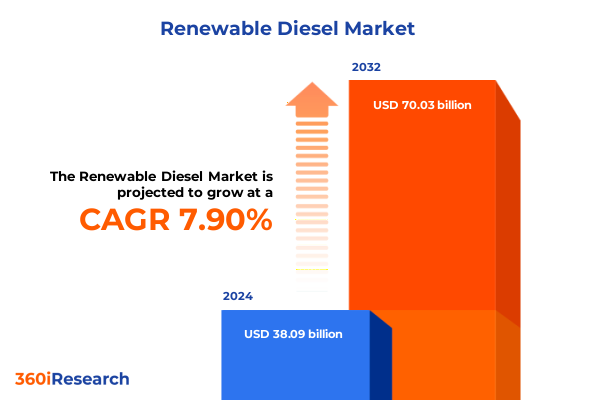

The Renewable Diesel Market size was estimated at USD 40.88 billion in 2025 and expected to reach USD 43.95 billion in 2026, at a CAGR of 7.99% to reach USD 70.03 billion by 2032.

Understanding the Transformative Rise of Renewable Diesel as a Sustainable Fuel Alternative in a Carbon-Constrained Global Energy Landscape

The energy landscape is undergoing a profound transformation as global imperatives to reduce carbon emissions and enhance fuel security converge on alternative fuel solutions. Renewable diesel has emerged as a cornerstone in this transition, offering a drop-in replacement for petrodiesel that meets rigorous specifications without requiring engine modifications. Unlike biodiesel, which relies on transesterification to produce fatty acid methyl esters, renewable diesel is synthesized through hydrotreating or other advanced processes that align its chemical structure more closely with conventional diesel. This distinction underpins its superior compatibility and performance, making it an attractive option for heavy-duty transportation, power generation, and industrial applications.

In recent years, policy frameworks have catalyzed growth in renewable diesel demand. Governments across major markets have instituted carbon intensity standards, blending mandates, and tax incentives aimed at decarbonizing the fuel supply. In the United States, the Renewable Fuel Standard (RFS) has set escalating targets for biomass-based diesel volumes, while the Inflation Reduction Act of 2022 delivered significant investment tax credits for clean fuel production facilities. Consequently, producers have accelerated capacity expansions, and feedstock suppliers have adapted supply chains to meet the evolving requirements of renewable fuels. This confluence of technological innovation and regulatory momentum has propelled renewable diesel from a niche offering to a mainstream solution in the global energy mix.

As the global community intensifies its focus on net-zero objectives, renewable diesel stands out for its ability to deliver immediate emissions reductions in existing diesel fleets. This introduction provides the context for a detailed exploration of the market’s transformative shifts, the impact of tariffs on feedstock flows, critical segmentation insights, regional dynamics, and strategic recommendations. Understanding these factors is essential for stakeholders navigating the complexities of renewable diesel adoption and seeking to capitalize on emerging opportunities in a carbon-constrained world.

Exploring the Pivotal Strategic and Technological Shifts Reshaping Renewable Diesel Markets amid Evolving Regulatory, Environmental, and Commercial Imperatives

The renewable diesel market is being reshaped by a series of strategic and technological inflection points that extend beyond conventional supply-demand paradigms. Policy evolution remains the predominant catalyst, with new low-carbon fuel standards and lifecycle greenhouse gas reduction targets driving stakeholders to seek more carbon-efficient feedstocks and processes. At the same time, technological advancements in hydrotreating catalysts and modular pyrolysis units have lowered conversion costs and enhanced process flexibility, enabling producers to process a broader range of lipids including animal fats, vegetable oils and waste oil residues. This dual thrust of regulation and innovation has accelerated the replacement of legacy refineries with integrated biorefinery models that co-locate feedstock pretreatment and fuel upgrading in a seamless value chain.

In parallel, commercial strategies have evolved to foster cross-sector collaboration. Energy companies are forging joint ventures with agricultural producers to secure consistent supplies of soybean oil and tallow, while waste management firms are partnering with refiners to channel used cooking oil and other residues into fuel production. These alliances are underpinned by digital platforms that enhance traceability, verifying the carbon intensity of feedstocks in real time to align with increasingly stringent reporting requirements. Furthermore, financiers are deploying green bond frameworks and sustainability-linked loans to de-risk large-scale investments, signaling a shift in capital allocation toward renewable diesel assets.

