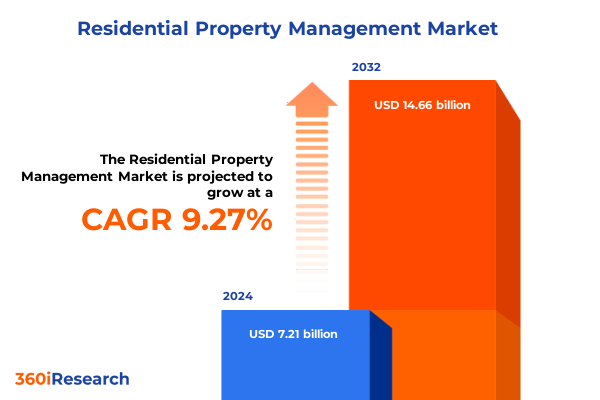

The Residential Property Management Market size was estimated at USD 7.84 billion in 2025 and expected to reach USD 8.54 billion in 2026, at a CAGR of 9.33% to reach USD 14.66 billion by 2032.

Forging the Foundation for a New Era of Residential Property Management in a Rapidly Evolving Technological and Regulatory Environment

The landscape of residential property management stands at the cusp of profound transformation, influenced by rapidly evolving technologies, shifting regulatory frameworks, and heightened tenant expectations. As urbanization intensifies and rental markets expand, providers must balance operational efficiency, cost containment, and service quality to remain competitive. This introduction presents a high-level perspective on the forces reshaping the sector, from digital integration in day-to-day operations to the growing imperative of sustainability and compliance.

Drawing upon cross-industry parallels and emerging best practices, this analysis underscores the critical importance of data-driven decision-making. It highlights how property managers are leveraging advanced analytics to gain real-time visibility into portfolio performance, preempt maintenance needs, and optimize resource allocation. In parallel, the rising emphasis on personalized tenant experiences is driving the adoption of seamless communication platforms and automated workflows, setting new benchmarks for responsiveness and satisfaction.

Ultimately, this introduction serves as the foundation for the ensuing sections, which will collectively explore the most consequential shifts in technology, policy, segmentation, regional dynamics, and industry leadership strategies. By framing the primary challenges and opportunities facing residential property managers in 2025, this section sets the stage for a detailed executive summary that equips stakeholders with the insights necessary to navigate a complex and dynamic market.

Identifying Paradigm-Shifting Innovations and Market Dynamics Redefining Residential Property Management Operations Across the Value Chain and Stakeholder Engagement Ecosystems

The residential property management sector is experiencing transformative shifts driven by the rapid integration of digital tools and next-generation service models. PropTech innovations such as IoT-enabled maintenance sensors, AI-powered tenant engagement platforms, and predictive analytics engines are revolutionizing traditional workflows. These technologies enable property managers to anticipate maintenance issues before they escalate, streamline lease management processes, and deliver personalized communication channels that enhance tenant retention and satisfaction.

In parallel, the industry is adapting to a surge in demand for sustainable practices and green building certifications, prompting managers to incorporate energy management systems and waste reduction protocols. Regulatory pressures are intensifying as governments introduce stricter energy efficiency standards and tenant protection laws. This evolving compliance landscape is compelling organizations to invest in robust policy management frameworks and to forge closer partnerships with legal advisors to ensure adherence while maintaining agility.

Concurrently, demographic and social trends-such as remote work proliferation, multigenerational living arrangements, and a growing preference for flexible leasing options-are reshaping service delivery paradigms. Property management firms are responding with modular leasing models, enhanced amenity offerings, and digital concierge services that cater to diverse tenant needs. Together, these forces are redefining the competitive environment, compelling stakeholders to innovate both their operational strategies and customer engagement approaches.

Analyzing the Comprehensive Impact of 2025 United States Tariff Policies on Residential Property Management Supply Chains and Operational Expenditures

In 2025, the cumulative impact of United States tariff policies has significantly influenced residential property management supply chains and cost structures. Tariffs imposed on essential construction materials-such as steel, aluminum, and select wood imports-have elevated procurement expenses for property upgrades and routine maintenance. As a result, managers are reevaluating vendor agreements, increasing reliance on domestic suppliers, and exploring alternative material options to mitigate price volatility.

This tariff-driven cost pressure has also accelerated the adoption of technology-driven maintenance solutions that reduce material dependency. Predictive maintenance algorithms and 3D printing of custom components are being piloted to minimize downtime and control expenses. Moreover, some firms are renegotiating service contracts to incorporate shared-risk models, aligning maintenance provider incentives with performance outcomes and cost-efficiency goals.

Beyond materials, tariffs on electronic components have reverberated through building automation and security systems procurement. Property management teams are balancing the trade-offs between advanced feature sets and the escalating total cost of ownership by prioritizing modular, scalable platforms. These strategic responses underscore the importance of agility and proactive planning in managing the financial fallout of trade policy shifts.

