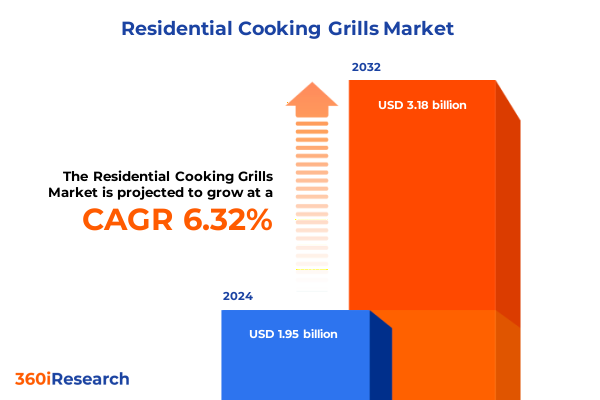

The Residential Cooking Grills Market size was estimated at USD 2.07 billion in 2025 and expected to reach USD 2.21 billion in 2026, at a CAGR of 6.32% to reach USD 3.18 billion by 2032.

Unveiling Key Drivers Shaping the Residential Cooking Grills Market as Consumer Lifestyles Evolve and Technological Innovations Take Center Stage

The residential cooking grills landscape is being reshaped by evolving consumer lifestyles, technological advancements, and heightened expectations for convenience and performance. Homeowners are increasingly seeking seamless outdoor cooking experiences that blend traditional methods with modern innovation. This shift is fueled by a desire to entertain guests, enhance family bonding through shared cooking moments, and elevate home value with stylish backyard amenities.

Simultaneously, manufacturers are leveraging breakthroughs in materials science and digital connectivity to introduce features such as infrared heating, precise temperature controls, and integrated smartphone applications. These innovations not only optimize cooking outcomes but also align with broader smart-home ecosystems, meeting the needs of tech-savvy consumers. As the market continues to mature, our analysis unpacks how foundational drivers-from demographic shifts to sustainability demands-are guiding both product development and consumer adoption pathways.

Mapping the Transformative Shifts Redefining Residential Cooking Grill Preferences Amid Sustainability and Smart Technology Trends

The residential grills sector is undergoing transformative shifts as sustainability priorities, digital integration, and multi-fuel versatility take precedence. Eco-conscious buyers now scrutinize fuel sources and emissions profiles, prompting brands to invest in low-smoke charcoal options, energy-efficient electric models, and hybrid gas solutions. This movement toward greener grilling aligns with broader environmental initiatives and fosters product differentiation in a crowded marketplace.

Concurrently, the ascent of the smart-home revolution is driving connectivity features that transform grills into intelligent appliances. Real-time temperature monitoring, remote diagnostics, and automated cleaning cycles are redefining convenience and ensuring consistent cooking performance. These digital enhancements are further complemented by modular designs and interchangeable components, enabling customization and scalability for diverse outdoor living spaces.

Moreover, the competitive interplay between traditional brick-and-mortar retailers and digital platforms has intensified, as online marketplaces harness data analytics to deliver personalized recommendations and seamless purchasing journeys. This shift accelerates the adoption of direct-to-consumer models and fosters new partnerships between grill manufacturers and e-commerce specialists. Together, these dynamics are forging a new era in residential cooking grills, where sustainability, connectivity, and omnichannel engagement converge.

Analyzing the Cumulative Impact of Escalating United States Tariffs on Residential Cooking Grills and Component Supply Chains in 2025

Since the beginning of 2025, U.S. trade policy has layered new tariff obligations onto residential cooking grills and related components, triggering a notable recalibration of import costs. In March, the administration introduced a 20% IEEPA tariff on all Chinese imports, adding to the existing Section 301 levies initially imposed to counter unfair trade practices. This move alone elevated the baseline duty for many grills assembled in China, a country that remains a major source of mid-range portable units.

Shortly thereafter, on March 12, Section 232 tariffs were extended, enforcing a 25% duty on all steel and aluminum imports, irrespective of origin. As grills often rely on steel burners, aluminum side shelves, and other metal fixtures, this blanket tariff created further cost pressures on manufacturers sourcing these critical materials abroad.

On January 1, select electrical grill components, including infrared modules and semiconductor-based controllers, became subject to a 50% Section 301 increase following a four-year statutory review. The convergence of these tariffs-IEEPA, Section 232, and enhanced Section 301 rates-has resulted in total import burdens exceeding 70% for some Chinese-manufactured grills and parts.

As a result, many manufacturers have initiated supply-chain realignment strategies, seeking alternative sources in Southeast Asia or accelerating domestic production capabilities. Retail price tags for end consumers have experienced upward adjustments, narrowing margins for value-driven segments while simultaneously spurring innovation in fuel efficiency and material substitution to mitigate duty impacts.

