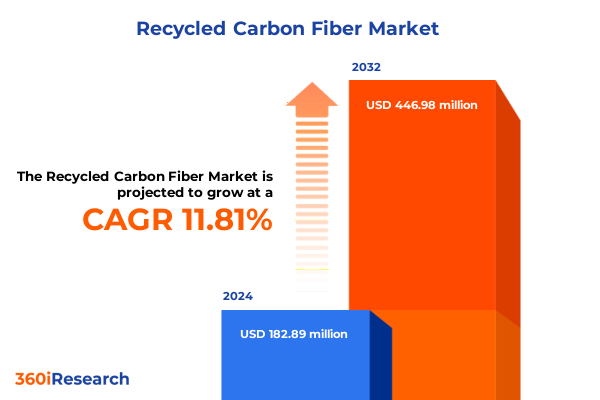

The Recycled Carbon Fiber Market size was estimated at USD 202.16 million in 2025 and expected to reach USD 228.56 million in 2026, at a CAGR of 12.00% to reach USD 446.97 million by 2032.

Discover the foundational role of recycled carbon fiber in driving sustainable innovation and circular economic growth across modern manufacturing landscapes

Recycled carbon fiber is rapidly emerging as a foundational pillar in the transition toward sustainable manufacturing and circular economies. Within the compost of today’s industrial ecosystems, end users and OEMs alike are increasingly prioritizing materials that balance performance with environmental stewardship. This heightened scrutiny has catalyzed investment in technologies that convert end-of-life composites into high-quality feedstock, thereby reducing reliance on energy-intensive virgin carbon fiber production. As a result, recycled carbon fiber is not merely a substitute material but a strategic enabler of product differentiation across a host of demanding applications.

Against a backdrop of regulatory pressures aimed at curbing carbon emissions and waste streams, the recycled carbon fiber supply chain has matured from nascent pilot projects into robust commercial operations. Early adopters in automotive and aerospace sectors have validated material integrity through rigorous testing, demonstrating that properly processed recycled fibers can deliver comparable mechanical properties to virgin equivalents. This convergence of sustainability mandates, cost optimization drivers, and performance requirements sets the stage for recycled carbon fiber to redefine industry norms, positioning it as a catalyst for both technological innovation and environmental responsibility.

Unveiling the critical transformative forces reshaping recycled carbon fiber markets amid technological breakthroughs and regulatory evolution

The landscape of recycled carbon fiber has undergone a profound transformation driven by converging technological and market forces. Innovations in thermal processes such as pyrolysis have significantly enhanced fiber recovery rates and preserved filament strength, enabling high-value reintegration into composite parts. Concurrently, advancements in mechanical handling techniques-ranging from precision shredding to controlled milling-have optimized particle size distribution and cleanliness, broadening the spectrum of viable applications from structural aerospace components to high-performance sporting goods.

Moreover, evolving regulatory frameworks across North America and Europe have elevated sustainability requirements, incentivizing manufacturers to pursue closed-loop recycling solutions. This regulatory impetus has spurred collaborative ventures between original equipment manufacturers, recyclers, and materials innovators seeking to establish standardized protocols for fiber reclamation and certification. As technology developers refine chemical depolymerization and solvolysis methods to recover polymer matrices, the value proposition of recycled carbon fiber is further reinforced by its ability to feed back into thermoplastic-compatible composite systems. Together, these transformative shifts are forging a dynamic ecosystem in which recycled carbon fiber advances from niche sustainability initiatives to mainstream industrial adoption.

Analyzing the far-reaching consequences of 2025 United States tariffs on recycled carbon fiber supply chains pricing dynamics and global competitiveness

The imposition of new tariffs on imported recycled carbon fiber in the United States as of 2025 has introduced a critical inflection point for supply chain strategies and cost structures. Heightened duties on inbound materials have elevated landed costs, prompting domestic manufacturers to reassess sourcing decisions and explore closer integration with regional recyclers. In turn, this realignment has stimulated investment in local processing capacity to mitigate tariff exposures and secure consistent fiber quality. Consequently, lead times have shortened as domestic recycling facilities expand their footprints, although initial capital expenditures to scale up capacity have increased production breakeven thresholds.

Furthermore, the tariff-induced cost pressures have spurred innovation in process optimization, driving stakeholders to increase yields while minimizing energy consumption in thermal and chemical reclamation units. End users are now evaluating total cost of ownership more holistically, incorporating tariff differentials into lifecycle assessments that weigh environmental impact against economic performance. As a result, recycled carbon fiber producers with vertically integrated operations or strategic alliances with domestic recyclers have secured competitive advantages, reinforcing the importance of nimble supply chains and collaborative partnerships. Overall, 2025 tariffs have accelerated the maturation of North American recycled carbon fiber capabilities while recalibrating the global trade dynamics of advanced composite materials.

