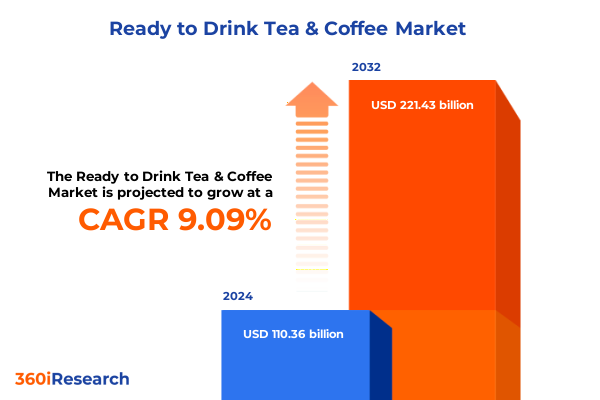

The Ready to Drink Tea & Coffee Market size was estimated at USD 119.43 billion in 2025 and expected to reach USD 129.25 billion in 2026, at a CAGR of 9.21% to reach USD 221.43 billion by 2032.

Examining How Evolving Lifestyles and Innovation Are Propelling Growth in the Ready-to-Drink Tea and Coffee Landscape

The ready-to-drink tea and coffee sector has emerged as one of the most vibrant corners of the beverage industry, fueled by shifting consumer lifestyles and an unrelenting appetite for convenience. In recent years, on-the-go consumption patterns have accelerated demand for packaged beverages that deliver both quality and speed. This transition has been underscored by the proliferation of premium cold brews, artisanal blends, and functional infusions that cater to diverse taste preferences and wellness aspirations.

Amid this surge, manufacturers have invested in novel processing techniques and sustainable packaging solutions to extend shelf life and reduce environmental impact. The intersection of health and indulgence has never been more pronounced, as consumers weigh natural ingredients and clean labels against sensory gratification. Meanwhile, digital channels and subscription models have redefined purchase journeys, enabling brands to engage directly with end users and gather real-time feedback to inform product innovation.

This executive summary provides a concise yet comprehensive overview of the forces reshaping the ready-to-drink tea and coffee landscape. It distills the transformative shifts in consumer behavior, trade policy impacts, granular segmentation insights, regional nuances, and competitive strategies. The ensuing analysis sets the stage for strategic recommendations designed to empower stakeholders to harness emerging opportunities and navigate the complexities of today’s rapidly evolving market.

How Innovation, Wellness Focus, and Sustainable Practices Are Driving Dramatic Shifts in the Ready-to-Drink Tea and Coffee Market

Innovation has emerged as the linchpin of competitive advantage in the ready-to-drink tea and coffee market. Brands are no longer satisfied with delivering a standard cold brew or iced tea; they are exploring functional ingredients like adaptogens, probiotics, and vitamin infusions to cater to health-conscious consumers. This pivot beyond mere caffeine delivery highlights a broader movement: beverages as vehicles for holistic wellness, mental clarity, and sustained energy.

Simultaneously, sustainability considerations are rewriting the rules for packaging and production. The shift toward recyclable glass, selected bio-based plastics, and infinitely recyclable aluminum has accelerated partnerships between beverage producers and materials science innovators. As a result, lifecycle assessments and circular economy principles are becoming core to product development roadmaps.

Beyond product design, distribution channels have also undergone profound transformation. The expansion of direct-to-consumer e-commerce platforms has granted brands unprecedented control over customer relationships and data analytics. At the same time, omnichannel strategies that integrate brick-and-mortar retail, foodservice, and vending machine placements enable companies to balance reach with experiential marketing. Together, these trends are catalyzing new growth trajectories and demanding agility from established players and new entrants alike.

