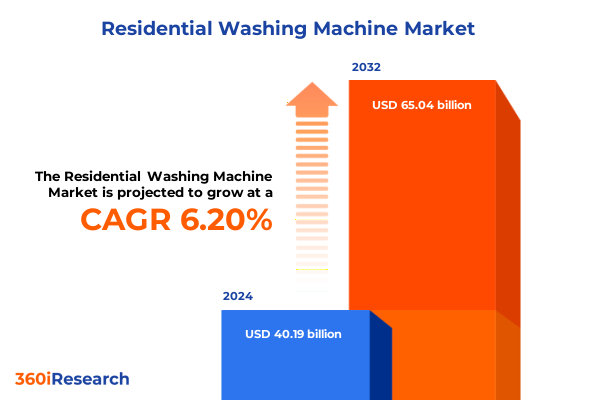

The Residential Washing Machine Market size was estimated at USD 51.15 billion in 2025 and expected to reach USD 53.79 billion in 2026, at a CAGR of 5.43% to reach USD 74.08 billion by 2032.

Pioneering the Future of Home Care: Understanding the Evolving Role of Residential Washing Machines in a Digitally Driven Market

Residents and businesses alike are witnessing an evolution in how laundry is managed at home. No longer simple mechanical devices, modern washing machines have transformed into sophisticated systems that integrate software, sensors, and connectivity. This shift is driven by the pursuit of convenience, energy efficiency, and sleek aesthetic appeal. Leading brands are racing to deliver appliances that not only clean clothes effectively but also enhance daily routines through personalized settings and smart diagnostics.

Consumer expectations have never been higher. As households juggle busy schedules, the demand for wash cycles tailored to fabric type, soil level, and load size has soared. Toward this end, innovations such as AI-driven wash algorithms and IoT-enabled remote control are rapidly gaining traction. Energy Star certification remains a pivotal consideration for cost-conscious and environmentally aware buyers, making energy rating a key differentiator in purchasing decisions.

Furthermore, global trade actions and tariff fluctuations are reshaping supply chains and pricing dynamics. Manufacturers and retailers must now balance the benefits of advanced features with the impact of import duties on production costs. This delicate interplay between technology, consumer demand, and regulatory measures sets the stage for a dynamic market landscape that calls for a comprehensive assessment of current and emerging trends.

Navigating the Whirlpool of Innovation: Transformative Technological, Consumer and Sustainability Shifts Redefining Residential Laundry Appliances

The residential washing machine industry is currently in the grip of multiple transformative currents. Foremost among these is the integration of artificial intelligence, which has enabled appliances to learn user preferences and optimize cycle parameters in real time. Adaptive algorithms now detect fabric weight and material type, automatically adjusting water levels and drum motion to maximize cleaning performance while preserving clothing quality. Alongside AI, the infusion of advanced sensor technologies has opened the door to predictive maintenance, allowing households to receive timely alerts for potential mechanical issues before they escalate.

Converging with digitization is the growing imperative for sustainability. Manufacturers are embedding eco-friendly materials and water-saving features into new models, cognizant of both regulatory pressures and rising consumer eco-consciousness. Enhanced wash cycles that reduce energy consumption by up to 20% are becoming staples in premium lines. Meanwhile, user engagement is being reshaped by seamless connectivity: touchscreens, mobile apps, and voice assistants are bridging the interaction gap between consumers and their appliances, offering unprecedented control and convenience.

Supply chain resilience has also emerged as a critical priority. Recent policy shifts have highlighted the vulnerability of global sourcing networks, prompting manufacturers to diversify component procurement and invest in regional production capabilities. Collectively, these technological, environmental, and logistical shifts are redefining what consumers expect from their laundry appliances, demanding a strategic response from industry players.

Assessing the Ripple Effects of United States 2025 Trade Measures on Production Costs, Consumer Prices and Domestic Manufacturing Dynamics

Since the imposition of steep import duties on large residential washing machines in January 2018, the United States has experienced marked changes in both manufacturing and consumer price behavior. Initial duties of 20%, escalating to 50% after import quotas were reached, were credited with spurring domestic production capacity and creating thousands of new jobs in Tennessee and South Carolina. By the tariffs’ expiration in early 2023, the industry had not only expanded its workforce but also strengthened its competitive position without enduring long-term price increases for consumers.

