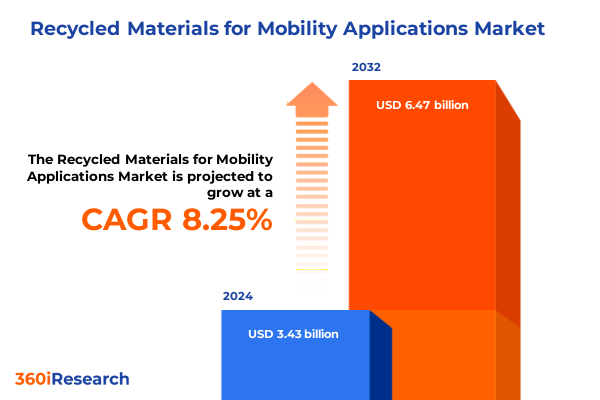

The Recycled Materials for Mobility Applications Market size was estimated at USD 3.71 billion in 2025 and expected to reach USD 4.00 billion in 2026, at a CAGR of 8.23% to reach USD 6.47 billion by 2032.

Navigating the Rise of Recycled Materials in Mobility Applications through Sustainable Innovation and Regulatory Alignment and Industry Collaboration

The growing imperative to integrate recycled materials into mobility applications has redefined the automotive, aerospace, and transportation industries. As environmental regulations tighten and consumers demand greater sustainability, manufacturers increasingly seek to replace virgin inputs with recycled composites, metals, plastics, and rubber. This introduction outlines how recycled materials have evolved from niche components to central pillars of modern mobility design, driven by technological advances and policy frameworks.

Originally, material recovery initiatives focused primarily on basic plastics and metals, but rapid progress in material science and processing techniques has broadened the portfolio of viable recycled inputs. Advances in composite recycling now enable the recovery of high-performance carbon fiber in chassis and structural elements, while enhanced chemical recycling processes allow for the depolymerization of complex plastics into feedstocks suitable for battery casings and engine seals. At the same time, supply chain digitization and life cycle assessment tools have provided manufacturers with unprecedented visibility into environmental impacts and cost efficiencies.

Consequently, an ecosystem has emerged where innovation intersects with regulation and market demand. Collaborative partnerships between recyclers, OEMs, and technology providers have accelerated the development of closed-loop systems. Furthermore, public and private investment in infrastructure-from advanced sorting facilities to energy recovery plants-has lowered barriers to adoption. This section sets the stage for understanding how these interwoven forces position recycled materials as a strategic asset for future mobility solutions.

Understanding Transformative Shifts Driving the Evolution of Sustainable Mobility Supply Chains and Circular Economy Strategies in Recycled Materials Usage

Mobility markets are undergoing a transformative shift as recycled materials become integral to supply chain resilience and environmental stewardship. This evolution is propelled by new international standards mandating minimum recycled content in vehicle components, alongside voluntary sustainability commitments from leading brands. Governments have introduced incentives and tax credits that reward the use of circular materials, while penalties for exceeding carbon thresholds have compelled firms to re-evaluate sourcing strategies.

Simultaneously, consumer attitudes have shifted dramatically over the past five years. There is growing awareness of the carbon footprint associated with raw material extraction and processing. Buyers now prioritize brands that demonstrate genuine commitments to circularity, prompting OEMs to communicate recycled content percentages prominently in marketing campaigns. This consumer-driven pressure has catalyzed innovation, encouraging material scientists to optimize mechanical recycling processes and improve the quality of recycled composites to match or exceed virgin material performance.

Moreover, digital platforms and blockchain-enabled traceability systems are transforming how stakeholders verify material origins and recycling streams. By ensuring transparency, these technologies foster trust among end-users and regulators alike. As a result, recycled materials are no longer perceived as inferior substitutes but as superior choices that contribute to reduced lifecycle emissions and enhanced brand reputation. This section highlights the pivotal shifts redefining sustainability in mobility supply chains and prefaces a closer look at policy impacts and segmentation nuances.

Assessing the Cumulative Impact of 2025 United States Tariffs on Recycled Material Supply Chains Costs and Market Viability for Mobility Manufacturers

In 2025, the United States enacted a series of tariffs targeting imported recycled materials with the aim of protecting domestic recyclers and promoting onshore processing. These measures increased duty rates on imported plastics and composite feedstocks, leading to a realignment of cost structures across mobility supply chains. As a result, many OEMs faced higher procurement costs for specialized recycled polymers and carbon fiber composites, compelling them to re-examine supplier networks.

