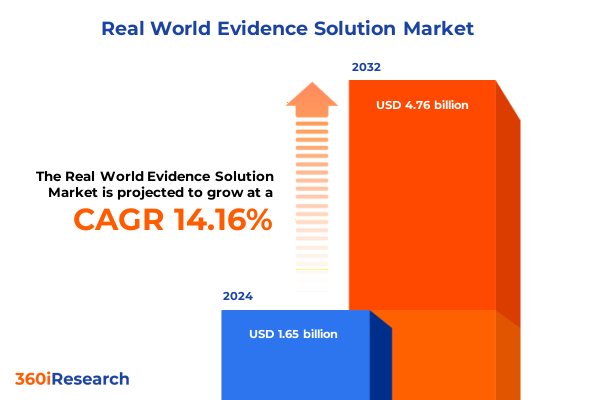

The Real World Evidence Solution Market size was estimated at USD 1.87 billion in 2025 and expected to reach USD 2.13 billion in 2026, at a CAGR of 14.23% to reach USD 4.76 billion by 2032.

Delivering a Comprehensive Real World Evidence Executive Summary to Illuminate Market Dynamics and Strategic Imperatives for Healthcare Decision-Makers

Real World Evidence (RWE) has emerged as an indispensable resource for healthcare stakeholders seeking to bridge the gap between clinical trials and everyday clinical practice. As the volume of healthcare data generated across medical records, insurance claims, and patient registries multiplies, organizations are poised to harness these insights to inform regulatory submissions, optimize clinical trial designs, and improve patient outcomes. The convergence of advanced analytics platforms with domain expertise has created an environment where evidence generation extends beyond retrospective observations to encompass pragmatic trials and dynamic patient engagement models. Consequently, decision-makers face the dual imperative of integrating diverse data sources and ensuring methodological rigor, while navigating evolving regulatory standards.

Amid this complexity, an executive overview is essential to distill prevailing trends, identify strategic inflection points, and highlight actionable opportunities. By synthesizing the latest developments in service offerings, software innovations, and collaborative frameworks, this summary presents a cohesive narrative of the RWE landscape. It delineates how organizations are reimagining data management pipelines, deploying real-time analytics, and forging partnerships that span consultancies, technology providers, and healthcare institutions. Ultimately, this introduction sets the stage for a deeper exploration of transformative shifts, policy impacts, segmentation nuances, and regional dynamics that will define the next chapter of Real World Evidence strategies.

Uncovering the Pivotal Paradigm Shifts in Real World Evidence Adoption Shaping the Future of Healthcare Analytics and Clinical Decision-Making Across Global Markets

The Real World Evidence ecosystem is experiencing a fundamental reshaping driven by technological breakthroughs and shifting stakeholder priorities. Artificial intelligence and machine learning techniques have accelerated the processing of vast, unstructured datasets, leading to predictive insights that guide patient stratification and risk modeling. At the same time, the proliferation of cloud-native analytics software solutions is reducing time to insight by automating data cleaning, integration, and storage workflows. In parallel, consulting services providers are deepening their capabilities in pragmatic clinical trial design and observational study methodologies to meet growing demands for robust, real-time evidence.

Concurrently, healthcare payers and providers are elevating the strategic importance of patient-centered outcomes, prompting dedicated offerings for patient recruitment, digital engagement, and outcome tracking. This shift underscores a broader reorientation from retrospective analyses toward prospective, patient-focused studies that align with value-based care models. Moreover, pharmaceutical and biotechnology companies are forging cross-sector alliances with academic research institutions and government agencies to establish data sharing consortia that address regulatory requirements for transparency and reproducibility. These collaborative frameworks are redefining competitive boundaries, encouraging ecosystem participants to adopt flexible service-and-software hybrid models that cater to complex evidence generation needs.

Assessing the Combined Effects of the 2025 United States Tariffs on Real World Evidence Initiatives Supply Chains Research Collaborations and Budget Allocations

In 2025, newly implemented United States tariffs on imported technologies and data services have introduced a notable layer of complexity for Real World Evidence initiatives. By imposing additional levies on software licensing fees, analytics platforms, and specialized consulting services sourced from abroad, these measures have driven stakeholders to reconsider supply chain dependencies and cost management strategies. Pharmaceutical companies and contract research organizations have responded by nearshoring certain data management functions and intensifying investments in domestic analytics software development to mitigate exposure to tariff escalations.

Simultaneously, the reclassification of select data processing services under tightened trade codes has led to delays in cross-border data transfers, prompting entities to explore enhanced data governance frameworks and local hosting solutions. As a consequence, the agility of multinational evidence generation programs has been tempered by increased compliance overhead and infrastructure realignment. However, this environment has also spurred innovation: domestic analytics software vendors are capitalizing on heightened demand for tariff-exempt platforms, while data analysis service providers strengthen partnerships with regional technology firms. Looking ahead, organizations will need to continually adapt their procurement strategies and investment priorities to navigate the evolving tariff landscape while safeguarding the integrity and timeliness of their evidence generation efforts.

