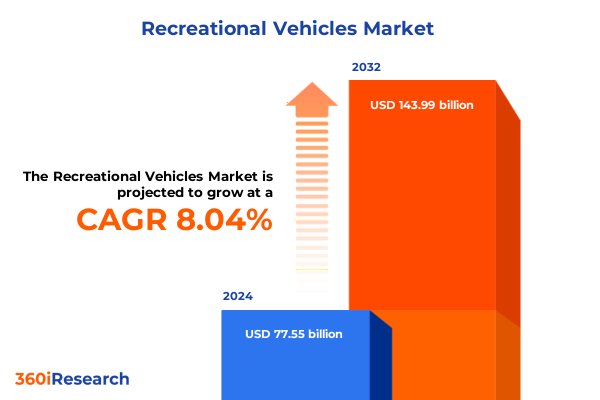

The Recreational Vehicles Market size was estimated at USD 12.81 billion in 2025 and expected to reach USD 13.82 billion in 2026, at a CAGR of 8.61% to reach USD 22.84 billion by 2032.

Unveiling the Evolving Recreational Vehicle Industry Landscape Driven by Lifestyle Changes, Technology Advances, and Market Dynamics

The Recreational Vehicle (RV) industry in the United States is in the midst of a profound evolution driven by changing consumer priorities, technological breakthroughs, and shifting economic landscapes. In recent years, lifestyle preferences have gravitated toward experiences over possessions, fueling renewed interest in outdoor travel and mobile living. As a result, modern RVs have become far more than simple travel trailers; they now feature integrated solar solutions, advanced connectivity options, and ergonomic layouts that cater to both families and remote workers. The convergence of design innovation and digital capabilities has redefined what consumers expect from their mobile accommodations.

In addition, the economic climate and supply chain adjustments have influenced both demand and production dynamics. While the surge in #VanLife and pandemic-era road trips created record highs in shipments in 2021, shipment volumes receded to 333,733 units in 2024 as consumer sentiment normalized and borrowing costs rose. Despite this, the industry remains resilient, with manufacturers responding to these headwinds by optimizing cost structures and prioritizing features that align with emerging preferences. Consequently, this pivotal moment offers an opportunity to explore how evolving motivators-from digital nomadism to sustainable travel-are reshaping the RV market’s trajectory.

Tracing the Revolutionary Shifts Reinventing Recreational Vehicle Ownership From Remote Work to Sustainable Travel and Digital Connectivity Trends

Over the past few years, a series of transformative shifts have reshaped the recreational vehicle industry, altering both product design and consumer behavior. Most notably, the rise of remote and hybrid work models has merged professional and leisure spaces, prompting manufacturers to integrate Wi-Fi boosters, workstation-friendly interiors, and enhanced insulation for year-round travel. These work-from-anywhere features have made RVs a preferred solution for digital nomads seeking a balance between productivity and adventure.

Concurrently, environmental consciousness has surged to the forefront of consumer decision-making. Advanced battery technologies, solar-integrated roofs, and adoption of hybrid powertrains have accelerated the emergence of eco-friendly RV models. While fully electric RVs remain in early stages, incremental shifts toward energy-efficient appliances and off-grid readiness are evident across new product lines. Additionally, the expansion of sharing platforms has democratized access by enabling short-term rentals, lowering the barrier for first-time users and broadening the demographic reach. Together, these developments underscore a landscape in flux, one where technological convergence, sustainability imperatives, and sharing economy principles collectively redefine what modern RV ownership and usage entail.

Examining the Far-Reaching Economic and Operational Impact of U.S. Tariff Measures on Imported Recreational Vehicles and Key Components in 2025

In early 2025, the imposition of a 25% tariff on all imported passenger vehicles and light trucks, including recreational vehicles under Section 232 of the Trade Expansion Act, introduced significant cost pressures for manufacturers and consumers alike. Effective April 2, 2025, this measure applied atop existing duties and was followed by a 25% levy on key automotive components-such as chassis, electrical systems, and powertrain parts-beginning May 3, 2025. These tariffs have amplified input expenses for companies sourcing RV chassis and components from countries including Canada, Mexico, and China.

Moreover, the Recreational Vehicle Industry Association warned that Canadian and Mexican retaliation could disrupt critical export channels, given that Canada accounted for nearly 29,489 RV shipments valued at $1.38 billion wholesale in 2024. As production costs escalate, manufacturers are undertaking strategic adjustments-such as on-shoring certain assembly operations and renegotiating supplier contracts-to mitigate margin erosion. At the consumer level, the cumulative impact of import tariffs and inflationary pressures has dampened purchase propensity, leading to a recalibration of product strategies and financing terms across the industry.

