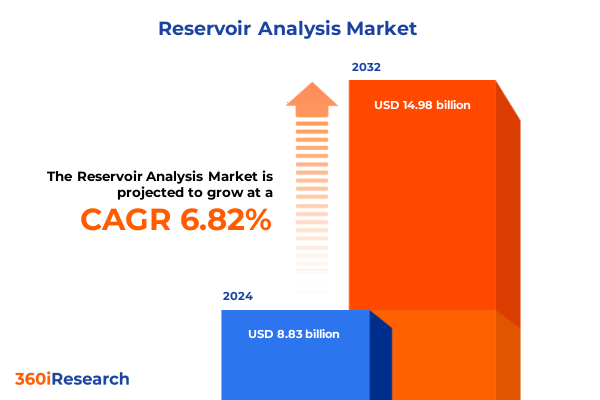

The Reservoir Analysis Market size was estimated at USD 9.43 billion in 2025 and expected to reach USD 10.07 billion in 2026, at a CAGR of 6.83% to reach USD 14.98 billion by 2032.

Navigating the Complexities of Modern Reservoir Analysis: Setting the Stage for Enhanced Production and Strategic Decision Making

In an era defined by resource optimization and digital innovation, understanding the nuances of reservoir behavior has never been more critical. Reservoir analysis transcends traditional interpretations of subsurface data by integrating geological, petrophysical, and engineering perspectives to deliver a holistic view of hydrocarbon potential. Through the convergence of high-resolution seismic imaging, machine-learning algorithms, and real-time well monitoring, industry leaders can now predict reservoir performance with unprecedented accuracy and confidence.

As operators face mounting pressure to maximize recovery while minimizing environmental footprints, advanced reservoir characterization techniques have emerged as indispensable tools. These methodologies not only inform well placement and completion strategies but also underpin efforts to deploy enhanced oil recovery (EOR) techniques effectively. By leveraging data-driven models and digital twins, engineers can optimize injection schemes, forecast production profiles, and mitigate operational risks across the asset life cycle.

Transitioning from exploratory phases to mature field management requires agile decision-making supported by comprehensive reservoir insight. This section sets the stage for a deeper exploration of how evolving technologies, shifting policy environments, and strategic segmentation frameworks are reshaping reservoir analysis capabilities.

Unveiling the Transformative Forces Redefining Reservoir Analysis: From AI-Driven Data Integration to Sustainable Enhanced Oil Recovery Solutions

Reservoir analysis is undergoing a profound transformation driven by seismic advances and the proliferation of subsurface analytics platforms. Notably, the integration of artificial intelligence and cloud-native workflows has accelerated the shift from batch-oriented data processing toward continuous, real-time reservoir monitoring. These digital threads enable operators to respond swiftly to dynamic downhole conditions, optimizing production and reducing non-productive time.

Concurrently, the industry’s focus on sustainability has catalyzed the adoption of carbon-management practices within reservoir frameworks. Techniques such as CO₂ injection for EOR and carbon sequestration are no longer niche applications; they have become strategic imperatives for companies seeking to align with net-zero ambitions. By coupling reservoir simulation with emissions-tracking models, operators can quantify both hydrocarbon recovery and carbon containment benefits, fostering integrated development plans.

Moreover, the maturation of unconventional resource plays continues to redefine reservoir paradigms. Multi-stage fracturing in shale and tight reservoirs demands unprecedented precision in geomechanical modeling and microseismic interpretation. In response, service providers are offering end-to-end digital EOR solutions that combine advanced visualization with predictive analytics. Consequently, the competitive landscape is evolving toward partnerships and outcome-based contracting, where success is measured by incremental recovery and operational efficiency.

Evaluating the Aggregate Effects of 2025 U.S. Tariff Policies on Upstream Reservoir Operations and Equipment Supply Chains

In 2025, U.S. trade policy adjustments have introduced a complex web of tariffs that reverberate through the upstream oil and gas sector. The administration imposed a 25% levy on steel and aluminum imports under Section 232, alongside escalating duties on goods from China averaging 145% and a 25% tariff on most imports from Mexico and Canada, creating supply chain uncertainty for drilling and completion services. These measures have immediate implications for critical equipment, notably oil country tubular goods (OCTG), pipelines, and structural components essential to reservoir operations.

As steel and aluminum costs surge, OCTG prices are projected to climb by as much as 15% year-over-year, given that the U.S. relies on imports for nearly 40% of its OCTG requirements. Such increases translate into approximately a 2.1% rise in total well construction expenses for onshore projects, particularly affecting smaller operators with limited hedging capabilities. Larger integrated producers, however, can leverage diversified procurement networks and absorb cost shocks to a greater extent.

