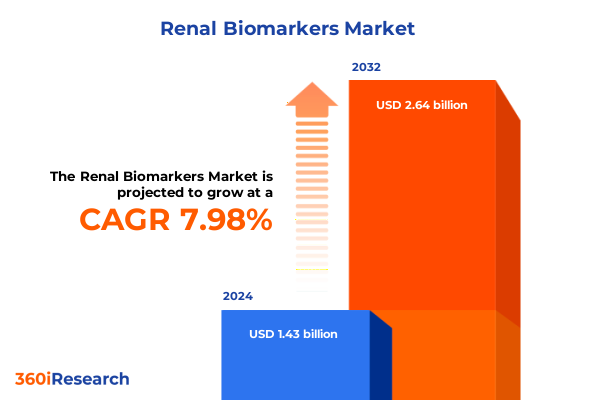

The Renal Biomarkers Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.68 billion in 2026, at a CAGR of 8.53% to reach USD 2.74 billion by 2032.

Pioneering a New Era in Renal Biomarker Analysis Through Breakthrough Technologies and Collaborative Clinical Applications

Innovative advancements in renal biomarker discovery and implementation are reshaping patient care paradigms and research strategies across the healthcare continuum. From academic laboratories pioneering novel markers to diagnostic service providers integrating high-throughput platforms, the ecosystem has evolved to prioritize sensitivity, specificity, and rapid turnaround. This introduction examines the convergence of technological breakthroughs, regulatory evolutions, and shifting clinical demands that underpin the current transformation in renal biomarker analytics.

Over the past decade, clinical decision-making has increasingly incorporated quantitative biomarker data to enable early detection of kidney dysfunction and precise monitoring of disease progression. As chronic kidney disease rates continue to climb globally, healthcare systems are under pressure to adopt more reliable diagnostic tools. In response, innovators have harnessed mass spectrometry, immunoassay enhancements, and machine learning algorithms to deliver robust biomarker profiles that inform personalized treatment pathways.

Furthermore, the drive toward decentralized testing models has catalyzed investments in compact immunoassay analyzers and point-of-care spectrophotometers that meet the exigencies of outpatient and home-based care. Simultaneously, reagent manufacturers have intensified development of high-sensitivity colorimetric and mass spectrometry reagent kits, bolstering capabilities for both large centralized laboratories and smaller diagnostic facilities. This multi-faceted innovation journey sets the stage for a more proactive, data-driven approach to renal health management.

Emergence of Point of Care Diagnostics and AI Driven Data Analytics Redefining Precision and Accessibility in Renal Biomarker Testing Landscape

The renal biomarker landscape is undergoing seismic shifts driven by the integration of artificial intelligence and decentralized diagnostic platforms. Clinical laboratories are moving beyond traditional central testing, adopting point-of-care solutions that deliver rapid, actionable results in community settings. This shift not only accelerates time to intervention but also empowers patients and practitioners with real-time insights, reducing dependency on hospital infrastructure and streamlining care pathways.

Concurrently, advanced data analytics and machine learning models are augmenting the interpretation of complex biomarker datasets. By applying predictive algorithms to longitudinal protein and metabolite profiles, researchers can identify subtle patterns indicative of early kidney impairment. This fusion of biosensor outputs with algorithmic processing is revolutionizing disease monitoring, enabling clinicians to preempt acute episodes and tailor interventions based on predictive risk stratifications.

Moreover, collaborative networks between academic research centers, diagnostic instrument providers, and software developers have emerged, fostering co-development of integrated platforms. These alliances have accelerated regulatory clearances by pooling expertise in assay validation, clinical trial design, and data security. Ultimately, the transformative shifts in point of care diagnostics and AI-enabled data analysis are reshaping the renal biomarker field, laying the groundwork for more precise, accessible, and patient-centered healthcare solutions.

