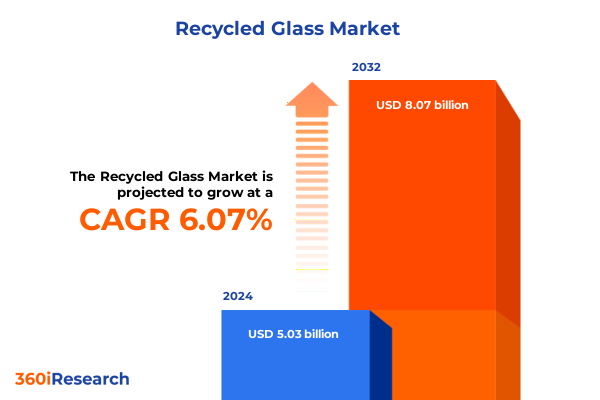

The Recycled Glass Market size was estimated at USD 5.03 billion in 2024 and expected to reach USD 5.32 billion in 2025, at a CAGR of 6.07% to reach USD 8.07 billion by 2032.

Recycled Glass Emerges as a Strategic Circular Material Linking Decarbonization, Resource Security, and Innovation Across Industrial Value Chains

Recycled glass has evolved from a narrow waste-management topic into a strategic material at the heart of decarbonization, circular economy initiatives, and industrial resilience. As governments, brands, and investors intensify their focus on resource efficiency and climate commitments, demand is rising for secondary raw materials that can displace energy‑intensive virgin inputs without compromising performance or safety.

Glass is uniquely positioned in this transition. It is infinitely recyclable without significant loss of quality, and the use of cullet in melting furnaces can materially reduce energy consumption and associated emissions. At the same time, recycled glass now reaches far beyond traditional container manufacturing, finding its way into construction materials, abrasives, filtration media, fiberglass, decorative applications, and even additive manufacturing.

Within this shifting landscape, executives and decision-makers must navigate a complex interplay of policy pressures, technological advances, and evolving end‑use requirements. The competitive environment is being reshaped not only by sustainability expectations but also by trade, tariff, and regional regulatory developments that influence cost structures and cross-border flows of both cullet and finished products.

This executive summary provides a structured view of the factors redefining the recycled glass ecosystem. It examines how transformative shifts in policy and technology are reconfiguring value pools, assesses the implications of recent United States tariff strategies, distills insights from key market segmentations, and highlights the regional and corporate dynamics that matter most for strategic planning. The objective is to equip industry leaders with a clear, actionable narrative to inform investment, sourcing, and innovation decisions in the years ahead.

Structural Shifts in Policy, Technology, and End-Use Demand Are Rapidly Redefining How Recycled Glass Is Collected, Processed, and Valued

The operating environment for recycled glass is undergoing a profound transformation as circular economy policies, corporate sustainability commitments, and technological innovation converge. Regulatory frameworks in many jurisdictions are moving from voluntary recycling targets toward mandatory recycled content requirements, extended producer responsibility schemes, and tighter landfill restrictions. These measures elevate the strategic importance of securing reliable supplies of high-quality cullet and other recycled glass fractions, pushing glass producers, brand owners, and recyclers to reconsider long‑standing supply arrangements.

Simultaneously, technological advances are changing what is technically and economically feasible. Investments in sophisticated collection and sorting infrastructure, including optical sorting systems, density and gravity separation, and more accurate magnetic and eddy current separation, are improving the purity and color segregation of recovered glass. Digital tools and sensors are being embedded into processing lines to monitor contamination, particle size, and moisture levels in real time, allowing processors to tailor outputs precisely to the needs of different downstream applications.

Beyond the processing plants, new application spaces are emerging. Additive manufacturing technologies are experimenting with glass powders and fines as sustainable feedstocks, while road and infrastructure projects are incorporating crushed glass into asphalt and construction aggregates to reduce reliance on natural sand and gravel. Water treatment facilities are adopting glass-based filtration media that offer durability and performance advantages over traditional materials, and designers are increasingly specifying recycled glass in decorative surfaces and art installations to meet both aesthetic and environmental goals.

These developments are occurring within a broader shift in how stakeholders perceive risk and value. Large food and beverage brands, personal care companies, and retailers are setting explicit targets for recycled content in packaging and promotional materials, embedding recycled glass into their brand narratives. Construction and automotive firms are likewise exploring glass-based solutions that can help them meet embodied carbon and resource-efficiency objectives. As a result, competition is intensifying for consistent sources of clean, well-characterized recycled glass, and market power is beginning to concentrate around those actors that can guarantee quality, traceability, and long-term supply.