Assessing How 2025 United States Tariff Policies on Ingredients and Packaging Are Reshaping Cost Structures and Competitive Dynamics

In 2025, cumulative tariff measures implemented by the United States have exerted notable pressure on import-reliant elements of the ready-to-drink tea and coffee market. Specifically, elevated duties on glass and aluminum packaging components, as well as on certain botanical extracts sourced from major exporting regions, have introduced fresh cost complexities for manufacturers. While some importers have absorbed these increases through margin compression, others have pursued localized sourcing strategies to mitigate exposure.

This recalibration has had a ripple effect on supply chains, prompting investments in regional processing facilities and forging new supplier alliances. The drive toward nearshoring aims to balance import cost reductions with the operational expense of establishing domestic or regional manufacturing capabilities. In turn, brands that can demonstrate end-to-end provenance and reduced carbon footprints are finding favor among discerning consumers and retail partners.

Looking forward, the interplay between tariff policy and global trade negotiations will remain a pivotal determinant of competitive positioning. Companies that proactively adapt procurement, allocate resources to tariff engineering, and engage in advocacy efforts are best positioned to navigate ongoing regulatory fluctuations. As the market contends with these headwinds, strategic foresight will be essential to preserving value and sustaining innovation momentum.

Uncovering the Most Impactful Consumer and Channel Segmentation Dynamics That Shape Ready-to-Drink Tea and Coffee Strategies

A nuanced understanding of consumer segments is critical for tailoring product offerings and marketing approaches in the ready-to-drink tea and coffee arena. When considering product variety, demand for black and cold brew coffee is being outpaced by the popularity of creamy lattes and indulgent frappes that deliver a café-style experience at convenience. Meanwhile, tea consumers are gravitating toward antioxidant-rich green and herbal blends as part of broader wellness routines, even as classic black and fruit tea flavors maintain a steadfast consumer base.

Packaging choices further influence purchase decisions, with glass-bottled formulations commanding a premium positioning tied to artisanal and sustainable narratives, while PET bottles offer practicality for high-velocity retail channels. Cans, prized for portability and chilled shelf stability, are particularly favored among younger demographics. From an ingredient standpoint, caffeinated iterations continue to anchor the market, yet decaffeinated options are carving out a clear niche among evening consumers and those seeking reduced stimulation.

Distribution channels reveal additional layers of complexity. Off-trade outlets such as convenience stores, online retail platforms, and supermarket hypermarkets serve as the primary volume engines, each demanding bespoke pack sizes, pricing strategies, and promotional programs. On-trade venues-spanning restaurants, cafes, and vending machine networks-offer avenues for experiential engagement and co-branding opportunities. By aligning product features and channel tactics with these intersecting segmentation dimensions, companies can optimize reach and resonance across diverse consumer cohorts.

This comprehensive research report categorizes the Ready to Drink Tea & Coffee market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Ingredient

- Caffeine Level

- Distribution Channel

How Regional Consumer Preferences and Regulatory Frameworks Across Americas EMEA and Asia-Pacific Are Shaping Market Opportunities

Regional dynamics in the ready-to-drink tea and coffee market are defined by divergent consumer tastes, regulatory landscapes, and infrastructure maturity. In the Americas, particularly the United States, a blend of health-driven innovations and on-the-go lifestyles has fueled the mainstreaming of high-end cold brews, while Latin American markets display robust demand for traditional teas and emerging cold coffees, reflecting deep-rooted beverage cultures.

Across Europe, Middle East, and Africa, the packaging conversation has taken center stage as consumers demand recyclability and transparency in sourcing. European regulators are advancing stringent guidelines on single-use plastics, prompting widespread adoption of aluminum cans and refillable bottle programs. Meanwhile, the Middle East’s rapidly expanding café culture and Africa’s rising urbanization rates have created fertile ground for premium RTD offerings, albeit tempered by variable cold chain logistics and price sensitivity.

