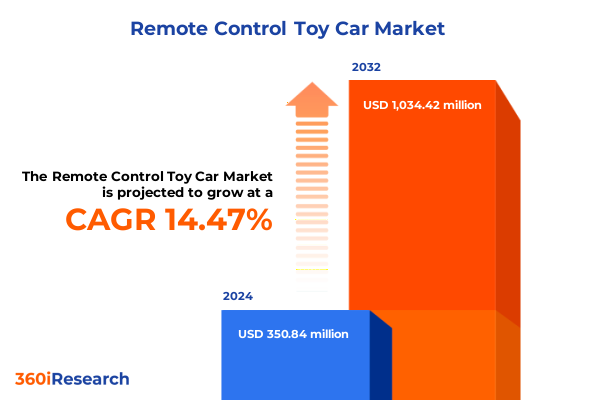

The Remote Control Toy Car Market size was estimated at USD 402.23 million in 2025 and expected to reach USD 452.47 million in 2026, at a CAGR of 14.44% to reach USD 1,034.42 million by 2032.

Contextual introduction to the remote-control toy car sector that frames technology choices, channel pressures, and policy dynamics shaping near-term decisions

The remote-control toy car category sits at the intersection of rapid consumer preferences, advancing component technologies, and shifting global trade dynamics. This executive summary synthesizes the most relevant signals for business leaders, covering technological adoption, distribution and channel tensions, regulatory shifts, and the immediate policy environment shaping cross-border sourcing and cost structures. The aim is to provide a clear narrative that helps product, supply chain, and commercial teams translate discrete observations into coherent strategic choices.

To orient the reader, the analysis draws from primary interviews with manufacturers, distributors, and hobby-retailers, combined with secondary regulatory and trade reporting. The resulting view foregrounds how technical decisions-such as control protocol selection and powertrain architecture-cascade into sourcing complexity and margin sensitivity, while regulatory and tariff developments increasingly determine inventory strategies and near-term commercial viability. Taken together, these factors demand proactive scenario planning and closer coordination between R&D, procurement, and sales functions.

How accelerating technology adoption, supply chain realignment, and evolving retail dynamics are reshaping product development and commercial tactics

Over the last several years the ecosystem supporting remote-control toy cars has undergone transformative shifts that are now converging. Component-level innovations-especially in brushless motor controllers and lithium-based battery chemistry-have redefined what consumers expect from out-of-the-box performance. At the same time, radio communications have migrated from legacy infrared systems to robust 2.4 GHz digital protocols, enabling multi-user environments and more reliable control; this has broadened the play envelope and raised the baseline performance for even mass-market SKUs. These technological transitions have lowered barriers for premium features, but they have also raised engineering expectations and component sourcing complexity.

In parallel, channel dynamics have evolved. E-commerce and direct-to-consumer models now sit alongside hobby-store ecosystems, each with differing service and return expectations. Retailers are more sensitive to inventory cost and lead time variability, which makes long lead-time SKUs vulnerable under elevated tariff or freight-pressure scenarios. Further, consumer preferences have trended toward higher-performance electric models over combustion-powered variants for reasons including ease of use, lower maintenance, and environmental perceptions; this evolution has reshaped product roadmaps and aftermarket ecosystems. Consequently, manufacturers are balancing the economics of higher-value electronic subsystems with the need to preserve approachable price points for broad adoption.

Assessment of the cumulative effects of evolving United States tariff actions on sourcing choices, inventory risk, and seasonal availability across the toy category

Recent tariff policies enacted and contemplated by trade authorities have imposed material friction across the toy supply chain and, in particular, on categories heavily reliant on imports. The policy regime has had a pronounced effect on sourcing decisions, inventory management, and pricing strategies for companies of every scale. Larger manufacturers with diversified production footprints have begun rebalancing where they manufacture particular SKUs, while smaller firms with concentrated supplier relationships face acute margin pressure and inventory shortages.

These trade-driven cost pressures have catalyzed several practical responses. Firms are delaying discretionary product introductions, accelerating procurement of critical components before tariff changes take effect, and selectively reassigning production to alternate geographies where feasible. In many cases, the pause and uncertainty around tariff implementation has been as consequential as the tariff itself, because retailers and distributors have constrained orders while they assess exposure. The result is a contraction in import flows in affected categories and heightened volatility in availability for core seasonal windows, forcing companies to adopt contingency warehousing and flexible fulfillment strategies.