Taken together, these structural changes are transforming recycled glass from a by-product of waste management into a differentiated input across multiple industrial ecosystems. Companies that treat it purely as a low-cost substitute risk missing emergent opportunities in premium applications, while those that recognize and invest in its strategic role can unlock new revenue streams, strengthen customer relationships, and support their broader sustainability and resilience agendas.

Evolving United States Tariff Strategies in 2025 Reshape Cost Structures, Sourcing Choices, and Risk Profiles Across Recycled Glass Supply Chains

Tariff policy has become an increasingly important backdrop for strategic decisions in the recycled glass value chain, particularly in the United States. While cullet and other waste glass are generally classified under specific tariff lines that carry a zero general rate of duty, including subheadings within the 7001.00 category of the Harmonized Tariff Schedule, this does not mean the sector is insulated from broader trade measures. The cumulative effect of recent United States tariff initiatives in 2025 is reshaping cost structures and risk assessments across related materials, equipment, and downstream glass products.

A key feature of the current trade environment is the move toward more reciprocal and broadly applied tariff instruments that target large and persistent trade imbalances rather than isolated product categories. Recent executive actions in 2025 have highlighted the intention to adjust tariffs as a response to perceived non‑reciprocal trade practices, building on existing authorities to impose additional duties across a wide range of imports. Although recycled glass itself may remain largely duty‑free under most‑favored‑nation treatment, related inputs such as refractory materials, metals, and certain machinery used in collection, sorting, and melting operations can be caught in these wider measures, indirectly raising capital and operating costs for recyclers and glass manufacturers.

In parallel, policymakers are exploring tariff instruments that explicitly link trade measures to environmental performance. Proposals such as the Foreign Pollution Fee Act seek to levy fees on industrial imports based on the emissions intensity of their production, effectively acting as a form of carbon‑related border adjustment. While such mechanisms are still under debate, their trajectory is clear: lower‑emission production routes and secondary raw materials could gain a relative advantage if policy design recognizes their reduced environmental footprint.

For recycled glass stakeholders, these overlapping tariff dynamics translate into both challenges and opportunities. On the risk side, companies that rely heavily on imported glass containers, specialty glass products, or processing equipment from specific trading partners must plan for potential cost volatility and supply disruptions. Sudden changes in duties can alter the economics of importing cullet versus sourcing domestically, affecting regional trade in waste glass and influencing where processing capacity is built.

On the opportunity side, growing interest in carbon‑ or pollution‑adjusted tariffs reinforces the value proposition of recycled glass as a lower‑emission feedstock compared with virgin raw materials. Producers that can document the environmental benefits of high‑cullet formulations and transparent supply chains may be better positioned to support customers facing tighter trade‑linked climate requirements. Coupled with domestic policy incentives for recycling and circular manufacturing, the evolving United States tariff framework in 2025 is nudging the market toward deeper localization of high-quality cullet supply, more resilient regional networks, and increased emphasis on lifecycle performance as a differentiator.

Executives should therefore treat tariff developments not as a narrow compliance issue but as a strategic variable. Scenario analysis that integrates tariff pathways, technology investments, and sourcing options will be critical to minimizing downside exposure while capturing upside from policy shifts that favor circular, low‑emission materials like recycled glass.

Granular Segmentation by Product, Color, Source, Technology, Application, Industry, and Channel Reveals Diverse Value Pools in Recycled Glass

Understanding the recycled glass landscape requires a nuanced view of how value is distributed across product forms, colors, sources, technologies, applications, industries, and distribution models. At the product level, the market spans crushed glass, cullet, and glass fines, each serving distinct roles in the broader ecosystem. Cullet remains central to closed‑loop container and fiberglass production, where consistent particle size and minimal contamination are essential to furnace performance and product quality. Crushed glass, by contrast, is increasingly important in construction aggregates, road base, and abrasive media, where its angularity and gradation can be engineered to meet specific performance criteria. Glass fines, including milled powders, are finding growing use in specialized fillers, 3D printing feedstocks, and filtration media, underscoring the emergence of high‑value niches that rely on precise size reduction and classification.

