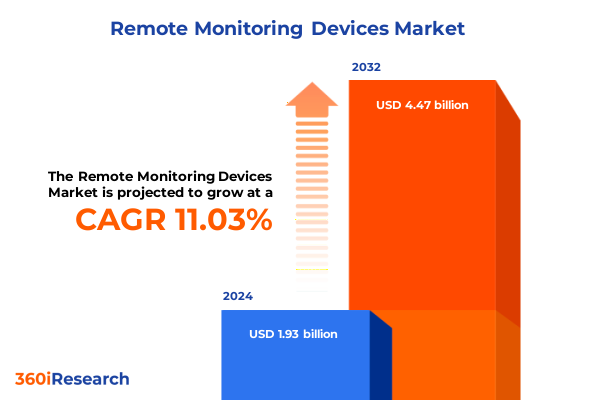

The Remote Monitoring Devices Market size was estimated at USD 2.14 billion in 2025 and expected to reach USD 2.36 billion in 2026, at a CAGR of 11.06% to reach USD 4.47 billion by 2032.

Unlocking the Full Potential of Remote Patient Monitoring Devices to Revolutionize Chronic Disease Management and Elevate the Quality of Global Healthcare Delivery

The landscape of healthcare delivery has undergone a profound transformation driven by the increasing demand for continuous, real-time patient monitoring outside traditional clinical settings. Remote monitoring devices have emerged as pivotal enablers in this evolution, bridging the gap between patients and providers while enhancing the quality and efficiency of care. This introduction explores how interconnected sensors, advanced data analytics, and telemedicine platforms have converged to create a new paradigm in patient management, where timely intervention and proactive health management are the norm rather than the exception.

Looking back on the historical trajectory, initial iterations of remote monitoring focused primarily on stationary bedside monitors within hospital environments. However, accelerating technological innovation and the maturation of wireless communication networks have propelled the field into a diverse ecosystem that includes implantable devices and wearable technologies. These developments have not only expanded the spectrum of measurable parameters-from vital signs to neurological and fetal metrics-but also redefined the patient experience by enabling care continuity in ambulatory centers, at home, and in remote or resource-limited settings.

Moreover, the imperative to manage chronic diseases more effectively, driven by aging populations and rising prevalence of conditions such as diabetes and cardiovascular disorders, has catalyzed widespread adoption of remote monitoring solutions. Payers and healthcare systems are increasingly recognizing the value of early detection, prevention, and reduced hospital readmissions, which translates into cost savings and better patient outcomes. As a result, stakeholders across the value chain-from device manufacturers to technology integrators and healthcare providers-are collaborating to scale these solutions, underscoring the critical role that remote monitoring devices play in shaping the future of global healthcare delivery.

Embracing a New Era of Connected Healthcare Through the Integration of IoT, Artificial Intelligence, and Advanced Data Analytics in Remote Monitoring Devices

In recent years, the remote monitoring sector has been propelled by a wave of technological breakthroughs and strategic partnerships that have redefined how healthcare data is collected, transmitted, and interpreted. The integration of Internet of Things (IoT) frameworks with clinical workflows has enabled devices to communicate seamlessly via standardized protocols, ensuring interoperability and reducing the friction that previously impeded data exchange between disparate systems.

Concurrently, advancements in artificial intelligence and machine learning have fortified analytical capabilities, allowing providers to extract actionable insights from vast streams of patient-generated data. For instance, predictive modeling algorithms now empower clinicians to foresee potential clinical events, such as arrhythmias or glycemic excursions, well before they manifest, permitting preemptive interventions and personalized care plans. This shift from reactive to proactive healthcare delivery marks a pivotal moment in the maturation of remote monitoring practices.

Furthermore, the deployment of edge computing architectures has substantially mitigated latency and bandwidth constraints by processing critical algorithms locally on devices or gateway nodes. This architectural evolution enhances real-time responsiveness and fortifies cybersecurity by minimizing the exposure of sensitive patient data to external networks. As a result, stakeholders are witnessing a convergence of miniaturized sensors, robust connectivity technologies, and cloud-based analytic engines, all coalescing to deliver a truly intelligent and resilient remote monitoring ecosystem.

