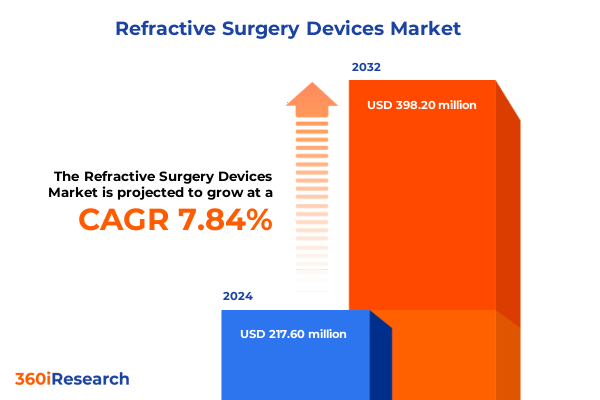

The Refractive Surgery Devices Market size was estimated at USD 234.30 million in 2025 and expected to reach USD 252.96 million in 2026, at a CAGR of 7.87% to reach USD 398.20 million by 2032.

Emerging Innovations and Market Dynamics Shaping the Future of Refractive Surgery Devices in a Rapidly Evolving Ophthalmic Landscape

The landscape of vision correction has undergone a profound transformation in recent years, shaped by technological breakthroughs and evolving patient expectations. Refractive surgery devices now occupy a central role in corrective ophthalmic care, offering solutions ranging from laser-based procedures to advanced intraocular implants. As global populations age and the prevalence of visual impairments such as myopia and presbyopia climbs, demand for precision-driven, minimally invasive interventions has never been higher.

At the forefront of this evolution are excimer and femtosecond laser platforms, which have redefined surgical accuracy and safety thresholds. Complementing these laser systems, phakic intraocular lenses have emerged as a powerful modality for high myopia, with variants including angle-supported, iris claw, and posterior chamber designs each tailored to distinct anatomical considerations. Technological innovations such as small-incision lenticule extraction and surface ablation techniques like LASEK and PRK further broaden the toolkit available to ophthalmic surgeons.

This executive summary distills critical insights into the dynamics shaping the refractive surgery devices market, exploring the interplay of technological innovation, regulatory shifts, and competitive forces. By providing a nuanced understanding of device segmentation, regional differentiation, and strategic imperatives, it aims to equip decision-makers with the clarity required to navigate a complex, rapidly evolving environment.

Revolutionary Technological Advancements and Regulatory Paradigm Shifts Redefining Refractive Surgery Devices and Patient Care Pathways Worldwide

In the past decade, refractive surgery has experienced a series of transformative shifts driven by both innovation in device engineering and a recalibration of regulatory frameworks. Laser platforms have progressively adopted femtosecond technology to replace mechanical instrumentation, elevating precision and reducing collateral tissue trauma. Concurrently, intraocular lens designs have evolved through refined materials and implant geometries that improve biocompatibility and postoperative refractive stability.

Regulatory pathways have mirrored this technological acceleration, with agencies streamlining approvals for incremental enhancements and novel indications. The introduction of real-time intraoperative imaging systems and integrated digital planning tools has shifted procedural paradigms, enabling personalized treatment profiles for astigmatism, hyperopia, myopia, and presbyopia correction. This confluence of hardware advances and software integration has accelerated the acceptance of procedures such as SMILE and advanced surface ablation, which were once niche offerings.

Additionally, advancements in patient engagement platforms and telemedicine have redefined the continuum of care. Preoperative diagnostics and postoperative monitoring can now leverage artificial intelligence to predict visual outcomes and flag early complications. As healthcare delivery models evolve, refractive surgery providers are prompted to align clinical excellence with patient-centric digital experiences, reshaping the competitive landscape and opening new avenues for value creation.

Assessing the Broad Economic and Operational Consequences of the 2025 United States Tariffs on Refractive Surgery Device Innovation Supply Chains and Cost Structures

The tariff landscape in the United States has emerged as a critical factor influencing the manufacturing, distribution, and adoption of refractive surgery devices. In early 2025, the imposition of broad-based reciprocal tariffs introduced an additional layer of complexity for device producers reliant on global supply chains. Steel and aluminum-containing components now carry a 25% levy, while imports from China face cumulative duties reaching 145% after successive rounds of punitive measures and International Emergency Economic Powers Act provisions.

These tariffs have led some industry leaders to absorb elevated costs, whereas others have opted to restructure their supply chains across lower-tariff jurisdictions. For instance, a major diversified medical products company projected a $400 million impact on its medtech divisions, primarily stemming from export levies on devices shipped to China. As a result, firms with significant dependence on international manufacturing have reported inventory write-downs and one-time earnings adjustments, which have weighed on stock valuations in the short term.

Stakeholder discussions at the White House underscored concerns over affordability and patient access, prompting proposals to revisit “Made in USA” labeling standards, pursue regulatory exemptions for essential ophthalmic instruments, and incentivize onshore component production. Consequently, decision-makers in the refractive surgery devices space must weigh the trade-offs between cost mitigation strategies and long-term commitments to supply resilience in a tariff-driven environment.

