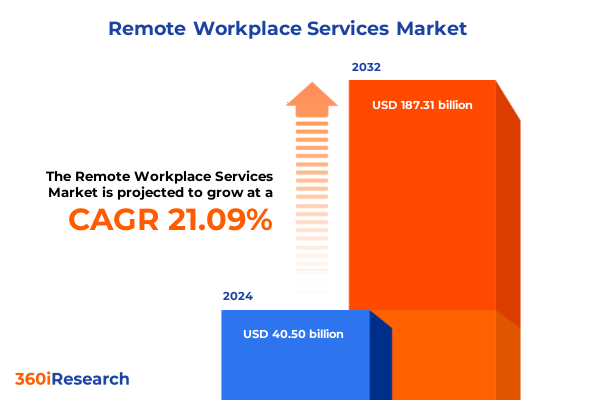

The Remote Workplace Services Market size was estimated at USD 48.89 billion in 2025 and expected to reach USD 59.02 billion in 2026, at a CAGR of 21.15% to reach USD 187.31 billion by 2032.

Exploring the Emergence of Remote Workplace Services as a Catalyst for Organizational Transformation in the Digital Era

Organizations across industries are undergoing a fundamental rethinking of how work is performed, and remote workplace services have emerged as a critical driver of both operational continuity and future strategic growth. As digital transformation initiatives have intensified, the ability to seamlessly support distributed teams has transitioned from a nice-to-have to a core competency. In this context, service providers are innovating at unprecedented speed to address the diverse needs of enterprises seeking to enhance collaboration, improve security, and optimize costs in an era where physical office space is no longer the sole hub of productivity.

With technological advances in cloud computing, collaboration platforms, and cybersecurity, the remote workplace market has reached a level of maturity that demands more nuanced strategic approaches. Companies are no longer merely adopting video conferencing or secure VPN tunnels; they are orchestrating comprehensive ecosystems that blend infrastructure, applications, and professional services to empower a truly hybrid workforce. Looking ahead, this executive summary unpacks the transformative shifts reshaping the landscape, analyzes the implications of 2025 U.S. tariffs on service delivery and costs, and presents insights derived from rigorous segmentation, regional dynamics, and competitive positioning. Together, these findings will equip decision-makers with the foresight needed to navigate and lead in the remote workplace domain.

Identifying Pivotal Technological and Cultural Shifts Redefining the Remote Workplace Services Landscape for Future Growth

The remote workplace services market is experiencing transformative shifts that extend beyond mere adoption of new tools to a fundamental redefinition of how work is conducted, managed, and secured. Technological innovation continues to accelerate, with artificial intelligence–driven collaboration features and automated security orchestration becoming increasingly mainstream. These advanced capabilities are enabling organizations to streamline workflows, reduce friction in communication, and proactively identify and mitigate threats without human intervention. At the same time, the emergence of edge computing and 5G connectivity is enhancing real-time collaboration and expanding the potential for immersive virtual experiences, effectively blurring the lines between remote and in-office environments.

Alongside these technological dynamics, cultural shifts are equally influential. The workforce of today places a premium on flexibility, autonomy, and a healthy work–life balance, with many employees viewing the ability to work remotely as a baseline expectation rather than an exceptional perk. This cultural evolution has prompted organizations to reevaluate performance metrics, placing greater emphasis on outcomes and deliverables rather than traditional time-based attendance. Consequently, service providers must tailor offerings to facilitate outcome-driven frameworks, embedding analytics and productivity insights directly into collaboration and communication platforms.

Regulatory considerations are also reshaping the landscape, as stringent data sovereignty and privacy requirements compel enterprises to adopt more sophisticated deployment architectures. Hybrid and multi-cloud strategies are gaining traction as enterprises seek to balance compliance with the need for scalability and agility. These converging forces-technological innovation, cultural evolution, and regulatory complexity-are collectively forging a new paradigm in which remote workplace services are integral to the competitive strategies of forward-thinking organizations.

Assessing the Compound Effects of 2025 United States Tariffs on the Remote Workplace Services Ecosystem and Supply Chain Dynamics

In the first quarter of 2025, the United States introduced a series of tariffs targeting key hardware imports, including networking equipment, endpoint devices, and various infrastructure components critical to remote workplace deployments. These measures have had a cumulative impact on the cost structures of service providers, prompting them to reassess supply chain strategies and explore alternative sourcing options. As a result, global providers are diversifying manufacturing footprints and negotiating long-term contracts to offset potential price fluctuations, while smaller niche players are turning to domestic partners to secure inventory and maintain delivery timelines.