Segmentation-driven insights that reveal where controller choices, powertrain technology, drive architecture, and usage profiles create distinct product and sourcing imperatives

In-depth segmentation clarifies where demand elasticities, engineering trade-offs, and supply vulnerabilities are concentrated. Controller technology divides the field between simple, low-cost line-of-sight infrared systems and higher-performing 2.4 GHz radio links that support reliable multi-user operation and longer range; product managers must weigh cost-to-performance trade-offs when selecting the control system to match target age and use cases. Vehicle powertrains present another critical axis: combustion-based nitro models continue to serve a passionate enthusiast niche, but electrically powered cars have become the mainstream choice because they simplify ownership and lower operational complexity; within electric drivetrains there is an important split between brushed motor platforms that retain cost advantages and the increasingly dominant brushless systems that deliver greater efficiency, speed, and longevity.

Drive architecture and application-led segmentation further refine strategic choices. Two-wheel-drive layouts remain cost-effective for many entry and mid-tier products, with front-wheel and rear-wheel variants offering distinct handling characteristics, while four-wheel-drive platforms provide traction and performance for higher-end and off-road designs, with mechanical options such as belt or shaft drives influencing reliability and maintenance expectations. Finally, application use-cases-indoor versus outdoor-shape materials, battery systems, and chassis tolerances: indoor designs require different surface interactions and noise considerations than outdoor off-road or on-road vehicles. Designing to a clearly defined segment avoids over-engineering and keeps Bills of Materials aligned with achievable retail price points.

This comprehensive research report categorizes the Remote Control Toy Car market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Controller Type

- Car Type

- Drive Type

- Application

How regional manufacturing strengths, regulatory priorities, and retail channel structures in Americas, EMEA, and Asia-Pacific determine resilience and go-to-market posture

Regional dynamics exert asymmetric influence across the value chain. In the Americas, demand is concentrated in mature retail channels and hobbyist communities where quality, service, and brand reputation drive purchasing decisions; this region also reacts quickly to pricing changes, making it particularly sensitive to tariff-driven cost shifts. Europe, the Middle East and Africa show a duality: Western and Northern Europe emphasize safety compliance and environmental considerations, while growth pockets in Southern and Eastern Europe and select Middle Eastern markets are opening for entry-level and mid-range models. The Asia-Pacific region remains both the principal manufacturing base for many suppliers and a vibrant consumer market, with strong supplier ecosystems and skilled component suppliers that support fast innovation cycles. The interaction of demand-side sophistication and supply-side concentration means that regional strategy must explicitly account for compliance regimes, freight economics, and local retail structures.

Supply-side agility varies by region. Manufacturers with production capacity in multiple geographies are better positioned to mitigate tariff or shipping shocks, whereas businesses that remain reliant on a single production hub face concentration risk and longer recovery timelines. This uneven resilience underscores the importance of region-specific sourcing playbooks and of maintaining deeper visibility into regional logistics and regulatory developments to preserve seasonal competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Remote Control Toy Car market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Company-level competitive intelligence revealing how platformization, safety compliance, and community engagement separate resilient players from vulnerable participants

The competitive landscape is shaped by a range of players, from global brands that invest in direct distribution and engineering differentiation to specialized manufacturers and a resilient network of hobby shops that sustain enthusiast communities. Leading firms have leveraged product platforms and modular designs to amortize the cost of higher-performance components such as brushless motors and advanced electronic speed controllers, while others compete on price by optimizing simplified feature sets and low-cost control systems. In addition, an active aftermarket and parts ecosystem supports longevity and customer lifetime value, which benefits suppliers that prioritize repairability and spare-part availability.

Strategic positioning matters: companies that invest in safety testing, clear age-grading, and robust documentation find fewer regulatory frictions and stronger retail partnerships. Those that commit to supply-chain diversification and transparent supplier audits tend to secure steadier retailer allocation during shocks. Finally, brands that cultivate community and content-supporting local hobby clubs, racing events, and online tutorials-capture loyal user bases and reduce acquisition costs, turning enthusiasts into advocates and thereby amplifying product lifecycle value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Remote Control Toy Car market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amrik Singh & Sons

- Arrma RC

- Bburago S.p.A.

- Horizon Hobby, LLC

- HPI Racing Ltd.

- K. V. Toys India Limited

- Kamal Enterprises

- Maisto International, Inc.

- Masoom Playmates Pvt. Ltd.

- Mattel, Inc.

- Maverick RC

- R. G. Toys & Novelties

- Redcat Racing, Inc.

- Saini Toys

- Spin Master Corp.

- Tamiya, Inc.

- Team Corally NV

- Toyzone Impex Pvt. Ltd.

- Traxxas, L.P.

- Zephyr Toymakers Pvt. Ltd.

