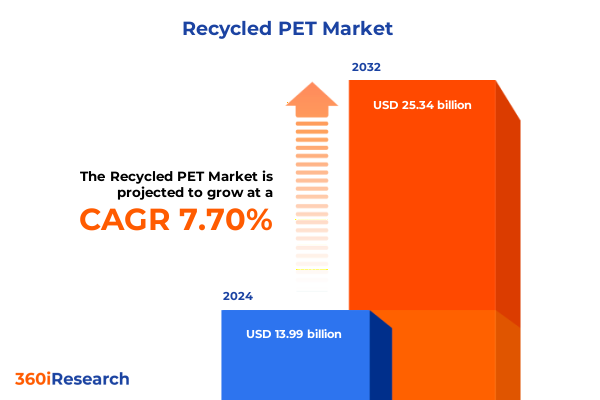

The Recycled PET Market size was estimated at USD 15.04 billion in 2025 and expected to reach USD 16.17 billion in 2026, at a CAGR of 7.73% to reach USD 25.34 billion by 2032.

Setting the Stage for Recycled PET’s Rise: Environmental Imperatives, Policy Evolution, and Industry Commitment to a Circular Plastics Economy

Despite growing awareness of plastic pollution, overall recycling rates for plastic materials remain low. Only 13.6 percent of plastic containers and packaging in the United States were recycled in 2018, underscoring the difficulty of sorting, cleaning, and economically processing mixed plastics for reuse turn2news12. However, polyethylene terephthalate-commonly known as PET-has demonstrated notable progress, driven by its clarity, durability, and widespread adoption in beverage and personal care packaging.

Navigating the New Era of Recycled PET Through Technological Breakthroughs, Consumer Demands, and Regulatory Catalysts Shaping Industry Transformation

Innovations in both mechanical and chemical recycling are redefining how post-consumer and post-industrial PET waste is reclaimed. Traditional mechanical processes now incorporate enhanced sorting, washing, and flake purification to deliver higher-quality recycled PET, while advanced chemical recycling techniques break down polymer chains into monomers for repolymerization into food-grade resin turn1news12. This dual approach strengthens the closed-loop potential of recycled PET and mitigates quality degradation inherent to repeated mechanical cycles.

Digital traceability solutions are transforming supply chains and bolstering trust in recycled content. Beyond conventional resin batch numbering, brands and recyclers are piloting digital watermarking and QR code labeling to capture granular data on polymer origin, processing history, and recycled content levels turn1search0. These systems empower stakeholders with transparent, verifiable records of material provenance and reinforce consumer confidence in recycled PET applications.

Assessing the Far-Reaching Consequences of Newly Imposed 2025 United States Tariffs on Recycled PET Imports and Domestic Production Dynamics

In February 2025, the U.S. administration implemented 25 percent tariffs on recycled material imports from Canada and Mexico, and 10 percent tariffs on recycled PET commodities from China, disrupting established trade flows and raising costs for domestic converters turn0search0. These measures, announced via executive orders, reflect a broader geopolitical strategy aimed at protecting domestic industries while addressing border security and economic policy objectives.

Recyclers and converters have responded by redirecting imports of PET flakes and chips from unaffected regions, notably Southeast Asia and Latin America, to mitigate the impact of North American tariffs turn0search2. While this shift preserves feedstock availability, it introduces new logistics challenges and lengthens supply chains, potentially eroding the environmental and cost advantages of localized recycling.

In parallel, equipment and processing costs have escalated as a result of higher import duties on critical recycling machinery and replacement parts, many of which are sourced internationally turn0search5. This upwards pressure on operational expenses has prompted brands to reevaluate recycled content targets and adjust product incorporation strategies based on revised price dynamics.

Looking ahead, sustained tariff uncertainties could accelerate investments in domestic recycling capacity and feedstock collection systems. Some stakeholders foresee a consolidation of regional recycling hubs and stronger collaboration between brand owners and local reclaimers to secure consistent, tariff-free material supplies turn0search4.

Unveiling Comprehensive Segmentation Dynamics That Illuminate Diverse Product Types, Sources, Processes, Technologies, End-Use Applications, and Distribution Pathways

The recycled PET market encompasses two primary output forms: chips and flakes, each tailored to distinct processing requirements and end applications. The source of feedstock further differentiates offerings, with post-consumer material derived from bottles, containers, and textile waste, and post-industrial inputs originating from manufacturing off-cuts and production residues. Within these categories, the drive toward purity and performance has spurred investment in both chemical depolymerization processes-such as glycolysis, hydrolysis, and methanolysis-and refined mechanical sorting techniques that maximize yield with minimal polymer degradation.