Revealing Critical Insights Derived From Segmenting the Recreational Vehicle Market Across User Types, Propulsion, Models, and Distribution Channels

Examining the market through multiple lenses reveals nuanced performance across end-user, propulsion, vehicle type, purchase type, distribution channel, and length categories. For instance, private owners continue to dominate demand, though rental fleets have expanded rapidly as travel platforms capture first-time enthusiasts. Within propulsion, diesel powertrains remain preferred in luxury motorhomes for their torque and efficiency, whereas gasoline engines still command share in budget-conscious towable models.

Diving deeper, motorhomes and towables exhibit distinct adoption patterns. Class A motorhomes facilitate long-haul travel with premium amenities, while compact Class B and Class C designs serve flexible urban-to-countryside itineraries. Towable segments, including fifth wheels, travel trailers, and pop-ups, appeal to weekend travelers and entry-level buyers, with truck campers carving out a niche among adventure seekers. Purchase behavior is further stratified between new units-driven by feature innovation and warranty offerings-and used models-valued for affordability amid tighter household budgets.

Finally, distribution dynamics influence market access. Direct sales through factory outlets and digital platforms have gained traction, whereas independent dealers maintain strong footholds in rural and suburban regions. OEM dealerships, with integrated financing and service, continue to play a critical role for buyers seeking turnkey experiences. Across length categories-from sub-20-foot trailers to super-sized 31-foot and above units-consumer preferences align with lifestyle objectives, validating the importance of tailored product portfolios.

This comprehensive research report categorizes the Recreational Vehicles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Vehicle Type

- Purchase Type

- Length

- End User

- Distribution Channel

Unearthing Regional Nuances Shaping the Recreational Vehicle Market Across the Americas, EMEA, and Asia-Pacific Powerhouses

Regional dynamics play a pivotal role in shaping the RV market’s performance and strategic outlook. In the Americas, the United States remains the epicenter, given its extensive highway infrastructure, mature dealer networks, and entrenched camping culture. Despite a post-pandemic normalization in shipments, the U.S. continues to lead global demand, buoyed by domestic tourism and flexible financing solutions that cater to both retirees and younger cohorts.

Meanwhile, Europe, the Middle East, and Africa present a sophisticated landscape where sustainability regulations and emission standards heavily influence product specifications. European consumers exhibit strong appetite for electric and hybrid RVs, while stringent road usage policies in urban centers foster innovative micro-RV concepts. Germany holds a commanding share of the continent’s market, underpinned by brands renowned for quality and technological leadership, even as France and the U.K. drive growth through experiential tourism and digital rental platforms.

In the Asia-Pacific region, burgeoning middle classes in China, India, and Southeast Asia are unlocking new avenues of expansion. Rising disposable incomes, coupled with government investments in tourism infrastructure, have elevated RVs from niche luxury to attainable lifestyle assets. Moreover, an emerging sharing economy and rental networks-particularly in Australia and Japan-are accelerating adoption, underscoring the region’s high-growth potential and its role in the industry’s next chapter.

This comprehensive research report examines key regions that drive the evolution of the Recreational Vehicles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Strategic Movements and Competitive Dynamics Among Leading Recreational Vehicle Manufacturers and Specialty Innovators

Leading manufacturers and specialty innovators are executing diverse strategies to secure competitive advantage. Thor Industries, the world’s largest RV producer, announced a strategic partnership shifting Class A diesel motorhome production from Jayco to Tiffin Motorhomes in Alabama to optimize capacities and maintain premium quality standards. This move underscores Thor’s focus on operational synergy and brand integrity within its portfolio. Concurrently, Thor’s realignment of Heartland RV under Jayco reflects a broader initiative to streamline operations and enhance dealer support amid market fluctuations.

Financial performance highlights diverging regional trends. In the third quarter of fiscal 2025, Thor Industries outperformed expectations with EPS of $2.53 and revenue of $2.89 billion, driven by a 9.1% rise in towable sales and effective cost controls. However, European revenues dipped 5.1%, revealing the continent’s mixed recovery pace. REV Group, known for specialty vehicles, also reported strong overall earnings but noted a 2.4% decline in RV sales, reflecting sector-wide headwinds mitigated by proactive pricing measures. Winnebago Industries continues to pursue operational agility and brand differentiation in response to shifting consumer demographics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recreational Vehicles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Honda Motor Co., Inc.

- American LandMaster

- Arctic Cat Inc.

- Bobcat Company

- CFMOTO Powersports, Inc.

- Hisun Motors Corp., USA

- Jiangsu LINHAI Power Machinery Group Co., Ltd.

- John Deere GmbH & Co.

- Kandi Technologies Group Inc.

- Kawasaki Heavy Industries, Ltd.

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Massimo Motor Sports, LLC

- Polaris Inc.

- Segway Technology Co.,Ltd.

- SSR Motorsports

- Suzuki Motor Corporation

- Tao Motor

- Textron Inc.

- The Coleman Company, Inc.

- Tracker Off Road

- Yamaha Motor Co., Ltd.