Assessing the Intensified Cost Pressures from 2025 U S Tariff Adjustments on Imported Instruments Reagents and Software in Renal Biomarker Ecosystem

The United States’ tariff adjustments implemented in early 2025 have introduced significant headwinds for stakeholders involved in the procurement of imported renal biomarker instruments, reagents, services, and software. Higher duties on mass spectrometers and immunoassay analyzers sourced from key manufacturing hubs have elevated acquisition costs for clinical laboratories and research organizations. As a result, budgets allocated to instrumentation upgrades have contracted, prompting a reallocation of resources toward optimizing existing assets and pursuing local sourcing alternatives.

Reagent suppliers have felt the impact as well, particularly those specializing in colorimetric kit production and mass spectrometry reagents manufactured overseas. Increased import duties have eroded profit margins, leading some vendors to adjust pricing structures and re-evaluate distribution strategies. Maintenance and consulting services reliant on imported spare parts have experienced extended lead times and cost escalations, driving service providers to stockpile critical components or diversify supplier networks to maintain operational continuity.

Software vendors in the laboratory informatics space have also contended with elevated tariffs on hardware-software bundles, compelling many to accelerate development of cloud-based solutions that minimize reliance on locally imported servers and workstations. Despite these challenges, some service providers have leveraged the tariff landscape as an opportunity to negotiate value-added maintenance agreements and bundled training services that deliver cost efficiencies for end users. The cumulative effect of the 2025 tariff regime underscores the need for agile supply chain management and strategic partnerships to navigate rising costs and sustain innovation in renal biomarker testing.

Unveiling Deep Segmentation Strategies That Illuminate Distinct Trends Across Product Type Biomarker Type End User Technology Application and Sample Type

An in-depth segmentation analysis reveals nuanced dynamics across multiple dimensions of the renal biomarker market. By product type, the landscape encompasses sophisticated diagnostic instruments such as immunoassay analyzers designed for high-throughput screening, mass spectrometers capable of multiplexed protein quantification, and spectrophotometers optimized for rapid optical measurements. Complementing these platforms are reagents categorized into colorimetric kits for enzyme-linked assays, immunoassay kits tailored to specific protein targets, and mass spectrometry reagents that support advanced proteomic workflows. Services within this segment extend to consulting engagements that guide assay validation, maintenance contracts ensuring uninterrupted operation of critical equipment, and training programs that enhance laboratory proficiency. Meanwhile, software solutions range from data analysis applications providing advanced statistical and bioinformatic capabilities to fully integrated laboratory informatics systems that harmonize sample tracking, results reporting, and regulatory compliance.

Focusing on biomarker type underscores the prevalence of albumin and creatinine assays as foundational indicators of renal function, while emerging markers such as cystatin C and neutrophil gelatinase-associated lipocalin are gaining traction for their superior sensitivity in early kidney injury detection. End-user segmentation highlights distinct adoption patterns among academic and research institutes driving discovery programs, contract research organizations conducting preclinical and clinical studies, hospitals and diagnostic labs demanding rapid turnaround for patient results, and pharmaceutical companies seeking robust biomarkers to guide therapeutic development.

Technology-based segmentation reveals that biosensor platforms are achieving greater penetration in decentralized settings, colorimetric assay methods retain prominence for cost-effective screening, immunoassays continue to dominate centralized laboratories, and liquid chromatography-mass spectrometry is preferred for comprehensive multiplex panels. Application-oriented insights illustrate how academic research leverages experimental biomarker discovery, clinical diagnosis relies on validated assays for patient management, disease monitoring programs track longitudinal biomarker changes, and drug development efforts integrate biomarker endpoints to assess therapeutic efficacy. Lastly, sample type segmentation emphasizes the continued importance of serum and plasma matrices in quantitative analyses, alongside growing utilization of urine-based assays for noninvasive screening and home collection models.

This comprehensive research report categorizes the Renal Biomarkers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Biomarker Type

- Technology

- Sample Type

- Application

- End User

Discerning Regional Dynamics That Shape Supply Chains Adoption Rates and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional analysis reveals divergent growth drivers and challenges across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, robust healthcare infrastructure and favorable reimbursement frameworks underpin the adoption of advanced immunoassay analyzers and high-resolution mass spectrometers. Clinical laboratories benefit from established networks of diagnostic service providers, enabling rapid uptake of novel reagents and data analysis software. However, regulatory scrutiny and evolving payer policies create a dynamic environment requiring vendors to demonstrate clear clinical value and cost effectiveness for each new renal biomarker assay.

