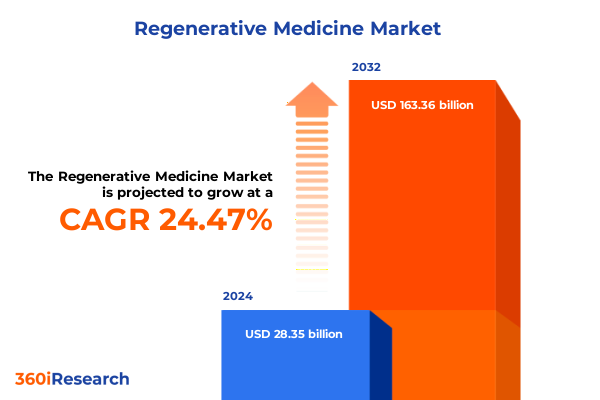

The Regenerative Medicine Market size was estimated at USD 30.03 billion in 2025 and expected to reach USD 36.39 billion in 2026, at a CAGR of 21.64% to reach USD 118.33 billion by 2032.

Exploring the Rise of Regenerative Medicine and Its Pivotal Role in Transforming Patient Outcomes and Industry Innovation Globally

The regenerative medicine field has rapidly transitioned from visionary concept to tangible clinical reality, driven by breakthroughs in cell therapy, gene editing, and tissue engineering. As patient populations demand treatments that not only manage symptoms but restore function, researchers and industry stakeholders are pushing the boundaries of science to deliver curative solutions. Recent advances in manufacturing scalability and regulatory clarity have further accelerated the translation of laboratory discoveries into therapeutic products, positioning regenerative medicine at the forefront of next-generation healthcare innovation.

Emerging modalities such as stem cell-based therapies have demonstrated remarkable efficacy across indications ranging from hematological disorders to orthopedics, while non-stem cell offerings leveraging immune cells-including dendritic cells, natural killer cells, and engineered T cells-are reshaping cancer immunotherapy paradigms. Meanwhile, the maturation of gene editing technologies, encompassing CRISPR-Cas systems and next-generation RNA- and DNA-based platforms, is unlocking unprecedented potential for precision interventions. Simultaneously, biomaterials and scaffold innovations are enhancing tissue repair and organ regeneration, underscoring the multidisciplinary nature of this rapidly evolving sector.

This executive summary distills the transformative trends, regulatory developments, segmentation dynamics, regional landscapes, and competitive positioning that define the regenerative medicine market today. It is designed to equip decision makers with a concise yet comprehensive overview of the factors driving growth, the challenges to navigate, and the strategic opportunities to pursue. By synthesizing these insights, leaders can chart informed pathways that accelerate product development, optimize market entry strategies, and deliver sustainable value to patients and stakeholders alike.

Unveiling the Breakthrough Innovations and Strategic Alliances Redefining the Regenerative Medicine Landscape and Accelerating Clinical Application

A wave of transformative shifts is redefining the regenerative medicine landscape, propelled by strategic alliances and technology convergence. Venture capital influx and corporate partnerships are unlocking new collaboration models between academic research institutes, contract research organizations, and pharmaceutical innovators, fostering an ecosystem where preclinical breakthroughs swiftly progress toward clinical validation. At the same time, the integration of digital manufacturing techniques-such as 3D bioprinting and automated cell culture platforms-has enhanced scalability and reproducibility, mitigating traditional production bottlenecks while accelerating time to market.

Regulatory authorities have also evolved, introducing adaptive frameworks that balance expedited review pathways with stringent safety requirements. These streamlined approval mechanisms, often guided by real-world evidence and risk-based assessments, are reducing development timelines for advanced therapies. In parallel, the convergence of omics technologies and artificial intelligence is enabling deeper insights into regenerative processes, guiding the design of next-generation scaffolds, growth factors, and gene transfer vectors. This data-driven approach not only refines therapeutic efficacy but improves patient stratification, reducing trial sizes and optimizing resource allocation.

Furthermore, global health initiatives and philanthropic funding have broadened the scope of regenerative interventions, extending beyond rare diseases into prevalent conditions such as cardiovascular repair, chronic wound healing, and osteoarthritis management. Taken together, these shifts underscore a market in which scientific innovation, regulatory facilitation, and financial commitment coalesce to accelerate the journey from bench to bedside.

