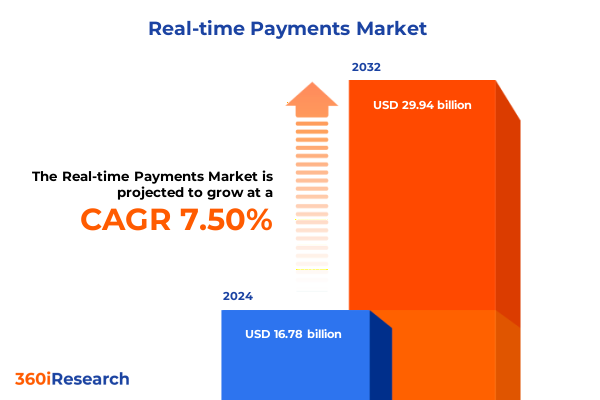

The Real-time Payments Market size was estimated at USD 17.98 billion in 2025 and expected to reach USD 19.27 billion in 2026, at a CAGR of 7.55% to reach USD 29.94 billion by 2032.

Opening the Door to Seamless Financial Transactions through an Introduction to the Evolution and Opportunities in Real Time Payments

Real-time payments have emerged as a critical pillar in the modern financial ecosystem, transforming the way individuals, businesses, and institutions move money. This introduction delves into the evolution of instantaneous transaction systems, tracing their journey from pioneering pilot programs to widespread adoption across global markets. Over recent years, continuous advancements in technology, shifting regulatory landscapes, and rising consumer expectations have converged to propel real-time payments from niche offerings into mainstream operations.

As digital commerce and mobile banking proliferate, organizations face growing pressure to deliver secure, resilient, and frictionless payment experiences. This section highlights the drivers that have accelerated the demand for real-time settlement, including the need for improved cash flow management, enhanced transparency, and reduced counterparty risk. By examining these trends, industry leaders can appreciate the strategic importance of embedding instant payment capabilities into their product portfolios and operational frameworks.

The forthcoming executive summary offers a structured roadmap through the pivotal shifts shaping this market, the influence of domestic tariffs, segmentation insights that inform product development, regional dynamics, company-level strategies, actionable recommendations for stakeholders, and a rigorous research methodology that validates our conclusions. Each section has been crafted to equip decision-makers with the knowledge required to navigate complex challenges and seize opportunities in this dynamic landscape.

Revolutionary Trends Redefining the Global Payment Ecosystem and Accelerating the Adoption of Instant Settlement Protocols Across Diverse Industry Verticals

The real-time payments landscape is undergoing profound shifts driven by revolutionary technological innovations and evolving customer expectations. Open banking initiatives have redefined how payment data flows between financial institutions, enabling third-party providers to deliver tailored services through standardized APIs. This movement toward interoperability has catalyzed the creation of novel payment rails that facilitate instantaneous settlements, thereby reducing latency and enhancing user satisfaction.

Simultaneously, the rise of cloud-native architectures and microservices has empowered payment processors to scale dynamically, manage peak transaction volumes, and rapidly deploy feature updates. These capabilities are complemented by the integration of artificial intelligence and machine learning frameworks, which bolster fraud detection, optimize routing, and predict transactional behaviors. Together, these advances are dismantling the limitations of legacy batch processing systems and ushering in an era of resilience and real-time analytics.

Emerging distributed ledger technologies and pilot central bank digital currencies are also reshaping cross-border settlements by offering more transparent and efficient mechanisms for value transfer. As regulatory bodies respond with updated frameworks and sandbox environments, collaboration between public and private sectors is on the rise. This convergence of stakeholders is setting new benchmarks for security, compliance, and customer-centric innovation across the real-time payments ecosystem.

Assessing the Converging Effects of Tariff Adjustments on Domestic Real Time Payment Infrastructure Resilience and Cost Structures

In 2025, adjustments to United States tariff policies have introduced a set of complex challenges for the real-time payments sector, particularly in terms of infrastructure sourcing and operational expenditures. Elevated duties on imported hardware components, including secure modules, encryption accelerators, and networking equipment, have inflated capital costs for financial institutions and technology providers. These added expenses have necessitated strategic recalibrations in procurement planning, with many organizations exploring alternate supply chains and onshore manufacturing partnerships to mitigate the financial burden.

Beyond hardware, tariffs on software licensing and maintenance services procured from international vendors have heightened the total cost of ownership for payment platforms. Contract renegotiations and the pursuit of locally sourced solutions have become more prevalent as institutions aim to preserve budgetary discipline. At the same time, compliance and customs clearance processes have grown more intricate, prompting firms to invest in advanced trade-compliance systems to ensure uninterrupted operations and governance adherence.

Despite these headwinds, there has been a discernible shift toward domestic innovation. U.S.-based technology firms are accelerating research and development initiatives to fill capability gaps, while regional consortiums are fostering collaborative frameworks for cross-industry support and shared infrastructure. This collective resilience is driving a recalibration of cost structures and fostering greater self-reliance within the ecosystem, ultimately enhancing the sector’s ability to withstand future policy fluctuations.

