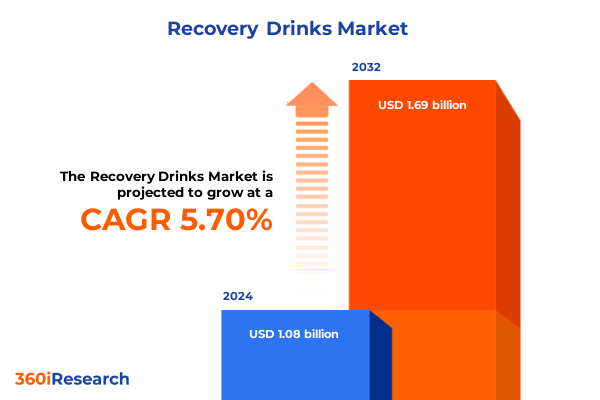

The Recovery Drinks Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.21 billion in 2026, at a CAGR of 5.69% to reach USD 1.69 billion by 2032.

Recovery drinks have evolved into a critical segment of functional beverages, blending hydration with muscle repair to meet diverse consumer wellness needs

Recovery drinks have transitioned from niche sports nutrition products to mainstream functional beverages that address evolving consumer demands for holistic wellness and performance support. What began as simple electrolyte solutions designed for elite athletes has broadened into a diverse category that encompasses muscle repair, immune support, and general hydration. This evolution reflects the increasing expectations of today’s health-conscious consumer, who seeks beverages that not only quench thirst but also deliver targeted benefits such as reduced muscle soreness, enhanced recovery time, and improved overall well-being.

Over the past several years, the recovery drinks segment has embraced innovation at multiple levels, expanding ingredient portfolios to include branched-chain amino acids (BCAAs), adaptogens, probiotics, and botanical extracts. This multifunctional approach positions recovery beverages as an integral component of daily routines, appealing to athletes, fitness enthusiasts, and general consumers seeking convenient nutrition solutions. Brands have responded by launching products with low-sugar formulations, natural sweeteners, and transparent labeling to cater to the clean-label movement that continues to gain traction among health-savvy audiences.

Moreover, packaging innovations-ranging from powder stick packs to single-serve bottles and grab-and-go cans-have improved convenience and portability, enabling consumers to integrate functional hydration seamlessly into active lifestyles. As a result, recovery drinks are no longer confined to post-gym rituals but have become a versatile category that fits diverse consumption occasions, from everyday hydration to focused performance recovery and wellness maintenance.

Functional hydration and advanced formulations are reshaping recovery drink portfolios to align with emerging wellness preferences and performance goals

The landscape of the recovery drinks market has undergone transformative shifts driven by technological advancements, changing consumer behaviors, and intensified competition. In recent years, digitalization has enabled brands to launch direct-to-consumer platforms and subscription-based models, fostering deeper engagement and personalized nutrition services. This paradigm shift away from traditional retail channels toward e-commerce ecosystems has not only expanded market access but also accelerated the pace of product innovation through real-time consumer feedback.

Simultaneously, the rise of precision nutrition has propelled the adoption of data-driven formulations, where advanced analytics and research partnerships guide ingredient selection and dosage. Manufacturers now leverage artificial intelligence to optimize electrolyte balances, protein blends, and phytonutrient combinations for specific demographic segments and activity levels. This scientific rigor has elevated product credibility, supporting marketing claims with clinical evidence and enhancing consumer trust.

In parallel, the convergence of wellness and lifestyle culture has given rise to multifunctional recovery concepts that address mental resilience, immune support, and gut health alongside traditional muscle repair. The integration of adaptogens and postbiotics reflects a growing consumer desire for holistic solutions that support overall well-being. Breaking away from one-dimensional hydration drinks, this new era of recovery beverages emphasizes comprehensive health benefits, driving differentiation and expanding the competitive frontier.