Assessing the Comprehensive Effects of 2025 US Trade Tariffs on Supply Chains, Research Collaboration, and Cost Structures in Regenerative Medicine

In 2025, newly imposed United States tariffs on select advanced therapy raw materials and bioprocessing equipment have reshaped cost structures and supply chain strategies for regenerative medicine stakeholders. The levies, targeting critical components such as viral vector production reagents, scaffold precursors, and specialized biomaterials, have elevated sourcing expenses and prompted many manufacturers to reassess procurement footprints. Consequently, organizations have intensified efforts to localize key supply lines, forging domestic partnerships and investing in regional manufacturing hubs to mitigate tariff-driven margin erosion.

These trade measures have also influenced research collaboration patterns, with some international academic and contract research entities pivoting toward U.S.-based collaborators to offset cross-border cost escalations. While this trend enhances technology transfer and fosters knowledge exchange within domestic ecosystems, it simultaneously introduces competitive pressures on smaller innovators that lack the capital to invest in localized production. In response, industry players are exploring hybrid models, combining in-house capabilities with selective outsourcing to maintain agility and control over critical quality attributes.

Looking ahead, the tariff landscape is expected to remain a pivotal factor in strategic planning, driving the adoption of process intensification and single-use technologies that reduce material consumption. At the same time, forward-looking organizations are engaging with policymakers to advocate for tariff exemptions on life-saving therapeutic inputs, underscoring the societal importance of accessible regenerative treatments. These efforts aim to balance national economic interests with the imperative to sustain innovation and patient access.

Deep Diving into Market Segmentation to Reveal Product Types, Therapeutic Sources, Application Areas, and End User Dynamics in Regenerative Medicine

Delving into market segmentation provides critical clarity on where innovation and adoption intersect to drive value in regenerative medicine. Insights across product types reveal that cell therapy remains a cornerstone, with stem cell-based and non-stem cell-based modalities advancing in tandem. The former continues to attract substantial attention for autologous and allogeneic applications, while non-stem approaches-leveraging dendritic cells, natural killer cells, and T cells-have emerged as powerful immuno-oncology platforms. Parallel momentum in extracellular and acellular therapies reflects growing demand for off-the-shelf solutions, as clinicians seek scalable and cost-effective interventions that sidestep complex cell processing workflows.

Examining source configurations highlights the nuanced roles of autologous and allogeneic materials alongside synthetic and xenogeneic inputs. Autologous constructs, prized for immunocompatibility, coexist with allogeneic therapies optimized for commercial scalability. Meanwhile, innovations in synthetic biomaterials are enhancing scaffold performance, and xenogeneic derivatives are being refined through decellularization techniques to minimize antigenicity. Together, these sources create a dynamic interplay between safety, efficacy, and manufacturability.

Application area segmentation further underscores the market’s breadth, from cardiovascular regeneration targeting angiogenesis and heart valve repair to neurology programs aiming at spinal cord injury recovery and Alzheimer’s interventions. Oncology continues to benefit from tumor ablation and immunotherapy synergies, while orthopedic and musculoskeletal indications, including bone regeneration and cartilage repair, address vast unmet needs. Finally, end user segmentation reveals a diverse ecosystem comprising academic research institutes, contract research organizations, hospitals and clinics, and pharmaceutical and biotechnology companies, each playing distinct roles in R&D, clinical deployment, and commercialization.

This comprehensive research report categorizes the Regenerative Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Application Areas

- End User

Analyzing Regional Dynamics to Illuminate Growth Drivers, Regulatory Environments, and Collaborative Ecosystems across the Americas, EMEA, and Asia-Pacific

Regional analysis uncovers distinct growth drivers and strategic priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust venture capital landscapes, coupled with leading academic medical centers, have positioned the United States as a global innovation hub for cell and gene therapies. Cross-border collaborations with Canadian and Latin American institutions are also gaining momentum, fueled by shared regulatory harmonization efforts and patient access initiatives.

