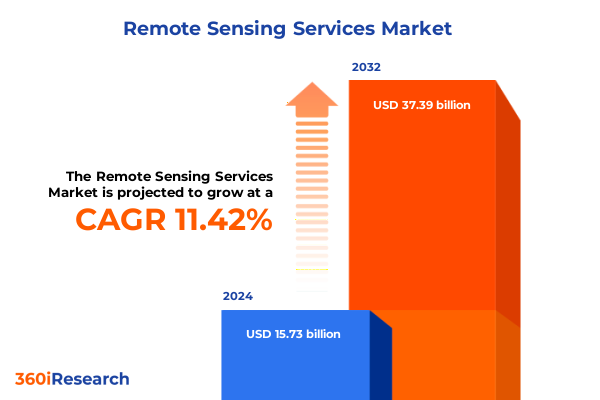

The Remote Sensing Services Market size was estimated at USD 17.38 billion in 2025 and expected to reach USD 19.20 billion in 2026, at a CAGR of 11.56% to reach USD 37.39 billion by 2032.

Unveiling the Critical Role of Remote Sensing Services in Navigating Complex Data Needs and Empowering Strategic Decisions Across Industries

Remote sensing services have emerged as indispensable pillars in an environment where data-driven decision-making dictates competitive advantage and operational efficiency. As organizations across agriculture, defense, urban planning, and environmental management contend with increasingly complex challenges, high-resolution imagery, advanced analytics, and timely insights have become essential. The convergence of multidisciplinary expertise, from satellite constellation management to machine learning–enabled image analysis, underscores how remote sensing platforms deliver unique value by transforming raw data into strategic intelligence.

Technological democratization has further accelerated the adoption of remote sensing services. Satellite miniaturization, proliferation of unmanned aerial vehicles, and improvements in sensor sensitivity have made it possible for players of varying scales to access and deploy sophisticated solutions. Concurrent advancements in cloud architectures and geospatial information systems ensure that the vast volumes of imagery and sensor outputs are efficiently processed and integrated into existing enterprise workflows. Consequently, remote sensing services have positioned themselves at the forefront of digital transformation initiatives, driving innovation and unlocking new frontiers of insight for organizations around the globe.

Identifying Key Transformational Shifts in Sensor Technologies Platforms and Analytics That Are Redefining Remote Sensing Service Capabilities Worldwide

The remote sensing landscape is undergoing radical transformation as next-generation sensor designs, data fusion techniques, and analytic capabilities redefine what organizations can achieve. Lidar devices are delivering unprecedented accuracy in terrain mapping, while improvements in hyperspectral imaging are supporting advanced material identification and precision agriculture. The rapid integration of radar and thermal sensors, capable of penetrating cloud cover and providing temperature profiles, has expanded the applicability of remote sensing in defense, emergency response, and industrial monitoring.

Simultaneously, platform diversification is reshaping service models. Satellite constellations in low Earth orbit are offering higher revisit rates, enabling near-continuous monitoring, while unmanned aerial systems have become cost-effective solutions for localized surveys. These shifts are further propelled by the incorporation of artificial intelligence and machine learning within data processing pipelines, enhancing feature extraction, anomaly detection, and predictive modeling. As the industry pivots toward edge computing and real-time analytics, remote sensing services are set to deliver faster, more granular, and context-aware insights than ever before.

Exploring the Multifaceted Impact of 2025 United States Tariff Policies on the Supply Chains Cost Structures and Strategic Planning in Remote Sensing Services

In 2025, newly instituted United States tariffs have introduced a layer of complexity into the remote sensing value chain, affecting everything from component procurement to platform assembly. The increased duties on imported sensor optics, semiconductor chips, and specialized telemetry hardware have led service providers to reassess sourcing strategies, including the exploration of domestic suppliers and investment in in-house manufacturing capabilities. This realignment is reducing exposure to supply disruptions while elevating the importance of vertical integration in sensor and subsystem production.

These trade measures have also influenced strategic planning and cost management. Service providers are adapting by optimizing logistics networks, renegotiating contracts, and leveraging long-term supply agreements to secure favorable pricing. The cumulative impact of these changes has driven a renewed focus on building resilient ecosystems, with many organizations exploring diversified partnerships across allied economies to mitigate tariff-induced cost pressures. As the market adapts, the ability to navigate evolving regulatory landscapes will remain a key differentiator for successful remote sensing service businesses.