Revealing Critical Segmentation Patterns Illuminating How Product Types Therapeutic Areas Applications and End User Profiles Drive Real World Evidence Market Dynamics

A nuanced understanding of market segments reveals distinct value drivers and growth avenues within Real World Evidence solutions. Based on product type, service providers specializing in consulting and data analysis are increasingly differentiating through domain-specific expertise, whereas software vendors emphasize end-to-end analytics and modular data management suites. Consulting services leverage strategic advisory capabilities to guide study design, while analytical specialists focus on statistical methodologies and observational study frameworks. On the software front, advanced analytics tools integrate machine learning pipelines, and data management platforms offer scalable architectures for ingestion and storage of heterogeneous data sources.

When examining therapeutic area applications, cardiology and oncology are at the forefront of utilizing real-world insights for regulatory submissions and value demonstration, whereas infectious diseases and neurology studies are benefiting from adaptive trial designs and patient-reported outcomes tracking. Application-wise, organizations deploy robust data cleaning, integration, and storage techniques to ensure dataset fidelity; meanwhile, pragmatic clinical trials and prospective studies offer dynamic frameworks for hypothesis testing, and retrospective analyses provide historical benchmarks. Patient recruitment and outcome measurement tools are enhancing engagement strategies and enriching evidence datasets with nuanced patient perspectives.

Considering end users, contract research organizations and pharmaceutical companies demand comprehensive, scalable solutions, healthcare providers are integrating evidence platforms for clinical decision support within clinics and hospitals, and payers require real-world data to inform formulary decisions. Research institutions-including academic centers, government agencies, and nonprofit organizations-prioritize methodological transparency and open data initiatives. These segmentation insights guide stakeholders in tailoring offerings to specific organizational objectives and therapeutic contexts.

This comprehensive research report categorizes the Real World Evidence Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapeutic Area

- Application

- End User

Exploring Regional Variations in Real World Evidence Uptake and Opportunities Across the Americas EMEA and Asia-Pacific Healthcare Ecosystems and Regulatory Environments

Regional dynamics significantly influence the adoption, regulatory acceptance, and commercialization pathways of Real World Evidence strategies across global markets. In the Americas, robust regulatory frameworks and established healthcare infrastructures have catalyzed early adoption of pragmatic trial methodologies and advanced analytics, while alignment with value-based care reimbursement models is further driving demand for patient-centered evidence generation. North American organizations continue to pioneer digital health collaborations, leveraging scalable cloud architectures and real-time data integration to support rapid evidence delivery.

Meanwhile, the Europe, Middle East & Africa landscape is characterized by heterogeneous regulatory environments, spurring tailored evidence strategies that accommodate country-specific data privacy requirements and ethical guidelines. Collaborative initiatives, such as multi-country registries in oncology and neurology, showcase the region’s commitment to harmonizing data standards and advancing cross-border research consortia. Additionally, emerging hubs in the Middle East are investing in health data ecosystems to strengthen local capabilities in patient outcome tracking and observational research.

In the Asia-Pacific sphere, rapid digital transformation and government-led health technology assessments have created fertile ground for RWE adoption. Stakeholders in this region are expanding investments in data localization, forging partnerships with domestic technology firms, and cultivating capabilities in real-world evidence generation to support regulatory submissions and market access. Collectively, these regional insights underscore the importance of adaptive strategies aligned with local regulatory, cultural, and infrastructure nuances.

This comprehensive research report examines key regions that drive the evolution of the Real World Evidence Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Advancing Real World Evidence through Innovative Partnerships Technological Integrations and Strategic Growth Initiatives in a Competitive Landscape

Key industry players are driving competitive differentiation through strategic partnerships, technology integrations, and service expansions that address evolving Real World Evidence needs. Leading global consultancies have broadened their offerings to include specialized data analysis capabilities, while natively digital analytics vendors are embedding advanced machine learning modules into their core platforms. Moreover, contract research organizations are evolving into end-to-end evidence solution providers by acquiring niche software firms and establishing centers of excellence focused on pragmatic trial design.

At the same time, healthcare technology companies are collaborating with payers and provider networks to integrate RWE-derived insights into clinical decision support systems and reimbursement models. This cross-functional synergy is enabling more dynamic evidence generation workflows and aligning stakeholders around patient-centric outcomes. Pharmaceutical corporations are also investing in internal real-world data initiatives, establishing dedicated analytics teams and forging alliances with academic research centers to validate novel study methodologies. The convergence of these corporate strategies reflects a broader industry trend: organizations that successfully blend advisory services, platform innovation, and stakeholder collaboration are best positioned to capitalize on the expanding RWE landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Real World Evidence Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cardinal Health, Inc.

- Certara, L.P.

- Clinerion Ltd

- Clinixir Company Limited

- Cognizant Technology Solutions Corporation

- Datavant

- Flatiron Health, Inc.

- ICON plc

- International Business Machines Corporation

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Medidata Solutions, Inc. by Dassault Systèmes SE

- Optum, Inc.

- Oracle Corporation

- Parexel International Corporation

- PerkinElmer Inc.