Assessing the Compound Effects of New 2025 United States Tariff Policies on Supply Chains, Production Costs, and Pricing Strategies in Remote Monitoring Markets

The introduction of new tariff measures by the United States in 2025 has exerted significant pressure on the global supply chains underpinning remote monitoring device manufacturing. Manufacturers reliant on imported electronic components and subassemblies have experienced heightened production costs, which in turn have reverberated through pricing strategies and profit margins. These cumulative effects have necessitated rapid adjustments in procurement practices to secure supply continuity and maintain cost efficiencies.

In response to these fiscal pressures, industry players have accelerated efforts to diversify their supplier bases, culminating in the establishment of regional manufacturing hubs. By localizing key production stages, companies are mitigating exposure to tariff fluctuations and logistical bottlenecks. Such strategic realignment has also fuelled investments in automation and smart factory technologies to optimize output and reduce reliance on labor-intensive processes, thereby safeguarding margins in a high-cost environment.

Nevertheless, end users have encountered incremental price adjustments for remote monitoring solutions, prompting healthcare providers and payers to reassess procurement frameworks. In consequence, vendors are intensifying value-based contracting models and offering comprehensive service packages-bundling hardware, software, and analytics-to justify cost differentials and reinforce long-term partnerships. Collectively, these adaptations exemplify how the cumulative impact of 2025 tariff policies is reshaping competitive dynamics, supply chain resilience, and market access strategies for remote monitoring devices.

Deriving Actionable Insights from Product Type, Connectivity Technology, Application, and End User Segmentation for Remote Monitoring Device Strategies

An in-depth examination of product type segmentation reveals a multifaceted market structure encompassing implantable, stationary, and wearable devices. Implantable solutions, including loop recorders and pacemakers, are increasingly favored for their ability to deliver continuous, long-term cardiac monitoring with minimal patient burden. Meanwhile, stationary devices such as bedside and wall-mounted monitors maintain their stronghold in hospital and clinical settings, where high-fidelity data acquisition and centralized monitoring stations remain essential. Wearable offerings-spanning patches and smartwatches-are capturing a growing share by combining ease of use with advanced biometric sensing capabilities, thus opening new avenues for patient engagement and remote diagnostics.

Connectivity technology segmentation highlights the critical role of seamless data transmission in amplifying the utility of remote monitoring devices. Bluetooth, encompassing both classic and low energy variants, continues to dominate short-range, low-power applications, particularly for wearable and home-based systems. Cellular networks, evolving through 2G/3G toward widespread 4G and emerging 5G deployments, are unlocking high-bandwidth, low-latency use cases such as real-time video diagnostics and continuous telemetry. Wi-Fi standards, including Wifi 4, 5, and the latest Wifi 6, are enabling robust local area connectivity in clinical and residential environments, while emerging protocols like Zigbee are carving out niche applications within constrained network topologies.

Application segmentation underscores the diverse clinical imperatives addressed by remote monitoring devices. Cardiac monitoring solutions employ technologies such as ECG telemetry, Holter monitoring, and implantable loop recorders to diagnose arrhythmias and manage heart failure. Fetal monitoring, differentiated by invasive and noninvasive techniques, is enhancing maternal-fetal surveillance in both inpatient and outpatient settings. Glucose monitoring devices, whether continuous or flash modalities, are empowering individuals with diabetes to track glycemic trends in real time. Neurological, respiratory, and vital signs monitoring further broaden the spectrum-leveraging EEG, EMG, capnography, pulse oximetry, blood pressure, multiparameter, and temperature sensing-to support comprehensive patient assessment and remote triage.

From an end user perspective, ambulatory centers, outpatient clinics, home care environments, and hospitals each present unique adoption drivers and operational requirements. Ambulatory centers prioritize portability and rapid deployment, clinics seek integration with their electronic health records, home care programs focus on ease of use and patient adherence, while hospitals demand enterprise-grade reliability and scalability. Together, these segmentation insights inform tailored product development, commercialization strategies, and value propositions that resonate across diverse stakeholder groups.

