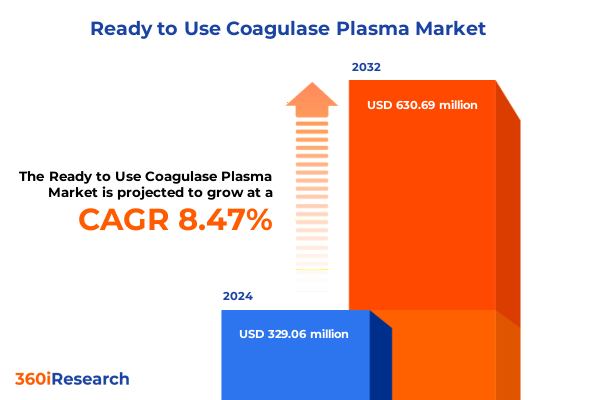

The Ready to Use Coagulase Plasma Market size was estimated at USD 348.08 million in 2025 and expected to reach USD 380.67 million in 2026, at a CAGR of 8.86% to reach USD 630.69 million by 2032.

Understanding the Evolving Importance of Ready to Use Coagulase Plasma in Advancing Diagnostic Precision and Research Innovations

The role of ready to use coagulase plasma has become instrumental in differentiating pathogenic Staphylococcus species with speed and reliability, a capability that underpins both clinical diagnostics and research innovation. Laboratories increasingly rely on this ready-to-use format to streamline workflows, reduce preparation errors, and accelerate time to result, especially in high-throughput environments. Moreover, by eliminating reagent preparation variability, ready to use coagulase plasma enhances reproducibility across tests, reinforcing confidence in diagnostic outcomes crucial for patient care.

In research settings, the convenience of pre-formulated plasma has catalyzed a range of applications from academic studies dissecting bacterial coagulation pathways to industrial investigations aiming to optimize plasma stabilization techniques. Furthermore, the availability of both liquid and lyophilized formats broadens experimental design flexibility, supporting protocols that require room temperature shipment or extended shelf life. As a result, investigators can allocate more resources toward hypothesis testing rather than reagent handling, fostering efficiency and accelerating discovery timelines.

Transitioning seamlessly between diagnostic and research environments, ready to use coagulase plasma embodies the convergence of operational agility and analytical rigor. This introduction establishes the foundation for understanding its impact on laboratory performance and outlines the transformative shifts explored in the following sections.

Unveiling the Transformative Shifts Reshaping the Ready to Use Coagulase Plasma Market Landscape in Clinical and Research Settings

Advances in microbial identification technologies, including automated blood culture systems and digital imaging, have reshaped the competitive context for coagulase plasma, prompting manufacturers to innovate for compatibility. In parallel, an intensifying focus on antimicrobial stewardship has heightened demand for rapid and accurate pathogen detection, encouraging adoption of ready to use reagents that deliver consistent coagulase test results within critical diagnostic windows. Consequently, providers have accelerated the refinement of plasma stabilization methods to meet these evolving performance criteria.

Simultaneously, the expansion of decentralized testing infrastructures has introduced new distribution dynamics. Point-of-care and small-scale laboratory operators now require smaller packaging configurations and flexible procurement models to manage tighter budgets and fluctuating test volumes. In response, suppliers have diversified offering sizes, from single-use vials to multi-use bottles, while also enhancing distribution through digital channels. These shifts reflect a broader realignment of supply chain strategies aimed at improving accessibility and reducing lead times.

Moreover, collaborative partnerships between reagent manufacturers and clinical research organizations have emerged, combining technical expertise with specialized application knowledge. These alliances are driving co-development of customized plasma formulations that address niche requirements, such as high-throughput screening or novel diagnostic algorithms. As a result, the landscape of ready to use coagulase plasma continues to evolve through an interplay of technological innovation, distribution agility, and strategic collaboration.

Examining the Cumulative Impact of United States Tariff Policies on Ready to Use Coagulase Plasma Supply and Distribution in 2025

Recent tariff adjustments enacted by United States authorities in early 2025 have introduced elevated duties on imported raw plasma materials, directly affecting cost structures for ready to use coagulase plasma products. Importers have faced incremental tariffs on bovine and porcine sources, leading to higher landed costs and underscoring the vulnerability of global supply chains to policy changes. As a result, many manufacturers have reevaluated sourcing strategies, emphasizing domestic partnerships to mitigate exposure to import levies.

In addition, the administrative complexity associated with tariff classification and customs compliance has created operational bottlenecks. Extended clearance times at ports have occasionally delayed shipments, prompting some end users to increase inventory buffers and renegotiate contract terms. Furthermore, these delays have accentuated the need for reliable forecasting of raw material requirements, compelling suppliers to invest in digital supply-chain platforms that provide real-time visibility and predictive alerts.

In response to cumulative tariff pressures, a trend toward alternative animal sources has also gained traction. Producers exploring rabbit plasma have found an opportunity to diversify inputs and reduce reliance on higher-tariff categories, while academic research labs have tested blend formulations that preserve test performance. Collectively, these adjustments illustrate how 2025 tariff policies have catalyzed supply-chain resilience measures and driven greater emphasis on local manufacturing capabilities.