Conversely, the Europe Middle East & Africa region presents a mosaic of market maturity levels. Western European markets maintain high investment in next-generation sequencing and liquid chromatography-mass spectrometry platforms, supported by harmonized regulatory pathways and extensive academic-industry partnerships. In contrast, emerging markets within the Middle East and Africa exhibit growing interest in point-of-care colorimetric kits and biosensor devices that address limited laboratory infrastructure. These regions prioritize scalable solutions that minimize capital expenditure while improving diagnostic reach in remote and underserved communities.

Asia Pacific stands out for its dual momentum in domestic manufacturing of instruments and strong clinical trial activity. Immunoassay kit developers and reagent producers are rapidly expanding production capacities to serve both regional and global markets. Additionally, the Asia Pacific region is capitalizing on digital health initiatives, integrating laboratory informatics with telemedicine platforms to support decentralized disease monitoring. Regulatory modernization efforts in key markets are streamlining approvals, further accelerating the deployment of innovative renal biomarker technologies.

This comprehensive research report examines key regions that drive the evolution of the Renal Biomarkers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Renal Biomarker Innovations Through Partnerships Mergers and Targeted R D Investments

The competitive landscape is characterized by established diagnostics giants and agile niche innovators forging strategic alliances to accelerate product development and global reach. Leading companies with broad portfolios leverage integrated immunoassay analyzers, high-throughput mass spectrometry systems, and proprietary reagent ecosystems to deliver end-to-end solutions. These incumbents are intensifying investments in cloud-native laboratory informatics platforms, embedding artificial intelligence modules that enhance data interpretation and predictive modeling.

Simultaneously, specialized firms focused on biomarker discovery and assay development are collaborating with pharmaceutical partners to validate novel markers for kidney injury and disease progression. These collaborations often span co-development agreements, joint clinical studies, and licensing arrangements that grant broader market access while mitigating development risks. In parallel, service providers offering contract research and maintenance solutions are differentiating through customizable consulting engagements and value-added support services aimed at optimizing laboratory performance.

Emerging players in the biosensor and point-of-care segment are introducing portable devices that utilize microfluidic channels and electrochemical detection to achieve rapid, near-patient quantification of key renal biomarkers. Their success in pilot programs has attracted attention from larger instrument manufacturers exploring acquisition and partnership opportunities. Collectively, these competitive dynamics underscore a market in which collaboration, technological convergence, and strategic investments drive sustained innovation and market expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Renal Biomarkers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AstraZeneca PLC

- Bayer AG

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- BioPorto Diagnostics A/S

- Cipla Limited

- Danaher Corporation

- DiaSorin S.p.A.

- Eli Lilly and Co

- Enzo Biochem, Inc.

- Eurofins Viracor Inc.

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- Novartis AG

- Novatein Biosciences Inc.

- PerkinElmer Inc.

- Randox Laboratories Ltd.

- Renalytix AI PLC

- Sanofi-Aventis, LLC.

- Sekisui Diagnostics, LLC

- Siemens Healthineers AG

- SphingoTec GmbH

- Thermo Fisher Scientific Inc.

Implementing Strategic Roadmaps to Capitalize on Technological Advances and Regulatory Shifts for Sustainable Leadership in Renal Biomarker Market

To navigate the complexity of post-tariff cost pressures and escalating competitive intensity, industry leaders should prioritize dual strategies that balance technological innovation with supply chain resilience. First, investing in modular instrument platforms that support multi-marker assays can enhance flexibility and reduce per-test costs, enabling laboratories to adapt swiftly to evolving clinical demands. By emphasizing software-defined instrumentation, companies can decouple assay development cycles from hardware rollouts, accelerating time to market for new biomarkers.

Second, forging strategic alliances with regional manufacturers and service providers can mitigate tariff impacts and secure preferential access to critical reagents and components. Localizing certain production processes not only buffers against import duty fluctuations but also fosters closer collaboration with end users and regulatory bodies. Third, augmenting cloud-based laboratory informatics solutions with advanced data analytics modules will empower clinical stakeholders to derive actionable insights from large-scale biomarker datasets, strengthening value propositions for payers focused on demonstrable health outcomes.

