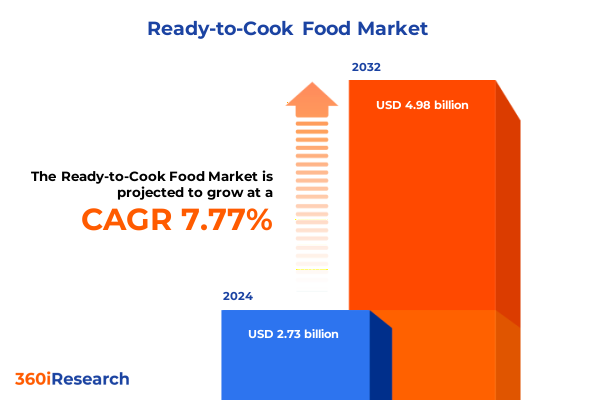

The Ready-to-Cook Food Market size was estimated at USD 2.95 billion in 2025 and expected to reach USD 3.18 billion in 2026, at a CAGR of 7.78% to reach USD 4.98 billion by 2032.

Setting the Stage for a Flourishing Ready-to-Cook Landscape Defined by Evolving Consumer Demand Patterns and Innovative Product Offerings

The ready-to-cook food sector has evolved from a niche convenience offering to a mainstream solution that caters to time-pressed consumers seeking high-quality meals with minimal preparation effort. Fueled by shifting demographics, urbanization, and the pervasive influence of digital media, the market has witnessed a surge in demand for products that balance culinary authenticity with ease of use. This dynamic environment has encouraged both established food producers and emerging brands to explore novel formulations, premium ingredients, and streamlined cooking processes that resonate with a broad spectrum of lifestyle preferences.

Simultaneously, advancements in cold chain logistics and packaging technologies have reduced barriers to entry, enabling a greater variety of ready meal formats to reach supermarket shelves and e-commerce platforms alike. Innovative collaborations between ingredient specialists, culinary influencers, and technology providers have accelerated the pace of product development, ensuring that offerings remain aligned with evolving taste profiles and nutritional expectations. As environmental sustainability has ascended on the corporate agenda, manufacturers are also integrating recyclable packaging solutions and responsibly sourced ingredients to meet growing consumer scrutiny around ecological impact.

Building upon this multifaceted backdrop, the following sections delve into the transformative shifts shaping the industry, examine the repercussions of tariff adjustments, and reveal granular segmentation insights that illuminate consumer behavior. By unpacking regional trends, profiling key market participants, and presenting strategic recommendations, this analysis equips decision-makers with the critical intelligence needed to navigate and thrive in the competitive ready-to-cook landscape.

Uncovering Pivotal Transformations Reshaping the Ready-to-Cook Food Sector Through Technological Innovation and Changing Lifestyle Dynamics

Amid the accelerating pace of change in the food industry, digitalization has emerged as a core catalyst for market expansion, enabling brands to engage directly with consumers through personalized marketing and seamless online ordering experiences. Subscription models have redefined the meal kit proposition by offering curated menus, flexible delivery schedules, and tailored dietary options that align with individual health objectives. Simultaneously, e-commerce platforms have empowered specialty retailers and emerging challengers to forge meaningful connections with niche audiences, bypassing traditional distribution constraints and fostering communities of loyal brand advocates.

Parallel to these distributional advances, the imperative for sustainability and wellness has spurred a renaissance in product formulation, prompting manufacturers to innovate around plant-based proteins, clean-label ingredients, and nutrient-dense meal profiles. Consumers today demand transparency and authenticity, driving companies to fortify their supply chains with traceable sourcing practices and to invest in regenerative agriculture partnerships. As a result, a new generation of ready-to-cook offerings has surfaced, blending culinary heritage with modern nutritional science to deliver both convenience and conscience.

The integration of emerging technologies continues to redefine the consumer cooking journey by introducing smart appliances that sync with recipe instructions, dynamic packaging that adjusts cook times to ambient conditions, and data analytics that anticipate replenishment needs. Machine learning algorithms now analyze consumer feedback and consumption patterns to optimize menu rotations, reduce waste, and predict flavor trends. Together, these transformative shifts are coalescing to elevate the ready-to-cook landscape into a highly adaptive and consumer-centric ecosystem.

Assessing the Cumulative Consequences of 2025 United States Tariff Policies on the Supply Chain and Cost Structures Within the Ready-to-Cook Food Segment

The introduction of revised tariff schedules by the United States Trade Representative in early 2025 has injected new complexity into the ready-to-cook market, particularly for manufacturers reliant on imported ingredients and packaging components. Duties applied to select vegetable proteins, dairy derivatives, and flexible film materials have elevated input costs, compelling suppliers to reexamine sourcing strategies. As a result, some companies have begun redirecting procurement toward domestic producers, while others negotiate long-term contracts with international partners to hedge against further escalations in duty rates.

