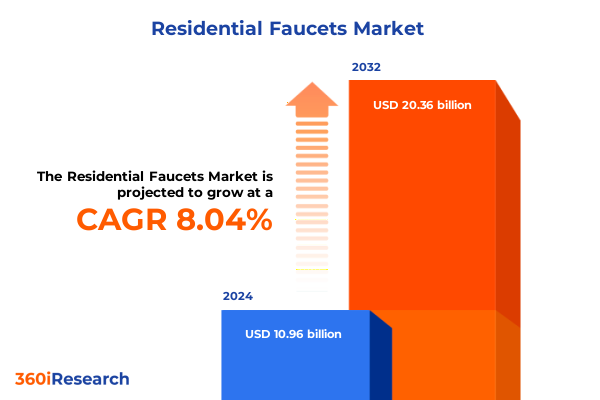

The Residential Faucets Market size was estimated at USD 11.80 billion in 2025 and expected to reach USD 12.71 billion in 2026, at a CAGR of 8.09% to reach USD 20.36 billion by 2032.

Introducing the Dynamic Residential Faucets Market That Is Shaped by Innovation, Consumer Expectations, Sustainability, and Evolving Industry Forces

The residential faucets industry stands at a pivotal juncture as evolving consumer preferences, stringent sustainability mandates, and rapid technological advancements redefine market dynamics. Homeowners now demand more than mere functionality; they seek fixtures that deliver precision performance, water conservation efficacy, and design sophistication. In parallel, regulatory frameworks at municipal and federal levels continue to tighten water usage standards, sharpening manufacturers’ focus on engineered flow optimization and low-consumption designs.

Against this backdrop, the executive summary offers a distilled overview of critical market developments, explores the forces reshaping competitive contours, and provides foundational context for stakeholders seeking to align strategic objectives with emerging opportunities. By synthesizing qualitative and quantitative findings from secondary research sources, industry interviews, and policy analyses, this section arms decision-makers with an informed understanding of where the market has been, where it stands today, and the key inflection points that will determine tomorrow’s winners.

Exploring How Water Conservation Mandates, Smart Technologies Integration, and Sustainable Material Innovations Transform the Residential Faucets Industry

As the residential faucets landscape evolves, three transformative shifts merit close attention. First, water conservation imperatives, driven by escalating municipal restrictions and consumer awareness, have prompted widespread adoption of aeration and flow-regulating technologies. Manufacturers are integrating advanced sensor mechanisms and precision valves to achieve flow rates at or below mandated thresholds without sacrificing user experience.

Second, the integration of smart home ecosystems has accelerated, with electronic faucets equipped with touchless activation, digital temperature controls, and app-enabled usage analytics emerging as premium differentiators. These features not only enhance hygiene but also empower end users with real-time insights into consumption patterns, facilitating proactive water management.

Finally, sustainability has become a core competitive axis. From the widespread use of recycled plastics and lead-free brass to eco-certified finishes, industry leaders are spotlighting materials and processes that reduce environmental footprints. As a result, product roadmaps increasingly prioritize life-cycle assessments and cradle-to-cradle certifications, anticipating future regulatory hurdles and allowing early movers to capture eco-conscious segments.

Assessing How U.S. Trade Policies and 2025 Tariff Adjustments Impact Cost Structures, Supply Chain Dynamics, and Competitive Strategies in Residential Faucets

The 2025 tariff environment has injected new complexity into cost structures and supply chain strategies for residential faucet manufacturers. In January, USTR announced tariff increases under Section 301 on certain Chinese-origin strategic goods, signaling sustained pressure on imported components and raw materials as part of a broader commitment to address perceived unfair trade practices. Concurrently, legislative proposals to revoke permanent normal trade relations with China and phase out the de minimis exemption have raised the prospect of minimum tariffs reaching 100 percent over the next five years.

These heightened duties have translated to material cost surges of up to 35 percent across key categories such as brass and stainless steel, amplifying margin pressures for producers and distributors alike. Many brands are navigating these headwinds by exploring tariff-exempt sourcing alternatives, including relocating certain production lines to Southeast Asia or Mexico. However, these reconfiguration efforts involve capital expenditures and lead-time extensions that further complicate near-term supply reliability.

In parallel, USTR’s extension of specific product exclusions from Section 301 duties through August 2025 offers brief relief for qualified imports, underscoring the importance of agile trade classification and proactive engagement with CBP guidance. For manufacturers, continuous monitoring of exclusion lists and tariff dialogues will remain vital to mitigating cost volatility, preserving competitive positioning, and ensuring uninterrupted product availability.