However, the trade environment remains fluid. As of June 23, 2025, an additional 50% tariff on the steel and aluminum content of imported appliances, including washing machines, has further altered cost structures. These material duties are raising the landed cost of entries across the segment, prompting manufacturers to reevaluate sourcing strategies and pushing some to seek exemptions or to establish localized supply partnerships.

Consumer prices have likewise been affected. While industry data suggest that prices stabilized after the initial tariff surge, recent reports indicate that major suppliers like LG Electronics are planning retail price increases in the range of 4–8% to offset the combined impact of constituent tariffs and higher input costs. This adjustment reflects both direct duty pass-through and broader inflationary pressures related to tariff-induced supply constraints. Concurrently, economists caution that the sustained effective tariff rate, now exceeding 20% on key washing machine imports, could continue to feed into consumer price indexes and influence purchasing behavior in the months ahead.

In summary, U.S. trade measures enacted between 2018 and mid-2025 have jointly driven a renaissance in domestic manufacturing while also introducing new layers of cost and complexity that industry participants must carefully manage.

Illuminating Key Consumer Profiles Through Segmentation Insights Spanning Type, Capacity, Energy Efficiency, Price Range, Design and Distribution Channels

The residential washing machine market can be dissected through several critical lenses that reveal distinct consumer behaviors and purchasing rationales. By differentiating between fully automatic and semi-automatic product types, it becomes evident that families seeking minimal intervention and convenient programmability gravitate toward fully automatic units, while value-focused buyers often select semi-automatic models for their affordability and straightforward operation. Similarly, capacity segmentation highlights varied household needs: those with moderate laundry demands frequently opt for machines in the 5–7 kg range, whereas larger families look to above 7 kg solutions to minimize cycle frequency, and occasional users find below 5 kg units appealing for compact spaces and light wash loads.

Energy efficiency ratings have emerged as a powerful decision driver. A rising proportion of consumers set their sights on 4-star and 5-star models, drawn by the promise of reduced utility bills and lower environmental impact, although 3-star machines still hold a place among budget-conscious buyers prioritizing upfront cost savings. Price range delineations further segment the market into economy, mid-range, and premium tranches. Entry-level offerings attract highly price-sensitive segments in emerging regions, mid-range designs balance features and cost for mainstream markets, and premium appliances deliver the cutting edge in AI-driven cycles, noise reduction, and durability for high-end consumers.

Design format also shapes purchasing paths. Front-load configurations, valued for their water efficiency and gentle fabric care, compete with top-load alternatives that emphasize ease of loading and shorter wash cycles. Finally, distribution channels delineate the shopping experience: offline channels continue to provide tactile reassurance and immediate post-purchase support, while online platforms drive growth through convenience, broader selection, and digital personalization tools that guide consumers to the optimal configuration for their needs.

This comprehensive research report categorizes the Residential Washing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Loading Configuration

- Capacity

- Automation Level

- Price Range

- Drive System

- Installation Form Factor

- Distribution Channel

- User

Unveiling Regional Nuances Shaping Residential Laundry Appliance Demand Across The Americas, Europe Middle East & Africa, and Asia Pacific Markets

Geography plays a decisive role in shaping preferences and adoption rates for residential washing appliances. In the Americas, particularly the United States and Canada, consumers demonstrate a high affinity for premium, feature-rich machines that integrate smart capabilities and energy-saving functions. This region’s established retail infrastructure and financing options further support uptake of higher-priced models, while the strong presence of local manufacturing facilities reduces lead times and alleviates tariff exposure.

In Europe, the Middle East, and Africa, the market exhibits a nuanced interplay between quality expectations and economic constraints. Western European buyers increasingly demand front-load variants with advanced water-conservation technologies to comply with stringent environmental regulations, whereas in emerging Gulf and African markets, affordability remains paramount, driving sales of economy and mid-range top-load machines. Distribution channels in these areas also vary markedly: mature retail networks in Europe coexist with a burgeoning online presence in the Middle East and select African urban centers, underscoring the need for a hybrid go-to-market approach.