Unearthing pivotal segmentation insights across applications processes fiber forms end users and resin compatibilities driving market differentiation

A multifaceted segmentation analysis reveals distinct performance drivers and adoption pathways across applications, processes, fiber forms, end users, and resin compatibility. Within applications, the adoption trajectory spans aerospace & defense, where exterior, interior, and structural components demand stringent mechanical properties, to automotive body panels, interior assemblies, structural supports, and under-the-hood components seeking weight reduction and cost savings. Construction & architecture deployments leverage recycled carbon fiber in insulation panels and reinforcement, capitalizing on thermal and structural benefits in building envelopes. At the same time, consumer goods and sporting equipment designers integrate recycled fiber into electronics housings, performance gear, and wearable devices, unlocking new storytelling dimensions around sustainability. Industrial machinery and tooling producers exploit the material’s rigidity for high-precision components, while medical and healthcare innovators develop implants, prosthetics, and surgical instruments with biocompatibility considerations. In wind energy, nacelle components, rotor blades, and tower sections increasingly incorporate recycled fiber to reduce environmental footprint without compromising turbine efficiency.

Turning to process segmentation, the market encompasses chemical pathways such as depolymerization and solvolysis that reclaim high-purity feedstock, mechanical approaches including grinding, milling, and shredding that yield diverse particle sizes, and thermal techniques like pyrolysis and thermolysis that preserve fiber length and tensile integrity. Each processing route offers trade-offs between energy intensity, fiber quality, and scalability, guiding material selection for specific end-uses.

In terms of fiber form, chopped fiber in long, medium, and short variants provides customizable reinforcement options across injection molding and extrusion processes, whereas continuous fiber, granules, powder, and tow fulfill requirements for highly oriented laminates, additive manufacturing feedstocks, and advanced weaving applications. Market participants also distinguish between aftermarket and OEM end-user segments, as long-established producers navigate certified supply agreements while aftermarket suppliers prioritize flexibility and cost competitiveness. Lastly, resin compatibility diverges between thermoplastic and thermoset systems, with thermoplastic composites benefiting from recyclability loops and rapid processing cycles, and thermoset matrices delivering unmatched thermal stability for high-temperature environments.

This comprehensive research report categorizes the Recycled Carbon Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- Fiber Form

- Resin Compatibility

- Application

- End User

Deciphering essential regional dimensions that define recycled carbon fiber market performance within the Americas EMEA and Asia-Pacific landscapes

Regional dimensions exert significant influence on recycled carbon fiber adoption patterns and infrastructure development. In the Americas, North American policy incentives for circular manufacturing have fueled investments in recycling hubs across the United States and Canada, while automotive and aerospace clusters in the Midwest and Southeastern states have formed strategic alliances with local recyclers to secure stable fiber sources. Latin America, by contrast, is emerging as a feedstock-export hub, with composite waste streams channeling into neighboring markets for high-value reclamation.

Across Europe, Middle East & Africa, stringent carbon reduction targets and extended producer responsibility mandates have driven pan-regional standardization efforts, supported by European Union funding for research consortia. Western European nations lead in chemical recycling trials, whereas Southern and Eastern European facilities focus on cost-effective mechanical reclamation. In the Middle East, pilot programs seek to leverage petrochemical expertise to scale solvolysis, while African manufacturers explore low-cost thermal recovery methods to address growing composite waste from wind turbine decommissioning.

Asia-Pacific encompasses heterogeneous dynamics, with Japan and South Korea pioneering high-throughput pyrolysis plants integrated into automotive supply chains. China’s large composite end markets catalyze both domestic recycling capacity and import reliance, whereas Southeast Asian economies are rapidly developing mechanical recycling capabilities to support burgeoning local OEM sectors. Australia’s renewable energy initiatives, particularly in wind farm maintenance, are driving nascent investments in recycled carbon fiber production to close local material loops. These regional insights collectively affirm that geographical context is a defining factor in shaping technology adoption, regulatory alignment, and collaborative network maturity.

This comprehensive research report examines key regions that drive the evolution of the Recycled Carbon Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic company profiles innovations and collaborative ecosystems propelling leadership in recycled carbon fiber advancements

Key industry players are distinguishing themselves through focused innovation, strategic collaborations, and investments in processing capabilities. Leading recyclers have enhanced thermal and chemical recovery units to deliver fiber integrity that meets or exceeds virgin benchmarks. At the same time, composite manufacturers and OEMs are forging joint ventures to align material specifications with application requirements, thereby streamlining qualification pathways for end components. Several established vertically integrated organizations have secured proprietary process patents, enabling them to offer grade-differentiated recycled carbon fiber tailored to specific mechanical profiles and resin systems.

In parallel, technology startups are disrupting traditional models by deploying modular recycling units capable of being co-located at manufacturing sites, reducing transportation costs and fiber contamination risks. These agile entrants often collaborate with research institutions to validate novel depolymerization catalysts and process control algorithms, while also participating in industry consortia that set emerging quality standards. Collectively, these initiatives reflect a market in which leadership is predicated on the ability to scale high-quality production, maintain supply chain transparency, and continuously evolve processing science to meet increasingly stringent performance and environmental criteria.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recycled Carbon Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Recycling Composites

- Carbon Conversions Company

- Carbon Fiber Remanufacturing

- CompLam Material Co., Ltd.

- Dell Inc.