Uncovering Segmentation Insights That Reveal How Product Types, Material Selections, Installation Methods, Technology Options, Distribution Pathways, and Applications Shape the Residential Faucets Market

A nuanced understanding of market segmentation provides clarity on where growth and margin opportunities lie within the residential faucets landscape. Product type diversity ranges from traditional ball and compression washer faucets to disk, bridge, and advanced pull-out or pull-down designs, each catering to distinct performance and aesthetic requirements. Single handle solutions offer streamlined operation for modern décor preferences, while two handle configurations retain appeal among consumers seeking classic profiles.

Material selection exerts a profound influence on both cost and consumer perception. Brass remains the enduring choice for its durability and corrosion resistance, while chrome finishes deliver the polished appeal favored in contemporary kitchens and bathrooms. Stainless steel resonates with minimalist and industrial design themes, whereas bronze and plastic alternatives-particularly recycled plastic-address budget-conscious or eco-driven segments.

Installation options further diversify the landscape, spanning deck-mount configurations that suit DIY enthusiasts and wall-mount setups preferred in space-optimized environments. Buyers increasingly weigh electronic functionalities against manual operations, seeking touchless activation in high-traffic home areas to reduce cross-contamination risks. Distribution channels encompass traditional showrooms and plumbing wholesalers, yet online platforms, including brand websites and major e-commerce marketplaces, are gaining share. Finally, application contexts bifurcate between kitchen and bathroom usages, each with unique flow-profile and design expectations, informing R&D and marketing strategies for targeted portfolio development.

This comprehensive research report categorizes the Residential Faucets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Installation

- Technology

- Application

- Distribution Channel

Revealing Key Regional Market Nuances Across the Americas, Europe Middle East & Africa, and Asia Pacific That Influence Demand Patterns, Regulatory Dynamics, and Growth Opportunities in Residential Faucets

Regional dynamics exert a pronounced influence on residential faucets demand, shaped by regulatory frameworks, consumer preferences, and distribution infrastructure. In the Americas, particularly the United States and Canada, stringent water efficiency standards and robust home-improvement spending drive demand for certified low-flow and touchless solutions. Brand loyalty remains strong, yet digital channels are steadily displacing traditional dealer networks as consumers research and purchase online.

In Europe, Middle East & Africa, fragmented regulatory landscapes yield a mosaic of requirements, from EU-mandated water ratings to local plumbing codes in the Gulf region. Established European brands leverage proximity to design hubs and green building initiatives, while emerging markets in North Africa and the Levant demonstrate rising interest in premium finishes and smart-enabled fixtures as disposable incomes grow.

Asia-Pacific presents a dual narrative: mature economies such as Japan and Australia emphasize ultra-efficient technologies and localized manufacturing, whereas rapidly urbanizing markets in Southeast Asia and India show robust appetite for cost-competitive manual faucets and hybrid electronic models. Distribution in these regions balances modern retail expansion with deep-penetration traditional trade channels, underscoring the need for tailored go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Residential Faucets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies That Drive Innovation, Navigate Tariff Pressures, Embrace Sustainability, and Shape the Competitive Landscape in Residential Faucets

Market leadership in the residential faucets sector is defined by a blend of technological innovation, supply chain resilience, and sustainability credentials. Global players such as Moen and Delta leverage extensive R&D capabilities to introduce sensor-driven and antimicrobial finishes, while European incumbents including Grohe and Hansgrohe differentiate through design heritage, water-saving aerator technology, and prestigious green certifications.

North American stalwarts American Standard and Kohler continue to command significant distribution reach via integrated wholesaler networks and kitchen-and-bath showrooms, yet they are increasingly challenged by nimble niche innovators prioritizing eco-materials and digital customer interfaces. Asian manufacturers, with strong capabilities in cost-efficient production, are expanding their global footprints by forming strategic partnerships with local distributors and investing in after-sales support infrastructure to enhance brand equity.

Collaboration across the supply chain has emerged as a competitive advantage, with leading companies forging alliances for raw material sourcing to secure tariff-exempt inputs. Concurrently, merger and acquisition activity, particularly by private equity players targeting high-growth smart-fixture startups, is reshaping the competitive landscape and consolidating IP portfolios around next-generation faucet platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Residential Faucets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquaviva India Pvt. Ltd.

- Aquant

- Boyel Living

- Brondell, Inc.

- CERA

- Dornbracht AG & Co. KG

- Duravit AG

- Fortune Brands Innovations, Inc.

- Franke Holding AG

- Geberit International Sales AG

- Gessi S.p.A.

- Hindware Home Innovation Limited

- Jacuzzi Inc.

- Jaquar Group

- KEUCO GmbH & Co. KG

- Kohler Co.

- Kraus USA Plumbing LLC

- Lecico PLC

- LIXIL Corporation

- Masco Corporation

- Neoperl Group AG

- Paini (UK) Ltd.