Unearthing Critical Segmentation Insights That Illuminate Consumer Choices Across Fuel Types Product Types Channels Price Tiers Materials and Capacities

Through a multifaceted lens of fuel type analysis, the grill market unveils distinct consumer behaviors and product trajectories. Charcoal enthusiasts often gravitate toward briquettes for their cost-effectiveness and uniform burn, whereas lump coal aficionados prize the natural flavor profile yielded by larger, variable pieces. In the electric category, infrared technology has carved a niche among performance-driven users seeking rapid heat-up times and precision, while traditional electric models maintain an audience that values simplicity and controlled temperature settings. Gas grills further diversify the landscape, with natural gas units appealing to homeowners seeking permanent outdoor kitchen installations and propane variants offering portability and flexibility for suburban backyards.

Beyond fuel, product typology delineates the market into integrated built-in systems that blend seamlessly with outdoor cabinetry, freestanding grills that balance stability and design versatility, and portable units favored for tailgating or compact spaces. Distribution channels shape discovery and purchase behaviors, as consumers oscillate between experiential purchases in hypermarkets or specialty stores and the convenience of curated online storefronts. Offline touchpoints remain critical for tactile evaluation, yet online platforms are progressively augmenting decision support through user reviews and virtual demonstrations.

Price segmentation further stratifies offerings, where economy models target first-time buyers and budget-conscious households, mid-range products balance feature richness with affordability, and premium grills cater to enthusiasts willing to invest in advanced heat management and build quality. Material selection-between time-tested cast iron for its heat retention and evolving stainless steel alloys for corrosion resistance-reinforces brand positioning and long-term durability claims. Meanwhile, capacity configurations, ranging from single-burner mini-grills to expansive units with more than six burners, enable tailored solutions for varying household sizes and entertainment scales.

This comprehensive research report categorizes the Residential Cooking Grills market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Product Type

- Distribution Channel

- Material

- Capacity

Highlighting Distinct Growth Patterns and Strategic Opportunities Across the Americas EMEA and Asia-Pacific Residential Grill Markets

In the Americas, the United States leads with robust demand for high-end gas grills complemented by a thriving charcoal segment that echoes traditional barbecue culture. Canada mirrors these dynamics, albeit with greater emphasis on portable electric grills suited to condominium living and urban patios. Mexico’s market, by contrast, is gaining momentum in affordably priced charcoal and propane models as outdoor cooking becomes an integral part of leisure activities.

Europe, the Middle East, and Africa present a mosaic of preferences: Western European consumers increasingly favor sleek built-in stainless steel units that harmonize with contemporary terraces, while Eastern European markets show resilient appetite for no-frills charcoal models. In the Middle East, where outdoor hospitality is deeply ingrained, large-capacity gas grills are aligning with villa and resort developments. Across Africa, nascent demand is emerging from urbanizing populations seeking accessible grill options, though cost sensitivity remains high.

Asia-Pacific is characterized by divergent landscapes: Australia and New Zealand have embraced premium freestanding gas and hybrid grills driven by a culture of outdoor living, whereas Southeast Asian markets, challenged by supply-chain constraints, often rely on mid-range charcoal and portable gas units. In densely populated East Asian cities, electric grills are gaining ground indoors, thanks to compact designs and emission controls. These regional contours inform growth strategies, inventory planning, and channel investments for manufacturers targeting global scale.

This comprehensive research report examines key regions that drive the evolution of the Residential Cooking Grills market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into Key Competitive Dynamics and Strategic Moves by Leading Residential Cooking Grill Manufacturers Enhancing Product Portfolios and Market Reach

Leading players in the residential cooking grills domain have intensified their competitive postures through product diversification, strategic partnerships, and sustainability commitments. One global manufacturer has prioritized a portfolio expansion into pellet and infrared electric segments, leveraging proprietary technology to heighten temperature precision and ease of use. Another industry stalwart has deepened its presence in the premium gas grill arena by introducing modular attachments, enabling consumers to transform standard units into smokers or pizza ovens.

Strategic acquisitions have reshaped the competitive landscape as well. A recent merger between two established brands consolidated distribution networks across North America and Europe, while facilitating shared R&D resources for next-generation material coatings that resist corrosion and wear. Joint ventures between grill OEMs and digital startups have also surfaced, pooling expertise to integrate IoT functionalities such as remote flame control and recipe-guided grilling through smartphone apps.

Meanwhile, a rising company specializing in portable, solar-assisted electric grills has drawn venture capital interest, signifying investor confidence in eco-friendly and off-grid cooking solutions. Across the board, industry leaders are coalescing around circular economy principles, experimenting with recycled steel frames and bio-based plastics for side shelves to reduce environmental footprints while reinforcing brand ethos.

This comprehensive research report delivers an in-depth overview of the principal market players in the Residential Cooking Grills market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blackstone Products, Inc.

- Blaze Outdoor Products, LLC

- Broil King Limited

- Camp Chef, LLC

- Char-Broil LLC

- Cuisinart, Inc.

- Dyna-Glo Inc.

- George Foreman Grill Company

- Green Mountain Grills, Inc.

- Kalamazoo Outdoor Gourmet, Inc.

- Kenmore Appliances

- Lynx Grills, Inc.

- Masterbuilt Manufacturing, LLC

- Nexgrill Industries, Inc.

