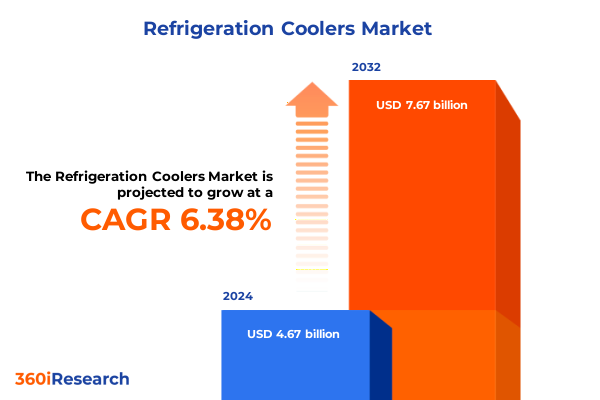

The Refrigeration Coolers Market size was estimated at USD 4.96 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 6.41% to reach USD 7.67 billion by 2032.

Pioneering the Future of Commercial and Residential Refrigeration Coolers with Cutting-Edge Technology, Efficiency, and Sustainability Advances

The commercial and residential refrigeration cooler sector is at a pivotal juncture, driven by escalating demand for reliable cold chain infrastructure and the imperative to minimize energy consumption. Across retail, food service, healthcare, and hospitality environments, operators are seeking next-generation cooling solutions that deliver consistent performance while adhering to stringent environmental regulations. Advances in digital monitoring platforms and sensor integration are enabling unprecedented visibility into equipment health, facilitating proactive maintenance strategies and reducing the risk of costly operational interruptions.

Meanwhile, the industry’s commitment to sustainability has accelerated the adoption of low-global warming potential refrigerants and waste heat recovery systems. Transitioning from hydrofluorocarbon-based coolants to natural alternatives such as ammonia and carbon dioxide not only aligns with evolving regulatory targets but also reduces lifecycle emissions. In tandem, modular system architectures and scalable designs are offering businesses the flexibility to expand or reconfigure their cooling capacity without major capital outlays, further underscoring the sector’s shift toward adaptive, eco-efficient solutions.

Emerging Disruptions Redefining the Refrigeration Cooler Landscape Through Digitalization, Eco-Friendly Refrigerants, and Supply Chain Innovations

Digital transformation is reshaping every facet of the refrigeration cooler landscape. Internet of Things–enabled sensors and advanced energy management systems powered by artificial intelligence are delivering real-time insights into temperature, humidity, and compressor performance. These smart controls automatically calibrate output to match dynamic load requirements, optimizing energy consumption while ensuring precise temperature stability in critical applications such as pharmaceuticals and perishable foods.

At the same time, the drive toward energy efficiency has yielded breakthroughs in variable-speed compressors and heat recovery technology. Variable-speed units adjust compressor speed continually, eliminating the inefficiencies of traditional start-stop cycles, while integrated heat recovery modules capture waste heat for supplemental space or water heating. Together, these innovations contribute to a more circular energy profile and support corporate sustainability objectives.

In addition, the proliferation of modular and scalable refrigeration architectures is empowering businesses to tailor cooling capacity to meet seasonal peaks and evolving operational footprints. By deploying compact, stackable units that can be added or removed with minimal disruption, organizations enhance uptime and reduce long-term maintenance costs, promoting resilience in the face of market volatility.

Navigating the Rising Costs and Operational Challenges Triggered by United States Steel, Aluminum, and Appliance Tariffs Throughout 2025

The United States’ decision to raise steel and aluminum tariffs to 50 percent as of June 4, 2025 has substantially increased the cost base for refrigeration cooler manufacturers that rely on imported metal components. This escalation under Executive Order 14298 affects both primary metals and downstream derivatives, intensifying cost pressures across the value chain as raw material surcharges are passed on to original equipment manufacturers and end users alike. In a further blow, an additional Federal Register notice announced that freezers, refrigerator-freezers, and related appliances will incur 50 percent duties on their steel and aluminum content beginning June 23, 2025, compounding the financial strain on importers and prompting many to revisit sourcing strategies.