Color is another critical dimension, shaping both pricing and end‑use options. Clear glass is particularly sought after because of its flexibility in producing a wide range of packaging formats, which makes clear cullet a premium feedstock. Amber and green cullet retain strong ties to beverage and food packaging, where brand identities and product protection requirements drive color preferences. Blue glass, while representing a smaller volume, commands attention in decorative, cosmetic, and premium beverage applications that use color to signal differentiation. Effective color segregation therefore has direct economic implications: well‑sorted color streams can re‑enter high‑value container manufacturing, whereas mixed-color material may be redirected toward construction, tiles, or other applications where aesthetics or optical properties are less constrained.

Source characteristics further define the opportunity space. Post‑consumer supplies collected through curbside programs, deposit‑return schemes, and drop‑off centers exhibit widely varying quality profiles. Curbside collection delivers volume but often suffers from higher levels of ceramics, metals, organics, and mixed colors, placing more pressure on downstream sorting and cleaning. Deposit‑return systems, by contrast, tend to provide cleaner, more uniform streams that more easily feed closed‑loop bottle‑to‑bottle recycling, making them especially attractive to beverage and food brands seeking verifiable recycled content. Drop‑off centers often occupy an intermediate position, allowing communities to channel glass separately from commingled recyclables and thus improve purity.

Post‑industrial sources, such as demolition glass, manufacturing scrap, and off‑spec products, contribute a different profile of advantages and constraints. Manufacturing scrap and off‑spec containers typically offer highly consistent chemistries and minimal contamination, supporting efficient remelting in container and fiberglass furnaces. Demolition glass, on the other hand, requires more intensive cleaning and separation to remove frames, coatings, and embedded materials but offers substantial volumes aligned with the long‑term renovation and replacement cycles of the built environment. The balance between post‑consumer and post‑industrial sources is therefore a central strategic consideration for processors that must align feedstock characteristics with downstream specifications.

Processing technology is where many of the most dynamic innovations are taking place. Cleaning and decontamination stages, including label and organics removal followed by washing and drying, are evolving to handle more complex packaging formats and higher contamination loads without sacrificing yield. Collection and sorting operations are integrating density and gravity separation, magnetic and eddy current separation, and increasingly sophisticated optical sorting systems to remove non‑glass contaminants, differentiate between glass colors, and segregate particle sizes in a single integrated flow. Size reduction and classification, through controlled crushing and milling, are being optimized to create tailored products for abrasives, filtration, or additive manufacturing, where particle shape and distribution can significantly affect performance.

Beyond mechanical processing, melting and re‑forming technologies are being fine‑tuned to accommodate higher cullet ratios and more diverse feedstocks while maintaining furnace stability and product quality. Separation and purification steps support specialty applications that demand stringent compositional control. Thermal treatments such as annealing and tempering are enabling recycled glass to enter safety-critical or performance‑sensitive uses, including architectural glazing, interior surfaces, and certain automotive components. The interplay between these technologies determines not only operating costs but also the range of applications that can be served from a given processing facility.

On the demand side, applications for recycled glass cut across traditional and emerging sectors. Container manufacturing remains a cornerstone, spanning bottles and jars across beverages, food, pharmaceuticals, and personal care. Here, cullet use is driven by energy savings, emissions reduction, and brand commitments to recycled content. Fiberglass production, including continuous filament for composites and wool and blanket for insulation, leverages cullet to improve furnace efficiency and support the development of lightweight, high‑performance materials for construction, automotive, and industrial uses. Abrasive applications such as grinding and sandblasting benefit from the hardness, angularity, and reduced silica dust potential of glass media compared with some mineral alternatives.

At the same time, more differentiated opportunities are emerging. 3D printing and additive manufacturing innovators are experimenting with glass powders to create custom parts, molds, and artistic pieces, broadening the technological frontier for recycled material. Art and craft supplies and decorative and aesthetic uses tap into consumer demand for visibly sustainable materials in furniture, interior finishes, jewelry, and bead making. Highway and road projects are incorporating crushed glass into asphalt and subbase layers, while water treatment facilities adopt glass-based filter media for municipal and industrial filtration systems. Fillers made from glass fines are also gaining traction in construction products, sealants, and specialty chemical formulations.