Providing Actionable Strategies for Industry Leaders to Navigate Market Challenges, Leverage Innovation, and Strengthen Competitive Positioning

To thrive in this period of complexity, industry leaders must adopt a multifaceted approach to innovation, operational resilience, and consumer engagement. First, prioritizing modular design platforms will enable faster adaptation to segment-specific requirements-such as hybrid powertrain compatibility and smart-home integration-without incurring prohibitive retooling costs. By collaborating closely with chassis suppliers and software developers, OEMs can create scalable architectures that support future electrification roadmaps.

Second, strengthening supply chain agility through dual-sourcing strategies and selective on-shoring can mitigate the impact of tariff fluctuations and geopolitical disruptions. Investing in near-shore production clusters for high-value components will reduce lead times and tariff exposure, bolstering both margin sustainability and time-to-market.

Third, leveraging digital ecosystems-spanning virtual showrooms, data-driven customer insights, and predictive maintenance services-will differentiate brands and enhance lifetime consumer value. By integrating telematics and aftermarket connectivity, companies can foster recurring revenue streams while providing personalized experiences that deepen customer loyalty.

Finally, forging cross-industry partnerships-whether in renewable energy, outdoor hospitality, or mobility services-will unlock new use cases and broaden market touchpoints. Strategic alliances with campground operators, digital travel platforms, and energy-tech firms can amplify reach while aligning product offerings with emerging lifestyle trends.

Detailing the Rigorous Research Approach Employed to Ensure Depth, Accuracy, and Reliability in Recreational Vehicle Market Analysis

The research underpinning this analysis combines primary stakeholder interviews, extensive secondary data collection, and rigorous validation protocols. Primary engagements include discussions with senior executives at OEMs, dealers, and technology suppliers, supplemented by insights from industry associations. These interviews yield qualitative perspectives on operational challenges, product roadmaps, and regulatory developments.

Secondary research draws upon publicly available financial statements, press releases, and regulatory filings, augmented by trade publications and reputable news outlets. Tariff measures and policy updates are cross-verified through official government notices and trade association bulletins. Market segmentation constructs are informed by product catalogs, dealership inventories, and consumer survey data to ensure accurate mapping of user preferences.

Data synthesis employs triangulation methods, aligning quantitative shipment records with qualitative forecasts to mitigate biases. Geographic analyses leverage regional trade data, distribution channel metrics, and macroeconomic indicators. Finally, all findings undergo peer review by domain experts to validate assumptions and refine interpretative narratives, ensuring that recommendations are robust, actionable, and relevant to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recreational Vehicles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recreational Vehicles Market, by Propulsion Type

- Recreational Vehicles Market, by Vehicle Type

- Recreational Vehicles Market, by Purchase Type

- Recreational Vehicles Market, by Length

- Recreational Vehicles Market, by End User

- Recreational Vehicles Market, by Distribution Channel

- Recreational Vehicles Market, by Region

- Recreational Vehicles Market, by Group

- Recreational Vehicles Market, by Country

- United States Recreational Vehicles Market

- China Recreational Vehicles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Key Takeaways Highlighting the Current State, Challenges, and Future Opportunities in the Recreational Vehicle Market

In summary, the recreational vehicle market is experiencing a period of recalibration following the exceptional growth of recent years. While core demand drivers-such as the blend of remote work and leisure, sustainability awareness, and digital connectivity-continue to propel innovation, the interplay of high interest rates and import tariffs has introduced new cost considerations. Manufacturers that demonstrate agility in design, supply chain management, and strategic partnerships will be best positioned to capture emerging opportunities.

Segmentation insights reveal that private ownership remains central, but rentals and peer-to-peer sharing are expanding the addressable market. Regionally, the Americas maintain leadership, Europe balances regulatory pressures with technological flair, and Asia-Pacific represents the next frontier fueled by rising incomes and infrastructure investments.

Finally, competitive dynamics affirm that scale-driven players like Thor Industries can leverage synergies across brands, while specialized firms must sharpen differentiation through niche excellence. In this evolving landscape, those who integrate consumer-centric innovation with resilient operations will shape the next chapter of RV travel and lifestyle.

Engage With Ketan Rohom to Acquire the Full Comprehensive Report and Unlock In-Depth Insights Into the Recreational Vehicle Industry

Unlock unparalleled strategic intelligence and comprehensive analysis by securing the full Recreational Vehicle market report directly from Ketan Rohom, whose expertise and guidance ensure that industry leaders gain competitive advantage. Engaging with Ketan opens the door to exclusive insights on tariffs, emerging propulsion technologies, and evolving consumer segments, all presented with the depth and rigor required to inform high-stakes decisions.

Act now to elevate your market understanding, harness actionable recommendations, and capitalize on transformative shifts shaping the RV landscape. Contact Ketan Rohom to purchase the report and unlock your organization’s ability to navigate complexities, mitigate risks, and pursue growth opportunities in 2025 and beyond.

- How big is the Recreational Vehicles Market?

- What is the Recreational Vehicles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?