- Roca Sanitario, S.A

- ROHL LLC

- Sloan Valve Company

- Spectrum Brands Holdings, Inc.

- TOTO Ltd.

- VitrA (UK) Limited

- Waterstone Faucets LLC

- Zurn Elkay Water Solutions Corporation

Providing Actionable Recommendations for Industry Leaders to Leverage Innovation, Diversify Supply Chains, Harness Sustainability, and Enhance Growth in the Residential Faucets Sector

To thrive in the evolving residential faucets market, industry leaders should prioritize four strategic imperatives. First, accelerate product modernization by embedding advanced sensor arrays, digital flow controls, and app-based consumption analytics into new faucets, thereby reinforcing water-efficiency credentials and addressing hygiene concerns in post-pandemic environments.

Second, diversify supply chain footprints to mitigate tariff risks and input cost volatility. This entails cultivating manufacturing or assembly partnerships in tariff-exempt geographies, optimizing trade classification processes, and engaging proactively with governmental agencies to secure duty exclusions for critical components.

Third, intensify sustainability differentiation through the adoption of recycled materials, lifecycle assessments, and eco-labels. By articulating transparent environmental claims and aligning with green building certifications, brands can capture rapidly growing eco-conscious consumer segments across North America and Western Europe.

Finally, fortify omnichannel strategies to meet customers where they engage. Integrating immersive digital product visualizers, virtual showrooms, and responsive e-commerce experiences alongside traditional distributor relationships will ensure broader market reach, boost conversion rates, and cultivate lasting brand loyalty.

Detailing the Rigorous Research Methodology, Data Sources, and Analytical Framework Employed to Deliver Reliable and Comprehensive Insights into the Residential Faucets Market

This research draws upon a rigorous, multi-stage methodology that integrates both primary and secondary data sources to ensure comprehensive market intelligence. Secondary research included an exhaustive review of trade publications, regulatory filings, and financial disclosures, enabling robust contextual understanding of industry trajectories and policy shifts.

Primary insights were obtained through in-depth interviews with senior executives at leading manufacturers, distributors, and water efficiency advocacy groups, ensuring that executive perspectives inform interpretations of emerging technology adoption and supply chain reconfiguration. Quantitative data points were triangulated against publicly available customs and trade statistics to validate tariff impact assessments and regional demand patterns.

All data underwent systematic validation through cross-referencing multiple authoritative sources, coupled with sensitivity analyses to account for potential variances in raw material pricing and trade policy enactments. Furthermore, the forecast assumptions were stress‒tested to reflect scenario permutations, ranging from rapid tariff rollbacks to accelerated environmental regulation, reinforcing the adaptive utility of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Residential Faucets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Residential Faucets Market, by Product Type

- Residential Faucets Market, by Material

- Residential Faucets Market, by Installation

- Residential Faucets Market, by Technology

- Residential Faucets Market, by Application

- Residential Faucets Market, by Distribution Channel

- Residential Faucets Market, by Region

- Residential Faucets Market, by Group

- Residential Faucets Market, by Country

- United States Residential Faucets Market

- China Residential Faucets Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Critical Conclusions that Contextualize Market Forces, Innovation Trends, Regulatory Impacts, and Strategic Imperatives Shaping the Future of Residential Faucets

In conclusion, the residential faucets market is being reshaped by the confluence of regulatory pressures, technological innovation, and shifting consumer priorities. Water conservation mandates and smart home integration are no longer optional features but core differentiators that dictate competitive viability. Concurrently, trade policy uncertainties, specifically evolving tariff regimes, continue to influence cost structures and strategic sourcing decisions.

Looking ahead, manufacturers that couple agile supply chain management with sustainability-driven product roadmaps will be best positioned to capture emerging opportunities. Regional variations underscore the necessity of tailored market-entry approaches, while collaborative partnerships-whether through strategic alliances or targeted acquisitions-will unlock access to advanced IP and specialized distribution channels.

Ultimately, the ability to blend engineering excellence, environmental stewardship, and digital engagement will define the next generation of residential faucets, delivering value for end users and sustainable growth for industry players alike.

Connect with Ketan Rohom To Unlock Comprehensive Market Insights and Elevate Strategic Decisions with a Customized Residential Faucets Market Research Report

If you are ready to deepen your understanding of the residential faucets market and drive your strategic initiatives with unparalleled intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through tailored research objectives, clarify your unique business questions, and ensure you secure the comprehensive market research report that provides the actionable insights you need. Whether you aim to optimize product portfolios, navigate evolving tariffs, or capitalize on regional growth opportunities, Ketan will deliver a seamless purchasing experience and demonstrate how this report can empower your decision-making and accelerate competitive advantage

- How big is the Residential Faucets Market?

- What is the Residential Faucets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?