Within Europe, Middle East & Africa, progressive regulatory pathways in the European Union and early-stage frameworks emerging in select Middle Eastern markets are enabling a balanced environment for clinical adoption. Germany, the United Kingdom, and France spearhead regional development through public funding and translational science programs, while partnerships across the Gulf Cooperation Council seek to import expertise and infrastructure. At the same time, Africa presents an opportunity to address endemic diseases through scalable off-the-shelf modalities, supported by global philanthropic investments.

Asia-Pacific demonstrates a dual narrative of expansive biomanufacturing capacity and rapidly evolving regulatory standards. Japan’s pioneering conditional approval processes and South Korea’s aggressive support for stem cell ventures reflect national priorities to lead in regenerative innovation. China’s substantial R&D expenditures are driving large-scale cell therapy manufacturing platforms, while Australia emphasizes translational pipelines through collaborative research networks. Collectively, these regional ecosystems underscore the importance of tailored go-to-market strategies that align with local regulatory, reimbursement, and clinical trial landscapes.

This comprehensive research report examines key regions that drive the evolution of the Regenerative Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Emerging Innovators to Highlight Strategic Initiatives, Partnerships, and Pipeline Differentiators in Regenerative Medicine

A review of leading and emerging players illuminates the competitive landscape and strategic trajectories shaping regenerative medicine. Established pharmaceutical and biotechnology corporations have accelerated their presence through targeted acquisitions, bolstering capabilities in viral vector manufacturing, automated cell processing, and biomaterials development. At the same time, specialized cell therapy pioneers have differentiated through proprietary platforms for stem cell expansion, immune cell engineering, and scaffold design that enable next-generation treatment protocols.

Venture-backed innovators are driving disruptive approaches, including gene editing systems with refined precision and safety profiles, RNA-based therapies that harness endogenous repair pathways, and advanced scaffold fabrication techniques using natural and synthetic biomaterials. These emerging entities frequently collaborate with academic research institutes and contract research organizations to de-risk early-stage development, while selectively partnering with global pharmaceutical firms for late-stage clinical trials and commercialization synergies.

Moreover, cross-sector alliances are becoming more prevalent, as technology companies integrate digital tools-such as machine learning algorithms for patient stratification and cloud-based quality management systems-into the regenerative ecosystem. This convergence of biopharma and digital health underscores the critical role of interoperable data platforms in accelerating bioprocess optimization and enhancing patient outcomes. Together, these competitive dynamics reflect a market in which scale, pipeline diversity, and technological differentiation will define leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Regenerative Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Novartis AG

- Gilead Sciences, Inc.

- Johnson & Johnson

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- Stryker Corporation

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Zimmer Biomet Holdings, Inc.

- Merck KGaA

- AbbVie Inc.

- FUJIFILM Holdings Corporation

- Organogenesis Holdings Inc.

- AGC Biologics

- Vericel Corporation

- JCR Pharmaceuticals Co., Ltd.

- 4D Molecular Therapeutics, Inc.

- Abeona Therapeutics Inc.

- Athersys, Inc.

- CMIC HOLDINGS Co., LTD.

- CRISPR Therapeutics AG

- Eli Lilly and Company

- Fate Therapeutics, Inc.

- Integra LifeSciences Holdings Corporation

- Mesoblast Limited

- Orchard Therapeutics PLC

- Pluri Biotech Ltd.

- Poseida Therapeutics, Inc.

- REPROCELL Inc.

- SanBio Co,Ltd.

- Sumitomo Pharma Co., Ltd.

- Sysmex Corporation

- Tenaya Therapeutics, Inc.

- US WorldMeds, LLC

- Voyager Therapeutics Inc.

Strategic Imperatives for Industry Leaders to Navigate Regulatory Complexities, Diversify Supply Chains, and Elevate Clinical Innovation in Regenerative Medicine

Industry leaders must pursue a multifaceted strategy to capitalize on the opportunities within regenerative medicine. First, establishing flexible manufacturing networks that integrate single-use technologies and regional production hubs will mitigate supply chain disruptions and curtail the impact of trade policies. By diversifying suppliers and investing in modular facilities, organizations can sustain consistent output while preserving quality standards.

