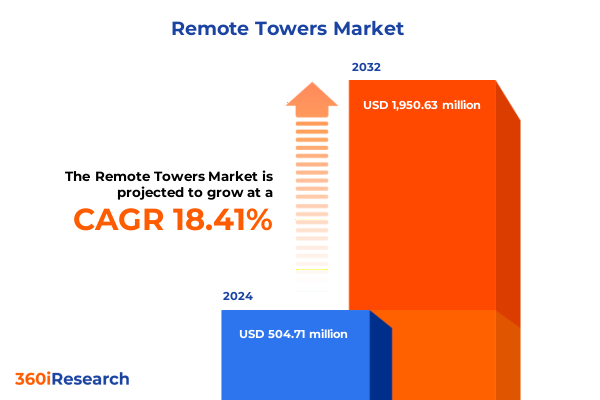

The Remote Towers Market size was estimated at USD 594.35 million in 2025 and expected to reach USD 701.51 million in 2026, at a CAGR of 18.50% to reach USD 1,950.63 million by 2032.

Unveiling the Dynamics and Strategic Importance of Remote Tower Solutions Transforming Air Traffic Management for Enhanced Safety and Efficiency

Remote tower solutions represent a fundamental shift in air traffic management, leveraging digital technologies to deliver surveillance, communication, and control capabilities from centralized locations. At their core, these systems decouple physical air traffic control towers from operational oversight, enabling one control center to serve multiple airports. This approach not only enhances scalability but also introduces redundancy measures that mitigate risks associated with staffing constraints or localized disruptions. Moreover, by aggregating remote operations, stakeholders can achieve more consistent procedural standards, driving operational safety across diverse airfields.

In recent years, advancements in high-definition video streaming, real-time data processing, and artificial intelligence have accelerated the practical deployment of remote towers. As a result, industry leaders are transitioning pilot projects into full-scale implementations, exploring both single-airport contingency configurations and multi-airport control centers. These developments underscore an industry-wide recognition that digital air traffic services can meet-and in many cases exceed-the performance benchmarks established by traditional tower infrastructure.

With regulatory frameworks adapting to recognize remote solutions as certified control mechanisms, the foundation has been laid for broader adoption. Consequently, air navigation service providers and airport authorities are evaluating their modernization roadmaps to integrate remote towers as a core component of future operational architectures. This introduction underscores the transformative nature of remote tower technologies and sets the stage for a closer examination of the shifts, impacts, and strategic insights that define today’s landscape.

Exploring the Key Technological and Operational Shifts Defining the Next Generation Remote Tower Landscape with AI Virtualization and Modular Architectures

Air traffic management is undergoing a profound transformation driven by a convergence of digital, operational, and environmental imperatives. Artificial intelligence algorithms now assist controllers by filtering noncritical alerts and highlighting potential airspace conflicts, reducing cognitive workload and enhancing situational awareness. Parallel to this, the virtualization of surveillance and communication components has enabled modular architectures that can be rapidly scaled or adapted to different airfield configurations without the constraints of bespoke tower construction. In turn, these technological innovations support agile responses to fluctuating traffic volumes, which is increasingly critical as passenger demand rebounds and regional air mobility initiatives expand.

Operationally, the integration of remote towers with broader digital ecosystems-including airport collaborative decision-making platforms and unmanned traffic management systems-has unlocked new efficiencies. Data sharing across stakeholders has become more seamless, enabling synchronized responses to weather events, airspace restrictions, and ground handling operations. This collaborative dynamic not only streamlines throughput but also consolidates critical intelligence for continuous performance improvement.

From a sustainability standpoint, remote tower installations reduce carbon footprints by minimizing the need for new construction and by centralizing energy-intensive control centers with optimized power management. As environmental regulations tighten and airport operators pursue net-zero objectives, remote towers emerge as a compelling pathway to lower emissions while maintaining or enhancing safety margins. Collectively, these technological, operational, and environmental shifts are redefining industry expectations and accelerating the transition toward a more connected, resilient airspace management paradigm.