Uncovering Critical Segmentation Insights to Navigate Service Offerings, Ownership Models, Contract Durations, and Deployment Preferences in Residential Management

Critical segmentation insights reveal distinct preferences and investment patterns across different service and software offerings, ownership structures, contract durations, and deployment modes. When examining the landscape based on offering, it becomes clear that managed services and professional services each address unique operational challenges: managed services excel in end-to-end facilities management, whereas professional services-spanning customer support, onboarding, SLA management, and training & consulting-focus on enhancing process maturity and tenant satisfaction. Parallel to these, software solutions for lease management, marketing & tenant communication, property maintenance & facility management, reporting & analytics, and security & payments are gaining traction as the digital backbone of modern portfolios.

Ownership-based segmentation further delineates the market into in-house and third-party management models. In-house teams prioritize direct control and integration with broader corporate systems, while third-party providers leverage economies of scale and specialized expertise to deliver outsourcing efficiencies. This contrast underscores a growing dilemma for property owners: whether to cultivate internal capabilities or to partner with specialized service providers capable of rapid innovation and market responsiveness.

Duration-based segmentation highlights the strategic trade-offs between long-term contracts, which offer stability and predictable revenue streams, and short-term agreements that enable flexibility and responsiveness to market fluctuations. Meanwhile, deployment mode segmentation shows an accelerating shift to on-cloud solutions due to their scalability, lower upfront investment, and ease of updates, even as certain portfolios retain on-premise deployments for enhanced data sovereignty and security control. Together, these segmentation insights inform tailored strategies for capturing value in each niche of the market.

This comprehensive research report categorizes the Residential Property Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Ownership

- Duration

- Deployment Mode

Mapping Regional Variations in Residential Property Management Demand and Service Adoption Trends Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in residential property management underscore varied adoption rates and strategic priorities across the Americas, EMEA, and Asia-Pacific. In the Americas, mature markets exhibit high digital penetration and advanced analytics usage, driven by tenant demand for seamless digital experiences and regulatory incentives for energy efficiency upgrades. This environment fosters innovation in tenant engagement platforms and smart building integrations, with leading firms experimenting with AI-driven tenant portals and blockchain-based lease execution to streamline processes.

Europe, the Middle East & Africa present a patchwork of regulatory frameworks and economic conditions that shape divergent management approaches. Western European markets focus heavily on sustainable building certifications and tenant protection legislation, prompting deeper investments in ESG compliance and stakeholder reporting. In contrast, emerging markets in EMEA demonstrate rapid urbanization but face challenges in consistency of regulatory enforcement, leading firms to prioritize scalability and risk mitigation when expanding across multiple jurisdictions.

Asia-Pacific is characterized by rapid urban growth, evolving homeownership models, and strong consumer appetite for technology-enabled services. In regions such as Southeast Asia, rising incomes and digital-first lifestyles support the proliferation of app-based tenant services and seamless payment solutions. Meanwhile, developed economies in the region push toward fully integrated, tech-forward property management ecosystems, with a particular emphasis on IoT-enabled facility management and AI-led predictive maintenance to optimize operational efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Residential Property Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Companies Shaping the Future of Residential Property Management Globally

Across the competitive landscape, leading companies are executing diverse strategies to cement their market positions. A number of established facility management providers are extending their portfolios by integrating advanced software suites that unify lease administration, tenant communication, and maintenance workflows into a single platform. These offerings often feature cloud-native architectures, modular add-ons, and API-driven integrations that appeal to enterprise-scale portfolios.

Meanwhile, specialist software vendors are deepening their product roadmaps with AI-enhanced analytics, automated marketing tools, and robust reporting functionalities to address the growing demand for actionable insights. Strategic partnerships between tech-focused startups and traditional service providers are becoming increasingly common, enabling rapid go-to-market for innovative capabilities while leveraging longstanding client relationships and operational expertise.

In addition, mergers and acquisitions activity has accelerated as firms seek to expand geographic footprints and diversify service lines. Companies with strong regional presence in high-growth markets have become attractive targets for global investors aiming to establish immediate market access. This M&A momentum highlights the sector’s recognition that scale, integrated service models, and technological differentiation are key drivers of sustainable competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Residential Property Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AppFolio, Inc.

- Building Engines, Inc.

- CBRE, Inc.

- CommunityVibe, Inc.

- Console Group

- CoreLogic, Inc.

- Entrata, Inc.

- Greystar Worldwide, LLC

- GuestPoint Software

- Hemlane Inc.

- IQware Inc.

- LeaseHawk

- London Computer Systems, Inc.

- ManageCasa Inc.

- MRI Software, LLC

- Nexus Systems, LLC

- OnSite Property Manager

- Oracle Corporation

- Property Boulevard, Inc.

- PropertyBoss Solutions

- RealPage, Inc.