Domestic recyclers, in contrast, experienced a surge in demand, as the tariff-induced price gap made onshore products more competitive. This shift stimulated investment in energy-efficient chemical recycling plants and mechanical sorting facilities, enabling greater throughput of post-consumer and post-industrial waste streams. However, smaller recyclers struggled to scale rapidly, revealing uneven capabilities within the local industry. Consequently, some global material processors redirected supply to regions outside the United States, while others formed strategic alliances with domestic partners to share infrastructure and expertise.

Furthermore, the tariffs prompted automotive and aerospace manufacturers to adopt a dual-sourcing approach, balancing the cost advantages of local recycled materials with the need for high-performance feedstocks from established offshore suppliers. In doing so, companies developed more sophisticated risk management frameworks to navigate tariff volatility and maintain uninterrupted production. This section delves into the cumulative impact of 2025 tariff policies, underscoring the balance between protective measures and the imperative for innovation-driven cost optimization.

Uncovering Key Segmentation Insights across Material Type Application Technology Source Material Vehicle Type and Distribution Channels for Strategic Positioning

A comprehensive understanding of the recycled materials market for mobility applications demands a nuanced look at multiple segmentation dimensions. Based on material type, markets such as composites, glass, metals, plastics, and rubber each follow distinct value chains. Within the metals segment, aluminum, copper, and steel each carry their own recycling processes, energy requirements, and price drivers, influencing their suitability for structural and battery applications. Plastics break down into high-density polyethylene (HDPE), polyethylene terephthalate (PET), and polypropylene (PP), with varied chemical recycling technologies determining feedstock quality and end-use viability. Rubber recycling, whether from natural or synthetic sources, involves unique challenges around devulcanization and recovery for tires and interior components.

Based on application, recycled feedstocks are channeled into battery components such as casings and electrodes, engine components including blocks, pistons, and valves, and exterior parts like bumpers and grilles, as well as interior assemblies encompassing dashboards, seating, and trim. The tire segment bifurcates into commercial and passenger tires, each requiring specialized rubber formulations with precise performance thresholds. Technology segmentation highlights the rise of chemical recycling methods-depolymerization, pyrolysis, and solvolysis-alongside energy recovery processes such as gasification and incineration. Mechanical recycling techniques like granulation, shredding, and sorting remain foundational, especially for glass and simple plastics.

Source material classifications split the market between post consumer waste streams-ranging from end-of-life vehicles to packaging-and post industrial waste such as manufacturing scrap and process residues. Vehicle type dynamics vary across commercial vehicles, electric and fuel cell electric vehicles, hybrids including full and mild configurations, passenger cars, and two wheelers, each demanding tailored material specifications. Distribution channels diverge between aftermarket and original equipment manufacturers; aftermarket distributors, online retailers, and repair shops serve different customer profiles than tier one, two, and three supplier networks. By weaving these dimensions together, this section reveals critical intersections where material quality, cost structures, and regulatory drivers converge to shape strategic positioning.

This comprehensive research report categorizes the Recycled Materials for Mobility Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology

- Source Material

- Application

- Vehicle Type

- Distribution Channel

Illuminating Regional Dynamics Shaping Recycled Materials Adoption in Mobility Markets across the Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics for recycled materials in mobility exhibit pronounced variations across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, established regulatory frameworks and substantial investment in chemical recycling infrastructure position the United States and Canada as leaders in high-purity feedstock production. Latin American nations, meanwhile, are ramping up recycling capabilities by leveraging abundant post-consumer waste streams and forging public-private partnerships to fund modern sorting facilities. Cross-border trade agreements within NAFTA successors influence material flows, with tariffs and logistical costs dictating supplier selection.

Meanwhile Europe, the Middle East, and Africa region demonstrates a unique blend of stringent environmental mandates and ambitious circular economy targets. The European Union’s recycled content quotas and carbon border adjustment mechanisms push OEMs to source recycled fibers and metals locally, spurring growth in Germany, France, and the Benelux countries. In the Middle East, nascent recycling ecosystems are emerging as governments diversify away from petrochemicals, investing in energy recovery plants and pilot mechanical recycling hubs. African markets focus primarily on post-consumer packaging and scrap metal, where informal sectors still play a critical role despite efforts to formalize collection and processing networks.