These tariff-driven cost pressures have also accelerated the shift toward software-defined services, as organizations look to reduce their reliance on expensive physical equipment. Cloud-based virtual desktops and network-as-a-service offerings have seen increased uptake, delivering improved scalability and flexibility with lower upfront capital expenditures. Meanwhile, managed security providers have elevated their focus on software-centric threat detection, intrusion prevention, and identity management, recognizing that digital defenses can be scaled more rapidly than traditional hardware appliances in response to shifting threat landscapes.

The ripple effects of these tariffs extend to professional services as well, with consulting, training, and implementation engagements increasingly incorporating tariff mitigation strategies and total cost of ownership analyses. Enterprises are demanding deeper advisory support to navigate complex import regulations and optimize their procurement portfolios. As organizations strive to balance resilience, performance, and cost-effectiveness, the cumulative impact of U.S. tariffs in 2025 is reshaping the economics of remote workplace services and driving innovation toward more agile, software-led solutions.

Revealing Critical Insights from Multidimensional Segmentation in the Remote Workplace Services Market to Inform Strategic Decisions

The remote workplace services market can be dissected through multiple dimensions to uncover both macro and nuanced trends that inform strategic planning. Based on service type, cloud offerings continue to dominate investment priorities, with IaaS providing the foundational compute resources, PaaS enabling rapid application development, and SaaS solutions delivering end-user productivity tools. Collaboration tools are evolving beyond basic chat and file sharing to integrate video conferencing and virtual whiteboards into unified digital workspaces. Communication platforms are advancing unified communications and VoIP to ensure high-quality, real-time connectivity across geographies. Managed services segments-spanning cloud, network, and security-are gaining traction as organizations outsource operational complexity in favor of predictable operating expenses. Professional services, encompassing consulting, implementation, and training, are vital for successful adoption, while security solutions across data loss prevention, endpoint protection, identity and access management, and network defense are indispensable for safeguarding distributed workforces.

Deployment models reveal a spectrum of choices, from purely cloud-based environments-whether community clouds tailored for specific sectors, private clouds for heightened control, or public clouds for maximum scale-to hybrid architectures that leverage multi-cloud integration alongside seamless on-premise interoperability. The hybrid approach allows enterprises to meet stringent data residency requirements and optimize workload performance by placing sensitive data within private environments while capitalizing on the elasticity of public infrastructure.

Organizations of varying sizes exhibit divergent priorities: enterprises seek comprehensive, integrated solutions that align with their complex governance structures; mid-market firms balance agility with budget constraints, often gravitating toward standardized bundles that accelerate time-to-value; and small and medium businesses prioritize turnkey offerings that minimize the need for extensive internal IT resources. Industry verticals underscore the importance of customization: BFSI institutions demand ultra-secure infrastructures with granular compliance controls; educational entities require scalable, user-friendly collaboration suites; government agencies focus on mission-critical resilience; healthcare providers need HIPAA-compliant environments with uninterrupted access; and retailers, whether brick-and-mortar or e-commerce, emphasize seamless omnichannel experiences. Finally, organizational type differentiates strategic imperatives, with public-sector agencies emphasizing accountability and transparency, while private enterprises-both large and SMEs-prioritize innovation velocity and market differentiation.

This comprehensive research report categorizes the Remote Workplace Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Organization Size

- Organization Type

- Industry Vertical

Unveiling Regional Variations and Strategic Imperatives Across the Americas Europe Middle East Africa and Asia Pacific in Remote Workplace Services

Regional dynamics play a pivotal role in shaping how remote workplace services are adopted and implemented. In the Americas, early maturity of cloud infrastructure, combined with a favorable regulatory environment, has fostered rapid uptake of integrated collaboration suites and managed services. Enterprises across North America have led the way in pioneering advanced analytics and automation features, setting benchmarks that influence global best practices. Meanwhile, Latin American markets are making significant strides by leveraging regional cloud zones and localized security operations centers to reduce latency and bolster compliance.