Unlocking Strategic Insights through Detailed Market Segmentation Based on Components Deployment Models and Transaction Dynamics

By analyzing the market through the lens of component segmentation, clear distinctions emerge between service offerings and technological solutions. Integration and consulting services have seen heightened demand as organizations grapple with system interoperability challenges, while maintenance and support functions are evolving to include proactive monitoring and predictive diagnostics. On the solutions side, advanced fraud detection frameworks are being deployed to counteract sophisticated cyber threats, and modular payment initiation platforms enable rapid onboarding of new channels.

Exploring deployment modes reveals a pronounced shift toward cloud-centric implementations, particularly the widespread adoption of platform-as-a-service models that offer elastic scalability and reduced time to market. Software-as-a-service offerings further streamline operations for end users by eliminating the need for extensive internal IT resources. However, for highly regulated or security-sensitive entities, dedicated on-premises configurations remain vital, and managed on-premises variants blend localized control with outsourced operational expertise.

When evaluating organizational demographics, multinational corporations are leveraging real-time payment capabilities to harmonize treasury operations across geographies, while national corporates optimize domestic liquidity. Micro enterprises and small enterprises alike are capitalizing on simplified pay-as-you-go solutions to enhance cash flow management. From the perspective of transaction types, corporate payment systems and real-time gross settlement networks underpin high-value transfers, whereas microtransactions and retail payment platforms democratize access to immediate settlement. The business-to-business sphere is witnessing growth in both large corporate disbursements and SME billing solutions, while business-to-consumer and person-to-person applications are broadening payment accessibility and fostering financial inclusion. Finally, end-user analysis shows that banks and fintech firms are at the forefront of adoption, governments are enhancing public service disbursements, healthcare providers are accelerating patient reimbursements, and retailers are optimizing point-of-sale experiences.

This comprehensive research report categorizes the Real-time Payments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Transaction Type

- Application

- End User

Unearthing Regional Variations in Real Time Payment Adoption Driven by Economic Ecosystems and Regulatory Frameworks Across the Globe

Across the Americas, robust investment in digital infrastructure and progressive regulatory frameworks have accelerated the adoption of real-time payment systems. The United States and Canada continue to innovate with interbank settlement platforms, while Latin American markets are experiencing rapid growth in person-to-person payment solutions due to high mobile penetration and the need for financial inclusion. Collaboration among central banks and private entities in this region is fostering interoperable networks that span national borders.

In Europe, Middle East, and Africa, regulatory harmonization and cross-border initiatives such as open banking directives are driving a unified payment landscape. The implementation of instant credit transfers in several EMEA markets has set new benchmarks for transaction speeds and security. Meanwhile, economic diversity across the region has led to varying levels of adoption, with advanced economies focusing on feature-rich enterprise solutions and emerging markets prioritizing low-value retail and microtransaction networks to bridge access gaps.

Asia-Pacific stands out for its scale and innovation, with several economies pioneering real-time payment rails that handle billions of transactions daily. Government mandates and high consumer demand are catalyzing the integration of instant payment APIs into e-commerce ecosystems and digital wallets. Adoption is particularly pronounced in markets where public-private partnerships have created highly interoperable, secure, and inclusive payment frameworks, making the region a hotbed for technological experimentation and cross-border connectivity.

This comprehensive research report examines key regions that drive the evolution of the Real-time Payments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Shaping the Real Time Payments Market with Innovative Solutions and Strategic Partnerships

Leading financial services conglomerates and specialized fintech innovators are continually redefining the real-time payments market. Global card networks have expanded their offerings to include dedicated instant payment rails, leveraging their extensive merchant networks and risk management capabilities. Technology giants with cloud and API platforms provide end-to-end solutions that accelerate integration cycles and deliver embedded payment functionalities across digital channels.

Fintech disrupters have distinguished themselves through modular architectures and developer-friendly interfaces, enabling rapid deployment of tailored payment use cases. Joint ventures between banks and technology partners are producing hybrid models that blend institutional trust with the agility of digital natives. Meanwhile, software vendors specializing in fraud analytics and biometric authentication are deepening the security posture of real-time systems by embedding adaptive controls and continuous monitoring.

Strategic alliances and acquisitions are reshaping the competitive landscape as companies seek to augment their value propositions through complementary capabilities. Cross-sector collaborations involving telecommunications firms, retail conglomerates, and logistics providers are creating frictionless payment experiences that extend beyond traditional financial channels. This convergence underscores the importance of an ecosystem-centric approach to delivering scalable, secure, and customer-focused real-time payment solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Real-time Payments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide

- Adyen N.V.

- Ant Group Co., Ltd.

- Fidelity National Information Services, Inc.

- Finastra Inc.

- Fiserv, Inc.

- Mastercard Incorporated

- Montran Corporation

- PayPal Holdings, Inc.

- Ripple Labs Inc.

- Stripe, Inc.

- Tencent Holdings Ltd.

- Visa Inc.