In Asia Pacific, diverse development levels create stark contrasts. China’s maturation of advanced sorting and pyrolysis capabilities drives down costs, enabling competitive exports of recycled polymers. Japan and South Korea emphasize technological sophistication in chemical recycling, targeting high-value composites for automotive lightweighting. Southeast Asian economies are in earlier stages, yet rapid urbanization and manufacturing growth present opportunities for scaling mechanical recycling operations. Together, these regional insights illuminate how policy, infrastructure, and market maturity shape the global race toward circular mobility materials.

This comprehensive research report examines key regions that drive the evolution of the Recycled Materials for Mobility Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Advancing the Use of Recycled Materials through Technological Breakthroughs and Strategic Partnerships

Leading companies in the recycled materials mobility market are pioneering technological breakthroughs, scaling infrastructure, and forging strategic alliances to solidify their competitive advantages. Global chemical recyclers invest heavily in pilot plants for depolymerization and solvolysis, aiming to reduce energy consumption while increasing the purity of recovered oligomers for use in battery casings and interior polymers. Concurrently, mechanical recycling specialists deploy advanced optical sorting and AI-driven defect detection to elevate the quality of granulated plastics destined for engine components and trim assemblies.

Strategic partnerships between OEMs and recycling technology firms are another defining trend. Automotive manufacturers collaborate with recyclers to co-locate processing facilities near assembly plants, thereby minimizing transport costs and enhancing feedstock traceability. Joint ventures between metal recyclers and aerospace suppliers accelerate the adoption of recycled aluminum in chassis structures and high-strength steel in safety-critical zones. Additionally, several tire manufacturers have established end-of-life collection networks, integrating devulcanization plants that recover both natural and synthetic rubber for next-generation tire compounds.

Emerging innovators also carve niches with specialized offerings. Startups developing enzymatic recycling pathways for hard-to-process polymers secure funding from venture capital arms of leading mobility suppliers. Companies focusing on post-industrial waste valorization partner with semiconductor and electronics firms to reclaim copper and rare metals from manufacturing scrap. These focused strategies exemplify how differentiated service models and technology specialization create defensible market positions in a rapidly evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recycled Materials for Mobility Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Group

- Arkema SA

- Asahi Kasei Corporation.

- BASF SE

- Carbon Conversions, Inc.

- Celanese Corporation

- Continental AG

- Covestro AG

- DOMO Chemicals GmbH

- DuPont de Nemours, Inc.

- Dätwyler Holding Inc.

- Ems-Chemie Holding AC

- Fairmat SAS

- Faurecia SE

- Formosa Plastics Corporation

- INEOS Group Limited

- Lanxess AG

- Lyondellbase Industries Holdinas B.V.

- Mercedes-Benz Group AG

- Mitsubishi Engineering-Plastics Corporation

- Mitsui Chemicals, Inc.

- Neste Oyj

- Procotex Corporation

- Saudi Basic Industries Corporation

- SGL Carbon SE

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Toray Group

- Ube Corporation

- Unifi, Inc.

- Vartega Inc

- Wellman Advanced Materials

Actionable Recommendations Empowering Industry Leaders to Optimize Recycled Materials Integration and Drive Competitive Advantage in Mobility Applications

To navigate the complexities of recycled materials integration, industry leaders should prioritize several strategic initiatives. First, fostering collaborative ecosystems that unite OEMs, recyclers, and technology providers accelerates innovation and mitigates supply chain risks. By establishing joint research programs focused on advanced chemical and enzymatic recycling methods, stakeholders can unlock new revenue streams and improve feedstock quality.

Second, investing in digital traceability platforms ensures material provenance and compliance with evolving regulatory requirements. Implementing blockchain-based systems enables real-time tracking from collection through processing, thereby enhancing transparency and bolstering brand reputation among environmentally conscious consumers. Furthermore, companies should adopt modular processing architectures, allowing incremental capacity expansions and technology upgrades without requiring massive capital outlays.

