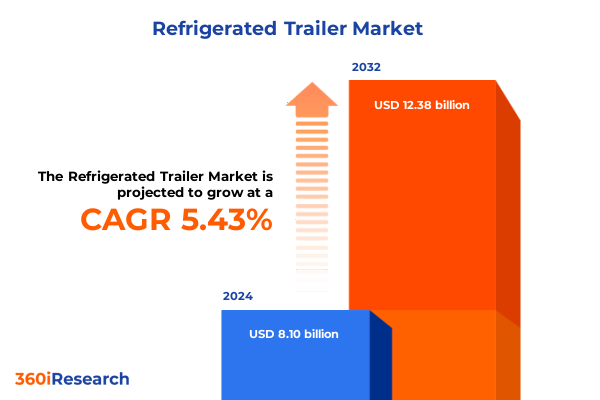

The Refrigerated Trailer Market size was estimated at USD 8.49 billion in 2025 and expected to reach USD 8.90 billion in 2026, at a CAGR of 5.53% to reach USD 12.38 billion by 2032.

Unveiling the pivotal role of refrigerated trailers in safeguarding perishable goods through advanced temperature control technologies across multifaceted supply chain networks worldwide

The global refrigerated trailer sector stands at the heart of cold chain logistics, ensuring that perishable goods maintain optimal quality from origin to destination. Recent enhancements in insulation materials and temperature control algorithms are revolutionizing how operators protect sensitive cargo across long distances. By integrating real-time monitoring systems, organizations now achieve heightened visibility into thermal performance metrics, reducing spoilage risk and boosting customer satisfaction.

Moreover, the intersection of sustainability mandates and rising demand for fresh food consumption is spurring significant investments in next-generation equipment. These trailers are increasingly equipped with intelligent thermostats, eco-friendly refrigerants, and modular design features that cater to diverse transport requirements. Concurrently, advancements in telematics platforms are empowering fleet managers to optimize routes, preempt maintenance issues, and comply with rigorous safety standards.

As global trade volumes expand and supply chains grow more interdependent, the role of refrigerated trailers transcends mere cargo conveyance. They are now integral to strategic logistics planning, linking production facilities, distribution centers, and retail outlets. This introduction sets the stage for an in-depth exploration of how technology, policy, and market dynamics are converging to shape the future of perishable goods transportation.

Exploring the transformative technological, regulatory, and market-driven shifts that are redefining refrigerated trailer operations to meet sustainability and efficiency demands of modern logistics

The refrigerated trailer industry is undergoing a profound transformation as technological innovation, regulatory evolution, and shifting consumer expectations converge. Electrification initiatives are gaining momentum, with electric-powered refrigeration units offering quieter operation and reduced carbon emissions compared to traditional diesel-driven systems. Simultaneously, cutting-edge hydrochemical cooling solutions are emerging, combining the environmental benefits of chemical-free refrigeration with the efficiency of hydro-based heat exchange. These shifts are not only improving operational performance but also aligning the sector with global decarbonization goals.

In parallel, regulatory frameworks are becoming increasingly stringent, mandating stricter greenhouse gas emissions limits and incentivizing the transition to low-GWP refrigerants. Manufacturers and operators are adapting by retrofitting legacy trailers and incorporating sustainable designs into new build processes. Meanwhile, the proliferation of digital connectivity is reshaping maintenance paradigms, enabling predictive analytics and remote diagnostics to minimize downtime and drive cost efficiencies.

Consumer preferences for fresher, premium-quality food continue to escalate, prompting logistics providers to differentiate through enhanced temperature precision and rapid delivery models. As a result, single-temperature trailers are being optimized for standard perishable goods, while multi-temperature configurations support complex mixed-load scenarios. This confluence of technological advancement, policy reform, and market demand underscores a dynamic landscape poised for continued innovation and strategic realignment.

Assessing the comprehensive ramifications of 2025 United States tariffs on refrigerating equipment imports and how these trade measures are reshaping domestic trailer manufacturing economics and strategies

In 2025, the introduction of new United States tariffs on imported refrigeration components and chassis has reshaped the competitive dynamics of refrigerated trailer manufacturing within domestic markets. These trade measures have amplified the cost of key inputs such as high-grade steel and specialized compressor modules, prompting manufacturers to reassess supply chain configurations and negotiate strategic partnerships with local suppliers. Consequently, there is growing interest in nearshoring production and expanding North American fabrication facilities to mitigate tariff impacts and preserve margin integrity.

