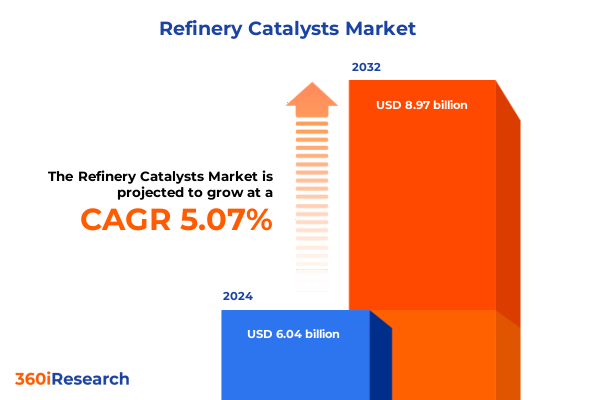

The Refinery Catalysts Market size was estimated at USD 6.33 billion in 2025 and expected to reach USD 6.64 billion in 2026, at a CAGR of 5.10% to reach USD 8.97 billion by 2032.

Navigating the Critical Role of Advanced Catalytic Technologies in Refinery Operations Amid Evolving Energy and Environmental Demands

In an era defined by stringent environmental regulations and the accelerating transition toward cleaner energy pathways, refinery catalysts serve as the unsung enablers of advanced hydrocarbon processing. These specialized materials mediate critical chemical reactions that convert heavy crude fractions into high‐value fuels and petrochemical feedstocks, ensuring both operational efficiency and compliance with low‐emission standards. As feedstock slates grow more complex, blending heavier crudes and incorporating greater proportions of biogenic inputs, catalysts must demonstrate heightened resilience against contaminants, superior selectivity for desired reaction pathways, and enduring activity under fluctuating process conditions.

Simultaneously, refinery operators face mounting pressure to reduce greenhouse gas footprints, prompting a surge in investment toward catalysts capable of supporting hydrogen‐rich processes and carbon capture integration. Against this backdrop, legacy catalyst formulations are being re‐engineered to unlock incremental gains in conversion while maintaining stability over extended run lengths. Moreover, digitalization initiatives are yielding real‐time catalyst performance monitoring, enabling predictive maintenance and more agile process optimization. This introduction sets the stage for a comprehensive exploration of how the refinery catalyst landscape is transforming, driven by environmental mandates, feedstock diversification, and technological innovation.

Embracing the Paradigm Shift in Refinery Catalyst Technologies to Drive Efficiency Sustainability and Resilience in Modern Petrochemical Processes

The refinery catalyst sector is witnessing profound shifts prompted by converging imperatives of sustainability, operational agility, and technological advancement. Foremost is the movement toward catalysts engineered for low‐temperature activation and enhanced resistance to coke formation, a direct response to the growing utilization of heavy and ultra‐heavy crude oils. These next‐generation formulations leverage tailored metal loading, hierarchical pore structures, and novel support matrices to optimize active site accessibility and mitigate deactivation.

Concurrently, digital transformation initiatives are redefining catalyst lifecycle management. High‐resolution sensor arrays paired with advanced analytics facilitate continuous monitoring of reaction kinetics, enabling real‐time adjustments to process parameters and extending catalyst service life. This data‐driven approach not only lowers unplanned shutdowns but also accelerates innovation cycles by feeding performance insights back into development pipelines.

In parallel, the drive for decarbonization has elevated interest in catalysts that support hydrogen production via steam reforming, as well as those that enable carbon monoxide conversion within integrated capture schemes. Research into bi‐functional catalysts capable of valorizing biowaste alongside conventional hydrocarbons underscores the industry’s commitment to circularity. Collectively, these transformative shifts are redefining the competitive landscape, compelling stakeholders to invest in sustainable, smart, and multi‐purpose catalyst solutions.

Assessing the Ripple Effects of United States Trade Measures on Catalyst Supply Chains Innovation Investment and Refinery Competitiveness in 2025

In 2025, the imposition and adjustment of tariffs on imported catalyst precursors and active materials have introduced a complex cost matrix for U.S. refineries. Tariffs targeting alumina and silica, which underpin a broad range of chemical compound catalysts, have exerted upward pressure on raw material costs. Concurrently, levies on precious and rare earth metals have compounded price volatility for metal‐based catalysts, nudging refiners to reassess supply chain strategies and consider local sourcing alternatives.

The repercussions extend beyond immediate procurement expenses. Heightened import duties have incited a surge in domestic catalyst production initiatives, supported by government incentives aimed at bolstering critical materials manufacturing. Refiners are consequently evaluating total cost of ownership, balancing higher upfront material expenditures against reduced logistical lead times and potential tariff exemptions for domestically produced inputs.

Innovation trajectories have also shifted, with R&D teams prioritizing formulations that minimize reliance on tariff‐sensitive metals or that substitute high‐cost components with more abundant transition metals and engineered supports. While these adaptations mitigate short‐term financial strains, they require extensive validation to ensure parity in performance and longevity. As the tariff landscape evolves, the cumulative impact on refining margins, investment timelines, and competitive positioning underscores the critical need for agile supply chain management and strategic material innovation.