New U.S. tariff measures in 2025 are disrupting international supply chains and recalibrating cost structures across the recovery drinks industry

In 2025, sweeping U.S. tariff policies have exerted a notable cumulative impact on the recovery drinks supply chain, compelling industry players to reevaluate sourcing strategies and cost structures. The recent introduction of a 50% tariff on Brazilian agricultural exports, including fruit concentrates and juices, has disrupted the supply of key raw ingredients such as orange and citrus extracts. This measure threatens to elevate procurement costs for beverage manufacturers who rely on Brazilian imports to maintain consistent flavor and nutritional profiles.

Broader tariff hikes have also increased the average duty on imported inputs from just above 2% to approximately 15%, the highest level observed since the mid-20th century. As a result, ingredient procurement, packaging materials, and finished goods have become significantly more expensive, eroding traditional margins and spurring manufacturers to seek alternative suppliers or reformulate recipes. Companies have responded by diversifying geographic sourcing, forging partnerships with suppliers in emerging markets, and investing in domestic production capabilities to circumvent import duties and mitigate volatility.

Looking ahead, sustained tariff uncertainty may continue to reshape global value chains, prompting vertical integration and strategic alliances. By proactively adapting to the evolving trade environment, recovery drink manufacturers can enhance supply chain resilience, optimize production footprints, and protect profitability amid an increasingly complex international trade landscape.

Diverse product formats, distribution channels, ingredient profiles, applications, and packaging innovations underpin segmentation strategies in the recovery drinks market

Segmentation analyses reveal that recovery drinks extend across multiple product formats, each offering unique consumer benefits and market dynamics. Liquid concentrates appeal to value-oriented buyers seeking customizable serving sizes, whereas powders cater to those prioritizing shelf stability and transport convenience. Ready-to-drink formulations, available in both bottles and cans, dominate on-the-go consumption occasions but require more complex manufacturing and distribution capabilities.

Distribution channels also play a pivotal role in shaping market access and consumer reach. Convenience stores provide immediate, impulse-driven pickup opportunities, while supermarkets and hypermarkets serve as primary venues for mainstream shoppers seeking familiar brands. Specialty retailers reinforce premium positioning by curating novel or niche formulations, and online retail-through brand websites and third-party marketplaces-enables personalized purchasing experiences and subscription models, driving repeat engagement and direct consumer relationships.

Ingredient type segmentation highlights clear distinctions in consumer preferences and functional claims. Carbohydrate-based formulas, ranging from simple carb blends for rapid energy replenishment to complex carbs for sustained release, remain fundamental to post-exercise recovery. Electrolyte-based offerings employ either single-electrolyte salts or multi-electrolyte blends to restore mineral balance, while multi-nutrient solutions combine protein and electrolyte functionality for comprehensive support. High-protein blends featuring whey, casein, or plant-derived sources have attracted fitness-focused consumers seeking muscle repair and growth.

Application-based differentiation underscores the versatility of recovery drinks across fitness and wellness, healthcare, meal replacement, and sports nutrition contexts. These segments encompass pre- and post-workout formulations, clinical rehabilitation solutions, weight management meal replacements, and specialized products for endurance and strength athletes. Finally, packaging variations-spanning bottles, cans, pouches, and sachets-provide brand owners with multiple avenues to optimize cost, convenience, and shelf appeal.

This comprehensive research report categorizes the Recovery Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Ingredient Type

- Application

- Packaging Type

Regional demand patterns in the recovery drinks sector reveal contrasting growth drivers across the Americas, EMEA, and Asia-Pacific markets

Regional landscapes in the recovery drinks market reveal distinct growth drivers, consumption patterns, and regulatory considerations across the Americas, EMEA, and Asia-Pacific. In the Americas, robust wellness trends and high per capita spending on functional beverages support a mature market environment. Consumers in North America are increasingly gravitating toward clean-label and organic formulations, fueling demand for plant-based proteins and natural electrolyte blends that align with health and sustainability values.

Europe, Middle East, and Africa (EMEA) present a heterogeneous mosaic of market conditions. Western European markets show strong uptake of premium, clinically validated recovery solutions, driven by established sports science communities and regulatory frameworks that support precise nutritional claims. In contrast, emerging Middle Eastern and African economies are demonstrating accelerated growth as rising disposable incomes and expanding retail infrastructures enable wider access to imported and locally produced recovery drinks.