With rising raw material expenses filtering through to production budgets, margin compression has become an urgent concern for food manufacturers. Several industry players have responded by implementing tiered pricing structures and introducing entry-level SKUs that leverage cost-effective formulations without undermining product quality. However, the necessity to maintain competitive price points has spurred investments in process efficiencies, such as high-speed aseptic packaging lines and optimized logistics routes, designed to offset tariff-induced cost increases and preserve profitability.

Looking ahead, the sustained impact of tariff revisions is anticipated to foster greater supply chain resilience as market participants diversify their vendor base and pursue nearshoring initiatives. Collaborative sourcing alliances, joint ventures with domestic ingredient specialists, and the adoption of alternative packaging platforms are gaining traction as strategic levers to mitigate the volatility introduced by protectionist trade measures. These adaptive measures underscore a broader industry commitment to safeguarding operational continuity in the face of evolving regulatory landscapes.

Deconstructing Market Segmentation to Reveal Consumer Preferences Across Product Types Channels Packaging Formats and End User Applications

An examination of product type segmentation highlights two primary categories shaping consumer choice: meal kits and ready meals. Within meal kits, discerning shoppers bifurcate their selections between retail meal kits available in supermarket aisles and subscription meal kits delivered directly to their doorsteps on a recurring schedule. Retail meal kits appeal to those seeking the convenience of immediate in-store acquisition, whereas subscription meal kits cultivate ongoing relationships through curated menus and customizable dietary profiles. The ready meals category, on the other hand, encompasses ambient formats that thrive on shelf stability, chilled offerings designed for fridge storage, and frozen varieties optimized for extended preservation. Each of these subcategories serves distinct consumer occasions, from improvised weeknight dinners to bulk preparation scenarios.

Distribution channel segmentation further illuminates the pathways through which ready-to-cook products reach end users. Convenience stores deliver instant gratification for impulse-based purchases and last-minute meal solutions. Specialty stores cater to niche interests by curating premium and international ready-to-cook options, while supermarkets and hypermarkets drive broad-market visibility with ample choice and promotional activity. The online retail channel has expanded rapidly, balancing brand-owned e-commerce sites where companies maintain direct consumer touchpoints against third-party platforms that amplify reach through marketplace dynamics. This dual-pronged online approach has proven instrumental in capturing both loyal subscribers and spontaneous one-time buyers.

Diverse packaging formats play a critical role in reinforcing brand differentiation, operational efficiency, and consumer convenience. Bag formats are prized for lightweight portability and minimal storage footprint, bowls cater to heat-and-serve occasions with integrated serving vessels, pouches offer flexible reheating profiles and compact disposal, and tray structures support premium presentations with compartmentalized meal components. Overarching these distribution and packaging considerations are end user applications that dichotomize demand between residential households and food service operators. Within food service channels, catering professionals, institutional buyers, and restaurants leverage ready-to-cook items to streamline back-of-house processes and ensure consistent portion control.

Finally, the cuisine type segmentation underscores the importance of cultural authenticity and flavor diversity as market drivers. Asian cuisines, segmented further into Chinese, Indian, and Japanese offerings, continue to expand their footprint alongside Latin American, Middle Eastern, and Western options. Culinary explorers seeking bold spices or familiar comfort foods alike gravitate toward products that transport them across regions while maintaining the ease of home preparation. Together, these segmentation lenses provide a composite view of consumer preferences and inform targeted strategies that resonate with specific audience segments.

This comprehensive research report categorizes the Ready-to-Cook Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Format

- Cuisine Type

- Distribution Channel

- End User

Highlighting Regional Nuances That Drive Ready-to-Cook Food Adoption Across the Americas Europe Middle East & Africa and Asia-Pacific Markets

In the Americas, busy lifestyles and a proliferation of urban center populations have fueled demand for convenient meal solutions, with North America leading in subscription meal kit penetration. Consumers across the United States and Canada increasingly embrace innovative value propositions that blend culinary exploration with time-saving convenience. Latent growth in Latin American markets is propelled by rising disposable incomes and expanding cold chain infrastructure, enabling brands to introduce chilled and frozen ready meals in urban centers that previously lacked reliable refrigeration networks. These dynamics have encouraged manufacturers to tailor offerings to regional taste profiles, such as incorporating local ingredients and spice blends that resonate with both metropolitan and emerging suburban consumers.