- Pit Boss Grills, LLC

- PK Grills LLC

- The Coleman Company, Inc.

- Traeger Pellet Grills, LLC

- Weber-Stephen Products LLC

- Wolf Steel Ltd.

Formulating Actionable Strategic Recommendations to Guide Industry Leaders in Adapting to Market Disruptions and Driving Sustainable Growth

To navigate the evolving grill market, industry leaders should prioritize the development of hybrid fuel systems that seamlessly switch between gas, electric, and charcoal modes, catering to a diverse user base. Concurrently, optimizing supply chains through dual-sourcing strategies and near-shoring initiatives can mitigate tariff exposure and logistical bottlenecks. It is paramount to engage directly with component suppliers to co-innovate advanced materials that offer superior corrosion resistance without escalating costs.

In parallel, brands must deepen engagement across digital channels by curating immersive online showrooms and leveraging augmented-reality applications that allow consumers to visualize grill installations in their outdoor spaces. Strengthening direct-to-consumer capabilities, including subscription-based maintenance services and loyalty programs, will foster long-term customer retention. On the product front, incorporating sustainable materials-such as recycled stainless steel and low-emission combustion chambers-will resonate with environmentally aware segments and preempt regulatory shifts.

Finally, adopting a tiered pricing architecture that spans economy, mid-range, and premium offerings ensures market coverage while preserving brand prestige. Investing in localized after-sales networks will further differentiate the value proposition, enabling swift support and promoting accessory sales. Through these strategic moves, executives can drive profitable growth and fortify their competitive moats in a dynamic, tariff-impacted environment.

Detailing the Robust Research Methodology Underpinning This Analysis Including Data Collection Expert Validation and Comprehensive Segmentation Techniques

This analysis is underpinned by a robust research methodology that integrates primary and secondary data, ensuring comprehensive coverage of market dynamics. The secondary research phase involved a systematic review of industry publications, government trade bulletins, and company disclosures to track regulatory changes, such as tariff announcements and material cost trends.

For primary insights, in-depth interviews were conducted with over twenty senior executives across grill OEMs, component suppliers, and channel partners to validate emerging product and distribution trends. Supplementary surveys targeting end consumers across key regions provided quantitative corroboration of purchase drivers and fuel-type preferences.

Data triangulation techniques were employed to reconcile varying estimates, while segmentation analysis leveraged fuel type, product type, distribution channel, price range, material, and capacity frameworks to ensure nuanced insights. Regional performance metrics were derived by mapping macro-economic indicators against grill adoption rates, and cross-checked with import/export statistics to capture supply-chain disruptions. This methodological rigor delivers a high-fidelity overview of the residential cooking grills market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Residential Cooking Grills market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Residential Cooking Grills Market, by Fuel Type

- Residential Cooking Grills Market, by Product Type

- Residential Cooking Grills Market, by Distribution Channel

- Residential Cooking Grills Market, by Material

- Residential Cooking Grills Market, by Capacity

- Residential Cooking Grills Market, by Region

- Residential Cooking Grills Market, by Group

- Residential Cooking Grills Market, by Country

- United States Residential Cooking Grills Market

- China Residential Cooking Grills Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Core Insights Driven by Market Trends Tariff Impacts and Regional Dynamics to Chart a Path Forward in Residential Cooking Grills

Against a backdrop of heightened consumer expectations, technological breakthroughs, and complex trade policies, the residential cooking grills market stands at a pivotal juncture. Sustainability concerns and smart-home integration have elevated performance and convenience to key purchase imperatives, encouraging manufacturers to innovate across fuel types and product categories.

Simultaneously, the imposition of layered tariffs in 2025 has recalibrated global supply chains, incentivizing near-shoring and supplier diversification to preserve margin structures. As brands vie for traction across evolving channels, segmentation insights reveal clear paths for targeting value-driven, performance-oriented, and premium buyers through tailored offerings.

Regional dynamics underscore the necessity of localized strategies, from the high-end American gas grill craze to the rising demand for compact electric solutions in East Asian urban centers. Meanwhile, competitive moves-from modular expansions to IoT partnerships-illustrate how industry leaders are shaping the future grill landscape.

By synthesizing these trends, executives can chart a strategic roadmap that anticipates regulatory shifts, meets nuanced consumer needs, and leverages technological advances, ensuring enduring success in this dynamic market.

Connect with Ketan Rohom to Access Exclusive Residential Cooking Grills Market Research Insights and Propel Strategic Decision-Making with a Comprehensive Report

To explore the full spectrum of strategic insights, in-depth regional analyses, and actionable recommendations captured in this comprehensive residential cooking grills market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. With specialized expertise in guiding business leaders through complex industry landscapes, Ketan is ready to provide tailored solutions, detailed briefings, and customized data extracts that align with your organization’s unique growth objectives. Engage today to secure your competitive advantage and drive informed decision-making supported by rigorous analysis and forward-looking projections.

- How big is the Residential Cooking Grills Market?

- What is the Residential Cooking Grills Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?