Asia-Pacific is the fastest-growing region, propelled by surging fitness adoption, government initiatives promoting active lifestyles, and increasing e-commerce penetration. Markets such as China, Japan, and Australia lead in innovation adoption, with consumers embracing multifunctional beverages that blend hydration, cognitive support, and beauty-enhancing ingredients. Meanwhile, Southeast Asian territories represent a dynamic frontier, where local manufacturers are tailoring formulations to regional flavor preferences and sourcing domestically available nutrients to reduce import dependencies.

This comprehensive research report examines key regions that drive the evolution of the Recovery Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading beverage brands and emerging challengers are leveraging innovation, partnerships, and strategic positioning to capture share in the recovery drinks landscape

A diverse array of established multinationals and agile challengers compete for leadership in the recovery drinks category, each leveraging differentiated capabilities to strengthen their market positions. Large beverage conglomerates have injected significant R&D resources into developing clinically supported formulations, scaling production capabilities, and expanding distribution footprints across retail and direct channels. Their extensive brand portfolios enable cross-category promotions and strategic partnerships with fitness and healthcare providers.

At the same time, emerging brands continue to disrupt the market by focusing on niche consumer segments, such as plant-based protein recovery, multifunctional hydration, or gut-health support. These challengers capitalize on leaner innovation cycles and direct-to-consumer channels to rapidly test new formulations, gather consumer feedback, and refine their offerings. Many have adopted transparent supply chain practices, emphasizing traceable ingredient sourcing and eco-friendly packaging to appeal to ethically minded consumers.

Collaborative ventures between established players and startups have become increasingly common, fostering co-development of novel products and joint marketing campaigns. By uniting the scale and infrastructure of larger firms with the agility and creativity of smaller innovators, these partnerships aim to accelerate time-to-market and enhance competitive differentiation. As the competitive landscape evolves, companies that effectively balance scale economies with consumer-centric innovation will be best positioned to capture growth opportunities in the dynamic recovery drinks arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recovery Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Danone S.A.

- Fast&Up India

- Fluid Sports Nutrition, Inc.

- Glanbia plc

- GU Energy Labs

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Liquid I.V., Inc.

- Monster Beverage Corporation

- Mountain Fuel Ltd.

- Oatly Group AB

- Osmo Nutrition, Inc.

- OWYN, LLC

- PepsiCo, Inc.

- Skratch Labs, LLC

- Sufferfest Beer Company, LLC

- Suntory Holdings Limited

- Tailwind Nutrition, LLC

- The Coca-Cola Company

- Zydus Wellness Limited

Industry leaders should adopt agile innovation, diversify sourcing strategies, and enhance consumer engagement to navigate competitive pressures and trade uncertainties

To navigate the complexities of the recovery drinks market and capitalize on emerging opportunities, industry leaders should embrace a multi-faceted strategic approach that emphasizes agility, consumer centricity, and supply chain resilience. First, accelerating innovation pipelines by integrating digital consumer insights and rigorous clinical validation will support differentiated product offerings that meet precise nutritional needs and substantiate health claims.

Second, diversifying ingredient sourcing across geographies can mitigate the impact of trade disruptions and tariff fluctuations. Establishing partnerships with domestic growers, co-packing facilities, and alternative suppliers in low-tariff regions will enable manufacturers to optimize cost structures and ensure consistent ingredient quality. Vertical integration or long-term supply agreements may further enhance control over critical inputs.

Third, deepening consumer engagement through direct-to-consumer platforms and personalized subscription models will foster loyalty and drive repeat purchases. Brands should leverage data analytics to tailor marketing communications, recommend product variations, and anticipate emerging trends. Omnichannel distribution strategies-combining digital channels with selective brick-and-mortar partnerships-will deliver seamless experiences and maximize market reach.