Domestic OEMs are recalibrating their business models by enhancing value-added services, such as extended maintenance programs and performance-based leasing options, to offset increased capital expenses. At the same time, international competitors are exploring tariff exemption mechanisms by refining their product specifications and qualifying for regional trade incentives. These efforts have intensified competition, driving innovation in chassis light-weighting techniques and advanced thermal insulation solutions to maintain cost competitiveness despite rising import levies.

As tariffs continue to influence investment decisions, market participants are closely monitoring legislative developments and evaluating the long-term viability of cross-border procurement strategies. This cumulative impact narrative highlights how regulatory interventions are not just altering cost structures, but also catalyzing strategic reinvention across the refrigerated trailer value chain.

Diving into segmented perspectives on how product type, trailer category, refrigeration unit technology, operational model, and end-user profiles collectively shape market dynamics and growth trajectories

An in-depth examination of market segmentation reveals a multifaceted landscape guided by diverse product categories and varying stakeholder requirements. In the Food & Beverage segment, demand patterns diverge between bakery and confectionary operators prioritizing consistent humidity control, dairy processors requiring stringent temperature uniformity, and meat producers emphasizing rapid thermal recovery capabilities. Industrial Chemicals users face dual imperatives for hazardous goods containment and specialty compound stability, driving the adoption of reinforced trailer linings and advanced spill-prevention systems. Meanwhile, the Pharmaceuticals domain places the highest emphasis on secure cold chain integrity, with distinct requirements for drugs and vaccines that demand ultra-precise temperature maintenance alongside samples and medical supplies that benefit from customizable interior layouts.

Category-based variations further influence equipment selection, as multi-temperature trailers facilitate consolidation of different perishable goods, while single-temperature models cater to standardized transport cycles. Specialized pharma trailers, engineered with partitioned compartments and remote monitoring alarms, are increasingly critical for clinical trial logistics and vaccine distribution initiatives. From the perspective of refrigeration unit technology, diesel-powered solutions remain prevalent for long-haul applications, but electric-powered units are gaining traction in urban last-mile delivery due to zero-emission regulations. Hydrochemical-powered systems offer a promising alternative for regions with limited fuel infrastructure, leveraging phase-change materials for passive cooling support.

Operational models are similarly nuanced; ownership affords greater customization capabilities and residual value retention for large fleet operators, whereas rental arrangements appeal to businesses seeking flexibility and predictable operating expenses. Finally, the end-user landscape spans cold storage facility operators focused on throughput optimization, third-party logistics providers emphasizing service level agreements, and retail chains prioritizing shelf-life extension to reduce shrinkage. This rich tapestry of segmentation insights underscores the imperative to tailor product design, service offerings, and commercial strategies to distinct end-market needs.

This comprehensive research report categorizes the Refrigerated Trailer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Category

- Refrigeration Unit

- Operation Model

- End-User

Uncovering the nuanced regional dynamics across the Americas, EMEA, and Asia-Pacific that influence refrigerated trailer demand, infrastructure development, and regulatory compliance landscapes globally

Regional dynamics play a pivotal role in steering the refrigerated trailer industry’s innovation and deployment strategies. In the Americas, mature infrastructure networks and robust cold chain investments have fostered advancements in telematics-enabled fleet management and electric-unit integration, particularly within the United States and Canada. The adoption of specialized last-mile delivery solutions is rising to accommodate burgeoning e-commerce demand, prompting close collaboration between trailer OEMs and logistics innovators to develop compact, emission-free refrigeration units that comply with urban air quality mandates.

Across Europe, the Middle East, and Africa, regulatory diversity creates both challenges and opportunities for stakeholders. European nations are at the forefront of enforcing low-GWP refrigerant standards and decarbonization targets, spurring the rollout of hydrochemical and electric technologies. In the Middle East, high ambient temperatures drive demand for enhanced insulation and auxiliary cooling capabilities, while burgeoning logistics hubs in Africa are accelerating investments in modular trailer designs that can be easily retrofitted for varying cargo specifications.