- Elevated Materials

- Fairmat S.A.S

- Gen 2 Carbon Limited

- Hadeg Recycling GmBH

- Mitsubishi Chemical Corporation

- Procotex Belgium SA

- ROTH International GmbH

- Rymyc s.r.l.

- SGL Carbon SE

- Shocker Composites, LLC

- Sigmatex (UK) Limited

- Teijin Ltd.

- The Boeing Company

- V-Carbon

- Vartega Inc.

- Zoltek Corporation by Toray Group

Formulating actionable strategic imperatives to empower industry leaders in navigating challenges and capitalizing on recycled carbon fiber opportunities

To capitalize on the expanding recycled carbon fiber opportunity, industry leaders should adopt a multifaceted strategic agenda. First, manufacturers must invest in scalable processing technologies that optimize fiber recovery yield and quality, thereby enhancing integration with high-value applications. Secondly, establishing long-term supply agreements between recyclers and OEM clusters will mitigate tariff and transportation risks, creating stable demand pipelines and cost predictability. Additionally, engaging with regulatory bodies to shape emerging compliance frameworks and standards will ensure material acceptance across global markets.

Furthermore, fostering cross-industry partnerships with chemical innovators, academic research centers, and end-user consortiums will accelerate the development of next-generation reclamation methods, such as advanced solvolysis catalysts or energy-efficient thermolysis protocols. Equally important is the implementation of robust traceability systems for recycled fiber batches, leveraging digital twins and blockchain to guarantee material provenance and quality certification. Finally, marketing strategies that articulate the environmental impact benefits and lifecycle advantages of recycled carbon fiber will be essential for driving adoption across both OEM and aftermarket channels. This cohesive approach will position market leaders to capture growth while reinforcing sustainability commitments.

Outlining robust research methodologies integrating primary consultations secondary intelligence and rigorous analytical frameworks to ensure data integrity

The research methodology underpinning this analysis integrates primary and secondary data sources, structured to ensure comprehensive market insights and data integrity. Primary research involved in-depth consultations with recycling facility managers, composite manufacturers, and OEM procurement executives to capture firsthand perspectives on processing efficacy, supply chain dynamics, and application-specific performance criteria. These interviews, conducted across North America, Europe, and Asia-Pacific, provided qualitative depth and validated emerging trend hypotheses.

Secondary research encompassed the review of technical journals, trade association white papers, and regulatory filings to map the evolution of recycling technologies and policy frameworks. In parallel, a rigorous analytical framework was applied to synthesize data points, employing comparative process benchmarking to evaluate thermal, mechanical, and chemical recycling routes. Geospatial mapping techniques were leveraged to assess the distribution of processing infrastructure, while portfolio matrix analyses identified competitive positioning among key industry players. Quality assurance protocols included cross-validation between primary interview insights and secondary data findings, ensuring that the final deliverables accurately reflect current market realities and technological capabilities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recycled Carbon Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recycled Carbon Fiber Market, by Process

- Recycled Carbon Fiber Market, by Fiber Form

- Recycled Carbon Fiber Market, by Resin Compatibility

- Recycled Carbon Fiber Market, by Application

- Recycled Carbon Fiber Market, by End User

- Recycled Carbon Fiber Market, by Region

- Recycled Carbon Fiber Market, by Group

- Recycled Carbon Fiber Market, by Country

- United States Recycled Carbon Fiber Market

- China Recycled Carbon Fiber Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding the critical narrative with synthesized insights underscoring recycled carbon fiber’s transformative potential and strategic imperatives

In summary, recycled carbon fiber has transcended its role as an experimental niche to become a strategic enabler of sustainable manufacturing and high-performance composites. Technological breakthroughs in pyrolysis, thermolysis, and depolymerization are unlocking feedstock quality that rivals virgin materials, while evolving regulatory environments and corporate sustainability mandates reinforce the imperative for circular material economies. Despite the complexities introduced by 2025 U.S. tariffs, market participants have responded with domestic capacity expansions and process optimizations that underscore the sector’s resilience and adaptability.

Segmentation insights reveal diverse application pathways, from aerospace structural components to consumer-grade sporting goods, underscoring the material’s versality. Regional analyses highlight that mature markets and emerging economies alike are shaping unique approaches to recycling infrastructure and collaborative frameworks. Leading companies are differentiating through proprietary technologies, strategic partnerships, and transparent supply chains that foster trust and performance validation. Moving forward, stakeholders who align processing innovation, regulatory engagement, and supply chain integration will secure the competitive advantages essential for thriving in this dynamic landscape.

Engage with Associate Director of Sales and Marketing to secure tailored recycled carbon fiber market insights through a personalized research report purchase

To access the comprehensive recycled carbon fiber market research report and gain unparalleled visibility into emerging trends strategies and growth opportunities, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who will guide you through tailored solutions and exclusive insights. Leveraging his deep understanding of advanced composite materials and industry dynamics, Ketan will ensure you receive the data and analysis necessary to drive your strategic decisions with confidence. Don’t miss the opportunity to secure your organization’s competitive edge in the evolving recycled carbon fiber marketplace by engaging today.

- How big is the Recycled Carbon Fiber Market?

- What is the Recycled Carbon Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?