- Volante Technologies

- Wise

Actionable Strategic Roadmap for Industry Leaders to Navigate Emerging Opportunities in Instantaneous Payment Landscapes and Regulatory Complexities

Industry leaders should prioritize the development of scalable, open API frameworks that facilitate seamless integration with partner ecosystems and third-party developers. By fostering an innovation-friendly environment, organizations can accelerate time to market and respond to evolving customer demands without compromising on security or compliance. Additionally, investing in advanced analytics and machine learning capabilities will enable proactive fraud detection and personalized payment experiences that strengthen trust and drive customer loyalty.

Establishing strategic collaborations with central banks, regulatory bodies, and cross-industry consortia is critical to shaping favorable policy frameworks and ensuring system interoperability. Active participation in sandbox initiatives can expedite product validation and reduce time to regulatory approval. Concurrently, embedding robust compliance tooling within payment platforms will help manage evolving tariff regimes and trade-compliance requirements, mitigating operational risks and optimizing total cost of ownership.

Talent acquisition and capability building must focus on cultivating multidisciplinary teams that combine financial expertise with data science, cybersecurity, and regulatory know-how. Empowering these teams through continuous training and access to cutting-edge research will fuel innovation and operational excellence. Ultimately, a proactive, ecosystem-driven approach that balances technological agility with regulatory engagement will position industry leaders to capitalize on the full potential of real-time payment networks.

Comprehensive Research Methodology Underpinning the Analysis Including Primary Interviews Secondary Data and Analytical Frameworks

This analysis is grounded in a rigorous research methodology that integrates both primary and secondary data sources. Primary research was conducted through in-depth interviews with C-level executives, technology architects, regulatory officials, and payment system operators across key markets. These insights provided firsthand perspectives on strategic priorities, pain points, and emerging use cases within the real-time payments ecosystem.

Secondary research involved the systematic review of regulatory filings, policy documents, white papers, and proprietary databases to capture the latest developments in tariff changes, cybersecurity standards, and market innovations. An analytical framework was applied to classify and triangulate data, ensuring consistency across component, deployment, organizational, transaction, application, and end-user dimensions. Qualitative and quantitative findings were validated through peer reviews and cross-referenced with industry benchmarks to enhance the accuracy and reliability of our conclusions.

Segmentation analysis was performed by mapping solution capabilities against market needs, while regional assessments incorporated macroeconomic indicators, regulatory maturity levels, and infrastructure readiness. Company profiling combined public disclosures, financial performance metrics, and strategic partnership announcements to identify key players’ competitive advantages. This comprehensive approach underpins the credibility of the strategic insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Real-time Payments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Real-time Payments Market, by Component

- Real-time Payments Market, by Deployment Mode

- Real-time Payments Market, by Organization Size

- Real-time Payments Market, by Transaction Type

- Real-time Payments Market, by Application

- Real-time Payments Market, by End User

- Real-time Payments Market, by Region

- Real-time Payments Market, by Group

- Real-time Payments Market, by Country

- United States Real-time Payments Market

- China Real-time Payments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Perspectives on the Future Trajectory of Real Time Payments Emphasizing Resilience Innovation and Collaborative Growth

As real-time payments continue to mature, the industry stands at the cusp of a new era characterized by seamless interoperability, embedded financial services, and heightened security. The integration of advanced analytics, cloud-native architectures, and distributed ledger technologies will further accelerate transaction velocity while reinforcing resilience against evolving threats. Strategic collaborations between public institutions and private enterprises will be pivotal in sculpting regulatory landscapes that both protect stakeholders and foster innovation.

Organizations that embrace a customer-centric mindset-one that prioritizes frictionless user experiences and transparent real-time insights-will differentiate themselves in a competitive market. Moreover, adaptability to policy changes, including tariff adjustments and data sovereignty requirements, will dictate the agility with which institutions can expand cross-border services. Sustainable growth will be achieved by balancing technological advancement with prudent risk management and operational excellence.

Looking ahead, the fusion of real-time payment capabilities with emerging trends such as decentralized finance, IoT-enabled commerce, and AI-driven personalization will redefine the boundaries of financial services. Stakeholders equipped with holistic market intelligence and strategic foresight will be best positioned to harness these opportunities, driving transformative value for businesses and consumers alike.

Connect with Ketan Rohom to Unlock In Depth Market Intelligence and Propel Your Organization’s Growth in the Rapidly Evolving Real Time Payments Domain

To explore the comprehensive insights detailed in this report and to secure tailored recommendations that align with your organization’s strategic objectives in the real-time payments arena, please reach out to Ketan Rohom. With deep expertise in sales and marketing, Ketan can guide you through the report’s rich analysis, facilitate custom data requests, and help translate findings into actionable plans. Engaging directly with Ketan will ensure you leverage the latest intelligence on technological trends, regulatory shifts, and competitive benchmarking.

By connecting with Ketan, you will gain immediate access to exclusive add-on modules, expert briefings, and priority support tailored to your market needs. His collaborative approach will streamline your decision-making process and empower your teams to implement solutions that drive efficiency, reduce costs, and enhance customer satisfaction.

Take the next step toward future-proofing your payment infrastructure and capitalizing on emerging opportunities-contact Ketan today to purchase the full market research report and unlock unparalleled strategic guidance in the rapidly evolving real-time payments domain.

- How big is the Real-time Payments Market?

- What is the Real-time Payments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?