These application trends map onto a wide spectrum of end‑use industries, from automotive and construction to chemicals, electronics, food and beverage, and personal care and cosmetics. Consumer goods categories such as art glass and studio glassblowing, furniture, and jewelry are leveraging recycled glass to differentiate on design and sustainability simultaneously. Food and beverage brands see recycled glass packaging as a tangible expression of environmental responsibility, while construction and insulation producers rely on cullet to help meet increasingly stringent energy and building code requirements.

Finally, distribution channels are evolving alongside digitalization. Offline channels remain dominant for bulk cullet, crushed glass aggregates, and large-volume industrial supplies where logistics and local relationships are paramount. However, online platforms are becoming increasingly important for specialty grades and smaller batch orders, particularly in art, craft, decorative, laboratory, and additive manufacturing segments. This growing online presence enhances market transparency, facilitates access to niche products such as specific particle-size distributions or color blends, and enables smaller buyers to participate more actively in the recycled glass economy.

Across these segmentation dimensions, the central insight is that recycled glass is not a single, homogeneous commodity. Instead, it comprises a suite of differentiated products and services whose value depends on precise alignment between feedstock characteristics, processing capabilities, application requirements, and distribution strategies. Companies that can navigate and actively shape these segments are better positioned to capture premium opportunities and build resilient, high‑margin positions across the recycled glass value chain.

This comprehensive research report categorizes the Recycled Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Glass Color

- Source

- Processing Technology

- Application

- End-Use Industry

- Distribution Channel

Divergent Regional Policy Ambitions, Infrastructure Maturity, and Industrial Bases Shape Recycled Glass Trajectories in the Americas, EMEA, and Asia-Pacific

Regional dynamics strongly influence how recycled glass markets develop, with distinct policy priorities, infrastructure maturity, and industrial structures shaping trajectories in the Americas, Europe, the Middle East and Africa, and the Asia‑Pacific region. In the Americas, the United States and Canada anchor a landscape characterized by well-established glass manufacturing bases, growing emphasis on container deposit systems, and incremental expansion of curbside and drop‑off collection infrastructure. Several states and provinces are tightening recycling requirements and supporting investments in processing capacity, especially where container manufacturing and fiberglass plants seek higher cullet ratios to meet internal sustainability targets.

Within Latin America, a different picture emerges. Rapid urbanization and rising consumption of packaged goods are increasing the availability of post‑consumer glass, but collection and sorting infrastructures remain uneven across countries and cities. Informal collection networks often play a critical role in aggregating material, while formal recycling programs are gaining momentum in major metropolitan areas. As policy frameworks evolve and multinational brands push for higher recycled content, there is significant potential for new processing capacity that can upgrade locally collected glass into specification‑grade cullet for regional consumption.

In Europe, part of the broader Europe, Middle East and Africa grouping, regulatory ambition is particularly strong. Long‑standing packaging directives, producer responsibility schemes, and circular economy action plans have driven higher collection and recycling rates, creating a sophisticated market for color‑sorted cullet. Many European countries are pursuing aggressive recycled content targets and considering additional measures to limit exports of strategic secondary materials, which could, over time, redirect more cullet toward domestic and regional demand. The Middle East is investing in glass recycling in line with large‑scale construction and infrastructure programs, while selected African economies are at earlier stages of developing organized collection and processing systems but show growing interest in using crushed glass as a construction aggregate and container feedstock.

Asia‑Pacific presents perhaps the most heterogeneous regional landscape. Mature economies such as Japan, South Korea, Australia, and New Zealand have relatively advanced glass recycling infrastructures and are experimenting with higher cullet use in both containers and specialty glass applications. In contrast, emerging economies across Southeast Asia and South Asia exhibit rapidly growing consumption of glass-packaged products and expanding glass manufacturing capacity, but face constraints in collection, contamination control, and formal recycling infrastructure. China and India, in particular, are balancing the need for large-scale container and fiberglass production with efforts to reduce waste, improve urban sanitation, and meet environmental targets, creating strong incentives to modernize glass collection and processing.

Trade flows intersect with these regional developments. Historically, some regions exported surplus cullet to markets where processing capacity or demand was stronger, but intensifying circular economy policies and potential trade measures affecting secondary materials are encouraging more localized value creation. As regulations and tariffs evolve, companies must consider not only where glass waste arises and where it can be processed most efficiently, but also how regional policy shifts could reconfigure cross‑border movements of cullet and recycled glass products.