Unlocking Nuanced Market Perspectives Through an Integrated Analysis of Catalyst Types Applications and End User Industry Dynamics

A nuanced understanding of the refinery catalyst market emerges from dissecting its foundational types, applications across process units, and the industries that deploy them. Within catalyst types, chemical compounds are exemplified by alumina and silica supports that provide robust platforms for active metals, whereas metal catalysts differentiate between precious metals prized for unparalleled activity, rare earth metals valued for unique redox properties, and transition or base metals selected for cost efficiency. Zeolite‐based catalysts further diversify options, with natural variants offering cost‐effective microporous networks and synthetic analogs engineered for bespoke pore architectures.

Applications span a spectrum of critical refining operations. Alkylation catalysts foster high-octane component formation, contrasting with fluid catalytic cracking media optimized separately for gasoline and diesel production. Hydrocracking agents are tailored to maximize yield of middle distillates and naphtha streams, while isomerization catalysts specializing in butane or pentane/hexane conversions elevate low‐value streams to blendstock quality.

End users integrate these catalysts within broader processing schemas. Chemical manufacturers leverage tailored catalysts to produce specialty chemicals, fuel additive producers focus on anti‐knocking and octane enhancement formulations, and oil and gas refineries deploy a blend of catalytic technologies to optimize hydrocarbon upgrading. This integrated segmentation insight emphasizes how each catalyst class and application influences operational decisions across industries.

This comprehensive research report categorizes the Refinery Catalysts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End User Industry

Exploring Regional Divergences in Catalyst Demand Market Priorities and Policy Drivers Across Americas EMEA and Asia Pacific Operations

Regional distinctions in refinery catalyst demand reflect diverse policy frameworks, feedstock profiles, and investment priorities. In the Americas, the shale revolution has catalyzed an abundance of lighter feedstocks, driving demand for catalysts that enhance gasoline yield and improve octane via isomerization, while also supporting expanded hydrocracking capacity for diesel production. Government incentives fostering domestic manufacturing of critical materials have bolstered localized catalyst production, reducing dependence on imports and mitigating tariff impacts.

Europe, the Middle East, and Africa present a contrasting dynamic, where stringent emissions standards and ambitious decarbonization targets are accelerating investment in catalysts that facilitate hydrogen integration and carbon mitigation. Refineries in this region prioritize robust, long‐life catalysts resistant to high sulfur and heavy metal contaminants typical of crude oils produced locally, while strategic partnerships with technology providers emphasize the co‐development of low‐carbon solutions.

In the Asia-Pacific, surging energy demand in China and India underpins substantial refinery expansions and downstream capacity growth. Operators here are focused on catalysts that address both volume throughput and evolving product specifications, including lower‐sulfur diesel. Additionally, emerging petrochemical complexes emphasize fluid catalytic cracking catalysts optimized for mixed feed streams, reflecting the region’s blend of refining and chemical integration.

This comprehensive research report examines key regions that drive the evolution of the Refinery Catalysts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Leadership Innovations and Collaborations That Define the Competitive Landscape of Refinery Catalyst Providers Worldwide

Leading catalyst providers continue to redefine competitive boundaries through strategic alliances, portfolio diversification, and technology breakthroughs. Major chemical companies have expanded their catalyst divisions by acquiring specialty firms with proprietary active materials and advanced support designs, thereby enhancing their capacity to deliver turnkey solutions for complex refinery configurations. Parallel to these M&A activities, partnerships between catalyst producers and technology licensors are facilitating the co‐creation of integrated process packages, bundling catalyst supply with reactor designs and digital monitoring systems.

Innovation hubs within these corporations are pioneering bio-hybrid catalysts that merge biological feedstocks with traditional refining streams, as well as next-generation hydrogenation catalysts tailored for lower‐temperature operation. At the same time, demonstrated success in scaling up synthetic zeolite production has enabled providers to offer highly customized pore structures that precisely target contaminants and maximize reaction selectivity. These collaborative and technology‐driven approaches are sharpening competitive differentiation, compelling buyers to evaluate not only catalyst performance metrics but also the depth of post‐sales service, digital integration, and co-development potential offered by suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Refinery Catalysts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- ANTEN CHEMICAL CO., LTD.

- Arkema S.A.

- Avantium N.V.

- Axens SA

- BASF SE

- Chempack

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- Clariant AG

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- Eurecat France SAS

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- JGC Holdings Corporation

- Johnson Matthey PLC

- KNT Group

- LyondellBasell Industries N.V.

- N.E. CHEMCAT Corporation

- Nippon Ketjen Co., Ltd.

- Royal Dutch Shell PLC

- Taiyo Koko Co., Ltd.

- Topsoe A/S

- W. R. Grace & Co.

