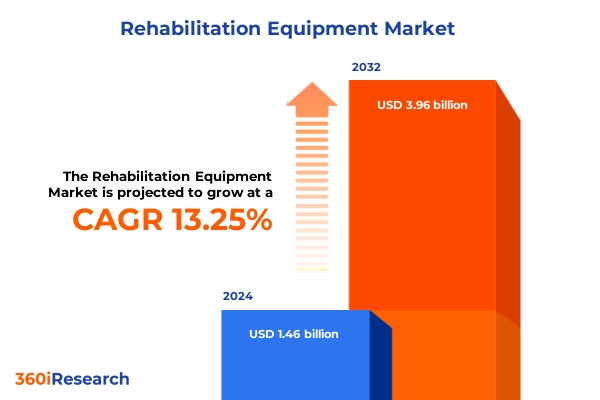

The Rehabilitation Equipment Market size was estimated at USD 1.64 billion in 2025 and expected to reach USD 1.85 billion in 2026, at a CAGR of 13.37% to reach USD 3.96 billion by 2032.

Initiating the Comprehensive Exploration of Rehabilitation Equipment by Highlighting Core Industry Drivers Emerging Innovations and Patient-Centric Developments

Rehabilitation equipment has undergone a remarkable transformation driven by converging forces of medical innovation, patient empowerment, and advanced materials science. As the population ages and chronic conditions prevail, the imperative for accessible, reliable and highly adaptable assistive devices has never been greater. Emerging technologies such as sensor integration, Internet of Medical Things connectivity, and tele-rehabilitation platforms are converging to redefine how patients interact with mobility and support devices throughout their recovery journeys. Moreover, shifting care paradigms toward home-based therapies and value-based healthcare models have elevated the importance of equipment that delivers clinical efficacy in non-traditional settings. This introduction sets the stage for a deeper exploration of how industry stakeholders are navigating these converging trends to engineer smarter, more ergonomic and cost-effective solutions that foster independence and enhance quality of life for end users.

Examining Transformative Shifts in Rehabilitation Equipment Landscape Driven by Technological Integration Rapid Digitalization and Changing Patient Care Models

Against the backdrop of accelerating digital transformation, the rehabilitation equipment landscape is experiencing several paradigm shifts. First, connectivity has transcended basic functionality, enabling devices to communicate real-time performance metrics to clinicians and caregivers remotely, fostering data-driven interventions. Secondly, modular design philosophies have taken hold, empowering manufacturers to assemble customizable configurations that cater to patient-specific anatomical and functional needs, thereby reducing the time and expense associated with bespoke fabrication. In parallel, additive manufacturing techniques are gaining traction, offering the promise of lightweight, durable components tailored to individual biomechanics. These shifts are further strengthened by evolving reimbursement policies that reward patient outcomes and functional gains rather than mere device acquisition. Collectively, these trends are catalyzing a new era in which rehabilitation equipment providers must integrate digital intelligence, personalization, and outcome-oriented frameworks to remain competitive and deliver measurable value.

Analyzing the 2025 United States Tariff Implications on Rehabilitation Equipment Supply Chains Production Cost Structures and Long-Term Competitive Market Dynamics

In 2025, a comprehensive review of the United States tariff landscape reveals a confluence of duties affecting critical components and raw materials used in rehabilitation equipment manufacturing. Elevated tariffs on imported steel and aluminum have directly impacted cost structures for wheelchair frames, patient lifts, and stair lift rails, compelling manufacturers to explore domestic sourcing and material alternatives such as carbon fiber composites or plastic blends. Concurrent levies on electronic modules and sensors have increased production expenses for powered mobility scooters and patient monitoring systems, motivating organizations to integrate vertically by establishing local assembly lines or forging alliances with regional electronics suppliers. These strategic responses are not limited to cost mitigation; they also encompass supply chain resiliency planning, as companies diversify their vendor base across multiple continents to hedge against future tariff fluctuations. As a result, long-term competitive dynamics are being reshaped by the interplay of trade policy, material innovation and network reconfiguration, emphasizing the importance of agility in procurement, manufacturing and distribution.