The Asia-Pacific region exhibits dynamic growth fueled by expanding food processing industries, pharmaceutical manufacturing clusters, and industrial chemicals production. China, India, and Southeast Asian markets are prioritizing infrastructure modernization and cross-border connectivity, resulting in heightened demand for versatile trailers with multi-temperature compartments. Government initiatives supporting domestic manufacturing are also encouraging the development of localized production facilities for refrigeration units, further accelerating the uptake of advanced cooling technologies.

These regional insights highlight the need for global players to adapt product portfolios and service models to diverse regulatory frameworks, climatic conditions, and logistical priorities across the Americas, EMEA, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Refrigerated Trailer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the strategic maneuvers of industry-leading refrigerated trailer manufacturers, their innovation pathways, partnerships, and competitive positioning in a rapidly evolving global marketplace

Leading players in the refrigerated trailer arena are leveraging strategic R&D investments, cross-industry partnerships, and portfolio diversification to maintain competitive advantage. Thermo King continues to push the envelope on low-emission electric refrigeration units, collaborating with telematics providers to offer integrated fleet diagnostics and advanced energy management solutions. Carrier Transicold, having expanded its footprint through targeted acquisitions, is focusing on modular product platforms that enable rapid adaptation to emerging cargo requirements, and is piloting next-generation hydrocarbon refrigerants that deliver superior thermal performance with minimal environmental impact.

Daikin Refrigeration has intensified its emphasis on digital services, offering subscription-based monitoring packages that integrate IoT sensors and cloud analytics to ensure real-time compliance with stringent temperature-control standards. Mitsubishi Heavy Industries has pursued co-innovation ventures with material science firms to develop ultra-light composite trailer shells, reducing overall energy consumption while preserving structural integrity. Other notable entrants, including domestic manufacturers in North America and regional OEMs in Asia, are exploring joint ventures to localize component production, secure government incentives, and accelerate time-to-market for specialized configurations.

Collectively, these corporate initiatives highlight the strategic priorities of reducing total cost of ownership, meeting evolving regulatory requirements, and delivering differentiated value through advanced technologies. As market rivalry intensifies, success will increasingly depend on the ability of companies to align product innovation with service excellence and sustainability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Refrigerated Trailer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAA Trailers

- Carrier Global Corporation

- CIMC Vehicles Co., Ltd.

- Daimler Truck AG

- Fahrzeugwerk Bernard KRONE GmbH & Co. KG

- Gray & Adams Group

- Great Dane LLC

- Halvor Lines, Inc.

- Humbaur GmbH

- Hyundai Motor Company

- Kögel Trailer GmbH

- LAMBERET SAS

- Manac Inc.

- Montracon Ltd.

- Polar King. International, Inc.

- Schmitz Cargobull AG

- SOR Ibérica S.A.U

- Stevens Transport, Inc.

- STI HOLDINGS, INC.

- The Reefer Group

- Tiger Trailers Limited

- Trane Technologies Company, LLC

- Trans-System, Inc.

- Utility Trailer Manufacturing Company, LLC

- Vanguard National Trailer Corp.

- Wabash National Corporation

Presenting actionable strategies for industry leaders to capitalize on emerging trends, enhance operational resilience, adopt cutting-edge technologies, and forge partnerships for sustainable growth

Industry leaders should pursue a multi-pronged strategy to capitalize on the evolving refrigerated trailer landscape. First, accelerating the deployment of electric-powered refrigeration units in urban distribution networks can deliver substantial emissions reductions and meet tightening air quality regulations. Complementing this, investing in modular design architectures will enable swift customization for diverse cargo types, from bakery and dairy items to pharmaceutical shipments requiring stringent temperature control.

Next, forging strategic alliances with telematics and IoT providers will empower operators to implement predictive maintenance regimes and optimize route planning, thereby minimizing downtime and maximizing asset utilization. Furthermore, expanding rental fleet offerings can address the needs of seasonal and emerging market participants seeking flexibility without capital-intensive commitments. In parallel, cultivating relationships with local suppliers and nearshoring component manufacturing can mitigate tariff impacts and strengthen supply chain resilience.