Moreover, the interplay between renewable diesel and emerging carbon markets is driving new commercial paradigms. Stakeholders are exploring opportunities to monetize carbon credits generated through feedstock sourcing, process optimization and lifecycle enhancements. This nexus of policy incentives, technological progress and innovative financing mechanisms constitutes a transformative shift in the renewable diesel landscape, redefining how value is created and distributed across the industry.

Assessing the Comprehensive Influence of Newly Implemented United States Tariffs in 2025 on Feedstock Accessibility and Competitive Market Dynamics

The imposition of new United States tariffs in 2025 has introduced a fresh layer of complexity to the renewable diesel feedstock market. In a bid to protect domestic oilseed and animal fat industries, tariff adjustments have raised the cost of certain imported vegetable oils and tallow, leading producers to reevaluate sourcing strategies. As supply chain managers grapple with these additional duties, there has been a discernible shift toward domestic waste oil and residue streams, which are tariff-exempt and offer a more stable cost base. This pivot has not only altered the geography of feedstock procurement but also challenged refineries to enhance pretreatment capabilities to handle higher impurity loads in alternative lipid sources.

Furthermore, tariffs have prompted downstream stakeholders to renegotiate offtake agreements and explore long-term feedstock purchase contracts to mitigate price volatility. The resulting contractual frameworks often incorporate price-adjustment clauses tied to tariff fluctuations, incentivizing greater collaboration between refiners and feedstock suppliers. Simultaneously, importers have sought tariff classification reviews and legal recourse to contest the applied duties, underscoring the importance of proactive trade compliance functions within corporate operations.

In addition, the tariff environment has spurred domestic feedstock producers to expand capacity and pursue quality enhancements, seeking to capture market share vacated by costlier imports. This dynamic has prompted investments in refining animal fat and vegetable oil streams, as well as novel partnerships with municipal waste handlers to aggregate higher volumes of used cooking oil. As a result, the tariff regime has had a cumulative impact that transcends mere cost increases, ultimately reshaping feedstock flows, contractual norms and infrastructure investments across the renewable diesel sector.

Revealing How Feedstock Origins, Production Technologies, Capacity Tiers, End User Industries and Distribution Channels Shape Renewable Diesel Market Insights

A nuanced examination of segmentation reveals the multifaceted drivers behind renewable diesel market growth. When evaluating raw material sources, attention must be paid to the relative availability and carbon profiles of animal fats, vegetable oils and waste oil residues. Poultry fat and tallow, for instance, can deliver favorable cost structures but may require dedicated pretreatment to remove contaminants. Canola, corn, palm and soybean oils each bring unique supply chain considerations, ranging from regional concentration to land-use implications, while waste oils and residues demand robust collection networks and quality controls to ensure consistent chemical inputs.

Turning to production technologies, the choice between gasification, hydrotreating and pyrolysis defines both capital intensity and feedstock flexibility. Among these, hydrotreating-further subdivided into hydrocracking and hydrogenation pathways-remains the predominant approach due to its established track record in petroleum refining. However, pyrolysis is gaining traction for its ability to process lignocellulosic residues, alleviating competition for edible oils. Meanwhile, gasification holds promise for integrating municipal solid waste streams, enabling production facilities to qualify for additional environmental credits linked to waste diversion.

Production capacity also exerts a significant influence on market dynamics. Large-scale producers benefit from economies of scale and the ability to integrate operations vertically, whereas medium and small producers often excel in niche feedstock sourcing and regional market penetration. Capacity tiers impact logistical footprints, financing options and technology adoption rates. Additionally, end user industries shape demand patterns, with agriculture machinery operators deploying renewable diesel in combine harvesters and tractors, construction and mining fleets relying on it in excavators and loaders, and transportation sectors using it across aviation, marine, rail and road applications. Finally, distribution channels-ranging from direct sales agreements to distributor networks-determine how fuel is marketed and delivered to customers, influencing margin structures and service levels.

This comprehensive research report categorizes the Renewable Diesel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material Source

- Production Technologies

- Production Capacity

- End User Industry

Illuminating Regional Dynamics and Growth Trajectories across the Americas, Europe Middle East Africa and Asia-Pacific Markets for Renewable Diesel Integration

Regional dynamics within the renewable diesel ecosystem reflect a patchwork of policy frameworks, infrastructure readiness and feedstock endowments. In the Americas, the United States leads with its Renewable Fuel Standard and production tax incentives, while Canada leverages provincial mandates to stimulate waste oil collection programs. Brazil’s long-standing expertise in biodiesel feedstock cultivation has also positioned it as a critical exporter of vegetable oil into North American refineries. This confluence of policies and endowments creates a synergistic environment in which cross-border logistics facilitate year-round feedstock availability and asset utilization.