The Asia-Pacific region stands out for its rapid urbanization and evolving consumer lifestyles. Capacity choices trend upward, with above 7 kg models gaining traction in multi-generational households. Price sensitivity encourages a strong showing for mid-range products, but the region’s technology hubs in South Korea, Japan, and China also serve as test beds for AI-enabled wash cycles and connected appliance ecosystems. E-commerce giants and digital marketplaces exert considerable influence, enabling consumers to compare features, read peer reviews, and complete purchases with unprecedented ease.

This comprehensive research report examines key regions that drive the evolution of the Residential Washing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Positions And Innovations Of Leading Players In The Competitive Residential Washing Machine Industry Landscape

The competitive landscape of residential washing machines is anchored by a cadre of global and regional players, each leveraging unique strengths to capture market share. Samsung Electronics has distinguished itself through aggressive deployment of AI Wash, AI Energy Mode, and vibration-reduction technologies, reinforcing its reputation as a pioneer in seamless connectivity and performance optimization. LG Electronics follows closely, focusing on premium front-load and top-load lines that emphasize quiet operation and advanced drum systems, while simultaneously addressing cost pressures stemming from recent tariff actions by refining its supply chain and negotiating localized production partnerships.

Whirlpool Corporation maintains a strong foothold by emphasizing reliability and expansive after-sales support. Its washing machines frequently feature in top consumer rankings for their robust build quality and ease of maintenance. Emerging contenders like Haier and Electrolux capitalize on agile manufacturing processes to introduce targeted models for diverse regional segments, ranging from ultra-efficient compact units to large-capacity, family-oriented designs. Meanwhile, heritage brands such as Maytag and GE Appliances continue to leverage brand loyalty among long-standing customer bases, often bundling extended warranties and service plans to differentiate within the mid-range price band.

Across the board, these key players are intensifying collaboration with digital platforms and exploring direct-to-consumer initiatives, recognizing that consumer engagement increasingly begins online. Strategic partnerships for smart home interoperability, extended reality-enabled troubleshooting, and subscription-based detergent replenishment services are emerging as critical battlegrounds for differentiation in the coming years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Residential Washing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Haier Smart Home Co., Ltd.

- Samsung Electronics Co., Ltd.

- Hisense Group Co., Ltd.

- Midea Group Co., Ltd.

- Whirlpool Corporation

- BSH Hausgeräte GmbH

- LG Electronics Inc.

- Godrej & Boyce Manufacturing Company Limited

- Alliance Laundry Systems LLC

- Amica S.A.

- Arçelik A.Ş.

- Avanti Products LLC

- Electrolux AB

- Feilong Home Appliance

- Gree Electric Appliances Inc.

- Hitachi, Ltd.

- IFB Industries Limited

- Miele & Cie. KG

- MIRC Electronics Limited

- Ningbo Haifei Electrical Appliance Co., Ltd.

- Ningbo Kingsun Group Co.,Ltd.

- Panasonic Holding Corporation

- Robert Bosch GmbH

- Skyworth Group Co., Ltd.

- Smeg S.p.A.

- TCL Technology Group Corporation

- Vestel Elektronik Sanayi ve Ticaret A.Ş.

- Winia Electronics

- Wuxi Risen Electrical Appliances Co., Ltd.

- Xiaomi Corporation

- Zhongshan Donlim Weili Electrical Appliances Co., Ltd.

Actionable Recommendations Empowering Industry Leaders To Navigate Disruptions And Capitalize On Emerging Opportunities In The Washing Machine Sector

To thrive in an ever-evolving market, industry leaders should accelerate investment in artificial intelligence and machine learning capabilities that personalize wash cycles and offer predictive maintenance. By integrating real-time data analytics and user-behavior insights, manufacturers can deliver differentiated value propositions that resonate with tech-savvy consumers. Parallel to this, establishing redundant and localized component supply chains will mitigate the impact of tariff volatility and ensure production agility in the face of shifting trade policies.

