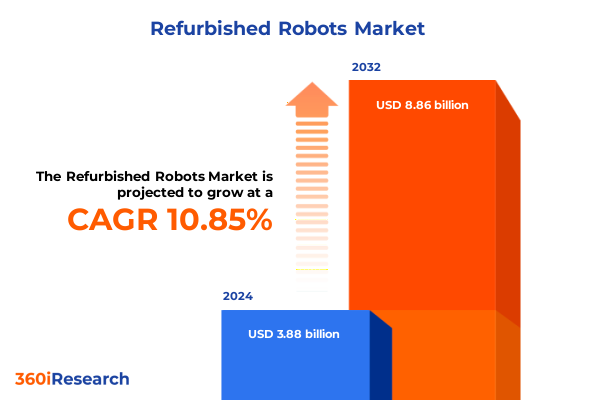

The Refurbished Robots Market size was estimated at USD 3.88 billion in 2024 and expected to reach USD 4.26 billion in 2025, at a CAGR of 10.85% to reach USD 8.86 billion by 2032.

This comprehensive research report categorizes the Refurbished Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Category

- Robot Type

- Refurbishment Level

- Condition Grade

- Mobility

- Application

- End Use Industry

- Distribution Channel

This comprehensive research report examines key regions that drive the evolution of the Refurbished Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

This comprehensive research report delivers an in-depth overview of the principal market players in the Refurbished Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aeterno Industrial Robotics BV

- Alliance Robotics LLC

- Antenen Robotics, LLC

- Autotech Robotics Ltd

- Comau S.p.A.

- EUROBOTS

- FANUC CORPORATION

- Geometrix Automation And Robotics Pvt. Ltd.

- Global Robots Ltd.

- Hangzhou Weite CNC Device Co., Ltd.

- HERRLES Industrieservice Nord GmbH

- IRS Robotics

- Kawasaki Heavy Industries, Ltd.

- Krüger Industrieautomation GmbH

- Kuka AG

- Mahajan Automation

- Phoenix Control Systems Ltd.

- R2 Surgical

- REPROBOTS

- Robo Sapiens Automation

- RoboMotion Ltd

- Robot Store Ltd.

- Robots Done Right LLC

- Tennessee Industrial Electronics, LLC

- UsedRobotsTrade

- WEBEN SMART MANUFACTURING SYSTEM (SHANGHAI) CO., LTD.

- Xiangjing (Shanghai) M&E Technology Co., Ltd

- YASKAWA ELECTRIC CORPORATION

- Yoriyasu Corporation

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Refurbished Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Refurbished Robots Market, by Robot Category

- Refurbished Robots Market, by Robot Type

- Refurbished Robots Market, by Refurbishment Level

- Refurbished Robots Market, by Condition Grade

- Refurbished Robots Market, by Mobility

- Refurbished Robots Market, by Application

- Refurbished Robots Market, by End Use Industry

- Refurbished Robots Market, by Distribution Channel

- Refurbished Robots Market, by Region

- Refurbished Robots Market, by Group

- Refurbished Robots Market, by Country

- United States Refurbished Robots Market

- China Refurbished Robots Market

- South Korea Refurbished Robots Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1440 ]

- How big is the Refurbished Robots Market?

- What is the Refurbished Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?