In Europe, the Middle East, and Africa, the landscape is characterized by diverse maturity levels and regulatory frameworks. European Union directives on data protection and digital sovereignty have driven the adoption of private and hybrid clouds, while the Middle East is investing heavily in digital infrastructure to support national visions of economic diversification. Africa’s remote workplace services market, although nascent in several regions, is experiencing a surge in demand for mobile-first collaboration solutions and managed connectivity services, driven by a rapidly growing remote workforce and an expanding digital economy.

Asia-Pacific is distinguished by its dynamic growth trajectory and heterogeneity across markets. Japan and Australia are advancing next-generation collaboration technologies and robust security frameworks, whereas emerging economies in Southeast Asia and India are rapidly scaling public cloud adoption to address infrastructure gaps. This region’s emphasis on digital literacy initiatives and government-backed cloud programs is catalyzing a new wave of innovation in virtual training, remote learning, and telehealth services. Taken together, these regional insights highlight the need for tailored strategies that align with local infrastructure capabilities, regulatory regimes, and cultural expectations.

This comprehensive research report examines key regions that drive the evolution of the Remote Workplace Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Providers in the Remote Workplace Services Sector to Drive Innovation

Within the competitive landscape of remote workplace services, leading providers are differentiating themselves through strategic partnerships, platform integrations, and targeted acquisitions. Major hyperscalers have deepened their collaboration with software vendors to embed advanced features directly within cloud ecosystems, while networking and security specialists have intensified efforts to offer end-to-end managed services. Startups and specialized firms are gaining traction by focusing on niche capabilities such as virtual whiteboarding, AI-powered transcription, and zero-trust network access, forcing incumbents to continuously evolve their roadmaps.

Innovation is also being driven by cross-industry alliances, with technology vendors collaborating with professional services firms to deliver industry-specific solutions. In financial services, secure virtual desktop infrastructure tailored for trading floors is emerging as a standout offering, whereas healthcare-focused platforms now integrate medical imaging and patient data analytics with teleconferencing capabilities. In the education sector, vendors are bundling virtual labs, remote assessment tools, and classroom management dashboards into unified packages that resonate with both K-12 and higher-education institutions.

Additionally, established telecommunications providers are leveraging their network assets to deliver low-latency, carrier-grade connectivity services that complement cloud-based collaboration. This convergence of networking and software is empowering enterprises to implement reliable, high-performance remote workplace solutions with predictable service-level agreements. As competitive pressures intensify, providers that can seamlessly blend infrastructure, applications, and managed services while maintaining transparent pricing and world-class support will consolidate their leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Remote Workplace Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Adecco Group AG

- Allegis Group, Inc.

- ATOS SE

- Capgemini SE

- CDW Corporation

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Infosys Limited

- Insight Enterprises, Inc.

- International Business Machines Corporation

- Kelly Services, Inc.

- Korn Ferry

- ManpowerGroup Inc.

- NEC Corporation

- NTT DATA, Inc.

- Randstad N.V.

- Robert Half International Inc.

- Tata Consultancy Services Limited

- Unisys Corporation

- Wipro Limited

Delivering Targeted Recommendations for Industry Leaders to Capitalize on Remote Workplace Service Trends and Navigate Emerging Challenges

To thrive in an increasingly complex and competitive remote workplace services market, organizations must adopt a multi-faceted strategy that balances technological innovation, cost management, and employee experience. First, it is essential to prioritize integrated platforms that combine collaboration, communication, and security functionalities within a cohesive user interface, thereby reducing administrative overhead and enhancing adoption rates. Investing in AI-driven analytics can deliver actionable insights into usage patterns, enabling continuous optimization of resources and user engagement.

Second, mitigating the impact of ongoing tariff fluctuations requires a proactive supply chain resilience plan. Organizations should develop diversified sourcing strategies, negotiate flexible contracts, and incorporate total cost of ownership analyses into procurement workflows. Collaborative relationships with hardware and software vendors can also create opportunities for joint risk-sharing arrangements and innovation sprints that preempt cost escalations.

Third, leaders must focus on cultivating a digital-ready workforce. This involves not only providing comprehensive training programs but also embedding change management practices into every deployment phase. Empowering employees with self-service capabilities, clear governance models, and dedicated support channels will foster ownership and accelerate time-to-value. Meanwhile, aligning remote work policies with corporate culture and performance objectives ensures that flexibility does not come at the expense of accountability.