Deriving Key Insights from Diverse Segmentation Strategies Spanning Application, End User, Product Type, Animal Source, Packaging Size, and Distribution Channel

A close examination of market segmentation reveals that clinical diagnostics command the primary application space, with blood culture and wound infection testing procedures relying heavily on ready to use coagulase plasma for definitive staphylococcal identification. In parallel, research applications span both academic and industrial domains, where investigators employ plasma reagents to explore coagulation mechanisms or to validate novel diagnostics. This dual-application dynamic underscores the reagent’s versatile role across user communities.

End user segmentation further refines these insights: diagnostic laboratories occupy a pivotal position, with government laboratories leveraging bulk packaging solutions for high-volume screening, whereas private laboratories often prefer single-use vials for precision and minimal waste. Hospitals represent another critical channel, marked by preferences that vary between public institutions seeking cost-efficient formulations and private facilities prioritizing rapid turnaround times. Meanwhile, research institutes diversify their reagent procurement between academic entities focusing on publication-driven studies and contract research organizations delivering fee-for-service analytical projects.

Product type choices bifurcate between liquid formulations, prized for immediate usability, and lyophilized formats, valued for extended shelf stability and simplified transport. Animal source selection spans bovine, porcine, and emerging rabbit plasma, each offering unique performance and regulatory profiles. Packaging size options range from multi-use bottles in 100 ml or 500 ml volumes to single-use vials of 5 ml or 10 ml. Finally, distribution channels encompass direct sales agreements, national and regional distributors, and online retail via both manufacturer websites and third-party e-commerce portals, illustrating the complexity of market access strategies.

This comprehensive research report categorizes the Ready to Use Coagulase Plasma market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Source

- Packaging Size

- End User

- Distribution Channel

Highlighting Regional Dynamics Influencing Ready to Use Coagulase Plasma Demand and Adoption Patterns across the Americas, EMEA, and Asia-Pacific Regions

Regional demand patterns for ready to use coagulase plasma exhibit distinct characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust diagnostic infrastructures in North America drive consistent consumption, with clinical laboratories intensifying coagulase testing to support antimicrobial stewardship programs. Latin American markets, while smaller in scale, demonstrate a growing appetite for imported reagents, fostered by partnerships with international suppliers and an increasing focus on laboratory accreditation.

In Europe Middle East & Africa, regulatory heterogeneity shapes procurement decisions. Western European countries emphasize stringent quality and compliance standards, prompting suppliers to offer certified products aligned with local guidelines. The Middle East market reflects investments in healthcare modernization, with large teaching hospitals establishing in-house diagnostic capabilities that leverage ready-to-use reagents. Meanwhile, Africa presents opportunities in public health initiatives, where reagent donations and subsidized programs facilitate access in resource-constrained environments.

Asia-Pacific represents a dynamic terrain, led by expanding clinical and research infrastructures in China and India. High-throughput reference laboratories in these countries adopt liquid plasma formulations for streamlined workflows, while emerging markets in Southeast Asia explore lyophilized offerings to overcome cold-chain limitations. Consequently, regional insights underscore the importance of tailored market entry strategies that account for regulatory requirements, distribution networks, and end-user preferences unique to each zone.

This comprehensive research report examines key regions that drive the evolution of the Ready to Use Coagulase Plasma market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation, Strategic Partnerships, and Competitive Positioning within the Coagulase Plasma Market Ecosystem

Leading companies in the ready to use coagulase plasma market differentiate themselves through robust product portfolios, strategic alliances, and expansive distribution networks. Several global life sciences firms have capitalized on their scale to integrate coagulase plasma into broader diagnostic platforms, enabling bundled solutions that enhance value propositions. Simultaneously, specialized reagent suppliers maintain agility by targeting niche segments, such as veterinary diagnostics or advanced academic research, and by offering bespoke plasma formulations.

Strategic partnerships have become a hallmark of competitive positioning, with collaborations between reagent manufacturers and instrumentation providers facilitating seamless assay integration. These alliances not only accelerate time to market for new coagulase plasma variants but also reinforce end-user loyalty through combined service and support offerings. In addition, some companies are investing in localized production facilities to address tariff-related challenges and to shorten delivery cycles to key markets.

Furthermore, innovation pipelines reflect a commitment to continuous improvement, with R&D efforts directed toward enhancing plasma stability, reducing assay turnaround, and exploring next-generation reagent formats. Collectively, these company-level initiatives illuminate the competitive forces at play and the strategic maneuvers shaping the coagulase plasma ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ready to Use Coagulase Plasma market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analytica Chemie

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Rad Laboratories, Inc.

- Biolab Diagnostics

- bioMérieux SA

- Central Drug House (P) Ltd.

- Danaher Corporation

- Grifols, S.A.

- Hardy Diagnostics

- Hardy Diagnostics, Inc.

- Helena Laboratories Corporation

- HiMedia Laboratories Pvt. Ltd.

- LABORCLIN

- Mast Group Ltd.