Unveiling Key Segmentation Insights for Rehabilitation Equipment Spanning Product Types Operational Modes Materials Age Groups End Users and Distribution Channels

The rehabilitation equipment market encompasses a rich tapestry of product categories designed to support mobility and functional independence. Examining product type segmentation requires consideration of crutches and canes alongside mobility scooters categorized into four-wheeler and three-wheeler variants, as well as patient lifts differentiated by ceiling mounted, electric and hydraulic mechanisms. Stair lifts are characterized by curved and straight track designs to accommodate varied architectural layouts, while walkers include knee walkers, rollators and standard frames. Wheelchairs bifurcate into manual versions-including lightweight, sports and standard models-and powered options consisting of heavy-duty and pediatric equipment. Layered onto this are operation modes: manual devices optimize simplicity and cost efficiency, whereas powered systems integrate motorized assistance and smart control interfaces to enhance user autonomy. Material segmentation underscores the trade-off between weight, strength and cost, with aluminum offering lightness, carbon fiber delivering superior strength-to-weight ratios, plastic composites enabling customization and steel providing durability. Age group considerations influence ergonomic design and safety features, distinguishing adult, geriatric and pediatric offerings to meet biomechanical requirements across life stages. End users span ambulatory surgical centers, home care settings, hospitals, nursing homes and rehabilitation centers, each imposing unique clinical, regulatory and logistical demands. Finally, distribution channels encompass direct sales relationships, eCommerce platforms, hospital supplies distributors and specialized retailers, reflecting diverse procurement preferences and service expectations across the healthcare continuum.

This comprehensive research report categorizes the Rehabilitation Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mode Of Operation

- Material

- Age Group

- End User

- Distribution Channel

Revealing Regional Insights into Rehabilitation Equipment Adoption Trends Growth Drivers and Market Dynamics Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics in the rehabilitation equipment sector reveal unique growth catalysts and challenges within the Americas, Europe Middle East & Africa and Asia Pacific. In the Americas, emphasis on home-based care models and rising awareness of disability rights have driven investments in portable and connected devices, enabling manufacturers to refine user-friendly interfaces and telemonitoring capabilities. Across Europe Middle East & Africa, stringent regulatory frameworks and reimbursement schemes have spurred a focus on device efficacy validation and clinical outcomes, prompting collaborations between academic research centers and industrial partners to conduct multicenter trials. This region also benefits from strong orthopedic and neurological rehabilitation expertise, fostering product refinement for specialized clinical indications. Meanwhile, the Asia Pacific region is characterized by rapid urbanization, aging populations and expanding private healthcare infrastructure, fueling demand for cost-effective yet technologically advanced solutions. Local manufacturers are increasingly leveraging strategic partnerships to gain access to global distribution networks while adapting product portfolios to meet regional preferences and cost sensitivities. Although each geography presents its own set of regulatory and logistical hurdles, the overarching trend underscores the need for market players to tailor offerings and go-to-market strategies to regional healthcare landscapes.

This comprehensive research report examines key regions that drive the evolution of the Rehabilitation Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Principal Industry Players Shaping the Rehabilitation Equipment Market through Strategic Partnerships Product Innovations and Competitive Positioning

A cadre of specialized companies currently shapes the rehabilitation equipment landscape, each leveraging distinct competitive advantages. Firms renowned for pioneering manual devices continue to refine lightweight and ergonomic designs, whereas technology-driven organizations concentrate on smart mobility platforms that integrate sensor arrays and connectivity features. Strategic alliances between component manufacturers and rehabilitation experts are producing modular systems capable of rapid customization, while joint ventures with electronics producers are accelerating the development of intuitive control interfaces and remote monitoring services. Some market leaders are also investing in in-house additive manufacturing capabilities to expedite prototyping and reduce reliance on external suppliers. The convergence of healthcare IT and assistive device innovation has encouraged the emergence of new entrants specializing in software analytics and telehealth integration. Across the board, successful companies demonstrate agility in responding to shifting reimbursement models, evolving clinical guidelines and end user expectations, underscoring the importance of cross-functional collaboration in driving sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rehabilitation Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arjo AB

- Bauerfeind AG

- Baxter International Inc.

- Drive DeVilbiss Healthcare Inc

- Enovis Corporation

- Essity Aktiebolag

- Etac AB

- GF Health Products, Inc.

- Handicare Group AB

- Hanger, Inc.

- Invacare Corporation

- LINET Group SE

- Medi GmbH & Co. KG

- Medline Industries, LP

- Ottobock SE & Co. KGaA

- Stryker Corporation

- Sunrise Medical LLC

- Thuasne SA

- Zimmer Biomet Holdings, Inc.

