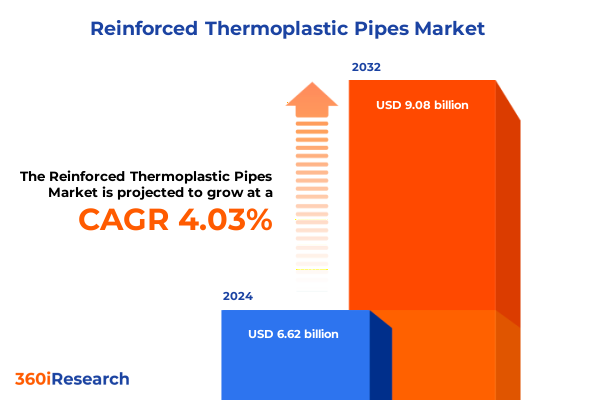

The Reinforced Thermoplastic Pipes Market size was estimated at USD 6.88 billion in 2025 and expected to reach USD 7.14 billion in 2026, at a CAGR of 4.03% to reach USD 9.08 billion by 2032.

Reinforced thermoplastic pipes represent a paradigm shift in fluid conveyance solutions by offering unmatched flexibility, strength, and longevity

Reinforced thermoplastic pipes have emerged as a transformative solution in fluid conveyance systems, blending the flexibility of polymer liners with the strength of advanced reinforcement materials. As industries face growing demands for corrosion resistance, weight reduction, and extended service life, these composite pipes offer a compelling alternative to traditional metallic and rigid plastic pipelines. The integration of thermoplastic liners such as high-density polyethylene and polyamide, coupled with reinforcement fibers like aramid and carbon, results in a versatile product capable of meeting a wide spectrum of operational requirements.

In recent years, reinforced thermoplastic pipes have gained traction across sectors including oil and gas, water infrastructure, chemical processing, and emerging hydrogen transport networks. Their inherent resilience against corrosive media, combined with reduced installation costs and accelerated project timelines, underscores their rising prominence. This introduction sets the stage for a deeper exploration of the technological advances, regulatory influences, segmentation insights, and regional trends that define the current and future state of the reinforced thermoplastic pipe market.

Unpacking the major technological breakthroughs, material innovations, and market dynamics that are reshaping the reinforced thermoplastic pipe industry across diverse industrial and infrastructure applications

The reinforced thermoplastic pipe industry is witnessing profound shifts driven by breakthroughs in material science and manufacturing processes. Innovations in reinforcement materials, such as next-generation glass fibers with enhanced tensile strength and novel polymeric coatings that improve fiber-matrix adhesion, have significantly elevated the performance benchmarks for composite pipelines. These material-level enhancements are complemented by advancements in automated filament winding and pultrusion techniques, enabling more consistent production quality and tighter tolerances in pipe geometry.

Simultaneously, the integration of digital monitoring technologies-ranging from embedded fiber optic sensors to wireless acoustic inspection modules-has revolutionized asset management and predictive maintenance. Real-time data analytics platforms now allow operators to monitor pipe integrity under varying pressure and temperature conditions, providing actionable insights that reduce unplanned downtime. Together, these technological and digital innovations are reshaping market expectations and driving the adoption of reinforced thermoplastic pipes across both established and emerging applications.

Analyzing how the introduction and escalation of United States tariffs in 2025 are influencing supply chains, cost structures, and competitive positions in the RTP market

The United States’ implementation of tariffs in early 2025 on key polymer resins and synthetic fibers has exerted a cumulative effect on the reinforced thermoplastic pipe supply chain. Manufacturers reliant on imported high-density polyethylene and specialized reinforcement fibers have encountered elevated input costs, which have necessitated a thorough reassessment of sourcing strategies and pricing models. While some suppliers have absorbed portions of these cost increases to preserve competitive advantage, others have redirected procurement toward domestic resin producers and regional fiber manufacturers to mitigate exposure.

This shift has also prompted a reevaluation of long-term supplier relationships and accelerated investments in localized production capabilities. Parallel to the tariff-driven cost pressures, regulatory scrutiny on supply chain transparency has intensified, compelling companies to reinforce due diligence and compliance protocols. As a result, the reinforced thermoplastic pipe sector is adapting to a landscape where tariff measures and regulatory frameworks converge to redefine cost structures, operational resilience, and market positioning.