Across Europe, the Middle East, and Africa, market growth is characterized by divergent consumer priorities and regulatory environments. Western European countries emphasize sustainability and health optimization, prompting a surge in organic and plant-based ready-to-cook introductions. In the Gulf Cooperation Council states, expatriate populations and high dining-out frequencies create opportunities for premium and fusion-based offerings. Meanwhile, African markets leverage local staples and indigenous grains to develop regionally relevant meal solutions, though infrastructure constraints in parts of the continent necessitate innovative packaging that can withstand extended distribution cycles. Regulatory complexities and import duties across this diverse region compel brands to forge local manufacturing partnerships to maintain competitive pricing and ensure compliance.

The Asia-Pacific region presents a tapestry of mature and nascent markets underpinned by distinct consumption habits. In developed East Asian economies, consumers demand high-quality chilled and ambient ready meals that emphasize freshness, while in South and Southeast Asia, rapid urbanization and digital adoption spur growth in direct-to-consumer meal kit subscriptions. Across Australia and New Zealand, lifestyle trends mirror those in North America, with a premium placed on health credentials and locally sourced ingredients. These regional nuances underscore the importance of geographically tailored product assortments and distribution models, guiding market participants toward context-specific strategies that align with consumer expectations and operational realities.

This comprehensive research report examines key regions that drive the evolution of the Ready-to-Cook Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players and Strategic Positioning That Define Competitive Dynamics in the Ready-to-Cook Food Ecosystem

A cohort of multinational conglomerates and agile challengers anchors the ready-to-cook landscape, each employing distinct approaches to capture consumer loyalty and drive incremental growth. Established food producers leverage expansive distribution networks, diversified product portfolios, and scale-driven cost advantages to maintain leadership in ambient and frozen ready meals. Their strategies emphasize incremental innovation, such as reformulated recipes with improved nutritional profiles and eco-friendly packaging upgrades, to retain shelf presence and appeal to evolving taste trends among mainstream shoppers.

In contrast, pure-play meal kit providers continue to refine their direct-to-consumer models by harnessing data-driven personalization and curated culinary experiences. These companies differentiate themselves through inventive menu rotations, themed promotions, and collaborations with celebrity chefs, thereby fostering brand advocacy and reducing churn. Strategic partnerships with grocery retailers have enabled cross-channel integration that extends subscription audiences into brick-and-mortar environments, while investments in cold chain optimization enhance operational efficiency and support geographic expansion.

Emerging entrants and regional specialists further enrich the competitive tapestry by focusing on niche segments and under-served consumer cohorts. Innovators targeting plant-based, ethnic, or functional nutrition categories bring a heightened sense of purpose and authenticity to their offerings, challenging incumbents to elevate product differentiation. Moreover, a wave of mergers and acquisitions has unfolded as both legacy players and venture-backed brands seek to fortify their market positions through complementary capabilities, such as proprietary digital platforms, supply chain expertise, and accelerated R&D pipelines. Together, these strategic maneuvers reflect an industry in vigorous flux, where agility and consumer-centric innovation serve as the primary levers of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ready-to-Cook Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Bakkavor Foods PLC

- Campbell Soup Company

- CG Corp.

- Conagra Brands, Inc.

- Desai Foods Pvt Ltd.

- General Mills, Inc.

- Gits Food Products Pvt. Ltd.

- Godrej Agrovet Ltd.

- Hormel Foods Corporation

- HyFun Foods

- iD Fresh Food (India) Pvt. Ltd.

- ITC Ltd.

- Kohinoor Foods Ltd.

- McCain Foods Ltd.

- MTR Foods Pvt. Ltd.

- Nestle S.A.

- Nomad Foods Limited

- Pink Harvest Farms

- Raised & Rooted

- Regal Kitchen Foods Ltd.

- Tat Hui Foods Pte. Ltd.

- Tata Sons Pvt. Ltd.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- The Schwan Food Company

- Tyson Foods, Inc.

- Unilever PLC

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Strengthen Market Footprint in Ready-to-Cook Foods

To harness the momentum generated by shifting consumer behaviors, companies should prioritize the integration of advanced analytics into their product development cycles. By deploying predictive modeling to interpret consumption patterns and regional taste preferences, manufacturers can optimize SKU rationalization and anticipate flavor trends more accurately. This data-driven approach extends beyond marketing into supply chain orchestration, enabling dynamic inventory management that reduces waste and enhances service levels in both retail and direct-to-consumer channels.

A renewed focus on sustainability and circularity will resonate deeply with environmentally conscious consumers. Manufacturers can enhance brand perception by adopting recyclable or compostable packaging innovations and by securing verifiable commitments to responsible sourcing. Engaging in transparent storytelling around these initiatives-through digital platforms and on-package labeling-reinforces trust and differentiates offerings in crowded market segments. Collaboration with material science start-ups and packaging consortiums can accelerate access to novel, low-impact solutions.

