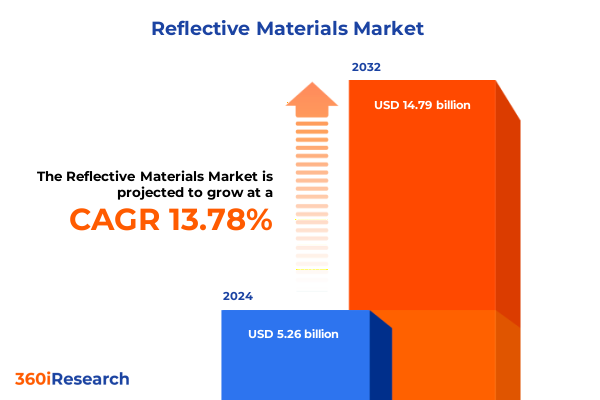

The Reflective Materials Market size was estimated at USD 5.96 billion in 2025 and expected to reach USD 6.76 billion in 2026, at a CAGR of 13.85% to reach USD 14.79 billion by 2032.

Unveiling the Core Themes and Objectives Underpinning the Reflective Materials Market Landscape and Its Strategic Importance for Stakeholders

Reflective materials have emerged as indispensable components across a wide range of safety-critical applications, elevating visibility standards in automotive, transportation, and personal protective equipment sectors alike. The foundational purpose of this study is to examine the intersections between material science innovation, regulatory developments, and end-user demands that are reshaping industry norms. By reviewing the evolution of reflective bead technologies, film advancements, and resin coatings, this report sets out to clarify the strategic levers that stakeholders must pull to achieve superior performance and compliance. In so doing, the introduction frames a comprehensive overview of market drivers, technological catalysts, and regulatory inflection points that collectively influence decision making and investment priorities.

Methodologically, this analysis integrates diverse data sources and expert perspectives to paint a cohesive picture of current conditions. As such, this introduction positions readers to appreciate the cascading effects of emerging trends on cost structures, innovation trajectories, and competitive positioning. By establishing clear objectives and delineating the report’s scope-ranging from tariff implications to regional adoption patterns-this section lays the groundwork for informed interpretation of subsequent insights.

Highlighting the Pivotal Transformations and Technological Advancements Redefining the Reflective Materials Industry and Driving Competitive Differentiation

Recent years have witnessed a series of transformative shifts that are redefining the reflective materials landscape, with each innovation rippling outward to influence adjacent industries. Technological breakthroughs in microprismatic sheeting have enhanced light return efficiency, while hybrid bead formulations are improving durability under harsh environmental conditions. Meanwhile, additive manufacturing techniques are enabling more precise bead geometries, thereby opening new horizons for custom-tailored visibility solutions. Concurrently, the growing emphasis on sustainability has prompted developers to explore recycled glass bead streams and bio-based resin encapsulation, signaling a pivot away from purely performance-driven criteria toward a balanced value proposition that includes environmental impact.

These dynamics are further complicated by evolving regulatory frameworks, which now demand tighter reflectivity thresholds for traffic markings and personal protective gear. As a result, manufacturers are accelerating R&D pipelines and forging academic partnerships to stay ahead of compliance requirements. Coupled with the rise of digital monitoring systems that measure in-field performance, these developments have collectively induced a new phase of competitive differentiation. Consequently, firms that can seamlessly integrate next-generation materials with data analytics stand to redefine end-user expectations and secure market leadership.

Analyzing the Aggregate Effects of United States Trade Policies and Tariff Adjustments Throughout 2025 on Material Costs and Industry Dynamics

Throughout 2025, the United States implemented a succession of tariff adjustments aimed at supporting domestic manufacturing, which have collectively exerted notable pressure on import costs for specialty raw materials. These measures have elevated the cost basis for key inputs such as zirconia ceramic beads and advanced polymer microspheres, prompting companies to reevaluate sourcing strategies and supply chain configurations. In response, some players have expanded domestic production capacities, while others have pursued strategic alliances with regional distributors to mitigate the pass-through of incremental duties.

The cumulative impact has extended beyond procurement; rising input costs have catalyzed innovation in product formulations and spurred investment in process efficiencies. For instance, resin coated beads have undergone compositional optimization to achieve equivalent performance with reduced material intensity. Furthermore, tier-one consumers in automotive safety and traffic sign applications have pressed for longer-term contracts and volume-commitment discounts, shifting bargaining power dynamics. As a consequence, companies that demonstrate agility in recalibrating supply networks and price architectures are better positioned to preserve margin profiles while maintaining service levels under this more protectionist trade environment.