- Össur hf.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Digital Transformation Regulatory Changes and Evolving End User Needs in Rehabilitation Equipment

In light of current and emerging trends, industry leaders should prioritize a strategic roadmap that accelerates digital transformation and amplifies patient value. Organizations must invest in seamless integration of connectivity and analytics capabilities within core product lines to bolster remote monitoring and personalized care pathways. Collaboration with healthcare providers, payers and patient advocacy groups will be vital to aligning device development with shifting reimbursement paradigms and outcome-based care models. To address tariff-induced cost challenges, companies should explore sourcing diversification, nearshoring and strategic partnerships with regional suppliers to safeguard supply chains and manage price volatility. Customization capabilities-enabled through modular architecture and additive manufacturing-must be scaled to meet individualized patient requirements without eroding operational efficiencies. Additionally, embedding user experience research within product design processes can uncover latent needs across adult, geriatric and pediatric segments, enhancing adherence and satisfaction. Finally, a regionally nuanced approach to market entry, supported by local regulatory expertise and culturally attuned marketing strategies, will position organizations to capture growth opportunities across the Americas, Europe Middle East & Africa and Asia Pacific landscapes.

Detailing Robust Research Methodology Employed for Comprehensive Analysis Including Data Gathering Validation and Multi-Level Triangulation Approaches

This report’s findings are the result of a rigorous, multi-step research methodology designed to ensure data validity and analytical depth. The primary research phase included in-depth interviews with key opinion leaders, product designers, regulatory experts and procurement decision-makers across rehabilitation centers, hospitals and home care settings. Concurrently, secondary research encompassed a comprehensive review of peer-reviewed journals, white papers, patent filings and government regulations to contextualize industry trends and technological advancements. To corroborate insights, a triangulation approach was employed, cross-referencing qualitative feedback with quantitative data garnered from manufacturer disclosures, trade association publications and customs tariff schedules. Segmentation analyses were validated through supply chain mapping exercises and expert workshops, ensuring that product, mode of operation, material, age group, end user and distribution channel categorizations reflect real-world application. Finally, regional dynamics were examined through economic indicators, healthcare expenditure reports and policy reviews to deliver an integrated, geographically nuanced perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rehabilitation Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rehabilitation Equipment Market, by Product Type

- Rehabilitation Equipment Market, by Mode Of Operation

- Rehabilitation Equipment Market, by Material

- Rehabilitation Equipment Market, by Age Group

- Rehabilitation Equipment Market, by End User

- Rehabilitation Equipment Market, by Distribution Channel

- Rehabilitation Equipment Market, by Region

- Rehabilitation Equipment Market, by Group

- Rehabilitation Equipment Market, by Country

- United States Rehabilitation Equipment Market

- China Rehabilitation Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding the Executive Summary with Critical Reflections on Rehabilitation Equipment Market Evolution and Strategic Considerations for Stakeholders

As the rehabilitation equipment industry continues its trajectory toward smarter, more personalized and geographically diversified solutions, market participants must remain vigilant to emerging technological, regulatory and demographic shifts. Sustained innovation in materials, connectivity and manufacturing processes will underpin the next generation of devices that deliver both clinical outcomes and user satisfaction. Concurrently, navigating evolving tariff landscapes and reimbursement frameworks will demand proactive supply chain strategies and collaborative engagement with policy makers and payers. By synthesizing insights from product segmentation, regional dynamics and competitive positioning, stakeholders can chart a strategic path forward that balances agility with long-term investment in R&D and market development. Ultimately, success in this sector will hinge upon an organization’s ability to anticipate patient needs, leverage data-driven insights and cultivate partnerships that amplify their capacity to deliver holistic rehabilitation solutions.

Engage with Ketan Rohom to Secure a Detailed Market Research Report on Rehabilitation Equipment and Unlock Strategic Insights for Informed Decision-Making

To access a comprehensive market research report that delves deeply into the rehabilitation equipment landscape and equips your organization with actionable intelligence, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan Rohom will guide you through the rich insights captured in the study, including detailed analyses of product innovation, regional dynamics, tariff implications, segmentation intelligence, and competitive positioning. By partnering with Ketan, your team gains exclusive clarity on market trends, regulatory shifts, and strategic opportunities essential for sustaining growth and differentiation in this evolving industry. Elevate your decision-making process by securing this report today and leverage expert support in interpreting findings to align your business roadmap with emerging customer needs and operational efficiencies

- How big is the Rehabilitation Equipment Market?

- What is the Rehabilitation Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?