In Asia-Pacific, the convergence of traditional tea legacies and modern coffee trends is unparalleled. Countries such as Japan and South Korea lead in premium tea innovations, incorporating botanical extracts and functional botanicals, while Southeast Asian markets are witnessing a surge in sweetened milk teas and instant coffee beverages. Infrastructure enhancements and e-commerce penetration further facilitate market expansion. Across all regions, agility in addressing local regulatory frameworks, taste profiles, and distribution nuances is imperative for establishing a sustainable competitive foothold.

This comprehensive research report examines key regions that drive the evolution of the Ready to Drink Tea & Coffee market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders That Excel in Innovation Partnerships and Brand Differentiation Within Ready-to-Drink Tea and Coffee

Leading companies in the ready-to-drink tea and coffee sector have demonstrated adeptness at marrying brand heritage with forward-looking innovation. Legacy beverage corporations have leveraged their extensive distribution networks to introduce premium lines and forge partnerships with emerging cold brew specialists. Simultaneously, nimble challengers are capturing market share by prioritizing sustainability credentials, such as post-consumer recycled packaging and ethically sourced ingredients.

Strategic collaborations between beverage producers, ingredient suppliers, and co-packing partners have accelerated time to market while ensuring quality consistency. Investment in advanced processing equipment-ranging from nitrogen infusion for smooth mouthfeel to UV-C sterilization for extended shelf integrity-has underscored the premiumization trend. Moreover, a select group of companies has excelled at digital engagement, harnessing social media, influencer partnerships, and subscription-based models to build dedicated consumer communities.

This competitive landscape rewards those who can blend operational excellence with agility. Companies that maintain a clear innovation pipeline, cultivate supplier diversity to buffer against trade disruptions, and embed sustainability as a core brand tenet are best positioned to capture growth. As the race intensifies, the capacity to anticipate consumer shifts and pivot swiftly around new product prototypes will distinguish winners from followers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ready to Drink Tea & Coffee market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AriZona Beverage Company

- Asahi Group Holdings, Ltd.

- Danone S.A.

- ITO EN, Ltd.

- Keurig Dr Pepper Inc.

- Lavazza Group

- Monster Beverage Corporation

- Nestlé S.A.

- PepsiCo, Inc.

- Starbucks Corporation

- Suntory Beverage & Food Limited

- Tata Consumer Products Limited

- The Coca-Cola Company

- Tingyi (Cayman Islands) Holding Corp.

- Unilever PLC

Strategic Recommendations for Industry Leaders to Leverage Innovation Data and Trade Strategies for Sustainable Growth

Industry leaders should prioritize a consumer-first innovation agenda that balances indulgence with wellness. Developing formulations that feature adaptogenic herbs, natural sweeteners, and cognitive support ingredients can unlock new consumer segments. Equally important is the adoption of sustainable packaging platforms that align with circular economy principles and emerging regulatory requirements.

To navigate tariff-related cost pressures, companies must diversify supply chains by securing regional source partners and exploring tariff engineering techniques. Collaborative alliances with local co-packers can reduce exposure to cross-border duties while maintaining flexibility to scale production. Integrating advanced data analytics across sales channels will also enable real-time visibility into pricing elasticity, inventory levels, and promotional performance.

Finally, a robust direct-to-consumer ecosystem-anchored by compelling brand narratives and personalized subscription offerings-can enhance customer lifetime value and yield invaluable behavioral insights. By orchestrating omnichannel experiences that seamlessly connect e-commerce, retail, and on-premise touchpoints, industry players can foster loyalty, accelerate adoption of new variants, and fortify margins against intense competition.

Outlining a Dual-Method Research Framework That Combines Executive Interviews Secondary Data and Consumer Intelligence for Market Analysis

This analysis draws on a dual-pronged research methodology, combining quantitative and qualitative approaches to ensure comprehensive coverage of the ready-to-drink tea and coffee market. Primary research entailed in-depth interviews with industry stakeholders, including executives at leading beverage companies, ingredient suppliers, trade associations, and retail buyers. These conversations illuminated current priorities, emerging challenges, and forward-looking investment plans.