Assessing the Comprehensive Effects of Recent US Tariffs on Remote Tower Hardware and Network Components Shaping Supply Chain Strategies in 2025

The imposition and continuation of United States tariffs in 2025 have exerted a cumulative influence on remote tower deployment strategies, particularly in relation to hardware and network solutions. Tariffs on communications equipment and high-precision optical components have raised the cost basis for importing critical surveillance cameras and shifting mechanisms. As a consequence, suppliers and service integrators must account for elevated procurement budgets, altering project timelines and requiring more robust cost mitigation strategies.

In addition, network solutions-spanning secure terrestrial links, satellite backhauls, and redundant transmission channels-have been impacted by levies on electronic modules imported from key manufacturing hubs. This has prompted airport authorities and air navigation service providers to reassess vendor contracts and to explore dual-sourcing arrangements that can buffer against further tariff escalation. Moreover, the increased financial burden has catalyzed interest in open-architecture approaches, where standardized interfaces allow components to be sourced from a wider array of regional suppliers.

Beyond hardware, service cost structures have also felt pressure as maintenance and support packages incorporate tariff pass-through elements. Training services for controllers and technical staff now require recalibrated budgeting to cover imported simulation hardware, while software modules integrating alarm systems and real-time data processing tools are adjusting subscription models to accommodate licensing fee fluctuations. These cumulative effects signify that while remote tower adoption continues apace, stakeholders must navigate a more complex economic environment, balancing strategic investment with prudent risk management.

Delivering Strategic Segmentation Insights Across Operation Types System Configurations Components Applications and End Users to Tailor Remote Tower Deployments

Deep insights emerge when remote tower markets are examined through the lens of operational configurations, system architectures, component breakdowns, application areas, and end-user profiles. Operation modes range from contingency setups-where a remote center backs up a single tower during outages-to single-airport models that replace legacy infrastructure entirely, and even multiple-airport frameworks that centralize traffic management across regions. These variations influence not only capital allocation but also the complexity of deployment roadmaps and regulatory approval processes.

System architectures span from airport-specific equipment suites, such as reinforced panoramic cameras and localized communication arrays, to comprehensive network solutions that link remote centers with endpoints via secured data channels. Additionally, modular remote tower cabins integrate hardware, software, and services into turnkey units, offering accelerated implementation paths for smaller airfields or specialized environments like heliports and unmanned aerial vehicle centers.

Component analysis further illuminates market dynamics. Hardware elements-comprising communication systems, shifting mechanisms, and surveillance cameras-form the physical backbone of any deployment. Meanwhile, services encompassing installation, maintenance, and training ensure operational continuity and skill readiness. Finally, software platforms handling air traffic control functions, alarm systems, and real-time data processing orchestrate the entire ecosystem. Each component layer interacts with application domains-communication, flight data handling, information and control, surveillance, and visualization-to deliver holistic air traffic management solutions.

End-user demand varies across commercial airports, heliports, military airbases, and UAV operation centers, each presenting unique operational tempos, security protocols, and integration challenges. Recognizing these segmentation dimensions is essential for tailoring value propositions and for aligning product roadmaps with the specific needs of each market vertical.

This comprehensive research report categorizes the Remote Towers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Operation Type

- Automation Level

- Application

- End User

Examining Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Understand Adoption Patterns and Infrastructure Readiness

Regional distinctions play a pivotal role in shaping remote tower adoption trajectories. In the Americas, a blend of technological innovation and budgetary constraints has driven pilots in remote and low-traffic airports, emphasizing modular solutions to minimize capital outlays. The United States and Canada have issued clear guidelines for certifying contingency and single-airport remote control setups, accelerating project approvals while encouraging public-private collaboration for system integration and funding.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of regulatory environments and infrastructure readiness levels. Northern and Western European nations lead in network backbone upgrades and virtualized air traffic control centers, often funded through pan-continental research initiatives. In contrast, emerging markets across Eastern Europe, the Middle East, and parts of Africa are focusing on smaller-scale deployments for regional airports and military bases, leveraging turnkey remote tower modules that simplify training and maintenance demands.