Beyond Section 232 measures, ongoing Section 301 tariffs on select Chinese imports have been extended through August 2025, preserving elevated duties on components and subassemblies used in refrigeration equipment. This protracted tariff environment, coupled with generalized increases in metal prices reported by U.S. manufacturers, is driving supply chain realignments and causing procurement lead times to lengthen. Companies are evaluating alternative suppliers, adjusting contractual terms, and, in some cases, absorbing higher costs to maintain market competitiveness amid a shifting trade policy landscape.

Illuminating Market Segmentation Patterns Spanning Sales Channels, Product Types, End-User Applications, Temperature Ranges, and Industry Use Cases Insights

The refrigeration cooler market can be understood through a multi-dimensional segmentation framework that illuminates opportunities across diverse channels and product categories. Analyzing sales channels reveals that direct-to-consumer e-commerce platforms and traditional brick-and-mortar showrooms each play crucial roles: online channels deliver convenience and data-driven personalization, while store-based outlets offer tactile assurance and rapid fulfillment. Examining product types highlights the coexistence of absorption systems favored in off-grid or solar-thermal applications, compressor-based units that dominate commercial and residential installations, and emerging thermoelectric coolers that cater to niche heat-sensitive environments.

End-user segmentation further refines market potential by distinguishing commercial and residential deployments. Within the commercial sphere, subsegments such as education and institutions, food service, healthcare and pharmaceutical facilities, hospitality venues, and retail outlets demonstrate varied cooling requirements and service expectations. The food service sector itself encompasses cafes, catering and events, fast food chains, and full-service restaurants, each prioritizing speed of access and product visibility. Retail end users, including convenience stores, hypermarkets, independent grocers, and supermarket chains, demand robust display cases to enhance product appeal and optimize energy use. Temperature range classification-spanning high, medium, and low temperature applications-addresses the specific rheological and preservation needs of items from beverages to frozen foods. Application-based insights reveal that beverage coolers differentiate between alcoholic and non-alcoholic displays, food cabinets segregate dairy, frozen goods, produce, and meat or seafood sections, while pharmaceutical and healthcare coolers maintain controlled environments for laboratory samples, medicines, and vaccines.

This comprehensive research report categorizes the Refrigeration Coolers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Temperature Range

- Application

- End User

- Sales Channel

Unveiling Regional Market Dynamics Across the Americas, Europe-Middle East & Africa, and Asia-Pacific Regions Shaping Refrigeration Cooler Demand

Regional dynamics underscore how geography shapes refrigeration cooler demand and innovation priorities. In the Americas, mature markets in the United States and Canada are characterized by rapid adoption of energy-efficient technologies and rigorous compliance with federal and state environmental mandates. Latin American economies exhibit growing investment in modern retail infrastructure and cold chain logistics, driven by expanding urbanization and the need to curb food spoilage.

Across Europe, the Middle East, and Africa, stringent regulations such as the European Union’s F-gas rulings and the United Kingdom’s net-zero targets are accelerating the transition to low-GWP refrigerants and smart control systems. In the Middle East, infrastructure development for hospitality and healthcare is creating pockets of intense demand. Meanwhile, the Asia-Pacific region combines burgeoning consumer markets with robust manufacturing capabilities. Rapidly expanding supermarket networks in Southeast Asia and the imperative to preserve perishable exports in countries like Australia and New Zealand are fueling adoption of advanced, digitally managed refrigeration solutions.

This comprehensive research report examines key regions that drive the evolution of the Refrigeration Coolers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Market Differentiation, and Strategic Partnerships in the Refrigeration Cooler Industry

Leading industry participants are forging strategic collaborations and portfolio realignments to accelerate innovation and market penetration. In November 2024, Copeland and Daikin announced a joint venture to introduce inverter swing rotary compressor technology into the U.S. residential segment, combining Copeland’s sales infrastructure with Daikin’s advanced compressor designs to deliver higher energy efficiency and reliability by mid-2025. Similarly, Carrier’s completion of its $775 million sale of the global commercial refrigeration cabinet business to Haier in October 2024 underscores a broader portfolio transformation, enabling Carrier to focus on transport refrigeration and digital cold chain offerings while Haier expands its footprint in display and merchandising solutions.

At the recent 2025 AHR Expo, Daikin Applied Americas showcased next-generation low-GWP refrigerant systems and inverter-driven compressors designed to meet emerging regulatory requirements. The company’s introduction of the Magnitude WME-D chiller, featuring an oil-free compressor and R-515B refrigerant, demonstrated as much as 40 percent energy savings versus fixed-speed predecessors, setting a new benchmark for efficiency in large-scale installations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Refrigeration Coolers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Electrolux

- Alfa Laval Corporate AB

- Amsted Industries

- Bitzer SE

- Blue Star Limited

- Carrier Refrigeration Benelux B.V.