Unearthing Actionable Insights Across Diverse Sensor Platform Service Application and End User Segments to Unlock Strategic Value in Remote Sensing Markets

A nuanced understanding of market segmentation reveals critical insights into how technology, service delivery, and customer requirements converge to shape the competitive landscape. Sensor type analysis highlights that Lidar solutions, whether airborne units optimized for wide-area elevation mapping or terrestrial systems for detailed structural analysis, occupy distinct niches. Optical platforms fluctuate between hyperspectral instruments that extract chemical signatures, multispectral sensors for vegetation and land-cover classification, and panchromatic cameras delivering high-resolution grayscale imagery, while thermal offerings span both long-wave sensors suited to meteorological applications and short-wave devices tailored to industrial and surveillance tasks.

Platform segmentation elucidates divergent adoption patterns, as aircraft deployments range from manned aerial survey teams to increasingly autonomous unmanned aerial vehicles using fixed wing or rotary wing configurations. Satellite platforms demonstrate varied mission profiles across geostationary, low Earth orbit, and medium Earth orbit vehicles, each addressing different temporal and spatial performance requirements. Service type distinctions further refine market dynamics, with consulting engagements guiding strategic roadmaps, data acquisition fueling baseline intelligence, data processing and analysis encompassing feature extraction, GIS integration, and image correction, and system integration ensuring seamless deployment. Applications spread across defense and intelligence operations-covering border security, reconnaissance, and surveillance-environment and agriculture monitoring-including crop health, climate assessment, and forestry management-and urban planning and infrastructure oversight, focusing on smart city frameworks, traffic management, and infrastructure monitoring. End users from agriculture and forestry firms to government agencies, mining and oil and gas operators, transportation and logistics providers, and utilities define project requirements, while delivery modes bifurcate between cloud-based platforms for scalable analytics and on-premise solutions for sensitive data environments.

This comprehensive research report categorizes the Remote Sensing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Platform

- Service Type

- Application

- End User

- Delivery Mode

Highlighting Critical Regional Dynamics and Growth Drivers Shaping Remote Sensing Service Adoption in the Americas Europe Middle East Africa and Asia Pacific

Regional analysis demonstrates that the Americas continue to lead remote sensing adoption, driven by extensive investment in satellite infrastructure and aerospace technology, robust defense spending, and a mature market for precision agriculture services. North American providers excel in leveraging data analytics frameworks that integrate seamlessly with existing enterprise resource planning and geospatial information systems, while Latin American nations are scaling usage for environmental conservation and resource management initiatives.

Across Europe, the Middle East, and Africa, diversity in regulatory frameworks and project funding mechanisms shapes adoption rates. Western Europe emphasizes sustainability and smart city projects, the Middle East deploys advanced surveillance and infrastructure monitoring solutions, and Africa is increasingly harnessing satellite and UAV data for economic development, disaster response, and natural resource exploration. In the Asia-Pacific region, rapid urbanization and infrastructure expansion create significant demand for remote sensing services in smart city planning, traffic management, and utilities monitoring. Moreover, agricultural powerhouses in the Asia-Pacific are adopting hyperspectral and multispectral imaging to optimize crop yields and manage water resources, solidifying the region’s position as a growth driver in global remote sensing markets.

This comprehensive research report examines key regions that drive the evolution of the Remote Sensing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives Partnerships and Technological Innovations Driving Market Leadership Among Top Remote Sensing Service Providers Globally

Leading companies in the remote sensing services arena are differentiating through strategic partnerships, technological innovation, and comprehensive service portfolios. Notable providers of satellite imagery and data analytics are expanding their offerings with advanced machine learning algorithms, enabling automated change detection and predictive modeling. Simultaneously, firms specializing in UAV-based data acquisition are forging alliances with software vendors to enhance real-time data processing and deliver turnkey solutions that integrate flight planning, sensor management, and analytics.

Other key players are investing heavily in research and development to advance sensor capabilities, including the development of compact hyperspectral sensors and miniaturized radar modules. Strategic mergers and acquisitions are consolidating expertise in areas such as system integration and GIS optimization, creating end-to-end providers that can deliver consulting, data acquisition, processing, analysis, and integration services under unified contracts. This trend toward full-spectrum service delivery is streamlining procurement processes for end users and enabling providers to capture greater value by overseeing project lifecycles from initial design to long-term support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Remote Sensing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Astro Digital US, Inc.

- BlackSky Technology Inc.

- Descartes Labs, Inc.

- DroneDeploy, Inc.

- Environmental Systems Research Institute, Inc.