Beyond raw materials, tariffs on valve fittings, sucker rods, and downhole tools have disrupted multinational sourcing strategies. Industry analysts at Morningstar estimate a 2–3% contraction in oilfield service revenue across major providers in 2025, with an even more significant impact on operating margins. Halliburton and SLB executives attribute recent profit declines partly to these elevated input costs, as drilling activity in North America softened under the weight of tariff-driven inflation.

Nevertheless, operators are adapting by offsetting tariff-related cost pressures with deflationary trends in proppant, drilling rig mobilization, and pressure-pumping services. Wood Mackenzie data highlights that while offshore projects could face up to a 14.6% cost increase, Lower 48 unconventional operations may see a more modest 6% hike, counterbalanced by reduced expenditures in other service categories. Looking forward, collaborative supply chain restructuring and strategic sourcing alliances will be critical to preserving project economics and sustaining capital efficiency.

Delving into Critical Reservoir Segmentation Criteria to Uncover How Fluid, Reservoir, Technology, Drive Mechanism, and Well Type Shape Market Dynamics

The reservoir analysis domain is delineated by multiple segmentation axes that collectively shape strategic focus areas. Fluid type segmentation illuminates distinct challenges when evaluating condensate reservoirs, which require accurate phase-behavior modeling; gas fields, where reservoir drive mechanisms and deliverability forecasting take precedence; and oil reservoirs, where viscosity and relative permeability curves drive production well architectures. Each fluid category demands tailored logging, sampling, and numerical simulation approaches to accurately capture flow dynamics.

Reservoir type segmentation further refines analytical methods. Conventional reservoirs typically rely on established volumetric calculations and pressure transient analyses, whereas unconventional plays such as coalbed methane, heavy oil, shale, and tight oil necessitate geo-statistical modeling, complex fracture network characterization, and laboratory-derived rock-fluid interaction experiments. These unconventional formations challenge reservoir engineers to integrate microseismic data, advanced petrophysical logs, and laboratory-scale testing to optimize completion designs and fracture stimulations.

Production technology segmentation underscores recovery mechanisms over the asset life cycle. Primary recovery leverages natural reservoir energy, while secondary recovery methods such as chemical flooding, gas injection, and water flooding extend production beyond initial pressure declines. Tertiary recovery techniques, encompassing chemical EOR, gas miscible processes, and thermal approaches like steam flooding and steam injection, demand iterative simulation workflows and pilot testing to calibrate injection schedules and chemical formulations.

Complementing these categories, drive mechanism segmentation-encompassing combination drive, gas cap drive, gravity drainage, solution gas drive, and water drive-provides critical insights into reservoir energy contributions. Well type segmentation, drawing distinctions among horizontal, multilateral, and vertical wells, further guides decisions on well placement, completion strategy, and production optimization. Together, these segmentation lenses enable a comprehensive reservoir analysis framework that informs capital allocation and development sequencing.

This comprehensive research report categorizes the Reservoir Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology

- End User

- Software Delivery Model

Illuminating Regional Variations in Reservoir Analysis Across the Americas, Europe, Middle East, Africa, and Asia-Pacific to Guide Strategic Investments

Regional dynamics in reservoir analysis are as varied as the geological settings they encompass. In the Americas, operators have capitalized on prolific shale basins to pioneer digital oilfield initiatives, integrating IoT sensors and machine-learning algorithms for continuous downhole performance monitoring. The United States, boasting the world’s largest rig fleet, leads the charge in real-time data capture, edge computing applications, and modular EOR pilot programs. Latin America, while in earlier stages of digital adoption, is increasingly deploying advanced reservoir modeling platforms to optimize mature fields in Brazil’s pre-salt plays and Mexico’s Cantarell assets.

This comprehensive research report examines key regions that drive the evolution of the Reservoir Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Reservoir Analysis Providers and Oilfield Services Corporations Driving Technological Innovation and Operational Excellence Globally

Leading oilfield service conglomerates and technology providers are reshaping reservoir analysis through strategic investment in digital platforms and integrated service offerings. Schlumberger (SLB) reported a 20% increase in digital and integrated revenues in its most recent quarter, attributing growth to AI-driven subsurface modeling and autonomous drilling solutions. The company’s Electris completions portfolio and Retina at-bit imaging system have garnered over 100 installations worldwide, demonstrating robust demand for real-time reservoir intelligence and precision drilling interventions.

Meanwhile, Halliburton’s Q2 results revealed a profit dip linked to softened North America drilling activity and tariff-induced cost inflation, prompting the company to emphasize its Landmark digital well construction and advanced EOR workflows as countermeasures to margin pressures. Baker Hughes, pursuing its transition toward emissions-aware operations, is embedding AI-powered predictive maintenance and asset performance management tools across its portfolio, seeking to optimize uptime and extend well life.