This comprehensive research report categorizes the Remote Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Technology

- Application

- End User

Navigating Diverse Regional Dynamics and Growth Drivers across the Americas, Europe Middle East Africa, and Asia Pacific in Remote Monitoring Markets

Across the Americas, market evolution has been influenced by progressive reimbursement policies, widespread digital health adoption, and the presence of key innovation hubs. North America, in particular, has witnessed strong collaboration between technology firms and healthcare institutions, fostering pilot programs that validate new remote monitoring use cases. Latin American markets are rapidly embracing telehealth initiatives, driven by the need to extend care to underserved populations and manage chronic disease burdens in resource-constrained environments.

Moving to Europe, Middle East, and Africa, regulatory harmonization within the European Union is facilitating cross-border deployment of remote monitoring solutions, while stringent data protection frameworks ensure patient privacy and security. Gulf Cooperation Council countries are investing heavily in smart hospital infrastructure, positioning the region as an emerging market for advanced telemetry systems. Sub-Saharan Africa, although still at a nascent stage, is witnessing pilot projects that leverage mobile networks and solar-powered devices to address connectivity constraints and expand access to maternal and neonatal monitoring.

In the Asia-Pacific region, rapid urbanization and government-driven digital health agendas are accelerating adoption rates. Markets such as China, Japan, and South Korea are at the forefront of integrating 5G-enabled remote monitoring platforms, unlocking new opportunities for real-time critical care outside traditional facilities. Meanwhile, Southeast Asian countries are capitalizing on cost-effective mobile technologies to deploy scalable monitoring networks, thereby improving healthcare outreach in both urban and rural settings.

This comprehensive research report examines key regions that drive the evolution of the Remote Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscape and Strategic Moves of Leading Remote Monitoring Device Manufacturers and Innovators Shaping the Future of Care

The competitive landscape is characterized by a blend of established medical device corporations and agile technology innovators. Leading implantable device manufacturers have leveraged deep clinical expertise and global distribution networks to introduce next-generation loop recorders and pacemakers with integrated connectivity modules. These incumbents have also pursued strategic acquisitions of telemedicine platforms and analytics startups to bolster end-to-end remote monitoring offerings.

Simultaneously, consumer electronics companies with strong backgrounds in wireless communication and wearable sensors have entered the healthcare segment, partnering with clinical laboratories and research institutions to validate the clinical efficacy of their devices. Such cross-industry collaborations are accelerating time to market and facilitating the convergence of consumer health data with traditional clinical workflows. In parallel, software firms specializing in health data analytics are integrating artificial intelligence and predictive algorithms into device ecosystems, enhancing diagnostic precision and enabling personalized health insights.

Together, these competitive dynamics are shaping a marketplace where differentiation is achieved through a combination of technological sophistication, regulatory compliance, and value-based service models. Companies that can seamlessly integrate hardware, software, and services while ensuring data security and user-friendly interfaces are best positioned to capture market share and sustain growth in an increasingly crowded field.

This comprehensive research report delivers an in-depth overview of the principal market players in the Remote Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bosch Sicherheitssysteme GmbH

- Brinks Home Security, Inc.

- Cardtronics USA, Inc.

- Diebold Nixdorf, Incorporated

- Fiserv, Inc.

- Genetec Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- March Networks Corporation

- NCR VOYIX Corporation

- Qognify

- Seico Security Technology (Europe) Ltd.

- Sensormatic Electronics, LLC

- Surveillance Secure International Inc.

- Synergis Software Development, LLC

- Verint Systems Inc.

Implementing Strategic Initiatives to Leverage Technological Advancements and Mitigate Risks for Business Growth in the Remote Monitoring Industry

Industry leaders should prioritize the development of interoperable platforms that facilitate seamless integration with electronic health record systems and telehealth portals. By adopting open architecture standards and investing in application programming interfaces, organizations can foster an ecosystem that supports collaborative care pathways and data sharing across stakeholder groups. In addition, diversifying supply chains through regional manufacturing partnerships and onshore production hubs will mitigate exposure to geopolitical shifts and tariff volatility, enhancing operational resilience.