Finally, leaders should engage proactively with regulatory agencies to shape clear guidance on emerging biomarkers, ensuring streamlined approval pathways and alignment with evolving reimbursement frameworks. By championing robust clinical validation studies and health economic assessments, companies can substantiate the clinical utility and cost effectiveness of next-generation renal biomarker assays. This integrated approach will position organizations to capture market opportunities while maintaining patient-centric innovation at the forefront.

Detailing a Rigorous Multi Stage Research Framework Integrating Primary Interviews Secondary Validations and Quantitative Data Triangulation

The research methodology underpinning this analysis combines rigorous primary and secondary research techniques to deliver a comprehensive perspective on the renal biomarker landscape. In the primary phase, in-depth interviews were conducted with senior executives from diagnostic instrument manufacturers, leading clinical laboratories, reagent suppliers, and academic investigators to capture expert insights on technology adoption, market drivers, and regulatory challenges.

Complementing this, secondary research activities entailed extensive review of peer-reviewed publications, regulatory guidance documents, conference proceedings, and corporate filings to validate market trends, competitive strategies, and emerging biomarker portfolios. Data from government health agencies and international standards organizations provided further context for reimbursement policies and diagnostic criteria.

Quantitative data triangulation was applied by synthesizing operational metrics from service providers, shipment volumes for key instrument categories, and procurement data from major healthcare networks. This multi-stage approach ensures that qualitative perspectives are grounded in measurable industry indicators, resulting in a robust, evidence-based framework for understanding the current state and future trajectory of renal biomarker markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Renal Biomarkers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Renal Biomarkers Market, by Product Type

- Renal Biomarkers Market, by Biomarker Type

- Renal Biomarkers Market, by Technology

- Renal Biomarkers Market, by Sample Type

- Renal Biomarkers Market, by Application

- Renal Biomarkers Market, by End User

- Renal Biomarkers Market, by Region

- Renal Biomarkers Market, by Group

- Renal Biomarkers Market, by Country

- United States Renal Biomarkers Market

- China Renal Biomarkers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Core Insights and Future Trajectories That underscore the Transformative Potential and Industry Imperatives in Renal Biomarkers

This executive summary has illuminated the critical forces reshaping renal biomarker development and deployment, from breakthrough point-of-care platforms to the growing influence of AI-driven analytics. The analysis of 2025 tariff impacts highlights the importance of flexible supply chains and strategic alliances in maintaining cost competitiveness, while the detailed segmentation review underscores distinct opportunities across product types, biomarkers, end users, technologies, applications, and sample matrices.

Regional insights demonstrate that each geography presents unique enablers and challenges-from advanced reimbursement systems in the Americas to infrastructure-driven innovations in the EMEA region and production-led growth in Asia Pacific. Competitive profiling reveals a landscape defined by both established diagnostics leaders and nimble innovators aggressively pursuing partnerships and targeted R&D investments.

Ultimately, the convergence of modular instrument design, localized production strategies, and cloud-based informatics solutions will drive the next phase of transformation in renal diagnostics. As the industry continues to evolve, stakeholders equipped with deep market intelligence and actionable strategies will be best positioned to deliver meaningful improvements in patient outcomes and commercial performance.

Secure Your Access to In-Depth Renal Biomarker Market Intelligence with a Tailored Consultation Led by Ketan Rohom Today

To explore the full depth of renal biomarker market dynamics and uncover tailored opportunities aligned to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for an exclusive guided overview of the comprehensive market research report. Engage directly with a senior expert to discuss custom licensing, enterprise access options, or bespoke analyses that align with your organization’s priorities. This personalized consultation ensures you gain clear visibility into emerging innovations, competitive landscapes, and regulatory shifts essential for informed decision-making. Act now to secure privileged insights that will empower your next strategic move in renal biomarker development and commercialization

- How big is the Renal Biomarkers Market?

- What is the Renal Biomarkers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?