Collectively, these companies are forging partnerships with major operators to co-develop deployment blueprints. Rystad Energy notes that multinational sourcing strategies now include clauses for collaborative data exchange and joint innovation road maps, underscoring the shift from transactional service models to outcome-based alliances that focus on incremental recovery and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Reservoir Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Baker Hughes Company

- CGG S.A.

- Core Laboratories

- DNV GL

- Emerson Electric Co.

- Expro Group

- Geolog International

- Halliburton Energy Services, Inc.

- Infosys Limited

- Intertek Group PLC

- Kappa Engineering

- National Oilwell Varco, Inc.

- NuTech Energy Alliance

- Oceaneering International, Inc.

- OilRock Technologies

- PBQ Oilfield Services

- Petrofac Limited

- Ryder Scott Company LP

- Schlumberger Limited

- SDP Services Ltd.

- Stratum Reservoir, LLC

- Tracerco

- Weatherford International PLC

Formulating Strategic Pathways for Reservoir Analysis Leaders to Harness Innovation, Optimize Performance, and Navigate Dynamic Market and Regulatory Challenges

Industry leaders must embrace an integrated strategy that combines advanced analytics, diversified sourcing, and collaborative innovation. First, deploying AI-enabled reservoir modeling tools and digital twins across all phases of field development allows for continuous performance optimization and risk mitigation. By establishing a unified data architecture, operators can harness predictive algorithms to anticipate pressure declines, identify bypassed pay zones, and tailor injection schemes with precision.

Second, supply chain resilience is non-negotiable in the face of tariff-induced cost fluctuations. Organizations should cultivate multiple procurement channels and engage in strategic inventory management to buffer against raw material price shocks. Collaborative frameworks with service providers, including transparent cost-sharing mechanisms, will enable sustained access to critical equipment and technologies.

Third, workforce transformation must parallel technological adoption. Upskilling programs focused on data science, reservoir simulation, and digital tool proficiency will drive adoption rates and unlock value from emerging solutions. Cross-disciplinary teams, blending geoscientists, engineers, and data analysts, foster agile decision making and holistic asset stewardship.

Finally, proactive engagement with regulatory bodies on methane management and carbon-capture initiatives will position operators at the forefront of sustainable reservoir stewardship. By integrating emissions-monitoring protocols within reservoir evaluation workflows, companies can align operational excellence with environmental mandates and stakeholder expectations.

Outlining a Robust Research Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation to Achieve Rigorous Findings

The research methodology underpinning this analysis integrates both primary and secondary information sources to ensure comprehensive coverage and accuracy. Secondary data collection entailed an extensive review of industry publications, regulatory filings, company disclosures, and technical journals. Key trade associations and government databases provided statistical and policy context, while industry newswire services offered contemporaneous updates on market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Reservoir Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Reservoir Analysis Market, by Service Type

- Reservoir Analysis Market, by Technology

- Reservoir Analysis Market, by End User

- Reservoir Analysis Market, by Software Delivery Model

- Reservoir Analysis Market, by Region

- Reservoir Analysis Market, by Group

- Reservoir Analysis Market, by Country

- United States Reservoir Analysis Market

- China Reservoir Analysis Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Key Takeaways from Reservoir Analysis Trends, Challenges, and Opportunities to Inform Strategic Decision Making Moving Forward

As reservoir analysis continues to evolve under the influence of digital innovation, regulatory shifts, and market dynamics, decision makers must remain agile and data driven. The synthesis of segmentation frameworks, regional differentiators, and technology trends underscores the multifaceted nature of modern reservoir evaluation. Informed by tariff impacts, supply chain considerations, and corporate strategies, stakeholders can craft development programs that balance recovery optimization with cost discipline and environmental responsibility.

Looking ahead, the convergence of AI, real-time analytics, and sustainable practices will define competitive advantage. By translating insights into action-through technology investment, operational excellence, and strategic partnerships-industry participants can unlock the full potential of subsurface assets. The path forward rests on the ability to integrate disciplines, adapt to evolving policies, and leverage cutting-edge tools to drive value at every stage of the reservoir life cycle.

Connect with Associate Director Ketan Rohom to Secure Your Copy of the Comprehensive Reservoir Analysis Market Research Report and Drive Informed Decisions

To acquire the comprehensive Reservoir Analysis Market Research Report that delves into advanced methodologies, segmentation insights, regional dynamics, and actionable strategies, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan Rohom is ready to guide you through the report’s detailed findings and ensure your organization gains the competitive advantage necessary to navigate evolving reservoir landscapes. Contact Ketan today to secure your copy and empower your team with the in-depth intelligence required for informed decision making.

- How big is the Reservoir Analysis Market?

- What is the Reservoir Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?