Delving into the nuanced segmentation of reinforced thermoplastic pipes by material type, pressure rating, diameter, installation method, and application to reveal critical market drivers

A comprehensive understanding of reinforced thermoplastic pipe market dynamics emerges when examining its segmentation across material type, pressure rating, pipe diameter, installation method, and application. Regarding material type, the market spans reinforcement materials such as aramid fibers, carbon fibers, and glass fibers alongside thermoplastic liners including high-density polyethylene, polyamide, polyethylene, polypropylene, and polyvinylidene fluoride, each combination delivering unique mechanical and chemical resistance profiles. When considering pressure rating, distinctions among high-pressure applications exceeding 150 bar, medium-pressure operations between 50 and 150 bar, and low-pressure scenarios up to 50 bar reveal varying design and reinforcement requirements that directly influence material selection and wall thickness.

Furthermore, pipe diameter segmentation differentiates small-diameter solutions under 4 inches for drilling and localized distribution systems, medium-diameter options ranging from 4 to 8 inches often utilized in chemical and process industries, and large-diameter configurations above 8 inches suited for bulk fluid transport. Installation methods also define market niches, with above-ground deployments favored in water treatment facilities, subsea applications dominating offshore flowlines, and underground installations prevalent in municipal water and wastewater networks. Application-based segmentation spans the chemical industry, hydrogen and CO₂ transport, the mining sector, oil and gas infrastructure-encompassing offshore and onshore flowlines-as well as water and wastewater management, which itself differentiates between sewage and effluent line installations and water distribution pipelines.

This comprehensive research report categorizes the Reinforced Thermoplastic Pipes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Pressure Rating

- Pipe Diameter

- Installation Method

- Application

Evaluating regional disparities and growth catalysts across the Americas, Europe Middle East and Africa, and Asia-Pacific to illuminate divergent demand patterns and infrastructure trends

Regional analysis illuminates distinct market trajectories for reinforced thermoplastic pipes across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, investment in aging water infrastructure and the expansion of shale gas networks have driven demand for corrosion-resistant and cost-effective pipe solutions, prompting utilities and energy companies to evaluate composite piping alternatives. Meanwhile, in Europe Middle East and Africa, stringent environmental regulations and a focus on offshore oil and gas recovery projects have fueled adoption of subsea-grade composite pipes that offer both chemical resilience and simplified installation over long distances.

Asia-Pacific presents a diversified growth landscape underpinned by rapid urbanization and industrialization in countries such as China and India. Major infrastructure initiatives, including large-scale water conveyance schemes and petrochemical complex expansions, have created robust requirements for durable, low-maintenance pipeline systems. At the same time, growing interest in carbon capture and hydrogen transportation networks has positioned reinforced thermoplastic pipes as a strategic component of the region’s energy transition roadmap.

This comprehensive research report examines key regions that drive the evolution of the Reinforced Thermoplastic Pipes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic initiatives, innovation priorities, and collaborative ventures among leading manufacturers and suppliers in the reinforced thermoplastic pipe sector to drive competitive advantage

Key players in the reinforced thermoplastic pipe sector are intensifying their focus on research and development, strategic partnerships, and vertical integration to sustain competitive differentiation. Leading manufacturers have formed joint ventures with fiber producers to secure reliable access to high-performance reinforcement materials, while simultaneously collaborating with polymer resin suppliers to co-develop specialized liner formulations that address stringent chemical compatibility requirements. These collaborative models not only streamline supply chains but also accelerate innovation through shared technical expertise and capital investment.

In parallel, top-tier suppliers are investing in digital platforms and service-oriented business models, offering condition monitoring and performance analytics as part of comprehensive lifecycle support. By integrating sensor-based inspection capabilities and proactive maintenance services, these companies aim to deepen customer relationships and unlock recurring revenue streams. Additionally, acquisitions of niche composite specialists have enabled larger firms to broaden their product portfolios, expand geographic reach, and enhance their ability to deliver end-to-end pipeline solutions tailored to high-value sectors such as offshore energy and municipal water management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Reinforced Thermoplastic Pipes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alwasail Industrial Company

- Ashirvad Pipes Private Limited

- Astral Limited

- Baker Hughes Company

- Cosmoplast Industrial Company (L.L.C.)

- Deutsche Bogenn GmbH

- Finolex Industries Limited

- FlexSteel Pipeline Technologies, Inc.

- Future Pipe Industries LLC

- Georg Fischer AG

- Jain Irrigation Systems Limited

- NOV Inc.

- PES.TEC GmbH

- Pipelife Nederland B.V.

- Polyflow, LLC

- Prysmian S.p.A.

- Shawcor Ltd.

- Strohm B.V.

- TechnipFMC plc

- The Supreme Industries Limited

Presenting tactical recommendations for industry leaders to capitalize on evolving market opportunities and mitigate emerging operational and regulatory risks in the reinforced thermoplastic pipe domain

Industry leaders seeking to optimize their position within the reinforced thermoplastic pipe market should pursue a multi-pronged strategy that balances innovation with operational resilience. First, prioritizing investments in next-generation reinforcement fibers and liner chemistries can unlock performance improvements in demanding service environments, while partnerships with material science institutions can expedite product development cycles. Second, diversifying supply chains to include both regional and domestic sources will mitigate tariff-related disruptions and enhance procurement agility.