Finally, embedding sustainability frameworks across product development, manufacturing, and end-of-life recycling processes will align corporate social responsibility objectives with regulatory compliance and customer expectations. By integrating renewable energy sources into reefer unit operation, exploring alternative refrigerant technologies, and establishing recycling partnerships for insulation materials, industry leaders can drive differentiation through environmental stewardship and operational excellence.

Detailing the robust mixed-method research approach encompassing comprehensive secondary analysis, primary stakeholder interviews, and rigorous data validation to ensure authoritative market insights

This comprehensive analysis combines rigorous secondary research and targeted primary insights to ensure robustness and reliability. Initially, a wide-ranging review of publicly available technical whitepapers, regulatory filings, and industry publications provided foundational knowledge on refrigerants, insulation materials, and emerging cooling technologies. Data from government trade databases and shipping registries illuminated shipment volumes and tariff classifications, while environmental regulation frameworks were examined to assess compliance trajectories.

Complementing the desk-based investigation, in-depth interviews were conducted with key stakeholders across trailer OEMs, component suppliers, logistics service providers, and regulatory bodies. These conversations yielded qualitative perspectives on strategic challenges, adoption barriers, and innovation roadmaps. Quantitative validation was achieved through structured surveys of fleet operators, capturing adoption rates for multi-temperature and electric-powered units as well as preferences for ownership versus rental models.

Data triangulation techniques were applied to reconcile disparate sources, while statistical analysis quantified the relative influence of factors such as operating costs, regulatory incentives, and sustainability objectives. This mixed-method approach guarantees that the insights presented are grounded in empirical evidence and enriched by expert judgement, forming a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refrigerated Trailer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refrigerated Trailer Market, by Product Type

- Refrigerated Trailer Market, by Category

- Refrigerated Trailer Market, by Refrigeration Unit

- Refrigerated Trailer Market, by Operation Model

- Refrigerated Trailer Market, by End-User

- Refrigerated Trailer Market, by Region

- Refrigerated Trailer Market, by Group

- Refrigerated Trailer Market, by Country

- United States Refrigerated Trailer Market

- China Refrigerated Trailer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Emphasizing the synthesis of market intelligence, regulatory analysis, and technological trends to underscore the critical factors guiding refrigerated trailer stakeholders toward informed decision-making

Through this report, stakeholders gain a nuanced comprehension of how advanced refrigeration technologies, regulatory shifts, and evolving consumer demands are converging to redefine the refrigerated trailer landscape. Insights into segmentation dynamics reveal the tailored requirements across food and beverage, industrial chemicals, and pharmaceutical sectors, while analysis of tariff impacts underscores the strategic importance of supply chain localization and cost optimization.

Regional perspectives illustrate that success hinges on adapting to distinct infrastructure capabilities, climate conditions, and policy regimes across the Americas, EMEA, and Asia-Pacific. Corporate case studies demonstrate that innovation leadership, strategic partnerships, and sustainability integration are key differentiators in a competitive market.

Armed with these findings, decision-makers are positioned to navigate complexity, mitigate risk, and capitalize on emerging growth opportunities. This synthesis of market intelligence provides a clear framework for aligning operational priorities with long-term strategic goals, ensuring that refrigerated trailer stakeholders remain resilient and future-ready.

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure tailored refrigerated trailer insights and drive data-backed strategy and investment

To explore the full depth of refrigerated trailer market intelligence and equip your organization with strategic clarity, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the research deliverables, highlight bespoke insights that address your specific supply chain challenges, and facilitate a customized package that aligns with your growth objectives.

Initiate a discussion to uncover how data-driven analysis can optimize your fleet investments, navigate evolving trade regulations, and accelerate your adoption of sustainable refrigeration solutions. Whether you are a manufacturer seeking competitive differentiation or an operator aiming to enhance operational efficiency, this comprehensive report provides the decision support you need.

Connect with Ketan to schedule a personalized briefing, request additional case studies, or secure priority access to upcoming updates and workshops. The refrigerated trailer market is poised for significant transformation, and engaging with an expert in market intelligence today ensures that your organization stays ahead of emerging trends and regulatory shifts.

Act now to harness exclusive insights and position your enterprise at the forefront of refrigerated transportation innovation.

- How big is the Refrigerated Trailer Market?

- What is the Refrigerated Trailer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?