Expanding distribution networks via omnichannel strategies remains crucial for maximizing market reach. Firms should explore partnerships with convenience store chains and specialty retailers that align with their brand ethos, while concurrently strengthening e-commerce infrastructure to support seamless consumer journeys from discovery to post-purchase engagement. Investments in last-mile logistics, combined with targeted digital marketing campaigns, can unlock incremental revenues and foster long-term customer loyalty, particularly among digitally native demographics.

Finally, cultivating strategic alliances across the value chain can fortify resilience against regulatory shifts and input cost volatility. Joint ventures with ingredient innovators, co-manufacturing agreements with regional processors, and collaborative R&D consortia can deliver shared efficiencies and expedite time-to-market for novel offerings. By embracing a collaborative mindset, market participants position themselves to navigate external pressures proactively and to co-create value in an increasingly complex ecosystem.

Elucidating the Robust Research Methodology Underpinning Comprehensive Analysis of the Ready-to-Cook Food Market with Rigorous Data Collection and Validation Procedures

This analysis synthesizes primary research inputs with extensive secondary data to present a holistic view of the ready-to-cook food sector. Primary research involved in-depth interviews with senior executives across manufacturing, distribution, and retail channels, supplemented by consumer focus groups to validate emerging preference patterns. These qualitative engagements were structured around open-ended discussions on purchasing motivations, product satisfaction, and anticipated future demands. Simultaneously, a proprietary survey targeting a demographically representative sample of end users captured quantitative metrics on consumption frequency, purchase drivers, and price elasticity across multiple regions.

Secondary research encompassed a thorough review of company annual reports, trade publications, regulatory filings, and technology white papers, in addition to a meticulous examination of import-export databases and logistics cost indices. Cross-verification of data points against third-party industry benchmarks and peer-reviewed studies ensured analytical rigor and accuracy. Statistical techniques, including triangulation and trend extrapolation, were applied to reconcile disparate data sources and to identify convergent insights. This multifaceted methodological framework ensures that the findings and recommendations presented herein rest on a solid evidentiary foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ready-to-Cook Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ready-to-Cook Food Market, by Product Type

- Ready-to-Cook Food Market, by Packaging Format

- Ready-to-Cook Food Market, by Cuisine Type

- Ready-to-Cook Food Market, by Distribution Channel

- Ready-to-Cook Food Market, by End User

- Ready-to-Cook Food Market, by Region

- Ready-to-Cook Food Market, by Group

- Ready-to-Cook Food Market, by Country

- United States Ready-to-Cook Food Market

- China Ready-to-Cook Food Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Chart a Future-Ready Pathway for Stakeholders in the Ready-to-Cook Food Market Amid Ongoing Market Flux

The convergence of technological innovation, shifting consumer expectations, and evolving regulatory landscapes has propelled the ready-to-cook food segment into a period of unprecedented transformation. Market participants who adeptly align their product portfolios with emerging lifestyle trends stand to benefit from enhanced consumer engagement and sustained revenue streams. At the same time, the residual effects of tariff adjustments underscore the importance of adaptive supply chain strategies and the pursuit of cost-mitigation levers through process optimization.

Geographical nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific regions underscore the necessity of localized approaches, from ingredient selection to distribution partnerships. Segmentation insights reveal that success will hinge on a nuanced understanding of meal occasion preferences, packaging convenience, and culinary authenticity. Meanwhile, competitive pressures are intensifying as established conglomerates and nimble challengers vie for consumer loyalty through differentiated value propositions and strategic collaborations.

Ultimately, the readiness to invest in data analytics, sustainability initiatives, omnichannel distribution, and cross-sector alliances will distinguish market leaders from follow-the-pack operators. The insights contained in this report equip stakeholders to make informed decisions, anticipate disruptive shifts, and craft resilient strategies that weather trade complexities and capitalize on new growth horizons. As the ready-to-cook domain continues to mature, those who combine agility with a steadfast commitment to consumer needs will define the industry’s trajectory.

Engage with Ketan Rohom for Exclusive Insights and Customized Strategies to Unlock Growth Potential in the Ready-to-Cook Food Market with an In-Depth Report Purchase Today

To secure a comprehensive understanding of the ready-to-cook food sector and gain actionable intelligence tailored to your strategic objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing. Drawing upon extensive industry expertise and deep analytical capabilities, this bespoke market research report provides the granular segmentation insights, regional analyses, and competitive benchmarking necessary to inform your next critical decisions. By partnering with Ketan Rohom, you will receive personalized guidance on leveraging emerging trends, navigating regulatory challenges, and accelerating innovation pipelines. Take the next step toward realizing your growth ambitions by contacting Ketan for report access and consultancy arrangements that align with your organizational imperatives.

- How big is the Ready-to-Cook Food Market?

- What is the Ready-to-Cook Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?