- Pharmaceutical Product Development, LLC by Thermo Fisher Scientific Inc.

- PRA Health Sciences, Inc.

- SAS Institute, Inc.

- Syneos Health, Inc.

- TATA Consultancy Services Limited

- TriNetX, LLC

- Turacoz

- United BioSource LLC

- Veeva Systems Inc.

- Verantos

Actionable Insights for Industry Leaders to Strengthen Real World Evidence Capabilities Drive Stakeholder Engagement and Cultivate Sustainable Competitive Advantages

To capitalize on Real World Evidence opportunities, industry leaders must adopt a holistic approach that integrates strategic vision with operational excellence. First, organizations should prioritize the development of interoperable data management infrastructures that facilitate seamless ingestion, cleaning, and integration of diverse datasets. By establishing robust governance frameworks and leveraging cloud-native architectures, stakeholders can ensure scalability and compliance while streamlining analytics pipelines.

Next, cultivating cross-sector partnerships remains imperative. Engaging with healthcare providers, payers, and research institutions through data sharing consortia fosters co-creation of evidence generation protocols and accelerates regulatory acceptance. In addition, embedding patient-centric methodologies-such as digital engagement platforms for recruitment and real-time outcome capture-enhances data granularity and aligns studies with evolving value-based care paradigms.

Finally, investing in talent development and organizational capability building is critical to sustain innovation. Upskilling teams in advanced analytics, pragmatic trial design, and regulatory sciences empowers them to deliver high-impact insights. By continuously evaluating emerging technologies and market shifts, leaders can refine their service offerings and software roadmaps to maintain a competitive edge and unlock long-term value from Real World Evidence initiatives.

Detailing a Rigorous Research Methodology Integrating Qualitative Interviews Quantitative Data Analysis and Expert Validation for Trusted Real World Evidence Insights

This research integrates a multifaceted methodology designed to ensure rigorous, transparent, and defensible findings. The qualitative component involved in-depth interviews with senior leaders across contract research organizations, pharmaceutical companies, healthcare providers, and regulatory bodies to capture firsthand perspectives on RWE adoption drivers and challenges. These insights were systematically coded and analyzed to identify recurring themes and strategic imperatives.

Complementing the qualitative analysis, a comprehensive review of publicly available regulatory guidance, policy briefs, and peer-reviewed literature provided contextual grounding for methodological best practices. Quantitative data analysis involved the aggregation of anonymized healthcare datasets, technical documentation, and software usage metrics to map technology adoption trends. Advanced statistical techniques were applied to validate correlations between data management practices and evidence generation outcomes. Expert validation panels, composed of academic researchers and industry veterans, reviewed preliminary findings to ensure methodological soundness and practical relevance. Through this blended approach, the research delivers a holistic, evidence-based narrative that informs strategic decision-making without relying on proprietary market estimates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Real World Evidence Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Real World Evidence Solution Market, by Product Type

- Real World Evidence Solution Market, by Therapeutic Area

- Real World Evidence Solution Market, by Application

- Real World Evidence Solution Market, by End User

- Real World Evidence Solution Market, by Region

- Real World Evidence Solution Market, by Group

- Real World Evidence Solution Market, by Country

- United States Real World Evidence Solution Market

- China Real World Evidence Solution Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Drawing Strategic Conclusions on Real World Evidence Trends and Market Drivers to Inform Decision-Makers and Shape Future Research and Investment Priorities

The convergence of advanced analytics technologies, evolving tariff landscapes, and diverse stakeholder requirements underscores a pivotal moment for Real World Evidence. Organizations that adapt their strategies to accommodate segmentation nuances-ranging from product and therapeutic focus to application-specific workflows and end user profiles-will unlock new avenues for evidence-driven innovation. Regional insights highlight the need for tailored approaches that resonate with local regulatory norms and infrastructure capacities.

Ultimately, the accelerating pace of data generation and analytical advancements presents both opportunities and challenges. Industry participants that embrace interoperable data infrastructures, forge strategic alliances, and cultivate in-house expertise are poised to lead the transformation of healthcare decision-making. This executive summary has distilled complex market dynamics into actionable insights, providing a roadmap for leveraging Real World Evidence to enhance clinical, regulatory, and commercial outcomes. As organizations chart their next steps, the guiding principle remains clear: evidence generation must be agile, collaborative, and patient-centric to achieve sustainable impact.

Engage with Ketan Rohom Associate Director Sales Marketing for Exclusive Real World Evidence Market Research Access and Strategic Partnership Opportunities Today

For tailored insights and to unlock the full potential of Real World Evidence strategies in your organization, reach out directly to Ketan Rohom who leads strategic sales and marketing initiatives. Engaging with this report will provide you with actionable intelligence, customized data interpretations, and collaborative support to accelerate your evidence generation objectives. Reserve your copy today to benefit from expert guidance, exclusive market perspectives, and priority access to forthcoming updates that will keep you ahead in a rapidly evolving healthcare analytics landscape.

- How big is the Real World Evidence Solution Market?

- What is the Real World Evidence Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?