Production methodologies range from batch operations optimized for flexible throughput to continuous lines that deliver scalable, cost-effective output. Technology choices directly influence resin quality and environmental footprint. On the downstream side, recycled PET serves diverse end-use sectors including automotive components, construction materials, electronics and electrical housings, food and beverage packaging, household goods, industrial machinery parts, personal care formats, and textiles and apparel fibers. Distribution channels split between traditional offline supply networks and rapidly growing online platforms that cater to specialized small-batch purchasers and direct-to-brand sourcing models.

This comprehensive research report categorizes the Recycled PET market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Recycling Process

- Production Technology

- Grade

- End-Use

- Distribution Channel

Identifying Regional Market Nuances Across the Americas, Europe Middle East Africa, and Asia Pacific That Drive Recycled PET Adoption and Innovation Globally

In the Americas, robust collection infrastructure and consumer awareness have driven record PET bottle recycling rates, with the United States achieving a 33 percent collection rate in 2023 and North America surpassing 41 percent overall turn2search0. While policy frameworks like extended producer responsibility in several states support recycled content mandates, recent U.S. tariffs on Canadian and Mexican imports are challenging established cross-border supply chains and prompting near-term adjustments among reclaimers turn0search0.

Throughout Europe, the Middle East & Africa region, regulatory directives such as the EU Packaging Directive and mandated recycled content thresholds are catalyzing investment in European recycling capacity. In April 2024, the European Commission imposed anti-dumping duties ranging from 6.6 to 24.2 percent on certain PET imports from China to protect domestic producers and safeguard over 1,500 jobs turn3search0. These measures reinforce the region’s commitment to building closed-loop manufacturing ecosystems.

Asia-Pacific markets display significant heterogeneity. China’s Operation National Sword policies have banned most plastic scrap imports since early 2018, reshaping global feedstock flows and prompting Southeast Asian nations to consider similar restrictions turn3search14. Meanwhile, countries like India and Japan are advancing extended producer responsibility regulations and deploying state-of-the-art sorting and processing technologies, laying the groundwork for accelerated recycled PET adoption across commercial packaging and textile sectors.

This comprehensive research report examines key regions that drive the evolution of the Recycled PET market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Initiatives, Breakthrough Collaborations, and Capacity-Enhancing Investments in the Recycled PET Ecosystem

Unifi, through its Repreve fiber brand, has recycled over 42 billion plastic bottles into branded textiles, forging collaborations with industry leaders like Nike and Patagonia. Repreve’s reported 60 percent reduction in greenhouse gas emissions compared to virgin polyester underscores the environmental leverage of high-quality recycled PET fibers turn1news13.

Eastman Chemical Company is advancing molecular recycling with an upcoming facility slated to process over 110,000 metric tons of waste plastics annually. This initiative will convert mixed PET waste into feedstock for high-performance polymer applications, marking a significant leap in scalability for advanced recycling technologies turn1search1.

TotalEnergies enhanced its recycling footprint in 2023 by acquiring Iber Resinas, securing access to specialized depolymerization expertise and expanding its presence in the European recycled PET resin market turn1search1. This strategic move underscores the value of targeted mergers and acquisitions in accelerating capacity.

Dow and Procter & Gamble’s partnership, launched in early 2024, leverages dissolution-based recycling to convert hard-to-recycle packaging into high-purity recycled polyethylene, exemplifying cross-industry collaboration as a catalyst for innovation turn1search1.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recycled PET market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroFibre Pvt. Ltd.

- Agr International, Inc.

- Alliance Fibres Ltd.

- Aloxe Holding B.V.

- Alpek S.A.B. de C.V.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Amcor PLC

- Dalmia Polypro Industries Pvt. Ltd.

- Eco Baltia group

- Evergreen Recycling, LLC. by Novolex

- Far Eastern New Century Corporation

- Ganesha Ecosphere Ltd.

- Gravita India Limited

- Green Group

- Green Recycled&Modified Polymer Co Ltd.

- Indorama Ventures Public Company Limited

- Intco

- JB rPET Industries Pvt. Ltd. by JB Ecotex Ltd

- KBR Inc.