Moreover, expanding investments into emerging connectivity technologies-such as 5G networks, edge computing, and low-power wide-area networks-will unlock new use cases that require ultra-reliable, low-latency data transmission. To this end, forging alliances with telecom carriers and network equipment providers is essential for testing and deploying advanced remote monitoring applications in both urban and rural environments. Parallel efforts should focus on strengthening cybersecurity protocols, adopting end-to-end encryption, and securing regulatory approvals to ensure patient privacy and compliance with evolving data protection mandates.

Finally, embracing a value-based contracting mindset by aligning pricing models with clinical and economic outcomes will foster deeper partnerships with payers and providers. By demonstrating tangible improvements in patient adherence, reduced hospital readmissions, and overall cost savings, companies can justify premium pricing tiers and long-term subscription services, thereby driving sustainable revenue streams.

Employing Rigorous Primary and Secondary Research Methods to Validate Data and Deliver Credible Intelligence for Remote Monitoring Market Analysis

A rigorous research methodology underpins the insights presented in this report, blending both primary and secondary sources to validate key findings. Primary research comprised in-depth interviews with industry executives, clinical practitioners, and technology developers, complemented by surveys of end-users across hospitals, clinics, and home care settings. These qualitative engagements provided first-hand perspectives on adoption barriers, feature preferences, and purchasing criteria.

Secondary research involved systematic reviews of scientific literature, regulatory filings, patent databases, and publicly available financial reports. Market trend analyses leveraged data triangulation techniques, cross-referencing multiple data sets to ensure consistency and reliability. In addition, competitive intelligence gathered through product catalogs, press releases, and patent landscapes was synthesized to map the strategic positioning of leading players.

This combined approach, anchored in robust data validation protocols and expert panel reviews, ensures that the conclusions and recommendations articulated herein reflect current realities and emerging trajectories within the remote monitoring device sector. Continuous refinement through iterative feedback loops further enhances the relevance and accuracy of the market intelligence provided.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Remote Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Remote Monitoring Devices Market, by Product Type

- Remote Monitoring Devices Market, by Connectivity Technology

- Remote Monitoring Devices Market, by Application

- Remote Monitoring Devices Market, by End User

- Remote Monitoring Devices Market, by Region

- Remote Monitoring Devices Market, by Group

- Remote Monitoring Devices Market, by Country

- United States Remote Monitoring Devices Market

- China Remote Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings and Strategic Implications to Provide a Cohesive Perspective on the Future of Remote Monitoring Solutions

Synthesizing the multifaceted insights from technological trends, regulatory shifts, tariff impacts, segmentation analyses, regional dynamics, and competitive strategies illuminates a clear narrative: remote monitoring devices are central to the transformation of modern healthcare. Stakeholders who embrace connectivity-driven innovation, prioritize interoperability, and champion value-based care models are poised to lead the market.

As the ecosystem continues to evolve, sustained investment in digital infrastructure, strategic partnerships, and user-centric design will be critical for unlocking new patient populations and enabling scalable deployment. By aligning strategic priorities with emerging regulatory and reimbursement frameworks, organizations can harness the full potential of remote monitoring solutions to improve outcomes, optimize operational efficiency, and achieve sustainable growth.

Engage with Ketan Rohom to Secure Comprehensive Market Insights and Drive Strategic Decision Making in Remote Monitoring Device Investments

To explore critical insights and leverage strategic intelligence for your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He is ready to guide you through the detailed findings of this comprehensive market research report and help you understand how these insights can drive impactful decision-making for your remote monitoring device initiatives. Engaging with Ketan will provide you with tailored recommendations, access to proprietary data sets, and personalized support to unlock new growth opportunities and competitive advantages in a rapidly evolving healthcare technology landscape.

- How big is the Remote Monitoring Devices Market?

- What is the Remote Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?