Against this backdrop, regional strategy becomes a critical axis of differentiation. Organizations that tailor their portfolios, sourcing strategies, and technology investments to the specific conditions of the Americas, Europe, the Middle East and Africa, and Asia‑Pacific can better align with local policy trends, customer expectations, and infrastructure realities, securing access to feedstock and end markets in an increasingly competitive environment.

This comprehensive research report examines key regions that drive the evolution of the Recycled Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Participants Accelerate Innovation, Partnerships, and Vertical Integration to Secure High-Quality Recycled Glass Feedstocks

Corporate strategies are playing a decisive role in how the recycled glass ecosystem evolves, as leading participants across the value chain reposition themselves from commodity suppliers to solution partners. Large glass container producers and fiberglass manufacturers are deepening their integration with collection and processing networks, securing access to high‑quality cullet through long‑term contracts, joint ventures with recyclers, and, in some cases, direct investment in material recovery facilities. This shift reflects both the need to manage cost and quality and the imperative to demonstrate credible progress against recycled content and emissions-reduction goals.

Specialized recyclers and processors are differentiating themselves through technology and service offerings. Companies that invest in advanced optical sorting, contamination control, and fine grinding or milling capabilities can offer tailored products for demanding applications such as insulation, abrasives, filtration media, and additive manufacturing. Many are also developing proprietary blends of crushed glass and glass fines that optimize performance in construction materials, water treatment, or specialty chemical formulations, effectively moving up the value chain from generic waste processors to materials engineering partners.

Brand owners in food and beverage, personal care, cosmetics, and consumer goods are exerting growing influence as they translate sustainability commitments into specific procurement requirements. These firms increasingly seek suppliers that can deliver verified recycled content, traceable supply chains, and stable quality, often supported by certifications and lifecycle assessments. Strategic partnerships between brand owners, glass manufacturers, and recyclers are becoming more common, enabling joint investments in infrastructure, pilot projects for novel packaging formats, and collaborative problem‑solving on issues such as color contamination or lightweighting.

Technology providers and equipment manufacturers represent another crucial segment of the corporate landscape. Vendors of collection systems, sorting equipment, washing and drying lines, melting technologies, and thermal treatment systems are integrating sensors, data analytics, and automation to improve process control and yield. Some are offering modular, scalable solutions that can be deployed in smaller markets or near major waste-generating hubs, broadening access to high‑performance recycling capabilities beyond traditional industrial centers.

Across these groups, digitalization is emerging as a common thread. Leading companies are implementing data platforms that track material flows from collection to end use, monitor quality parameters in real time, and support predictive maintenance of critical equipment. This data-driven approach enables more accurate forecasting of feedstock availability, better alignment of processing capacity with demand, and transparent reporting to regulators, investors, and customers.

Mergers, acquisitions, and strategic alliances are further reshaping the competitive landscape. Transactions often aim to secure geographic coverage, broaden technology portfolios, or gain closer access to key end‑use sectors. As the market matures, distinctions are emerging between players that compete primarily on cost in low‑value segments and those that focus on specialized applications, technical support, and integrated circular solutions. For executives, understanding where their organizations sit on this spectrum, and which capabilities they must build or acquire, is central to defining a resilient and profitable position in the recycled glass value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recycled Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Ardagh Group S.A.

- BA Glass B.V.

- Balcones Resources, Inc.

- CAP Glass LLC

- Chanja Datti Co. Ltd.

- Coloured Aggregates Inc.

- Compagnie de Saint-Gobain S.A.

- Dlubak Glass Company

- Gallo Glass Company by E & J Gallo Winery

- Gaskells Waste Services

- Glass Recycling & Logistics

- GlassEco. by Fisher Recycling

- Heritage Glass, Inc.

- Momentum Recycling, LLC

- Ngwenya Glass Eswatini

- O-I Glass, Inc.

- Omega Glass Pvt Ltd

- Reiling GmbH & Co. KG

- Renewi Ltd

- SCR-Sibelco NV

- URM UK Limited

- Veolia Environnement SA

- Verallia SA

- Vetropack Group

- Visy Group

- Vitro Minerals, Inc.

Strategic Priorities for Executives Include Quality Upgrades, Portfolio Diversification, and Policy Engagement Across the Recycled Glass Ecosystem

For senior decision-makers, translating the evolving recycled glass landscape into actionable strategy requires a deliberate focus on quality, diversification, and engagement with the broader policy environment. One critical priority is to elevate feedstock quality management from an operational concern to a strategic discipline. This entails working closely with municipalities, material recovery facilities, and collection partners to improve separation at source, invest in advanced sorting and decontamination technologies, and implement shared quality standards that align with the specifications of container manufacturing, fiberglass production, and high‑value niche applications.

