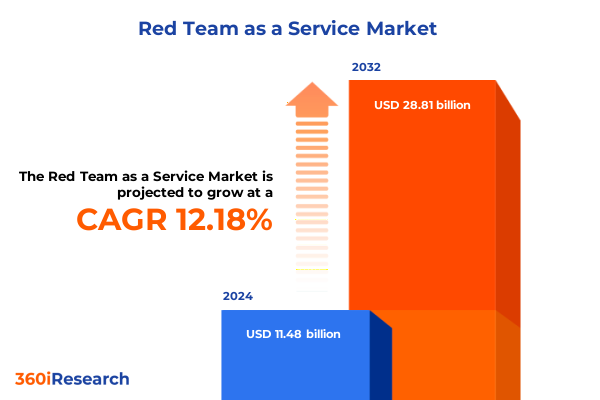

The Red Team as a Service Market size was estimated at USD 12.83 billion in 2025 and expected to reach USD 14.35 billion in 2026, at a CAGR of 12.16% to reach USD 28.66 billion by 2032.

Unlocking Proactive Cybersecurity Defenses Through Red Team as a Service Amid an Intensifying Global Threat Landscape Across Multiple Industries

Organizations today face an ever-evolving threat landscape in which adversaries leverage increasingly sophisticated tactics to exploit vulnerabilities across digital and physical infrastructures. As attack surfaces expand through cloud migrations, remote workforces, and interconnected operational technologies, enterprises are under relentless pressure to validate their defenses through rigorous, adversarial simulations. Red Team as a Service (RaaS) has emerged as a critical solution, empowering security teams to adopt continuous, subscription-based engagements that mimic real-world attackers without the overhead of building in-house expertise. This service model allows organizations to stay ahead of emerging threats by tapping into specialized skills and advanced toolsets on demand to test and strengthen their security posture

Examining the Emergence of AI-Driven Threat Simulations and Cloud-Optimized Red Team Services Reshaping Enterprise Cybersecurity Postures

The RaaS ecosystem has been fundamentally transformed by the integration of artificial intelligence and machine learning, enabling providers to orchestrate more dynamic and adaptive attack simulations at scale. Automated reconnaissance, intelligent payload generation, and AI-driven anomaly detection now augment human expertise, resulting in red team engagements that more accurately replicate sophisticated threat actor behaviors. These innovations yield faster identification of critical weaknesses and deeper insights into potential exploit chains, empowering organizations to remediate vulnerabilities before they can be weaponized

Assessing the Far-Reaching Effects of 2025 United States Trade Tariffs on Cybersecurity Operations and Red Team Service Delivery Strategies

In 2025, the United States significantly altered its trade policy through the restoration and amplification of Section 232 tariffs on steel and aluminum, alongside tariff increases under Section 301 for critical semiconductor and polysilicon components. Initially reinstated at a 25% rate on February 11, the steel and aluminum tariffs were further escalated to 50% effective June 4 to safeguard national security interests and bolster domestic manufacturing capacity

Uncovering How Service Models, Specialized Offerings, Diverse Methodologies, Enterprise Scales, and Industry Verticals Drive Red Teaming Innovation

By service model, external red teaming remains the most widely adopted approach for organizations seeking an objective, outsider’s perspective on their security defenses. Providers simulate advanced persistent threats by combining remote attacks with occasional on-site reconnaissance, uncovering network misconfigurations and procedural gaps that internal teams may inadvertently overlook. Meanwhile, hybrid red teaming offerings have gained traction among mid-market companies, striking a balance between external objectivity and in-house knowledge by augmenting client resources with managed services and periodic expert interventions. Internal red teaming, though less prevalent, serves large enterprises with mature security operations centers; it delivers continuous feedback loops integrated directly into security monitoring and incident response workflows.

This comprehensive research report categorizes the Red Team as a Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Offering

- Method

- Deployment Mode

- Enterprise Size

- End-User Industry

Analyzing Divergent Regional Adoption Trends and Growth Catalysts in the Americas, Europe, Middle East & Africa, and Asia-Pacific Cybersecurity Markets

The Americas lead global adoption of Red Team as a Service, anchored by North America’s sophisticated cybersecurity ecosystem and the United States’ extensive regulatory mandates. In this region, financial institutions and government agencies prioritize adversarial assessments to satisfy compliance frameworks and protect critical infrastructure. Mexico and Brazil have also demonstrated rising demand, driven by digital transformation initiatives and growing awareness of ransomware threats. Collectively, these markets underscore the Americas’ strategic role as both a testing ground for advanced red teaming techniques and a hub for innovation.