- Langgeng Jaya Group

- Libolon

- LOTTE Chemical Corporation

- Marglen Industries

- Mura Technology Limited

- Neo Group, UAB

- Nizza Plastics Company Ltd.

- Pashupati Group

- Phoenix Technologies International, LLC

- Placon Corporation

- Plastipak Holdings, Inc.

- PolyQuest, Inc.

- PT. Hadtex

- RM Corp.

- SLMG Beverages Pvt.Ltd.

- Srichakra PolyPlast

- Suntory Holdings Limited

- Toray Industries, Inc.

- Vegware Limited

- Veolia Environnement SA

- Verdeco Recycling

- Zhejiang BoReTech Environmental Engineering Co., LTD

Proven Strategic Imperatives for Industry Leaders to Scale Recycling Capacity, Secure Feedstock, and Strengthen Policy and Technology Alliances

Industry leaders should prioritize scaling chemical recycling facilities alongside mechanical operations to diversify their feedstock portfolio and minimize quality trade-offs. This dual-path approach will enhance supply chain resilience and align with regulations that recognize advanced recycling credits turn1search0.

Investing in digital traceability systems-such as watermarking and QR code platforms-will provide verifiable assurance of recycled content and support compliance with evolving recycled content mandates. Robust data capture will strengthen brand trust and streamline certification processes among downstream partners turn1search0.

Developing strategic partnerships with packaging brands, consumer goods companies, and technology providers can unlock shared investment in sorting infrastructure and innovation pipelines. Collaborative pilot programs will de-risk novel processes and accelerate market adoption of high-quality recycled PET turn1search1.

Finally, engaging proactively with policymakers through industry associations will ensure balanced regulation that supports both environmental objectives and the economic viability of recycling operations. Thought leadership and data-driven advocacy will shape practical policy frameworks that incentivize material circularity and infrastructure growth.

Comprehensive Multisource Methodology Combining Stakeholder Interviews, Public Policy Analysis, and Rigorous Data Triangulation for Robust Market Insights

This research draws upon a rigorous combination of primary and secondary methodologies. Primary inputs include in-depth interviews with recyclers, converters, brand procurement executives, industry association leaders, and technology providers. These stakeholder dialogues provided firsthand perspectives on operational challenges, pricing dynamics, and technological readiness.

Secondary research comprised an exhaustive review of public policy documents, trade association reports, regulatory filings, and reputable news sources. Data triangulation techniques ensured that market observations were cross-validated against multiple sources to maintain analytical integrity.

Quantitative and qualitative data sets were synthesized to identify prevailing trends, segment growth patterns, and regional regulatory impacts. The research framework adhered to established best practices for market intelligence, incorporating sensitivity analyses where applicable to test the robustness of key insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recycled PET market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recycled PET Market, by Type

- Recycled PET Market, by Source

- Recycled PET Market, by Recycling Process

- Recycled PET Market, by Production Technology

- Recycled PET Market, by Grade

- Recycled PET Market, by End-Use

- Recycled PET Market, by Distribution Channel

- Recycled PET Market, by Region

- Recycled PET Market, by Group

- Recycled PET Market, by Country

- United States Recycled PET Market

- China Recycled PET Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesizing Industry Evolution and Collaborative Opportunities to Drive the Next Phase of Sustainable Recycled PET Growth

Recycled PET stands at the nexus of environmental necessity and industrial opportunity, driven by continuous technological advancements, stringent policy mandates, and heightened corporate commitments to circularity. While tariff developments and anti-dumping measures introduce near-term volatility, they also catalyze domestic capacity expansion and strategic supply chain realignments. Continued innovation in chemical and digital recycling, alongside collaborative efforts among industry participants and regulators, will underpin the maturation of a truly closed-loop PET ecosystem. As the industry navigates these evolving dynamics, decisive action today will shape tomorrow’s sustainable plastics landscape.

Connect Directly with Our Associate Director to Acquire the Definitive Recycled PET Market Research Report

To secure comprehensive intelligence and strategic guidance on the recycled PET market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with Ketan to explore tailored insights, discuss your specific informational needs, and obtain your copy of the full market research report. Benefit from direct support in navigating subscription options, accessing detailed data, and leveraging expert analysis to drive your business forward. Contact Ketan today and empower your organization with the critical knowledge required to excel in the rapidly evolving recycled PET ecosystem.

- How big is the Recycled PET Market?

- What is the Recycled PET Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?