Asia-Pacific exemplifies rapid adoption fueled by ambitious civil aviation growth targets across China, Australia, and Southeast Asia. National air navigation service providers are investing in multiple-airport remote centers to handle burgeoning traffic volumes, while island nations leverage network solutions to connect isolated airfields. In each region, readiness factors-such as broadband penetration, regulatory maturity, and workforce training capabilities-dictate the pace and scale of remote tower integration, underscoring the need for tailored deployment strategies that align with local conditions.

This comprehensive research report examines key regions that drive the evolution of the Remote Towers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategies Driving Innovation Partnership Models and Competitive Positioning in the Remote Tower Market

A diverse ecosystem of technology and service providers is driving innovation in remote tower solutions. Industry frontrunners have forged partnerships with system integrators and air navigation service providers to co-develop cutting-edge surveillance and data processing systems. Some companies are concentrating on enhancing the resolution and low-light performance of panoramic cameras, enabling more reliable monitoring of runways and taxiways under all weather conditions. Others are pioneering software platforms that integrate machine learning analytics to predict traffic flows and automate routine controller tasks.

Partnership models are evolving as well, with technology vendors collaborating with telecommunication operators to provision secure network slices and dedicated bandwidth for remote tower connectivity. Service organizations are expanding their portfolios to include lifecycle management packages, combining installation, calibration, and iterative upgrades that respond to changing traffic profiles. Furthermore, specialist firms in simulation and training are developing scenario-based modules that replicate the remote tower environment for both seasoned controllers and trainees.

Competitive positioning has become increasingly nuanced, with companies differentiating through vertical integration of hardware and software portfolios or through open ecosystem platforms that encourage third-party development. Some players are venturing into unmanned aerial vehicle integration, positioning themselves at the nexus between manned and unmanned traffic management. Collectively, these strategic initiatives underscore the importance of collaboration, continuous innovation, and flexible business models for sustaining growth and addressing diverse customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Remote Towers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Thales Group

- Saab AB

- Frequentis AG

- Northrop Grumman Corporation

- RTX Corporation

- Raytheon Technologies Corporation

- Indra Sistemas, S.A.

- Lockheed Martin Corporation

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Adacel Technologies Limited

- ADB Safegate B.V.

- Aertec Solutions SL

- Avinor AS

- Becker Avionics GmbH

- Dallmeier electronic GmbH & Co.KG

- DFS Deutsche Flugsicherung GmbH

- EIZO Corporation

- Estonian Air Navigation Services

- HungaroControl Pte. Ltd. Co

- iBross s.r.o.

- Insero Air Traffic Solutions A/S

- Kongsberg Gruppen ASA

- LFV Holding AB

- NATS Holdings Limited

- Rohde & Schwarz GmbH & Co. KG

- S.I.T.T.I. SpA

- Skysoft-ATM

- TRIAC GmbH

- UFA, Inc.

- ACAMS AS

Outlining Strategic Actionable Recommendations for Industry Leaders to Accelerate Deployment Optimize Operations and Mitigate Risks in Remote Tower Programs

Industry leaders should prioritize the adoption of modular architectures that allow incremental scaling of remote tower capabilities. By deploying contingency-focused pilot programs, stakeholders can validate performance metrics and refine operational protocols before transitioning to single-airport or multiple-airport configurations. This phased approach minimizes risk and enhances stakeholder buy-in while providing valuable data to inform long-term infrastructure planning.

Supply chain resilience must be reinforced through diversified sourcing strategies, including partnerships with regional hardware manufacturers and open-architecture designs that accommodate different component suppliers. Establishing dual-sourcing agreements for critical surveillance and communication equipment will buffer against unforeseen tariff changes and geopolitical shifts. At the same time, investment in predictive maintenance analytics can optimize lifecycle costs and reduce downtime for hardware and network elements.

To harness the full potential of remote tower solutions, collaborative frameworks between air navigation service providers, airport operators, and technology vendors are essential. Establishing joint research initiatives and shared training curricula will standardize best practices and accelerate the certification process. Additionally, continuous skills development programs-blending virtual reality simulations and scenario-based drills-will ensure controller proficiency and adaptability as systems evolve.