Unveiling Critical Segmentation Insights Across Product Types Technologies Applications End Users and Distribution Channels for Refractive Surgery Devices

Insight into the refractive surgery devices market reveals nuanced patterns of adoption and performance across multiple segmentation axes. Within the product type dimension, excimer laser systems continue to dominate surface ablation and flap-based procedures, while femtosecond laser platforms gain traction for their versatility in lenticule extraction and corneal flap creation. Phakic intraocular lenses, segmented into angle-supported, iris claw, and posterior chamber variants, have widened treatment eligibility for high myopia, driven by differentiated safety profiles and long-term refractive stability.

Technological segmentation underscores the steady maturation of established procedures such as LASIK and PRK alongside the rising prominence of SMILE, which offers minimally invasive, flapless correction with reduced dry-eye risk. In parallel, surface technologies like LASEK cater to patients contraindicated for corneal incisions, amplifying the spectrum of individualized care pathways. Application-based insights highlight that myopia correction remains the largest procedural category, while growing clinical demand for astigmatism, hyperopia, and presbyopia correction fuels demand for sophisticated laser mapping and implantable solutions.

End-user segmentation reveals that ambulatory surgical centers and dedicated ophthalmic clinics drive volume through specialized refractive surgery programs, whereas hospitals leverage these devices to attract premium vision care clientele. Distribution channels further distinguish market dynamics, as direct sales models facilitate closer collaboration between manufacturers and high-volume surgical sites, while distributor networks extend reach into emerging practices and smaller clinic environments.

This comprehensive research report categorizes the Refractive Surgery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Mapping the Diverse Regional Landscape of Refractive Surgery Device Adoption Growth Drivers and Strategic Opportunities Across Major Global Markets

Regional dynamics in the refractive surgery devices market are marked by divergent regulatory environments, adoption rates, and reimbursement frameworks. In the Americas, mature markets in North America exhibit strong procedural volumes driven by established LASIK and femtosecond platforms. Healthcare providers increasingly integrate advanced diagnostic tools and remote monitoring to enhance perioperative efficiency, while Latin American markets demonstrate growing interest in cost-effective surface ablation systems as access to premium surgical modalities expands.

Across Europe, Middle East & Africa, the regulatory mosaic ranges from fast-track approvals in the Gulf Cooperation Council to more stringent clinical evidence requirements in the European Union. Robust public health initiatives in Western Europe have incorporated refractive surgery into corrective care pathways, stimulating demand for both laser systems and intraocular lens solutions. Meanwhile, sub-Saharan and North African regions present greenfield opportunities as urban healthcare infrastructure investments drive uptake of ambulatory surgical centers.

In the Asia-Pacific region, rapid urbanization and escalating prevalence of myopia have propelled innovative, high-throughput laser platforms and SMILE technology into the spotlight. Japan and South Korea continue to refine procedural techniques, while China’s expanding private hospital network is fostering partnerships with device manufacturers. Emerging economies in Southeast Asia and Australia offer fertile ground for distributor-led expansion, bolstered by evolving reimbursement policies and rising consumer awareness of vision health.

This comprehensive research report examines key regions that drive the evolution of the Refractive Surgery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Champions in Refractive Surgery Devices Highlighting Competitive Strategies Partnerships and Technological Leadership Trends

The refractive surgery devices ecosystem is characterized by a core group of innovators and diversified medical technology champions. Major laser platform providers have invested heavily in next-generation femtosecond systems, incorporating artificial intelligence-driven treatment planning and patient-specific nomogram integration. Leading intraocular lens manufacturers are pursuing partnerships with ophthalmic surgeons to co-develop phakic lens designs optimized for emerging high myopia cohorts.

Competitive strategies within this landscape include strategic alliances, acquisitions of complementary diagnostic firms, and the establishment of global training centers to accelerate procedural adoption. Some market players have leveraged direct sales teams to foster deep clinical relationships at high-volume refractive centers, while others rely on distributor networks to reach emerging clinics in secondary markets. From a technology standpoint, companies advancing small incision lenticule extraction and novel surface ablation protocols have captured attention for their minimal downtime and enhanced corneal biomechanics.

Beyond core refractive interventions, several key players are exploring adjunctive markets such as corneal cross-linking, driven by the convergence of keratoconus management and refractive correction. This diversification underscores a broader competitive dynamic, where device makers seek to broaden their clinical portfolios and foster integrated care solutions for ophthalmic ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Refractive Surgery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- Huvitz Corp.

- Iridex Corporation

- Johnson & Johnson Surgical Vision, Inc.

- Lumenis Ltd.

- Nidek Co., Ltd.