Delving into Distinctive Segmentation Perspectives to Reveal Tailored Insights Across Material Types Technologies Forms Applications and End Uses

Delineating the reflective materials market requires a nuanced appreciation of how product attributes, processing techniques, morphological variations, usage scenarios, and end-user contexts interact to generate differentiated value propositions. When viewed through the prism of material classifications, ceramic beads offer a spectrum of performance anchored by alumina silicate’s cost-effectiveness and zirconia’s superior hardness. Glass beads, categorized under Type I and Type II, deliver consistent retroreflective performance for traffic marking paints and high-visibility apparel. Meanwhile, olefin polymer beads-comprising polyethylene and polypropylene variants-enable lighter-weight assemblies, and resin coated beads featuring epoxy and polyester overcoatings provide enhanced environmental resistance.

In parallel, production methodologies divide into dry and wet processes, each presenting trade-offs in surface finish, throughput, and energy consumption. The physical form of beads, whether in pellet form conducive to extrusion or in powder suitable for spray-applied systems, further dictates downstream integration approaches. Application contexts range widely, from automotive safety components such as license plates and reflective tape to safety apparel including high-visibility jackets and vests, as well as infrastructure-oriented solutions like solventborne or waterborne traffic marking paints and both beaded sheeting and microprismatic sheeting for traffic signs. Finally, the end-use ecosystem spans automotive manufacturing, roadway maintenance, signage production, and specialty textiles, underscoring the importance of a segmentation framework that aligns technical capabilities with sectoral requirements.

This comprehensive research report categorizes the Reflective Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Technology

- Form

- Application

- End Use

Uncovering Strategic Regional Dynamics and Diverse Growth Patterns Influencing Demand and Adoption of Reflective Materials Across Global Markets

Regional dynamics in the reflective materials sector are shaped by a blend of regulatory imperatives, infrastructural investments, and evolving end-user expectations. In the Americas, stringent safety regulations and substantial infrastructure renewal programs have fueled steady uptake of next-generation bead and sheet technologies, while domestic capacity expansions are underway to reduce reliance on imported inputs. The emphasis on critical transportation corridors and private sector fleet safety has accelerated adoption curves, particularly in traffic marking paints and roadway signage solutions.

Shifting focus to Europe, Middle East & Africa, we observe a multifaceted landscape where advanced economies drive innovation through policy frameworks that prioritize sustainability and circularity. Efforts to incorporate recycled content into bead manufacturing are gaining traction, and public-private partnerships are fostering the rollout of extended-warranty reflective solutions to enhance longevity. Emerging markets within this region are simultaneously upgrading safety standards, creating a dual-track demand scenario that rewards suppliers capable of balancing cost and compliance.

Across Asia-Pacific, rapid urbanization and investments in smart infrastructure serve as key growth levers. Government-led safety initiatives and green building certification protocols have catalyzed demand for high-performance microprismatic sheeting in urban transit hubs and smart highway systems. Domestic manufacturers in major economies continue to scale output, while collaborations with global technology leaders are fostering the diffusion of advanced reflective solutions further inland.

This comprehensive research report examines key regions that drive the evolution of the Reflective Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Strategic Collaborations That Are Shaping Innovation Delivery and Competitive Advantage in Reflective Materials

Leading players in the reflective materials domain are advancing their market positions through a blend of organic innovation and strategic collaborations. New product pipelines emphasize next-generation microsphere formulations, as exemplified by initiatives to engineer ultra-high index reflective beads that maximize luminance while reducing weight. Meanwhile, incumbents have pursued alliances with automotive OEMs to co-develop tailor-made solutions that integrate seamlessly into modern headlamp assemblies and adaptive lighting systems.

Partnerships extend beyond direct end users to include materials companies specializing in high-performance polymers and coatings. These collaborations are accelerating time-to-market for hybrid bead composites that leverage proprietary resin encapsulations to achieve enhanced chemical resistance. In addition, joint ventures with logistics and distribution networks are optimizing global footprint efficiencies and shortening lead times in critical regions. Such alliances not only bolster supply chain resilience but also foster cross-pollination of technical expertise, thereby strengthening patent portfolios and reinforcing competitive moats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Reflective Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ALANOD GmbH & Co. KG

- Asian Paints PPG

- Avery Dennison Corporation

- Changzhou Hua R Sheng Reflective Material Co., Ltd.

- Coats Group plc

- Coats Group plc

- DM Reflective Material India Pvt. Ltd.