Sustainability must remain at the forefront of product development. Embracing advanced materials, closed-loop water systems, and next-generation detergents will satisfy regulatory imperatives and align with growing consumer demand for responsible consumption. Complementing eco-friendly design with transparent lifecycle footprint disclosures can strengthen brand credibility and foster customer loyalty. Furthermore, a balanced product portfolio that spans economy, mid-range, and premium segments will enable companies to capture broader demographic cohorts and buffer against economic downturns.

Finally, bolstering omnichannel capabilities is essential. Seamless integration between online configurators, augmented reality-based in-home placement tools, and immersive retail experiences will reduce purchase friction and reinforce brand differentiation. Investing in subscription services-such as detergent auto-replenishment-and expanded warranty options will generate recurring revenue streams and deepen consumer relationships. Collectively, these strategic actions will position industry leaders to capitalize on emerging opportunities and navigate disruptions with confidence.

Ensuring Rigor And Transparency Through A Comprehensive Research Methodology Spanning Data Sources, Validation Techniques And Analytical Frameworks

Our research methodology combines rigorous primary data collection with comprehensive secondary source analysis to ensure validity, depth, and practical relevance. Primary inputs include structured interviews with senior executives from leading appliance manufacturers, distributors, and industry associations, complemented by consumer surveys that elucidate behavioral drivers across demographic segments.

Secondary research spans a wide array of reputable publications, trade journals, regulatory filings, and corporate disclosures, bolstered by detailed examination of recent tariff notifications, energy-rating databases, and patent filings. Data points are triangulated through multiple independent sources to reduce bias and to confirm consistency.

Analytical frameworks such as SWOT assessments, Porter’s Five Forces analysis, and scenario forecasting are applied to interpret qualitative insights and to surface strategic imperatives. Rigorous statistical validation-incorporating trend extrapolation and sensitivity testing-underpins our sectoral comparisons and competitive benchmarking. Throughout, a multi-stage review process with external experts and in-house quality assurance teams ensures analytical transparency and methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Residential Washing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Residential Washing Machine Market, by Product Type

- Residential Washing Machine Market, by Loading Configuration

- Residential Washing Machine Market, by Capacity

- Residential Washing Machine Market, by Automation Level

- Residential Washing Machine Market, by Price Range

- Residential Washing Machine Market, by Drive System

- Residential Washing Machine Market, by Installation Form Factor

- Residential Washing Machine Market, by Distribution Channel

- Residential Washing Machine Market, by User

- Residential Washing Machine Market, by Region

- Residential Washing Machine Market, by Group

- Residential Washing Machine Market, by Country

- United States Residential Washing Machine Market

- China Residential Washing Machine Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3180 ]

Concluding Perspectives On The Dynamic Residential Washing Machine Market Emphasizing Strategic Insights And Future-Proof Considerations

In conclusion, the residential washing machine market is navigating a period of profound transformation, driven by rapid technological adoption, shifting consumer priorities, and evolving trade regulations. Stakeholders must remain vigilant to the interplay between AI-enabled innovation, sustainability mandates, and regional market idiosyncrasies to maintain competitive advantage.

The resurgence of domestic manufacturing, coupled with the continued influence of import duties, underscores the importance of flexible supply chains and dynamic pricing strategies. Segmentation clarity-from product type and capacity to energy rating and distribution channels-will enable more precise targeting and efficient resource allocation. Ultimately, companies that balance cutting-edge technological integration with strategic market segmentation and robust operational resilience will be best positioned to capture value in this dynamic landscape.

Seize Your Competitive Edge Today By Partnering With Ketan Rohom For Exclusive Access To A Definitive Residential Washing Machine Market Research Report

Ready to gain a competitive edge and uncover critical market intelligence? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, and secure your copy of the comprehensive residential washing machine market research report. By partnering with an experienced expert in appliance market dynamics, you will obtain exclusive access to in-depth analyses, actionable insights, and tailored strategic guidance designed to drive growth and innovation.

Contact Ketan today to discuss how this report can support your business objectives, enhance your product road map, and empower your team with the data needed to thrive in an increasingly competitive landscape. Act now to transform opportunities into measurable results and position your organization at the forefront of the residential washing machine industry.

- How big is the Residential Washing Machine Market?

- What is the Residential Washing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?