In Europe, Middle East and Africa, the European Union’s Renewable Energy Directive set binding targets that have accelerated facility upgrades and feedstock certification schemes, while carbon pricing mechanisms have rewarded the lowest-intensity fuel providers. Middle Eastern nations are exploring waste oil to fuel pathways to diversify export portfolios, and selective African markets are piloting agricultural residue gasification projects to support rural energy access. The interplay between carbon regulations, sustainability criteria and emerging biorefinery investments underscores the region’s strategic diversification of renewable diesel feedstocks.

Across Asia-Pacific, nascent markets are beginning to take shape as governments prioritize air quality improvements and decarbonization goals. China’s pilot low-carbon fuel zones and India’s biofuel purchase obligations have incentivized local refining companies to retrofit conventional units for renewable diesel production. Moreover, Southeast Asian nations rich in palm oil resources are navigating sustainability certifications to maintain export revenues while balancing land-use and biodiversity concerns. These distinct regional narratives illustrate how policy environments, feedstock profiles and industrial capacities converge to shape renewable diesel deployment in each geography.

This comprehensive research report examines key regions that drive the evolution of the Renewable Diesel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape and Strategic Movements of Leading Industry Stakeholders in Renewable Diesel Production and Technological Advancement

The competitive landscape of renewable diesel is defined by collaboration between traditional refiners, pure-play biofuel companies and integrated feedstock suppliers. Leading global players have adopted differentiated strategies based on their core competencies and regional footprints. Several integrated oil companies have repurposed existing hydrotreating units to broaden their renewable diesel output, leveraging established logistics networks to expedite market entry. Specialized producers have focused on securing high-quality waste oil streams and developing proprietary catalyst formulations to optimize conversion efficiencies and minimize hydrogen consumption.

Joint ventures and strategic alliances underscore the importance of feedstock security. Some entities have entered into long-term offtake agreements with agricultural cooperatives and waste management firms to guarantee steady volumes of soybean oil, tallow and used cooking oil. Others have pursued collaborations with technology providers to pilot advanced pyrolysis modules capable of handling forestry residues and municipal wastes. In parallel, several capital markets transactions highlight the growing appeal of renewable diesel projects among institutional investors seeking stable cash flows tied to existing fuel distribution channels.

Across each of these strategic initiatives, companies are balancing near-term production ramp-ups with mid- to long-term R&D investments aimed at lowering carbon intensity scores. This dual focus enables stakeholders to meet immediate policy requirements while laying the groundwork for next-generation processes. Ultimately, the competitive dynamics in renewable diesel reflect a balance between incumbent scale advantages, feedstock integration capabilities and innovation-driven differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Renewable Diesel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aemetis, Inc.

- AMERICAN GREENFUELS, LLC.

- Ampol Limited

- Ashcourt Group

- Bangchak Corporation Public Company Limited

- BP PLC

- Calumet, Inc.

- Cargill, Incorporated

- Chevron Corporation

- Darling Ingredients Inc.

- Emami Group

- Eni S.p.A.

- Euglena Co., Ltd.

- Exxon Mobil Corporation

- Geekay Fuels

- Gevo, Inc.

- Global Clean Energy Holdings, Inc.

- HF Sinclair Corporation

- Kern Energy

- Marathon Petroleum Corporation

- Metrohm AG

- Neste Corporation

- NSR Industries

- OMV AG

- PBF Energy Inc.

- Phillips 66 Company

- Preem AB

- Repsol, SA

- Shell PLC

- Valero Energy Corporation

- Verbio SE

Delivering Targeted Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Renewable Diesel Sector

Industry leaders seeking to thrive in the renewable diesel sector must adopt a proactive posture that integrates supply chain optimization, policy engagement and technological diversification. First, it is imperative to cultivate robust partnerships with feedstock suppliers across animal fats, vegetable oils and waste residues, ensuring volume security through multi-year agreements and flexible quality parameters. Concurrently, operational investments should prioritize modular process units that enable swift feedstock switching in response to tariff changes and price fluctuations, thus mitigating risk and bolstering resilience.