- Dunmore Corporation

- Eastman Chemical Company

- Nippon Carbide Industries Co., Inc.

- Nippon Carbide Industries Co., Inc.

- ORAFOL Europe GmbH

- Paiho Group

- Reflomax Co., Ltd.

- SKC Co., Ltd.

- Unitika Sparklite Ltd

Recommending Proactive Strategies and Tactical Initiatives for Industry Leaders to Capitalize on Emerging Opportunities in Reflective Materials

As reflective materials continue to gain prominence across safety-oriented applications, industry leaders should pursue a multifaceted approach that balances technological differentiation with customer-centric agility. They must invest in next-generation bead formulations and sheeting systems that prioritize both performance and sustainability, while simultaneously expanding pilot-scale facilities to validate novel material combinations under real-world conditions. Furthermore, establishing collaborative development agreements with end-user segments-ranging from highway authorities to protective apparel manufacturers-will help tailor solutions to nuanced performance requirements.

Complementing R&D investments, executives should evaluate opportunities for backward integration, securing critical raw material inputs to reduce exposure to trade-related cost volatility. Simultaneously, forging alliances with digital analytics providers can enable continuous monitoring of in-field retroreflective performance, thereby creating feedback loops that inform iterative product enhancements. By combining strategic sourcing, advanced manufacturing, and data-driven service offerings, companies can carve out sustainable competitive advantages and foster long-term partnerships with key stakeholders.

Illuminating Rigorous Research Frameworks and Methodological Approaches Underpinning the Analysis of Reflective Materials Market Insights

This analysis is underpinned by a rigorous research framework that integrates both primary and secondary methodologies. Primary research comprised in-depth interviews with senior executives, procurement specialists, and technical directors across the reflective materials value chain, providing firsthand insights into supply chain challenges, innovation roadblocks, and customer priorities. Secondary research encompassed a thorough review of industry standards, patent filings, regulatory publications, and trade association white papers, ensuring a comprehensive understanding of both historical context and emergent trends.

Data triangulation was employed to validate findings from disparate sources, while scenario analysis techniques were used to explore potential market responses to trade policy shifts and technological disruptions. Regular advisory panel sessions with cross-industry experts further refined the assumptions and interpretations, enhancing the report’s strategic relevance. Quality control measures, including peer reviews and sensitivity testing, were systematically applied to uphold analytical integrity and ensure that conclusions reliably reflect the current state of the reflective materials landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Reflective Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Reflective Materials Market, by Material

- Reflective Materials Market, by Technology

- Reflective Materials Market, by Form

- Reflective Materials Market, by Application

- Reflective Materials Market, by End Use

- Reflective Materials Market, by Region

- Reflective Materials Market, by Group

- Reflective Materials Market, by Country

- United States Reflective Materials Market

- China Reflective Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Comprehensive Conclusions to Highlight Key Learnings and Future Trajectories within the Reflective Materials Industry

In conclusion, the reflective materials industry stands at a pivotal crossroads where material innovation, trade policy, and regional heterogeneity converge to shape future prospects. The proliferation of next-generation bead technologies and advanced sheeting formats underscores the sector’s capacity for performance gains, while evolving safety regulations and sustainability mandates redefine success criteria. Cumulative trade policy adjustments have prompted supply chain recalibrations that not only influence cost structures but also act as a catalyst for localized production and compositional innovation.

Segmentation-level examination reveals a diverse set of value drivers, from the hardness advantages of zirconia ceramic beads to the process efficiencies of wet-applied formulations. Regional insights illuminate differentiated adoption trajectories, emphasizing the need for tailored go-to-market models. Moreover, the strategic interplay among leading companies and collaborative networks is setting the stage for accelerated commercialization of hybrid reflective solutions. Armed with these synthesized conclusions, decision makers can confidently chart pathways to capture emerging opportunities, mitigate risk exposures, and deliver superior safety outcomes for end users across multiple sectors.

Driving Immediate Engagement and Empowering Decision Maker Actions Through a Direct Invitation to Secure Tailored Insights from Associate Leadership

To explore the full depth of analysis, gain access to exclusive data visualizations, and receive bespoke strategic guidance tailored to your organization’s unique challenges and opportunities, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom can guide you through customized licensing options, package enhancements, and collaborative workshops designed to accelerate your go-to-market timeline and optimize investment returns. Engage now to secure your copy of the definitive reflective materials market research report and equip your leadership team with the actionable insights necessary to outpace competitors and navigate evolving regulatory landscapes with confidence.

- How big is the Reflective Materials Market?

- What is the Reflective Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?