Second, proactive engagement with regulatory authorities is essential. Companies should invest in cross-functional teams dedicated to navigating conditional approval pathways, real-world evidence generation, and harmonized regulatory submissions across multiple jurisdictions. Such efforts will reduce approval timelines and facilitate broader patient access. Concurrently, forging long-term partnerships with academic centers and contract research organizations can accelerate translational insights, enabling rapid adaptation of emerging scientific breakthroughs.

Finally, leveraging digital health platforms will enhance clinical trial efficiency, patient recruitment, and post-market surveillance. By integrating machine learning-driven analytics for patient stratification and employing decentralized trial designs, developers can streamline data collection and improve trial outcomes. Complementing technical capabilities with patient engagement initiatives and value-based reimbursement models will further strengthen the market proposition and drive sustainable adoption.

Detailing the Rigorous Research Framework Combining Primary Interviews, Secondary Data Analysis, and Quantitative Validation Methodologies

This research integrates qualitative and quantitative methodologies to ensure robust market insights. Primary research involved in-depth interviews with key stakeholders, including senior executives from pharmaceutical companies, heads of academic research institutes, contract research leaders, and clinical practitioners specializing in advanced therapies. These discussions provided firsthand perspectives on technological priorities, regulatory challenges, and emerging collaboration models.

Secondary research encompassed a systematic review of peer-reviewed journals, regulatory filings, patent databases, and industry white papers, enabling comprehensive mapping of scientific trends and competitive landscapes. Market segmentation analysis leveraged a triangulation approach, cross-validating information from corporate disclosures with expert surveys and clinical trial registries. Statistical techniques were applied to synthesize qualitative feedback and public data, ensuring consistency and reliability in the derived insights.

Finally, the research framework was augmented by advisory consultations with policy analysts and reimbursement specialists to contextualize the impact of tariff measures, regional regulatory frameworks, and funding dynamics. This rigorous, multi-layered methodology ensures that the report’s findings reflect current realities and support informed decision making for stakeholders across the regenerative medicine ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Regenerative Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Regenerative Medicine Market, by Product Type

- Regenerative Medicine Market, by Source

- Regenerative Medicine Market, by Application Areas

- Regenerative Medicine Market, by End User

- Regenerative Medicine Market, by Region

- Regenerative Medicine Market, by Group

- Regenerative Medicine Market, by Country

- United States Regenerative Medicine Market

- China Regenerative Medicine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Market Insights and Projecting Future Trajectories to Empower Strategic Decision Making in the Fast-Evolving Regenerative Medicine Sector

The regenerative medicine market stands at a pivotal juncture, where scientific ingenuity, strategic collaboration, and adaptive regulatory frameworks converge to unlock transformative therapies. As cell, gene, and tissue engineering modalities advance from experimental phases to clinical maturity, stakeholders must navigate evolving cost structures, regional nuances, and competitive dynamics to sustain momentum.

By synthesizing insights across segmentation, regional ecosystems, and corporate strategies, this report underscores the importance of integrated approaches that align technological innovation with operational excellence. Whether through localized manufacturing, strategic alliances, or digital platform integration, the path to scalable and accessible regenerative treatments hinges on proactive planning and agility.

In conclusion, decision makers equipped with a nuanced understanding of market drivers, regulatory landscapes, and segmentation opportunities will be best positioned to lead the next wave of breakthroughs. Embracing the recommendations and insights presented here will empower organizations to optimize their pipelines, strengthen their competitive positioning, and ultimately deliver life-changing therapies to patients worldwide.

Engage with Ketan Rohom to Access Comprehensive Regenerative Medicine Market Research Insights and Drive Strategic Growth Initiatives

To gain an in-depth understanding of the evolving regenerative medicine market and leverage actionable intelligence tailored to your strategic imperatives, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Our dedicated team will guide you through the comprehensive research report, outline custom engagement options, and discuss how these insights can be directly applied to accelerate your organization’s growth trajectory in cell therapy, gene editing platforms, and tissue engineering innovations. Reach out to arrange a personalized briefing that aligns with your investment horizons, partnership goals, and product development roadmaps, ensuring you stay ahead of competitors and capitalize on emerging opportunities.

- How big is the Regenerative Medicine Market?

- What is the Regenerative Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?