- Merck KGaA

- Oxoid Deutschland GmbH

- Sigma-Aldrich Co. LLC

- TCS Biosciences Ltd.

- Thermo Fisher Scientific Inc.

Actionable Strategic Recommendations to Enhance Market Penetration, Operational Efficiency, and Collaborative Growth for Industry Leaders

Industry leaders should prioritize diversification of raw material sources to buffer against tariff fluctuations and geopolitical risks by establishing relationships with both domestic and alternative animal plasma suppliers. This strategic approach will enhance supply-chain resilience and safeguard continuity of reagent availability. In addition, investing in advanced cold-chain tracking and digital supply-chain platforms can provide real-time insights, enabling agile adjustments to procurement plans.

To capture emerging demand in decentralized and point-of-care settings, providers should develop flexible packaging options tailored to smaller laboratories, including single-use vials with user-friendly packaging. Coupled with digital ordering systems, this will streamline procurement for end users managing variable test volumes. Simultaneously, forging closer ties with contract research organizations and academic institutes through collaborative research agreements can open new application areas and foster co-development of customized plasma formulations.

Moreover, enhancing product differentiation through value-added services-such as training programs on coagulase testing protocols, technical support, and certification assistance-can strengthen customer loyalty and justify premium pricing. By aligning product innovation with evolving regulatory requirements and end-user workflows, industry leaders will be well positioned to drive sustainable growth and maintain competitive advantage.

Detailed Overview of Research Methodologies Applied in Assessing the Ready to Use Coagulase Plasma Market with Emphasis on Data Integrity

The research methodology underpinning this report integrates primary and secondary data collection to ensure robust and reliable insights. Primary research involved in-depth interviews with laboratory directors, microbiologists, and procurement managers across clinical and research settings, capturing firsthand perspectives on reagent performance, supply challenges, and purchasing considerations. Secondary sources included peer-reviewed journals, regulatory filings, and industry white papers, enabling validation of market trends and technological developments.

Data triangulation was applied to reconcile divergent viewpoints and to cross-verify quantitative findings with qualitative inputs. This approach included comparative analysis of publicly filed financial reports, examination of procurement tender data, and integration of logistics and customs records to assess tariff implications. Furthermore, a structured framework guided the segmentation analysis, ensuring that each application, end-user, product type, animal source, packaging size, and distribution channel was thoroughly examined for impact and interdependencies.

Quality control measures encompassed data cleansing procedures, outlier validation, and iterative expert reviews, ensuring that conclusions drawn reflect the most accurate and up-to-date information available. As a result, this methodology provides a transparent and replicable foundation for strategic decision-making in the ready to use coagulase plasma market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ready to Use Coagulase Plasma market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ready to Use Coagulase Plasma Market, by Product Type

- Ready to Use Coagulase Plasma Market, by Animal Source

- Ready to Use Coagulase Plasma Market, by Packaging Size

- Ready to Use Coagulase Plasma Market, by End User

- Ready to Use Coagulase Plasma Market, by Distribution Channel

- Ready to Use Coagulase Plasma Market, by Region

- Ready to Use Coagulase Plasma Market, by Group

- Ready to Use Coagulase Plasma Market, by Country

- United States Ready to Use Coagulase Plasma Market

- China Ready to Use Coagulase Plasma Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Conclusive Perspectives on Market Trends, Competitive Forces, and Future Trajectories for Ready to Use Coagulase Plasma Products

In summary, the ready to use coagulase plasma market is characterized by dynamic interactions among technological innovation, regulatory influences, and evolving end-user needs. The transition to pre-formulated reagents has streamlined laboratory workflows, while tariff-driven supply-chain adjustments underscore the importance of sourcing agility. Segmentation analysis highlights the nuanced preferences across clinical diagnostics, research applications, product formats, and distribution channels, revealing opportunities for targeted strategies.

Regional disparities further illustrate the need for adaptive market entry and distribution approaches, as stakeholders in the Americas, EMEA, and Asia-Pacific exhibit distinct procurement priorities and regulatory landscapes. Meanwhile, leading companies are forging strategic partnerships and investing in localized production to navigate competitive and policy-driven challenges. Actionable recommendations emphasize the criticality of supply diversification, technological integration, and end-user engagement to sustain growth and resilience.

Ultimately, this executive summary distills complex market variables into cohesive insights, equipping decision-makers with the clarity required to optimize resource allocation, accelerate product development, and capitalize on emerging opportunities within the ready to use coagulase plasma domain.

Engaging Call to Action with Associate Director Ketan Rohom to Secure Comprehensive Ready to Use Coagulase Plasma Market Research Insights and Solutions

To act on these insights and arm your organization with the depth of analysis needed to navigate the evolving coagulase plasma landscape, reach out to Associate Director, Sales & Marketing Ketan Rohom. He is ready to guide you through the comprehensive research report packed with strategic perspectives, enabling you to make data-driven decisions with confidence and precision. Engage with Ketan to customize access to this indispensable resource that will catalyze growth and competitive advantage in your clinical diagnostics and research initiatives.

- How big is the Ready to Use Coagulase Plasma Market?

- What is the Ready to Use Coagulase Plasma Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?