At the same time, businesses should reassess their product and application portfolios. Relying solely on traditional outlets such as low‑grade aggregates or undifferentiated cullet can leave companies exposed to price volatility and margin pressure. By contrast, developing capabilities in areas such as finely milled glass for fillers and additive manufacturing, specialized abrasives, engineered filtration media, and decorative or design-focused products can create more resilient revenue streams. This diversification often requires closer technical collaboration with end users to tailor particle size distributions, color blends, and performance characteristics.

Sourcing strategies must also adapt to shifting tariff and trade conditions. Executives should map exposure to cross‑border flows of cullet, containers, equipment, and related inputs, and develop contingency plans that account for potential changes in duties, environmental fees, or non‑tariff barriers. Evaluating the trade‑offs between local and imported supply, including considerations of environmental footprint, reliability, and cost, will be essential to building robust supply chains. Scenario planning that integrates trade policy developments with investment decisions in processing capacity can help organizations avoid stranded assets and capitalize on emerging opportunities.

Policy and stakeholder engagement offer another lever for influence. Industry leaders who actively participate in discussions on packaging regulation, recycling targets, and trade‑related environmental measures can help shape frameworks that recognize the benefits of recycled glass and support investment in collection and processing infrastructure. Constructive engagement with regulators, standard‑setting bodies, and civil society organizations can also enhance reputational capital and open doors to pilot programs or funding opportunities.

Finally, embedding data and transparency into operations will be increasingly important. Implementing tracking systems that follow material from collection through processing to final use can support both operational excellence and credible reporting on recycled content and emissions reductions. Sharing selected data with customers can strengthen partnerships, while internal analytics can guide continuous improvement and capital allocation.

By focusing on these areas-quality, portfolio diversification, trade‑aware sourcing, policy engagement, and data‑driven management-industry leaders can move beyond compliance and cost minimization toward a proactive stance that treats recycled glass as a strategic asset. This approach not only enhances competitiveness but also aligns with broader societal expectations around circularity, climate action, and responsible resource use.

Robust Mixed-Methods Research Framework Integrates Value-Chain Intelligence, Policy Analysis, and Segmentation-Driven Understanding

The insights summarized in this executive overview rest on a research methodology designed to capture the full complexity of the recycled glass value chain. At its core, the approach combines qualitative and quantitative techniques to understand how policy, technology, trade, and end‑use demand interact across segments and regions. Primary research typically includes structured and semi‑structured interviews with stakeholders such as glass manufacturers, recyclers, technology providers, brand owners, regulators, and industry associations. These conversations provide ground‑level perspectives on operational realities, investment priorities, and emerging challenges.

To complement interview findings, extensive secondary research draws on a wide range of publicly available sources, including customs and trade statistics, harmonized tariff schedules, environmental agency reports, technical standards, and policy documents. For example, analysis of tariff classifications and duty rates for cullet and other waste glass under heading 7001 of the Harmonized System, as well as corresponding entries in national tariff schedules, helps clarify the direct and indirect exposure of recycled glass flows to trade measures. Similarly, review of recent executive orders and legislative proposals related to trade and environmental tariffs provides context on how broader policy trends may influence the sector.

Segmentation is a central organizing principle of the research design. The market is mapped by product type, glass color, source, processing technology, application, end‑use industry, distribution channel, and region, with each dimension analyzed in terms of drivers, constraints, and interdependencies. This structure allows for granular assessment of how, for instance, advances in optical sorting might differentially benefit clear cullet for container manufacturing versus mixed-color crushed glass for construction applications, or how regional policy variations affect the relative attractiveness of investment in new processing capacity.

Analytical techniques include value‑chain mapping, technology benchmarking, and scenario analysis. Value‑chain mapping traces the journey of glass from generation through collection, processing, and end use, highlighting points of material loss, quality degradation, and value creation. Technology benchmarking compares different collection, sorting, cleaning, and melting solutions on parameters such as capital intensity, operating costs, output quality, and flexibility. Scenario analysis explores potential futures under varying assumptions about regulatory tightening, tariff adjustments, technological breakthroughs, and changes in consumer or brand-owner behavior.