Finally, strategic partnerships with hyperscalers, security specialists, and industry-focused consultancies can unlock new revenue streams and co-innovation opportunities. By co-developing verticalized solutions-such as telemedicine platforms for healthcare or secure trading workstations for financial services-organizations can differentiate their offerings and deepen customer relationships. This collaborative approach will be critical for navigating the evolving regulatory landscape and capturing the next wave of remote workplace service demand.

Outlining a Robust and Transparent Research Methodology Underpinning the Analysis of Remote Workplace Service Market Dynamics

The insights presented in this analysis are underpinned by a rigorous mixed-method research framework. Primary research involved extensive interviews with C-level executives, IT decision-makers, and service provider leaders across North America, Europe, Middle East, Africa, and Asia-Pacific regions. These engagements provided firsthand perspectives on strategic priorities, technology adoption hurdles, and tariff-related procurement strategies. In parallel, a comprehensive secondary research phase examined public filings, investor presentations, regulatory disclosures, and industry whitepapers to validate emerging trends and benchmark vendor performance.

Quantitative data was gathered through proprietary surveys deployed to IT professionals and end users, capturing metrics related to platform usage, satisfaction levels, and intent to adopt next-generation features. These responses were cross-validated with usage logs from select collaboration and communication platforms to ensure accuracy. Vendor profiling employed criteria such as service portfolio depth, geographic reach, partnership ecosystems, and innovation pipelines. Market segmentation and regional dynamics were analyzed through cluster mapping techniques, enabling a nuanced understanding of adoption patterns across deployment models, organization sizes, industry verticals, and service types.

Data triangulation and statistical modeling were applied to reconcile discrepancies and forecast the potential implications of tariff scenarios on cost structures and service provider roadmaps. To ensure objectivity, all findings were subjected to peer review by an independent advisory panel comprised of former CIOs and industry analysts. The research methodology adhered to strict ethical guidelines, ensuring confidentiality for all participants and transparency in data handling processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Remote Workplace Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Remote Workplace Services Market, by Service Type

- Remote Workplace Services Market, by Deployment Model

- Remote Workplace Services Market, by Organization Size

- Remote Workplace Services Market, by Organization Type

- Remote Workplace Services Market, by Industry Vertical

- Remote Workplace Services Market, by Region

- Remote Workplace Services Market, by Group

- Remote Workplace Services Market, by Country

- United States Remote Workplace Services Market

- China Remote Workplace Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Key Findings and Strategic Implications to Chart a Course for Sustainable Growth in Remote Workplace Services

This executive summary has synthesized the most salient trends and strategic imperatives shaping the remote workplace services ecosystem. Technological advances in cloud computing, collaboration platforms, and security automation are converging with cultural shifts toward flexible work models and evolving regulatory landscapes to redefine how organizations operate. The cumulative impact of 2025 U.S. tariffs underscores the need for adaptable supply chain strategies and a pivot toward software-defined solutions. Multidimensional segmentation insights reveal that tailored offerings across service types, deployment models, organization sizes, industry verticals, and organizational types are critical for capturing market share. Regionally, distinct approaches are required to address maturity levels, regulatory regimes, and infrastructure capabilities within the Americas, EMEA, and Asia-Pacific.

Competitive analysis highlights that leaders are those who seamlessly integrate infrastructure, applications, and professional services while fostering collaborative alliances and maintaining transparent pricing. Actionable recommendations for industry stakeholders focus on platform integration, supply chain resilience, workforce readiness, and strategic partnerships to unlock new value. By following these guidelines and leveraging the rigorous research framework outlined, organizations will be well-positioned to drive innovation, optimize costs, and sustain growth in the dynamic remote workplace services market.

Engage with Our Experts to Access Comprehensive Market Research Insights and Drive Transformative Outcomes in Remote Workplace Services

Thank you for exploring the strategic insights and market dynamics within the remote workplace services ecosystem. To access the full breadth of data, in-depth analysis, and tailored recommendations presented in this research, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through the report’s comprehensive findings and help you identify how to leverage these insights for sustainable competitive advantage. Engage today to secure your organization’s position at the forefront of the evolving remote workplace services landscape and drive transformative outcomes.

- How big is the Remote Workplace Services Market?

- What is the Remote Workplace Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?