Secondary research encompassed an extensive review of trade publications, regulatory filings, academic journals, and publicly available corporate disclosures. Data triangulation allowed for cross-validation of trends in packaging technology, ingredient innovation, and channel performance. Additionally, proprietary consumer surveys were conducted to gauge evolving preferences around flavor profiles, functional claims, and sustainability expectations.

Together, these research components were synthesized through rigorous data analysis, scenario planning, and sensitivity testing. The resultant insights and strategic imperatives offer a holistic view of the market’s trajectory, grounded in empirical evidence and enriched by expert perspectives. This robust methodology ensures that recommendations are actionable, defensible, and tailored to the dynamic nature of the ready-to-drink tea and coffee sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ready to Drink Tea & Coffee market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ready to Drink Tea & Coffee Market, by Product Type

- Ready to Drink Tea & Coffee Market, by Packaging Type

- Ready to Drink Tea & Coffee Market, by Ingredient

- Ready to Drink Tea & Coffee Market, by Caffeine Level

- Ready to Drink Tea & Coffee Market, by Distribution Channel

- Ready to Drink Tea & Coffee Market, by Region

- Ready to Drink Tea & Coffee Market, by Group

- Ready to Drink Tea & Coffee Market, by Country

- United States Ready to Drink Tea & Coffee Market

- China Ready to Drink Tea & Coffee Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Pivotal Market Forces and Strategic Imperatives Defining the Future of Ready-to-Drink Tea and Coffee Markets

The ready-to-drink tea and coffee market stands at a pivotal juncture, shaped by accelerating consumer demand for convenience, health-oriented formulations, and sustainable packaging solutions. Trade policy developments in 2025 have underscored the importance of supply chain resilience and regional sourcing strategies, compelling companies to reevaluate cost structures and investment priorities. At the same time, segmentation insights reveal that success hinges on aligning product portfolios with distinct consumer expectations across product type, packaging, ingredient preference, and distribution channel.

Regional analysis highlights the necessity of tailoring approaches to varied regulatory landscapes, taste profiles, and infrastructure capabilities, from the health-driven cold brew craze in the Americas to the heritage tea influences in Asia-Pacific. Market leaders have distinguished themselves through strategic collaborations, digital engagement models, and a relentless focus on product and packaging innovation. These practices underscore the imperative of agility in a landscape where consumer tastes and trade dynamics can shift rapidly.

Looking ahead, companies that integrate consumer-first innovation, diversify sourcing to mitigate tariff exposure, and harness omnichannel data for informed decision-making will be best positioned to capture emerging growth opportunities. By embracing sustainability as both a brand differentiator and an operational imperative, and by leveraging deep market insights to guide strategy, stakeholders can secure a leadership position in this dynamic and expanding market.

Secure Expert Guidance from Ketan Rohom to Unlock Comprehensive Ready-to-Drink Tea and Coffee Market Intelligence

Engaging directly with Ketan Rohom opens the door to tailored insights that align with your organization’s objectives. As Associate Director of Sales & Marketing, he brings deep expertise in interpreting complex market dynamics and translating them into actionable strategies. By partnering with Ketan, you gain access to the full breadth of our comprehensive research report, complete with nuanced analyses, proprietary data, and in-depth interviews that reveal the underlying drivers of consumer behavior.

Whether you seek to refine product portfolios, optimize distribution networks, benchmark against emerging competitors, or navigate evolving trade policies, Ketan can guide you through every step. Reach out today to explore customized licensing options, request supplementary data modules, or schedule a detailed briefing. With his support, you can accelerate decision-making, mitigate risks associated with tariff fluctuations and supply chain disruptions, and uncover new growth avenues in the ready-to-drink tea and coffee segment.

Don’t let market complexities stall your strategic ambitions. Connect with Ketan Rohom to secure your competitive edge and propel your business forward with confidence.

- How big is the Ready to Drink Tea & Coffee Market?

- What is the Ready to Drink Tea & Coffee Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?