Furthermore, deploying advanced digital monitoring solutions across installed assets can yield insights into performance trends, facilitating predictive maintenance and minimizing unplanned outages. Companies should also engage with standardization bodies and regulatory agencies to shape evolving compliance frameworks and ensure alignment with emerging industry guidelines. Finally, fostering cross-industry alliances-particularly in sectors such as hydrogen transportation and carbon capture-will broaden addressable markets and accelerate commercialization of specialized composite pipe systems.

Outlining the rigorous research framework, data collection approaches, and analytical techniques employed to ensure comprehensive and reliable insights into reinforced thermoplastic pipes

The research underpinning these insights combines rigorous primary and secondary methodologies to deliver a holistic understanding of the reinforced thermoplastic pipe sector. Secondary research entailed exhaustive reviews of industry publications, patent filings, trade association reports, and regulatory documentation to chart historical developments and emerging trends. This desk-based analysis was complemented by primary engagements, including in-depth interviews with supply chain executives, manufacturing engineers, project developers, and end users across key application segments.

Quantitative data collection involved structured surveys distributed to a representative sample of industry stakeholders, capturing perspectives on material preferences, performance criteria, and procurement drivers. These data points were triangulated with market import-export statistics, tariff schedules, and environmental regulation databases to validate cost and demand assumptions. Throughout the process, insights were subjected to multiple layers of quality assurance, including expert panel reviews and consistency checks against independent benchmarks, ensuring both reliability and comprehensiveness.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Reinforced Thermoplastic Pipes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Reinforced Thermoplastic Pipes Market, by Material Type

- Reinforced Thermoplastic Pipes Market, by Pressure Rating

- Reinforced Thermoplastic Pipes Market, by Pipe Diameter

- Reinforced Thermoplastic Pipes Market, by Installation Method

- Reinforced Thermoplastic Pipes Market, by Application

- Reinforced Thermoplastic Pipes Market, by Region

- Reinforced Thermoplastic Pipes Market, by Group

- Reinforced Thermoplastic Pipes Market, by Country

- United States Reinforced Thermoplastic Pipes Market

- China Reinforced Thermoplastic Pipes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing the key takeaways from market trends, regulatory impacts, segmentation dynamics, and regional analyses to inform strategic decision-making in the reinforced thermoplastic pipe sector

The analysis presented underscores the transformative impact of material innovations and digital integration on the reinforced thermoplastic pipe market, driven by the need for corrosion resistance, operational efficiency, and reduced lifecycle costs. The imposition of tariffs in 2025 has accelerated the pursuit of regionalized supply chains and heightened the importance of flexible procurement strategies, while segmentation insights reveal clear opportunities in high-pressure, subsea, and specialized application domains.

Regionally, the Americas remain focused on infrastructure renewal and energy sector applications, Europe Middle East and Africa emphasize offshore and regulatory-driven adoption, and Asia-Pacific balances large-scale industrialization with emergent hydrogen and carbon transport needs. Leading suppliers are differentiating through collaborative material development, acquisition of niche expertise, and digital service offerings that embed lifecycle support into their value proposition. Collectively, these factors shape a dynamic landscape in which proactive investment, strategic partnerships, and regulatory engagement will determine market leadership going forward.

Engage with Ketan Rohom Associate Director of Sales and Marketing to secure tailored insights and comprehensive access to the reinforced thermoplastic pipe market research report

To gain unparalleled clarity and tailored guidance in navigating the complex reinforced thermoplastic pipe landscape, reach out directly to Ketan Rohom, whose deep industry expertise ensures a seamless path to strategic insights. As Associate Director of Sales and Marketing, Ketan Rohom can arrange a personalized consultation that delves into your organization’s unique challenges and objectives. During this session, you will explore how the synthesized research findings align with your operational priorities, enabling you to make data-driven decisions with confidence.

Securing the comprehensive market research report provides you with an indispensable tool for long-term planning, supplier evaluation, and innovation roadmapping. By partnering with Ketan Rohom, you unlock direct access to exclusive analyses, executive summaries, and supplementary data sets designed to support your executive leadership and project teams. Contact Ketan Rohom promptly to elevate your strategic initiatives and position your organization at the forefront of the reinforced thermoplastic pipe sector

- How big is the Reinforced Thermoplastic Pipes Market?

- What is the Reinforced Thermoplastic Pipes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?