Actionable and operational recommendations executives can implement to protect margins, secure inventory, and preserve product roadmaps in a volatile trade and regulatory climate

Industry leaders must move from reactive to anticipatory strategies to protect margin and availability. First, align product roadmaps with realistic sourcing scenarios: where higher-performance electronics are demanded, plan earlier procurement windows and consider forward-buying of critical components to lock in supply. Second, prioritize modular platforms that permit graceful downgrades of non-essential subsystems without disrupting the core user experience; this reduces the need to redesign full assemblies under cost pressure. Third, double down on regulatory compliance and testing early in the design cycle, especially for battery systems and age-graded products, since delayed certification can stall market entry and amplify seasonal risk.

Additionally, brands should formalize multi-tier inventory strategies that combine consigned safety stocks with rapid-response warehousing near key retail centers. Strengthen partnerships with freight forwarders and customs brokers to reduce clearance times and to capture real-time visibility into congestion risks. Finally, invest in demand-shaping programs-pre-orders, limited editions, and serialized community drops-that shift some inventory risk back up the funnel while preserving price integrity. These combined actions will allow companies to protect margins and preserve customer trust even as trade and regulatory conditions fluctuate.

Clear explanation of the mixed-methods research approach used to assemble regulatory, supply-chain, and product-segmentation insights that underpin these recommendations

The insights in this summary were developed using a mixed-methods approach that combined structured primary research with targeted secondary analysis. Primary research included confidential interviews with manufacturers, component suppliers, retail buyers, and hobby-channel operators to surface practical constraints and the tactical behaviors that manifest during policy shocks. These conversations were augmented with supplier audits and anonymized transaction sampling to validate observed procurement behavior and lead-time adjustments.

Secondary analysis drew on regulatory filings, industry association reports, and trade reporting to map policy developments and safety standards. Data triangulation emphasized cross-checks between interview evidence and publicly available regulatory guidance to ensure that recommendations are grounded in verifiable obligations and typical industry practice. Quality assurance steps included peer review of the draft findings with subject matter experts in product safety, radio-frequency engineering, and international logistics to minimize bias and to strengthen the operational relevance of prescribed actions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Remote Control Toy Car market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Remote Control Toy Car Market, by Controller Type

- Remote Control Toy Car Market, by Car Type

- Remote Control Toy Car Market, by Drive Type

- Remote Control Toy Car Market, by Application

- Remote Control Toy Car Market, by Region

- Remote Control Toy Car Market, by Group

- Remote Control Toy Car Market, by Country

- United States Remote Control Toy Car Market

- China Remote Control Toy Car Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concise concluding synthesis that links technology adoption, regulatory readiness, and sourcing discipline to competitive outcomes in the coming seasons

The remote-control toy car landscape has entered a period where engineering choices, supply-chain strategy, and public policy are tightly coupled, and where indecision carries measurable commercial cost. Technology transitions such as the ascendancy of brushless motors and robust 2.4 GHz control systems have raised expectations for out-of-the-box performance, but they have also increased dependency on specific electronic subsystems. At the same time, tariff actions and evolving safety standards have created a new operational environment in which inventory timing, certification readiness, and diversified sourcing are core competencies rather than optional capabilities.

For companies in this space the imperative is clear: invest in modular and test-ready platforms, accelerate procurement and certification lead times for critical subsystems, and adopt inventory and channel strategies that preserve product availability during peak seasons. Those who take these steps will preserve customer trust and competitive momentum, while those who delay risk losing shelf presence and price stability. The combination of technical clarity and deliberate supply-chain planning will separate winners from the rest over the next buying cycles.

Purchase this deeply actionable remote-control toy car market report now and secure an expert briefing with an Associate Director of Sales and Marketing

For access to the full market research report and to secure an immediate briefing tailored to your strategic priorities, please contact Ketan Rohom (Associate Director, Sales & Marketing). He can arrange a customized executive briefing, walk you through the report sections most relevant to sourcing, product development, and go-to-market planning, and provide options for licensing or bespoke deliverables that align with your timelines. Prompt engagement will help your organisation convert research insights into rapid operational actions ahead of the next buying season.

Reach out to arrange a confidential consultation and to receive a sample chapter, a prioritized slide deck, and a timeline for delivery of any supplemental analysis or custom queries. Early purchasers may also obtain prioritized analyst time to review supply-chain scenarios, tariff-sensitivity modeling, and product segmentation deep-dives that map directly to engineering, procurement, and commercial teams.

Act now to turn this intelligence into a defensible strategy that protects margins, preserves product availability, and positions your portfolio for competitive advantage in a volatile trade and regulatory environment. Ketan Rohom stands ready to coordinate next steps and to tailor the engagement to your budget and decision calendar.

- How big is the Remote Control Toy Car Market?

- What is the Remote Control Toy Car Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?