hot melt adhesives have emerged as an indispensable component in modern manufacturing. The packaging sector’s explosive growth driven by e-commerce has particularly underscored their value in carton sealing, case forming, and flexible packaging applications where speed, reliability, and low environmental impact are critical. With regulatory frameworks tightening on emissions and hazardous solvents, these adhesives have gained prominence for balancing operational efficiency with compliance and sustainability goals.

Breakthrough Technological and Sustainability-Driven Shifts Redefining the Reactive Hot Melt Adhesives Industry in a Rapidly Evolving Landscape

Technological breakthroughs are reshaping the reactive hot melt adhesives landscape by introducing formulations that cure faster, deliver higher bond strength, and adapt to emerging manufacturing paradigms. Advanced dual-cure chemistries now allow applicators to optimize green strength while achieving final curing through UV irradiation, addressing the needs of high-speed packaging lines and complex multi-material assemblies. Concurrently, the rise of bio-based and compostable raw materials has positioned these adhesives at the intersection of performance and environmental stewardship, with several leading developers achieving significant cradle-to-gate carbon footprint reductions in recent formula launches.

Smart adhesive technologies are also on the horizon, with self-healing and adaptive formulations that respond to temperature or pressure variations, enhancing reliability in electronics and aerospace applications. In parallel, the integration of Industry 4.0 principles-such as real-time performance monitoring through IoT sensors-has enabled proactive quality control and streamlined maintenance decision-making, reinforcing the crucial role of reactive hot melt adhesives in advanced manufacturing ecosystems.

Assessing the Complex Trade Environment and Tariff Implications for Reactive Hot Melt Adhesives Amid Evolving United States Trade Policies in 2025

Reactive hot melt adhesives imported under HTS 3506.91 continue to face a general rate of 2.1 percent, while imports from China are subject to a special 20 percent duty, reflecting longstanding trade policy distinctions for adhesives-based products. Despite successive rounds of Section 301 tariff adjustments introduced through 2024 and effective in 2025, adhesives classified under HTS 3506 remain absent from the additional duty lists published in Annex A, ensuring that no incremental 25 percent Section 301 tariff is levied on these products in the current cycle.

However, adjacent value chain elements-such as coated packaging films falling under headings like 3919.90 and 3920.10-have incurred increased duties, influencing the total landed cost for customers using adhesive-laminated substrates and prompting strategic supply chain realignment. To mitigate exposure, manufacturers are diversifying sourcing to North American and European producers, while also exploring nearshoring opportunities to maintain cost competitiveness and continuity of supply in an increasingly complex trade environment.

Unveiling Critical Market Segmentation Insights Highlighting Application, Type, Form, Technology, and Distribution Trends in Reactive Hot Melt Adhesives

A nuanced segmentation framework reveals the multifaceted nature of demand for reactive hot melt adhesives. In automotive assembly, applications range from exterior components requiring resistance to weathering and UV exposure to interior trim bonding that prioritizes rapid green strength. Bookbinding utilizes case binding for hardcover volumes and perfect binding for paperbacks, each demanding specific open time and curing properties. Within electronics, component bonding emphasizes precise positioning, while PCB assembly requires strong adhesion of low–thermal-expansion substrates. The packaging sector spans flexible film lamination and rigid carton sealing, with each application driving unique melt viscosity and setting time requirements. Woodworking applications include resilient flooring installations and high-strength furniture assembly, balancing moisture resistance with aesthetic finish considerations.

Product type further refines the competitive landscape, from ethylene acrylic acid and ethylene vinyl acetate grades that excel in flexibility and adhesion, to polyamide formulations prized for temperature stability and polyurethane adhesives valued for superior shear strength. Form variations-granules, liquids, pellets, and solid sticks-cater to automation needs or manual application scenarios, influencing melt delivery systems and equipment investments. Crosslinked technologies deliver irreversible bonds for permanent assemblies, while non-crosslinked variants offer reworkability and joint repair. Distribution channels range from direct OEM partnerships for customized solutions to distributor networks serving small and mid-size processors, and online platforms meeting rapid replenishment needs for aftermarket and regional customers.

This comprehensive research report categorizes the Reactive Hot Melt Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Technology

- Application

- Distribution Channel

Examining Regional Variations and Growth Drivers Alongside Emerging Opportunities Across Americas, EMEA, and Asia-Pacific Reactive Hot Melt Adhesive Markets

In the Americas, a robust manufacturing base spanning automotive, electronics, and packaging underpins steady demand for reactive hot melt adhesives that satisfy stringent performance requirements. Market leaders continue to expand capacity in North America to support regional OEMs emphasizing nearshoring and just-in-time delivery models, while end users are increasingly specifying bio-based and low-VOC formulations to align with corporate sustainability commitments and state-level regulatory frameworks.

Across Europe, the Middle East, and Africa, regulatory oversight of chemical substances under REACH and VOC emission limits has accelerated the adoption of eco-friendly reactive hot melt adhesives. In Europe, particularly, leading adhesive developers are investing in pilot plants to trial renewable raw material chemistries, while Middle Eastern and African markets show growing interest in modular packaging applications driven by expanding e-commerce and food processing sectors.

The Asia-Pacific region remains the fastest-growing market, fueled by China’s extensive electronics contract manufacturing, India’s booming packaging industry, and Southeast Asia’s automotive and construction investments. Local adhesive producers are scaling up capacity in China and India to capture volume, yet supply chain disruptions and regional content requirements are encouraging global formulators to establish joint ventures and localized production to secure market share.