Finally, decision-makers should align remote tower deployments with broader digital transformation roadmaps, integrating data feeds from ground operations platforms, unmanned traffic management systems, and environmental monitoring networks. This holistic perspective will deliver superior situational awareness, operational efficiency, and sustainability benefits across the air traffic ecosystem.

Detailing the Rigorous Research Methodology Combining Primary Interviews Secondary Data Synthesis and Validation Processes for Remote Tower Analysis

The analysis presented herein is grounded in a robust research methodology that integrates both qualitative and quantitative techniques. Primary data was collected through in-depth interviews with air navigation service executives, airport operations directors, and technology providers, capturing firsthand insights into adoption drivers, procurement considerations, and operational challenges. These discussions informed the identification of segmentation variables, regional variances, and tariff impacts.

Secondary data sources included industry white papers, regulatory publications, and technical standards documentation to validate technological specifications and certification requirements. Where applicable, regional aviation authority guidelines and public policy releases were reviewed to confirm the status of remote tower approvals and funding mechanisms.

To ensure analytical rigor, findings were cross-validated through expert workshops and peer reviews, involving controllers, systems engineers, and market analysts. This iterative validation process eliminated discrepancies, clarified assumptions, and refined the interpretation of tariff implications and supply chain dynamics. Additionally, scenario modeling was employed to stress-test key insights against potential regulatory shifts or technological breakthroughs.

This multi-layered approach delivers a comprehensive perspective that balances empirical observation with strategic foresight, offering decision-makers a solid foundation for both immediate action and long-term planning in remote tower market engagements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Remote Towers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Remote Towers Market, by Component

- Remote Towers Market, by Operation Type

- Remote Towers Market, by Automation Level

- Remote Towers Market, by Application

- Remote Towers Market, by End User

- Remote Towers Market, by Region

- Remote Towers Market, by Group

- Remote Towers Market, by Country

- United States Remote Towers Market

- China Remote Towers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Implications and Future Outlook of Remote Tower Adoption Emphasizing Operational Resilience Collaboration and Technology Integration

The strategic adoption of remote tower solutions heralds a new era in air traffic management, enabling more resilient, scalable, and sustainable operations. Implementation success hinges on navigating the evolving regulatory landscape, integrating advanced digital technologies, and forging collaborative partnerships across the aviation ecosystem. Despite the complexities introduced by tariffs and supply chain dynamics, the benefits of enhanced operational safety, cost optimization, and environmental impact reduction are compelling.

As the global aviation sector continues to expand, remote towers will play a pivotal role in addressing pilot shortages, accommodating variable traffic volumes, and extending air services to underserved regions. The interplay between system modularity, application diversity, and end-user requirements underscores the need for tailored deployment strategies and agile business models.

Looking ahead, the convergence of artificial intelligence, unmanned traffic management, and immersive training platforms will further elevate the capabilities of remote towers, fostering a more interconnected and adaptive airspace. Stakeholders that embrace innovation, maintain supply chain flexibility, and invest in workforce development will be best positioned to capitalize on this transformational shift.

By synthesizing insights from segmentation analysis, regional dynamics, and competitive strategies, aviation leaders can chart a clear path toward resilient and efficient remote tower operations. This conclusion emphasizes the imperative of aligning technological advancements with strategic objectives to realize the full potential of digital air traffic control.

Connect with Ketan Rohom to Unlock Exclusive Market Intelligence and Secure Your Comprehensive Remote Tower Report for Informed Strategic Decision Making

We invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing, for tailored insights and access to a comprehensive market research report that will empower your decision making in remote tower solutions. A brief conversation with Ketan will clarify how this in-depth analysis can be customized to address specific operational challenges, whether you are assessing infrastructure modernization, supply chain strategies, or technology partnerships. By connecting directly, you will gain clarity on data scope, regional coverage, and segmentation breakdowns most relevant to your organization’s objectives.

Take the next step toward leveraging actionable intelligence for planning, investment, and risk management. Reach out today to secure the full remote tower market report and position your enterprise at the forefront of air traffic control transformation.

- How big is the Remote Towers Market?

- What is the Remote Towers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?