Throughout the process, findings are cross‑validated across sources and stakeholder groups to ensure consistency and robustness. Divergent perspectives are examined to understand whether they reflect genuine structural uncertainty, regional differences, or information gaps. The outcome is a synthesised view that balances the breadth needed to cover global and cross‑sectoral trends with the depth required to inform specific strategic decisions in individual segments of the recycled glass market.

This methodology is designed not only to describe current conditions but also to provide a structured basis for ongoing monitoring. As policies evolve, technologies mature, and trade dynamics shift, the same framework can be updated with new data and insights, supporting continuous refinement of strategy for organizations engaged in or affected by the recycled glass value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recycled Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recycled Glass Market, by Product Type

- Recycled Glass Market, by Glass Color

- Recycled Glass Market, by Source

- Recycled Glass Market, by Processing Technology

- Recycled Glass Market, by Application

- Recycled Glass Market, by End-Use Industry

- Recycled Glass Market, by Distribution Channel

- Recycled Glass Market, by Region

- Recycled Glass Market, by Group

- Recycled Glass Market, by Country

- United States Recycled Glass Market

- China Recycled Glass Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Recycled Glass Sits at the Nexus of Circular Economy, Energy Efficiency, and Trade Policy, Demanding Proactive Executive Attention

Recycled glass stands at a pivotal intersection of environmental ambition, industrial performance, and trade policy. As circular economy objectives gain prominence, the material’s inherent recyclability and potential to reduce energy use and emissions in glass manufacturing are drawing heightened interest from policymakers, brand owners, and investors. At the same time, advances in collection, sorting, cleaning, and processing technologies are expanding the range of applications and improving the economics of incorporating recycled glass into both traditional and emerging products.

Yet this opportunity is not uniform or automatic. Differences in product type, color, source, processing sophistication, and end‑use requirements create a finely segmented landscape in which value accrues unevenly. Regional disparities in policy frameworks, infrastructure maturity, and industrial bases further shape how and where recycled glass can deliver its greatest impact. Overlaying these factors, evolving tariff and trade regimes influence the relative attractiveness of local versus imported feedstocks and equipment, underscoring the need for resilient, regionally attuned strategies.

For executives and decision-makers, the central conclusion is that success in the recycled glass arena depends on moving beyond a narrow focus on waste diversion or cost minimization. Instead, organizations must treat recycled glass as a strategic input, one that can support decarbonization, strengthen supply security, and unlock differentiated offerings across industries from packaging and construction to consumer goods and advanced manufacturing. Those that invest in quality, innovation, and collaborative partnerships across the value chain are well positioned to capture these benefits, while those that delay may find themselves constrained by rising expectations and tightening regulatory and trade conditions.

As the landscape continues to evolve, sustained attention, informed by rigorous analysis and grounded in an understanding of segmentation and regional dynamics, will be essential. Recycled glass will remain a critical material in the transition to more circular and climate‑aligned industrial systems, offering significant opportunities to those prepared to engage with its complexity and potential.

Engage with Ketan Rohom to Access Detailed Recycled Glass Intelligence and Turn Insight into Confident Strategic Action Today

Unlocking the full strategic value of recycled glass requires timely, granular intelligence that goes well beyond what an executive summary can offer. To translate the dynamics outlined here into concrete competitive advantage, leadership teams need access to deep segmentation analysis, technology benchmarking, regulatory mapping, and company-level profiling tailored to their operating context.

To move from high-level understanding to decisive action, engage directly with Ketan Rohom, Associate Director of Sales and Marketing, and request the complete recycled glass market report. Through this engagement, you can secure comprehensive coverage of product type and color segments, source and processing technology pathways, application and end-use industry trends, and region-specific developments that matter for your portfolio.

By purchasing the full study, your organization gains structured insight into shifting tariff regimes, procurement and pricing patterns, innovation pipelines, and partnership strategies across the value chain. In turn, this enables more confident investment, M&A, and sourcing decisions in an environment where both policy and technology are moving quickly.

Taking this step now positions your business to anticipate change rather than react to it. Connect with Ketan Rohom and obtain the complete report so that your next decisions on recycled glass are grounded in robust evidence, scenario-tested insight, and a clear understanding of where the market is heading next.

- How big is the Recycled Glass Market?

- What is the Recycled Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?