This comprehensive research report examines key regions that drive the evolution of the Reactive Hot Melt Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Innovations of Leading Global Players Shaping the Reactive Hot Melt Adhesives Market Landscape

Leading global players are driving innovation and shaping market dynamics through product launches, strategic partnerships, and capacity expansions. In April 2024, key developers introduced bio-based SUPRA formulations that reduced cradle-to-gate carbon footprints by 25 percent through proprietary rosin ester and polyolefin elastomer technologies, demonstrating a commitment to sustainability without performance compromise. In parallel, several manufacturers unveiled low-monomer reactive systems optimized for electronics, addressing stringent hazard labeling requirements in critical markets and supporting advanced device assembly processes.

Major chemical companies have also pursued strategic investments to strengthen their adhesive portfolios and geographic reach. Collaborative initiatives between adhesive formulators and OEM integrators are accelerating co-development of customized solutions, while acquisitions of specialty resin producers are enhancing vertical integration. These moves underscore a competitive landscape where product differentiation, regulatory compliance, and customer collaboration define success in the reactive hot melt adhesives segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Reactive Hot Melt Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Avery Dennison Corporation

- Beardow & Adams (Adhesives) Limited

- Bühnen GmbH & Co. KG

- Cattie Adhesives

- Cherng Tay Technology Co., Ltd.

- Clariant AG

- Costchem Srl

- Covestro AG

- Daubert Chemical Company

- DIC Corporation

- Eastman Chemical Company

- Evans Adhesive Corporation, Ltd. by Meridian Adhesives Group LLC

- Evonik Industries AG

- H.B. Fuller Company

- Helmitin Inc.

- Henkel AG & Co. KGaA

- Intercol BV

- Jowat SE

- Kleiberit SE & Co. KG

- Lubrizol Corporation

- MORESCO Corporation

- Nan Pao Resins Chemical Co., Ltd.

- Sanyhot Adhesivos, S.A.

- Sika AG

- Tex Year Industries Inc.

- The Dow Chemical Company

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Challenges in Reactive Hot Melt Adhesive Markets

To capitalize on emerging opportunities, industry leaders should prioritize R&D investments in sustainable chemistries, leveraging bio-based polymers and green curatives to meet escalating environmental requirements. Engaging closely with end-user OEMs through co-development programs will enable the creation of tailored adhesive solutions that enhance product performance and foster long-term partnerships. Additionally, expanding digital application capabilities-such as robotics-integrated dispensing systems and real-time bond monitoring-can drive operational efficiencies and quality consistency across high-volume production lines.

Supply chain resilience must remain a strategic focus, with diversification of raw material sourcing and targeted nearshoring initiatives reducing exposure to trade uncertainties and logistics disruptions. Establishing regional technical support hubs can bolster customer service and accelerate troubleshooting for critical applications. Finally, active participation in standards-setting bodies and proactive regulatory engagement will ensure that product portfolios remain compliant and market-ready, allowing companies to anticipate policy changes and maintain competitive advantage in a dynamic trade landscape.

Comprehensive Research Methodology Employed to Generate Robust Insights into Reactive Hot Melt Adhesive Market Segmentation and Trends

This research integrates both primary and secondary methodologies to deliver a robust market intelligence framework. Primary research involved in-depth interviews with industry stakeholders, including formulation scientists, equipment suppliers, and key end users, to capture qualitative insights on emerging applications and technology adoption. Secondary research comprised analysis of government publications, trade databases, patent filings, and company filings to validate historical trends and compile a comprehensive HTS classification review.

Data triangulation ensured accuracy by cross-referencing findings from multiple sources, while a rigorous segmentation approach-covering application, type, form, technology, and distribution-enabled nuanced insight into market dynamics. Regional analyses were informed by localized demand drivers, regulatory environments, and competitive landscapes. Finally, iterative validation sessions with subject matter experts refined the narrative and confirmed the strategic implications, ensuring that the conclusions and recommendations resonate with both executives and technical teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Reactive Hot Melt Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Reactive Hot Melt Adhesives Market, by Type

- Reactive Hot Melt Adhesives Market, by Form

- Reactive Hot Melt Adhesives Market, by Technology

- Reactive Hot Melt Adhesives Market, by Application

- Reactive Hot Melt Adhesives Market, by Distribution Channel

- Reactive Hot Melt Adhesives Market, by Region

- Reactive Hot Melt Adhesives Market, by Group

- Reactive Hot Melt Adhesives Market, by Country

- United States Reactive Hot Melt Adhesives Market

- China Reactive Hot Melt Adhesives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusive Perspectives Highlighting Growth Imperatives, Opportunities, and Strategic Imperatives in the Reactive Hot Melt Adhesives Landscape

The reactive hot melt adhesives landscape is characterized by rapid technological innovation, evolving regulatory pressures, and shifting trade dynamics. Strong performance demands across automotive, electronics, packaging, woodworking, and bookbinding applications underscore the need for tailored formulations that balance speed, durability, and environmental compliance. Market segmentation analysis highlights the diverse requirements that drive material selection and application methods, while regional insights reveal varied growth trajectories shaped by manufacturing footprints and sustainability priorities.

Strategic imperatives for market participants include investing in sustainable chemistries, enhancing supply chain resilience, and fostering collaborative partnerships with OEMs and equipment providers. By aligning product development with emerging application challenges and regulatory frameworks, companies can secure competitive advantage and drive long-term growth in this high-performance adhesive segment.

Contact Associate Director Ketan Rohom Today to Secure the Comprehensive Reactive Hot Melt Adhesives Market Research Report and Empower Strategic Decision-Making

To explore the in-depth findings of this comprehensive analysis and gain access to detailed segment-level data, regional breakdowns, and strategic insights tailored to your business needs, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the reactive hot melt adhesives market research report and equip your organization with authoritative intelligence for decisive action.

- How big is the Reactive Hot Melt Adhesives Market?

- What is the Reactive Hot Melt Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?