- Daikin Industries, Ltd.

- DANFOSS INDUSTRIES PRIVATE LIMITED

- Dometic Group AB

- Emerson Electric Co.

- FRIGEL AG

- GEA Group Aktiengesellschaft

- Haier Group Corporation

- Honeywell International, Inc.

- Ingersoll Rand Inc.

- Johnson Controls International plc

- Lennox International Inc.

- LG Electronics, Inc.

- LU-VE S.p.A.

- Marmon Holdings, Inc.by a Berkshire Hathaway company

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Parker Hannifin Corporation

- Roen Est S.p.A.

- Trane Technologies Company, LLC

- Voltas Limited

- Western Refrigeration Private Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Efficiency, Digital Transformation, and Sustainable Practices in Refrigeration Coolers

To capitalize on the sector’s rapid digitalization, industry leaders should accelerate the deployment of IoT-based monitoring systems, leveraging predictive analytics to transition from reactive to proactive maintenance models and thus minimize unplanned downtime. Investing in cloud-enabled energy management platforms will further reduce operating expenses and support sustainability commitments by identifying optimization opportunities in real time.

Simultaneously, organizations must prioritize the adoption of eco-friendly refrigerant alternatives and modular equipment architectures that allow for phased capacity expansion. By diversifying supply chains to include domestic and near-market component sources, companies can insulate themselves from trade-related cost shocks. Engaging with policymakers to articulate the cooling sector’s specific needs may also yield targeted tariff relief or extensions of exclusion periods.

Transparent Research Framework Combining Primary Interviews, Secondary Data Analysis, and Rigorous Quality Assurance Processes

This research initiative combined primary and secondary methodologies to ensure a robust and balanced analysis. Primary insights were obtained through interviews with senior executives at leading refrigeration equipment manufacturers, distributors, and end-user organizations. These discussions illuminated real-world challenges, adoption drivers, and anticipated technology roadmaps.

Secondary research encompassed a comprehensive review of regulatory filings, industry publications, and corporate press releases, supplemented by analysis of public policy documents and international standards. Cross-validation of data points was conducted through triangulation with multiple information sources. Quality assurance procedures, including peer review and expert validation, were applied at every stage to maintain analytical rigor and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refrigeration Coolers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refrigeration Coolers Market, by Product Type

- Refrigeration Coolers Market, by Temperature Range

- Refrigeration Coolers Market, by Application

- Refrigeration Coolers Market, by End User

- Refrigeration Coolers Market, by Sales Channel

- Refrigeration Coolers Market, by Region

- Refrigeration Coolers Market, by Group

- Refrigeration Coolers Market, by Country

- United States Refrigeration Coolers Market

- China Refrigeration Coolers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Evolving Refrigeration Cooler Ecosystem and Imperatives for Future Resilience and Growth

The refrigeration cooler industry is undergoing a paradigm shift fueled by converging imperatives of energy efficiency, environmental stewardship, and digital innovation. As regulatory landscapes tighten and end users demand greater transparency and reliability, the integration of smart controls, low-GWP refrigerants, and modular system designs will become table stakes for market participation.

Looking ahead, companies that embrace agile supply chain strategies and foster collaborative partnerships will be best positioned to navigate pricing pressures and capitalize on emerging opportunities. By aligning technology investments with evolving regulatory frameworks and end-user expectations, industry stakeholders can secure both short-term resilience and long-term growth in an increasingly competitive global environment.

Partner with Ketan Rohom to Unlock In-Depth Refrigeration Cooler Insights and Drive Your Business Forward with Targeted Market Intelligence

Ketan Rohom, Associate Director of Sales & Marketing, invites you to leverage this comprehensive analysis to gain a competitive edge in the rapidly evolving refrigeration cooler market. Partner with him to access bespoke market intelligence, tailored to your strategic priorities and growth objectives. Reach out to Ketan to secure your copy of the full market research report and unlock actionable insights that will empower your organization’s decision-making and drive sustainable success in 2025 and beyond

- How big is the Refrigeration Coolers Market?

- What is the Refrigeration Coolers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?