- Rayner Intraocular Lenses Limited

- SCHWIND eye-tech-solutions GmbH & Co. KG

- STAAR Surgical Company

- Ziemer Ophthalmic Systems AG

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Refractive Surgery Device Innovations and Navigate Regulatory and Market Complexities

Industry leaders poised to capitalize on emerging opportunities should consider a multi-pronged strategic approach that balances innovation, operational resilience, and regulatory engagement. Investing in the development of versatile laser platforms and advanced intraocular lens materials will ensure alignment with evolving clinical preferences and differentiate product portfolios. Concurrently, diversifying manufacturing footprints across regions with favorable tariff structures can mitigate exposure to sudden cost escalations while reinforcing supply chain robustness.

Engaging proactively with regulatory authorities to shape policy frameworks and secure potential tariff exemptions for essential ophthalmic devices will help preserve affordability and patient access. Strategic collaborations with key opinion leaders and specialized surgical centers can accelerate clinical validation and drive adoption of new procedures such as SMILE and advanced surface ablation techniques. Furthermore, enhancing digital support tools-ranging from AI-enabled treatment planning to mobile postoperative monitoring-can strengthen long-term patient satisfaction and drive referral volumes.

Finally, refining distribution strategies by balancing direct sales engagement at flagship centers with distributor partnerships in emerging markets will optimize market penetration and maintain service excellence. Leaders should continuously monitor competitive moves and regional reimbursement trends to adjust market entry plans and ensure sustained growth in an increasingly dynamic refractive surgery devices landscape.

Detailed Research Methodology Combining Quantitative Data Analysis Qualitative Expert Interviews and Robust Validation Processes Tailored to Refractive Surgery Device Insights

The research underpinning this executive summary combines rigorous quantitative analysis with qualitative insights sourced from industry experts. Secondary data collection involved the systematic review of peer-reviewed journals, regulatory filings, patent databases, and public financial disclosures to build a comprehensive landscape of device technologies, market participants, and regional regulatory frameworks. Custom segmentation matrices were developed to dissect product types, procedural modalities, end-user profiles, and distribution channels for nuanced analysis.

Primary research comprised in-depth interviews with refractive surgeons, healthcare executives, and regulatory advisors across North America, Europe, and Asia-Pacific. These engagements provided firsthand perspectives on clinical adoption drivers, supply chain challenges, and evolving patient preferences. Findings were triangulated through a validation workshop that included cross-functional stakeholders to ensure the accuracy and relevance of key insights.

To maintain methodological rigor, all data points underwent a multi-stage quality check process, including data cleaning, outlier analysis, and back-testing against historical trends. The resulting framework delivers a robust, action-oriented view of the refractive surgery devices market, equipping decision-makers with the confidence to pursue targeted growth initiatives and strategic partnerships.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refractive Surgery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refractive Surgery Devices Market, by Product Type

- Refractive Surgery Devices Market, by Technology

- Refractive Surgery Devices Market, by Application

- Refractive Surgery Devices Market, by End User

- Refractive Surgery Devices Market, by Distribution Channel

- Refractive Surgery Devices Market, by Region

- Refractive Surgery Devices Market, by Group

- Refractive Surgery Devices Market, by Country

- United States Refractive Surgery Devices Market

- China Refractive Surgery Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Outlook and Growth Potential of Refractive Surgery Devices Across Evolving Healthcare Ecosystems

The convergence of advanced laser technologies, innovative intraocular lens designs, and digital integration has irrevocably transformed the refractive surgery devices landscape. Today’s market is shaped by the interplay of precision engineering, patient-centric procedural approaches, and an increasingly complex regulatory and trade environment. As tariffs introduce new cost considerations, manufacturers and providers must balance immediate operational adjustments with long-term investments in innovation.

Segmentation analysis underscores the importance of tailoring solutions across product types-from excimer and femtosecond lasers to diverse phakic IOL models-and procedural technologies such as LASIK, PRK, and SMILE. Regional insights reveal that while mature markets continue to drive high procedure volumes, emerging economies offer novel avenues for growth through distributor partnerships and localized product adaptations. In parallel, leading companies are leveraging strategic alliances, training initiatives, and digital support tools to create differentiated value propositions.

Collectively, these findings point to a market at the cusp of further evolution, where agility, clinical collaboration, and foresight will determine success. By synthesizing technological progress with strategic operational planning, stakeholders can unlock new opportunities and steer the refractive surgery devices sector toward sustained growth and enhanced patient outcomes.

Take Action Today to Secure Comprehensive Refractive Surgery Device Market Intelligence and Connect with Ketan Rohom for Expert Guidance and Report Acquisition

Investing in comprehensive market intelligence can be the difference between seizing emerging opportunities and falling behind in a rapidly evolving refractive surgery devices landscape. To access in-depth analyses, expert perspectives, and actionable strategies tailored to your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His guidance will help you navigate complex market dynamics, optimize your product portfolio, and position your business for sustained success. Secure your copy of the full market research report today and empower your team with the insights needed to drive innovation and achieve competitive advantage in the refractive surgery devices sector.

- How big is the Refractive Surgery Devices Market?

- What is the Refractive Surgery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?