This comprehensive research report examines key regions that drive the evolution of the Red Team as a Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders, Innovative Entrants, and Strategic Collaborators Shaping Competitive Dynamics in Red Team as a Service Solutions

Within the RaaS landscape, established cybersecurity powerhouses and nimble disruptors compete fiercely to address evolving client needs. CrowdStrike’s subscription-based red teaming through its Falcon OverWatch platform leverages human analysts combined with AI-driven threat hunting, reflecting a 48% year-over-year growth in proactive service revenue in 2023.IBM Security’s X-Force Red applies decades of offensive security expertise to cloud and IoT testing, catering to clients in heavily regulated sectors such as banking and healthcare. Mandiant, operating under Google Cloud, differentiates itself with nation-state adversarial emulation programs that critically support government and defense engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Red Team as a Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- International Business Machines Corporation

- Fortinet, Inc.

- Trellix

- Deloitte Touche Tohmatsu Limited

- Rapid7, Inc.

- Check Point Software Technologies Ltd.

- Palo Alto Networks, Inc.

- Trend Micro Incorporated

- Secureworks Inc.

- CrowdStrike Holdings, Inc.

- Optiv Security Inc.

- Bishop Fox, Inc.

- BreachLock, Inc.

- Bugcrowd Inc.

- Cisco Systems, Inc.

- Coalfire Systems, Inc.

- Cobalt Labs, Inc.

- CyberNX Technologies Pvt Ltd

- Google LLC by Alphabet Inc.

- HackerOne Inc.

- Kratikal Tech Limited

- Kroll, LLC

- Pen Test Partners Inc,

- Qualys, Inc.

- Red Sentry

- SilentGrid Security Pty Ltd

- Tenable, Inc.

- Trustwave Holdings, Inc by LevelBlue

Strategic Measures for Industry Leaders to Leverage Red Team as a Service Capabilities and Build Resilience Against Sophisticated Cyber Threats

To harness the full potential of Red Team as a Service, industry leaders should establish continuous engagement models that blend automated AI-powered reconnaissance with periodic human-led adversarial simulations. Building strategic partnerships with RaaS providers ensures rapid access to specialized expertise and emerging threat intelligence feeds. Furthermore, organizations must align red teaming outcomes with broader risk management frameworks, integrating findings into incident response playbooks and executive dashboards. Investing in cross-functional training programs will help bridge the operational divide between security, IT, and business units, driving faster remediation cycles and more holistic security governance. Regularly reviewing and updating contractual SLAs to reflect evolving service requirements and threat landscapes will guarantee that RaaS engagements remain relevant and impactful.

Detailing the Comprehensive Research Methodology Incorporating Expert Interviews, Secondary Data Sources, and Multi-Faceted Market Analysis Techniques

This analysis was developed through a mixed-method research approach combining primary and secondary data. Primary insights were gleaned from in-depth interviews with cybersecurity executives, RaaS practitioners, and regulatory specialists to capture firsthand perspectives on service delivery challenges and innovation priorities. Secondary research drew upon industry publications, trade press, and open-source intelligence to validate technology trends, threat vectors, and regional market dynamics. Segmentation mapping was performed to analyze performance across service types, offering categories, delivery methods, enterprise scales, and vertical markets, ensuring a comprehensive understanding of market drivers and obstacles. Rigorous cross-verification of qualitative and quantitative inputs underpins the credibility of this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Red Team as a Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Red Team as a Service Market, by Service Type

- Red Team as a Service Market, by Offering

- Red Team as a Service Market, by Method

- Red Team as a Service Market, by Deployment Mode

- Red Team as a Service Market, by Enterprise Size

- Red Team as a Service Market, by End-User Industry

- Red Team as a Service Market, by Region

- Red Team as a Service Market, by Group

- Red Team as a Service Market, by Country

- United States Red Team as a Service Market

- China Red Team as a Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights to Highlight the Imperative of Proactive Red Team Engagements in Anticipating and Mitigating Cybersecurity Risks

As adversaries continuously refine their tactics, organizations can no longer afford to rely solely on traditional vulnerability scanning or annual penetration tests. Red Team as a Service offers an adaptable, proactive framework for stress-testing defenses, uncovering latent vulnerabilities, and rehearsing incident response mechanisms under real-world conditions. By integrating RaaS into their security strategies, enterprises gain a strategic advantage: the ability to anticipate attacker behavior, prioritize remediation efforts, and demonstrate compliance with stringent regulatory requirements. This approach will be indispensable for enterprises aiming to maintain cyber resilience in an era defined by relentless digital innovation and sophisticated threat actors.

Connect with Ketan Rohom to Secure the Comprehensive Red Team as a Service Market Report and Drive Your Cybersecurity Strategy Forward

To access authoritative insights and in-depth analysis of how Red Team as a Service is reshaping cybersecurity paradigms across diverse industries, reach out to Ketan Rohom at Associate Director, Sales & Marketing. He will guide you through the full market research report, ensuring you secure the strategic intelligence needed to fortify your organization’s cyber defenses and stay ahead of emerging threats.

- How big is the Red Team as a Service Market?

- What is the Red Team as a Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?