- Rentec Direct

- RentMaster, Inc.

- ResMan, LLC

- SimplifyEm Inc.

- Tenant Cloud

- Yardi Systems, Inc.

- Zoho Corporation

Delivering Actionable Recommendations for Industry Leaders to Accelerate Growth, Enhance Operational Resilience, and Strengthen Competitive Advantage

Industry leaders must adopt a proactive, multifaceted approach to capitalize on emerging opportunities and to buffer against market uncertainties. First, investing in integrated technology platforms that converge property maintenance, tenant engagement, and data analytics will create operational synergies and enhance decision-making agility. By selecting solutions with open APIs and modular design, organizations can future-proof their technology stacks and avoid vendor lock-in.

Second, diversifying supply chains and forging strategic partnerships with domestic and nearshore suppliers will mitigate the inflationary pressures of trade policies and tariffs. Establishing collaborative frameworks that align maintenance providers’ incentives with performance metrics ensures cost-effective service delivery and higher tenant satisfaction. Similarly, implementing predictive maintenance programs driven by real-time sensor data can substantially reduce unplanned downtime and repair costs.

Finally, developing a balanced portfolio of contract durations and deployment modes allows firms to capture value across multiple customer segments. Long-term agreements provide predictable revenue streams and facilitate deeper tenant relationships, while short-term and on-cloud options offer flexibility and rapid scalability. Coupled with a robust ESG strategy that integrates sustainable building practices and transparent reporting, these recommendations will empower leaders to achieve resilient growth and a differentiated market position.

Outlining Rigorous Research Methodologies and Analytical Frameworks Ensuring Robust Insights and Data Integrity in Residential Property Management Studies

This research harnesses a robust, multi-stage methodology to ensure rigor, validity, and comprehensive coverage. The process began with an exhaustive secondary research phase, examining industry reports, regulatory filings, publicly available financial statements, and white papers from credible sources. This laid the groundwork for mapping market structure, identifying key players, and understanding high-level trends.

Building upon this foundation, a series of primary interviews were conducted with senior executives, property management practitioners, technology vendors, and end-user representatives across major regions. These qualitative discussions provided nuanced perspectives on operational challenges, technology adoption drivers, and strategic priorities. Concurrently, quantitative surveys were administered to a broad cross-section of portfolio managers and tenants to validate market sizing hypotheses and segmentation assumptions.

Insights were triangulated through data modeling and multi-variable analysis, employing both descriptive and inferential statistical techniques. The research further incorporated benchmarking against regional regulatory standards and sustainability benchmarks to contextualize findings. Finally, the segmentation framework was stress-tested through scenario analysis to ensure alignment with evolving market conditions and stakeholder expectations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Residential Property Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Residential Property Management Market, by Offering

- Residential Property Management Market, by Ownership

- Residential Property Management Market, by Duration

- Residential Property Management Market, by Deployment Mode

- Residential Property Management Market, by Region

- Residential Property Management Market, by Group

- Residential Property Management Market, by Country

- United States Residential Property Management Market

- China Residential Property Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Implications to Empower Stakeholders with a Holistic Understanding of Residential Property Management Dynamics

In conclusion, the residential property management industry is undergoing a fundamental evolution driven by technological innovation, shifting regulatory landscapes, and dynamic tenant preferences. The sector’s capacity to harness advanced analytics, embrace digital collaboration tools, and adopt sustainable practices will be pivotal to long-term success. Furthermore, the impact of 2025 U.S. tariffs underscores the necessity for agile supply chain strategies and cost management frameworks.

Key segmentation and regional insights highlight diverse growth pathways, from cloud-native software adoption in the Americas to ESG-focused portfolios in Europe and rapid technology integration across Asia-Pacific. Competitive dynamics reveal that only those organizations combining scale with differentiated offerings and strategic alliances will capture the highest value. Consequently, decision-makers must calibrate their strategies to align with these multifaceted market realities.

By synthesizing these findings, stakeholders are equipped with a holistic understanding of the forces shaping residential property management. This knowledge base enables property owners, service providers, and technology vendors to craft informed roadmaps, prioritize investments, and deliver elevated tenant experiences while safeguarding operational resilience.

Energizing Engagement and Driving Decision-Making with a Direct Call to Collaborate for In-Depth Residential Property Management Intelligence and Insights

Are you poised to transform your residential property management strategy with unparalleled insights and guidance? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure the full market research report that will drive your operational excellence and competitive edge.

This comprehensive study delves into the most critical trends, landmark case studies, and sector-wide analyses designed to help you make informed decisions. By partnering with Ketan Rohom, you will gain exclusive access to in-depth data, tailored strategic recommendations, and interactive consultation tailored to your organization’s needs. Empower your leadership and accelerate growth with a report tailored for actionable outcomes.

- How big is the Residential Property Management Market?

- What is the Residential Property Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?