Finally, aligning procurement strategies with circular economy principles is essential. Embedding recycled content targets within supplier contracts and leveraging incentive mechanisms such as shared savings agreements can drive behavioral change across tiered supply networks. Additionally, leaders must remain agile in responding to trade policy shifts, including tariff adjustments and trade agreement revisions, by maintaining diversified sourcing portfolios. Through these actionable recommendations, mobility manufacturers can harness recycled materials to reduce costs, satisfy sustainability mandates, and achieve durable competitive differentiation.

Rigorous Research Methodology Combining Primary Interviews Secondary Data and Triangulation Techniques to Deliver Comprehensive Insights on Recycled Mobility Materials

This research initiative employed a rigorous methodology to ensure the reliability and comprehensiveness of insights on recycled materials in mobility sectors. Primary data collection included in-depth interviews with executives from OEMs, recycling technology providers, and regulatory bodies, supplemented by site visits to chemical and mechanical recycling facilities. These qualitative engagements provided nuanced perspectives on technology adoption barriers, feedstock quality challenges, and collaborative models shaping market trajectories.

Secondary research encompassed a thorough review of industry publications, policy whitepapers, and technical standards, facilitating contextual understanding of regulatory frameworks and market incentives across key regions. Additionally, proprietary patent and investment databases were analyzed to map technology evolution and capital flows into recycled materials ventures. Triangulation techniques validated findings by cross-referencing primary interview data with secondary sources, ensuring consistency and addressing potential biases.

Quantitative inputs focused on segmentation analyses, where material types, applications, technologies, source materials, vehicle types, and distribution channels were systematically evaluated. Regional insights were derived by overlaying policy landscapes with existing recycling infrastructure metrics. Final validation workshops with subject matter experts refined the conclusions and recommendations, assuring that the report delivers actionable guidance grounded in both empirical data and frontline expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recycled Materials for Mobility Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recycled Materials for Mobility Applications Market, by Material Type

- Recycled Materials for Mobility Applications Market, by Technology

- Recycled Materials for Mobility Applications Market, by Source Material

- Recycled Materials for Mobility Applications Market, by Application

- Recycled Materials for Mobility Applications Market, by Vehicle Type

- Recycled Materials for Mobility Applications Market, by Distribution Channel

- Recycled Materials for Mobility Applications Market, by Region

- Recycled Materials for Mobility Applications Market, by Group

- Recycled Materials for Mobility Applications Market, by Country

- United States Recycled Materials for Mobility Applications Market

- China Recycled Materials for Mobility Applications Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Conclusion Synthesizing Critical Insights on Recycled Materials Trends Challenges and Opportunities to Inform Strategic Decision Making in Mobility Sectors

The convergence of environmental imperatives, technological innovation, and policy drivers underscores the transformative potential of recycled materials in mobility applications. Throughout this report, we have explored how material segmentation reveals critical intersections where feedstock quality meets application-specific performance requirements, and how regional dynamics shape the accessibility and cost competitiveness of recycled inputs.

Moreover, the cumulative impact of United States tariffs illustrates the delicate balance between protecting domestic industries and maintaining global supply chain efficiency. The insights into leading companies and emerging innovators highlight the importance of strategic collaboration, technology specialization, and digital traceability in securing long-term advantages. Actionable recommendations chart a clear path for industry leaders to optimize procurement, invest in modular processing, and embrace circular economy principles.

Ultimately, the mobility sector stands at a pivotal juncture where circularity is no longer aspirational but imperative. By leveraging the comprehensive insights and strategic frameworks detailed herein, decision-makers can accelerate sustainable transformation, reduce operational risk, and create resilient business models. This conclusion reaffirms the critical role of recycled materials in shaping the future of mobility and lays the foundation for informed, strategic action.

Explore comprehensive recycled materials market research report by contacting Ketan Rohom Associate Director Sales & Marketing to drive sustainability and growth

Unlock unparalleled intelligence on recycled materials in mobility applications by securing the full market research report from an industry expert. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore tailored insights, comparative analyses, and strategic recommendations that address your specific business challenges. By partnering with Ketan, you will gain exclusive access to in-depth evaluations of emerging technologies, segmented market deep dives, and actionable guidance on navigating regulatory landscapes. Accelerate your sustainability goals and strengthen your competitive positioning by leveraging this comprehensive resource. Reach out today to transform raw data into strategic action and foster innovation across your supply chain.

- How big is the Recycled Materials for Mobility Applications Market?

- What is the Recycled Materials for Mobility Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?