- Zeolyst International

Delivering Actionable Pathways for Refinery Executives to Optimize Catalytic Performance Navigate Regulatory Complexity and Secure Sustainable Growth

Industry leaders should prioritize the development of a flexible catalyst roadmap that aligns with evolving feedstock portfolios and environmental mandates. By forging early‐stage partnerships with advanced materials developers, refiners can gain preferential access to emerging catalyst technologies and co-innovate solutions tailored to specific process challenges. Simultaneously, integrating real-time performance analytics into routine operations enables predictive maintenance planning, reduces unplanned downtime, and captures data that refines future catalyst selections.

To mitigate the uncertainty introduced by trade policies and raw material cost fluctuations, supply chain diversification is imperative. Establishing relationships with multiple qualified catalyst producers-domestic and international-ensures alternative sourcing routes and leverages regional tariff exemptions where available. In parallel, investing in pilot‐scale testing of low‐metal and non‐metal catalyst formulations can uncover viable substitutes that preserve performance while minimizing exposure to high‐duty components.

Finally, adopting a cross-functional governance structure that aligns procurement, R&D, and operations teams will accelerate decision making and foster a culture of continuous improvement. By embedding catalyst strategy within broader digital transformation and decarbonization initiatives, organizations can unlock synergistic gains and secure sustainable competitive advantages.

Ensuring Rigor and Credibility Through a Multi Tiered Research Framework Integrating Qualitative Insights Quantitative Analysis and Expert Validation

The research underpinning this report combines primary and secondary methodologies to ensure both depth and rigor in uncovering market dynamics. Primary research involved structured interviews with refining process engineers, catalyst R&D leaders, and procurement directors, offering first-hand perspectives on performance challenges, investment priorities, and evolving procurement criteria. Additionally, a targeted survey captured quantitative data on catalyst lifetimes, turnaround time impacts, and adoption rates of digital monitoring solutions across diverse geographies.

Secondary research encompassed an extensive review of industry white papers, technical publications, and patent filings to trace innovation trajectories and identify emerging material chemistries. Associations’ conference proceedings and regulatory filings provided insights into policy developments and environmental benchmarks shaping catalyst specifications. All data points were subjected to triangulation, cross-validated through multiple sources to ensure consistency and reliability. Expert panel workshops further refined key findings and validated strategic recommendations, ensuring that the analytical framework reflects both current realities and forward-looking scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refinery Catalysts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refinery Catalysts Market, by Type

- Refinery Catalysts Market, by Application

- Refinery Catalysts Market, by End User Industry

- Refinery Catalysts Market, by Region

- Refinery Catalysts Market, by Group

- Refinery Catalysts Market, by Country

- United States Refinery Catalysts Market

- China Refinery Catalysts Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways on Catalyst Innovations Market Dynamics and Strategic Imperatives to Guide Executive Decision Making in Refining

The evolving landscape of refinery catalysts is characterized by a dual imperative: achieving higher conversion efficiencies while aligning with decarbonization and emissions reduction goals. Advancements in catalyst formulations-particularly those that optimize metal dispersion, support architecture, and bi-functional activity-are enabling refiners to navigate feedstock diversity and stricter product specifications. Digital monitoring technologies are proving indispensable for maximizing catalyst uptime and refining lifecycle management.

Trade policies, notably tariffs on key precursor materials, have underscored the strategic importance of supply chain resilience and innovation in alternative formulations. Segmentation insights reveal that each catalyst class and application niche demands specialized solutions, emphasizing the need for an integrated approach that bridges technical performance with economic and regulatory considerations. Regional divergences further highlight the necessity for tailored strategies, as policy drivers and feedstock characteristics vary significantly across the Americas, EMEA, and Asia-Pacific.

As competitive intensity heightens, collaboration between refiners, catalyst manufacturers, and technology licensors will define success. By adopting the actionable pathways outlined, executive teams can better position their operations for sustained performance, cost efficiency, and environmental compliance. This synthesis of catalyst innovation, market dynamics, and strategic imperatives offers a clear roadmap for decision makers aiming to harness the full potential of catalytic technologies in refining operations.

Engage with Ketan Rohom to Unlock Exclusive Refinery Catalyst Market Research Insights and Elevate Strategic Planning with Tailored Expert Guidance

To explore the future of refining catalysts and ensure that your organization remains ahead in a rapidly evolving marketplace, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide you with tailored insights into the comprehensive market research report, covering the latest innovations, regulatory evolutions, and strategic opportunities within the refining catalyst ecosystem. His deep understanding of industry imperatives will allow you to identify the most impactful sections of the study for your business objectives, whether your focus is on technology adoption, supply chain resilience, or decarbonization strategies. By scheduling a consultation, you can access exclusive data, detailed competitive analyses, and best practices that will inform your executive decision making and drive sustainable growth.

Unlock authoritative research that will empower your strategy for catalyst procurement, advanced process optimization, and new market entry. Elevate your planning with expert guidance and take decisive action with confidence-contact Ketan Rohom today to purchase the full market research report and transform your approach to refinery catalysis.

- How big is the Refinery Catalysts Market?

- What is the Refinery Catalysts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?