In parallel, decision-makers should engage directly with regulatory bodies to shape emerging carbon intensity frameworks and low-carbon fuel standards. Early collaboration on certification protocols and lifecycle analysis methodologies will afford companies a competitive advantage by accelerating approvals and unlocking additional incentive layers. Additionally, establishing internal carbon management teams capable of tracking credits and optimizing hydrogen use will yield tangible cost savings and strengthen positioning within voluntary carbon markets.

Finally, executives must champion innovation by allocating a portion of R&D budgets to pilot emerging pathways such as lignocellulosic pyrolysis and gasification of mixed waste streams. Pilot successes can then be scaled through joint ventures that align technical risk sharing with strategic market access. This multi-pronged strategy, when coupled with transparent stakeholder communication and performance tracking, will enable renewable diesel leaders to capitalize on emerging opportunities while safeguarding against policy inflection points and feedstock disruptions.

Outlining a Robust Research Framework Emphasizing Data Integrity, Analytical Rigor and Multi-Source Validation to Derive Actionable Renewable Diesel Insights

This analysis rests on a multifaceted research framework designed to ensure data integrity and analytical rigor. Initially, secondary research was conducted using trade association reports, regulatory filings and publicly disclosed sustainability documentation to map policy frameworks and incentive structures. Proprietary databases were leveraged to track capital deployment trends, technology patent filings and feedstock trade flows, providing a quantitative backdrop for qualitative insights.

Complementing this secondary phase, primary research entailed in-depth interviews with key stakeholders across the renewable diesel value chain, including refinery engineers, feedstock aggregators and policy makers. These conversations were structured to validate emerging themes, test assumptions around feedstock availability and identify potential bottlenecks in production and logistics. Data triangulation techniques were applied to cross-reference findings with peer-reviewed academic studies and third-party certification bodies, ensuring consistency and reliability.

Finally, a structured analytical approach was employed to synthesize the information, combining SWOT analysis, scenario planning and sensitivity assessments. This methodological rigor enables the generation of actionable insights while maintaining transparency around underlying assumptions and data sources. By integrating diverse research methods and validation steps, this study delivers a comprehensive perspective on renewable diesel that stakeholders can trust for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Renewable Diesel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Renewable Diesel Market, by Raw Material Source

- Renewable Diesel Market, by Production Technologies

- Renewable Diesel Market, by Production Capacity

- Renewable Diesel Market, by End User Industry

- Renewable Diesel Market, by Region

- Renewable Diesel Market, by Group

- Renewable Diesel Market, by Country

- United States Renewable Diesel Market

- China Renewable Diesel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Strategic Insights Highlighting the Role of Industry Collaboration, Policy Alignment and Innovation in Advancing the Renewable Diesel Transition

In reviewing the trajectories, drivers and strategic imperatives shaping the renewable diesel market, the path forward becomes clear. Collaborative innovation across feedstock procurement, process development and policy alignment will define industry success. Stakeholders who embrace agile operational models, strengthen regulatory partnerships and invest in emerging technologies will be best positioned to navigate market uncertainties and capitalize on low-carbon fuel demand.

As tariff regimes and incentive structures continue to evolve, rigorous lifecycle analysis and dynamic feedstock strategies will remain central to maintaining competitive cost positioning. Moreover, integrating carbon credit optimization and transparent sustainability reporting will become standard practice, reshaping value capture across the supply chain. Ultimately, the transition to renewable diesel will hinge on the collective efforts of refiners, feedstock suppliers, technology partners and policy makers working in concert to drive systemic decarbonization.

By synthesizing these insights and remaining vigilant to emerging inflection points, industry leaders can chart a course that balances near-term production imperatives with long-term decarbonization goals. The conclusion underscores the importance of strategic cohesion, data-driven decision making and continuous innovation in advancing renewable diesel from an emerging alternative to a foundational pillar of a sustainable energy future.

Motivating Stakeholders to Engage with the Comprehensive Renewable Diesel Market Report and Connect with Ketan Rohom for Tailored Insights and Details

We invite executive stakeholders and strategic decision-makers to secure their access to the definitive market study on renewable diesel. Partnering with Ketan Rohom, Associate Director, Sales & Marketing, stakeholders will gain tailored guidance on report contents, bespoke insights on feedstock dynamics and policy developments, and clear next steps for leveraging this comprehensive analysis. Reach out to unlock the full potential of renewable diesel strategies and ensure your organization remains at the forefront of the transition to sustainable fuels.

- How big is the Renewable Diesel Market?

- What is the Renewable Diesel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?