- Garuda Aerospace Pvt. Ltd.

- ICEYE Oy

- L3Harris Technologies, Inc.

- Maxar Technologies Inc.

- Orbital Insight, Inc.

- Pix4D S.A.

- Pixxel Space Technologies Pvt. Ltd.

- Planet Labs PBC

- PrecisionHawk, Inc.

- Propeller Aero Pty Ltd.

- RMSI Pvt. Ltd.

- Skycatch, Inc.

- TerraAvion, Inc.

- Trimble Inc.

Delivering Practical Strategic Recommendations to Accelerate Innovation Partnership Development and Competitive Positioning for Remote Sensing Service Stakeholders

Industry leaders should prioritize the development of AI-augmented analytics platforms to accelerate data-to-insight cycles, ensuring that clients receive actionable intelligence faster than ever before. By integrating machine learning models directly into data processing pipelines, service providers can automate feature extraction, anomaly detection, and predictive forecasting, reducing manual intervention and improving consistency across projects.

At the same time, cultivating strategic partnerships across the technology ecosystem-ranging from satellite manufacturers and sensor developers to cloud service operators and GIS software companies-enhances value propositions. Collaborative ventures can streamline system integration efforts, reduce time to deployment, and open new revenue streams through bundled service offerings. Furthermore, diversifying supply chains and investing in domestic production of critical components will bolster resilience against tariff fluctuations and geopolitical uncertainties, ensuring uninterrupted service delivery in dynamic market environments.

Detailing Rigorous Research Methodologies Data Collection Techniques and Analytical Frameworks Underpinning the Credibility and Integrity of the Remote Sensing Services Study

This analysis rests on a rigorous blend of primary and secondary research methodologies designed to ensure methodological transparency and analytical integrity. Primary data was gathered through structured interviews and consultations with senior executives, technical directors, and end-user decision-makers across various industries, providing insights into strategic priorities, technology adoption patterns, and procurement criteria.

Secondary research encompassed an exhaustive review of corporate filings, industry journals, government reports, and white papers to contextualize market developments and identify emerging trends. Quantitative data points were triangulated and cross-validated using multiple sources to enhance reliability, while qualitative insights were refined through iterative expert reviews. The segmentation framework was developed based on sensor type, platform, service type, application, end user, and delivery mode, ensuring comprehensive coverage of market drivers and customer requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Remote Sensing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Remote Sensing Services Market, by Sensor Type

- Remote Sensing Services Market, by Platform

- Remote Sensing Services Market, by Service Type

- Remote Sensing Services Market, by Application

- Remote Sensing Services Market, by End User

- Remote Sensing Services Market, by Delivery Mode

- Remote Sensing Services Market, by Region

- Remote Sensing Services Market, by Group

- Remote Sensing Services Market, by Country

- United States Remote Sensing Services Market

- China Remote Sensing Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings Critical Trends and Strategic Implications to Provide a Cohesive Outlook on the Future Trajectory of Remote Sensing Services

The remote sensing services landscape is poised for sustained transformation as innovations in sensor technology, analytics, and platform deployment converge to offer deeper, more actionable insights. Strategic segmentation-spanning sensor modalities, platforms, service offerings, applications, end users, and delivery modes-illuminates distinct pathways to value creation, while regional dynamics underscore the importance of customized approaches for the Americas, EMEA, and Asia-Pacific markets.

As industry incumbents and new entrants alike navigate evolving tariff regimes, supply chain realignment, and regulatory shifts, a proactive emphasis on technological agility, strategic partnerships, and resilient sourcing models will define market leadership. By synthesizing core findings and aligning stakeholder strategies with emerging trends, organizations can confidently position themselves to capitalize on the next wave of opportunities in remote sensing services.

Engage with Ketan Rohom to Secure Exclusive Insights Advanced Customization and Strategic Support for Elevating Your Remote Sensing Services Strategy Today

To explore how these comprehensive insights can be tailored to your organization’s strategic objectives and to gain exclusive access to advanced data sets and bespoke analytical support, contact Associate Director, Sales & Marketing Ketan Rohom today. He can guide you through the report’s key findings, provide customized consulting options, and facilitate a partnership designed to enhance your remote sensing services strategy. Engage now to unlock unparalleled expertise and accelerate your decision-making capabilities with industry-leading intelligence and hands-on support from a seasoned expert ready to address your unique challenges and opportunities.

- How big is the Remote Sensing Services Market?

- What is the Remote Sensing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?