Finally, prioritizing sustainability throughout the product lifecycle-from eco-friendly packaging to carbon-efficient logistics-will resonate with environmentally conscious consumers and address evolving regulatory requirements. By embedding sustainability and nutritional science at the core of their strategies, industry leaders can differentiate their brands, strengthen stakeholder trust, and secure long-term competitive advantage.

Robust research methodology combining primary interviews, secondary data analysis, and triangulation ensures comprehensive insights into the recovery drinks market

This research leverages a comprehensive methodology designed to deliver robust, evidence-based insights into the recovery drinks market. The primary phase involved interviews with industry executives, nutrition scientists, and channel partners to obtain firsthand perspectives on market dynamics, consumer preferences, and innovation opportunities. Over fifty in-depth discussions were conducted to triangulate qualitative inputs with observed trends.

The secondary phase encompassed an extensive review of academic journals, regulatory filings, trade publications, and reputable news outlets to ensure a broad and credible knowledge base. Sources included peer-reviewed studies on nutrient efficacy, government tariff notifications, and industry news up to mid-2025, enabling a current and holistic understanding of both macroeconomic and category-specific factors.

Quantitative data from trade association reports, customs databases, and publicly disclosed financial statements were integrated into the analysis to identify historical patterns and supply chain movements. Where available, clinical trial results and product launch archives provided validation for emerging formulation trends.

Finally, all data points were synthesized through a triangulation process that reconciled primary interview insights with secondary research findings. This rigorous approach ensures that the conclusions and recommendations presented herein reflect both the strategic intents of market participants and the objective evidence base that underpins sustainable growth in the recovery drinks sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recovery Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recovery Drinks Market, by Product Type

- Recovery Drinks Market, by Distribution Channel

- Recovery Drinks Market, by Ingredient Type

- Recovery Drinks Market, by Application

- Recovery Drinks Market, by Packaging Type

- Recovery Drinks Market, by Region

- Recovery Drinks Market, by Group

- Recovery Drinks Market, by Country

- United States Recovery Drinks Market

- China Recovery Drinks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Comprehensive analysis underscores the evolving recovery drinks market, highlighting strategic pathways for innovation, resilience, and long-term growth

The recovery drinks market stands at a pivotal juncture, driven by an intricate interplay of consumer demand for functional beverages, rapid innovation cycles, and evolving trade environments. From diversified product formats-spanning concentrates, powders, and ready-to-drink options-to sophisticated ingredient portfolios that balance carbohydrates, electrolytes, proteins, and phytonutrients, the category continues to expand its reach and relevance.

Regional nuances underscore the importance of tailored strategies, as mature markets demand premium, clinically validated formulations while high-growth territories benefit from locally adapted flavors and domestically sourced inputs. Meanwhile, U.S. tariff changes in 2025 have heightened the urgency for resilient supply chains and adaptive sourcing decisions.

Competitive dynamics reflect a balance between established beverage conglomerates deploying scale advantages and nimble disruptors introducing novel, consumer-centric concepts. This landscape rewards companies that can integrate scientific rigor, sustainability commitments, and digital engagement to deliver compelling value propositions.

By synthesizing insights across segmentation, regional trends, corporate actions, and trade policies, this report illuminates strategic pathways for stakeholders to foster innovation, mitigate risks, and drive long-term growth. The findings provide a detailed roadmap for navigating market complexities and seizing opportunities within the dynamic recovery drinks ecosystem.

Secure expert insights and market-leading analysis from Ketan Rohom to elevate your strategic decisions and capitalize on the recovery drinks opportunity

To obtain the full recovery drinks market research report and unlock strategic insights that will propel your business forward, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you will gain access to in-depth analysis, actionable intelligence, and customized data that align with your unique business objectives. Engage with his expertise to explore tailored solutions, competitive benchmarks, and exclusive executive presentations designed to equip your leadership team with the knowledge required to capitalize on emerging opportunities in the recovery drinks market. Don’t miss the chance to secure a comprehensive understanding of consumer trends, regulatory developments, and innovation pipelines that can inform product development, supply chain resilience, and go-to-market strategies. Reach out now to initiate a discussion and request your tailored report today

- How big is the Recovery Drinks Market?

- What is the Recovery Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?