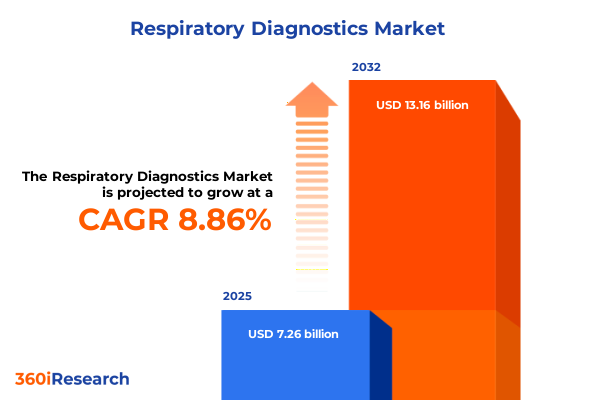

The Respiratory Diagnostics Market size was estimated at USD 7.26 billion in 2025 and expected to reach USD 7.86 billion in 2026, at a CAGR of 8.86% to reach USD 13.16 billion by 2032.

A Deep Dive into the Current Respiratory Diagnostics Landscape Revealing Foundational Trends and Emerging Opportunities for Stakeholders

The global respiratory diagnostics sector stands at the nexus of technological innovation and clinical necessity, driven by the growing prevalence of chronic respiratory diseases and an urgent need for early and accurate detection. Over recent years, the escalation in respiratory conditions such as COPD, asthma, and pulmonary fibrosis has underscored the importance of reliable diagnostic modalities deployable in both centralized laboratories and decentralized settings. Moreover, the lingering impact of the COVID-19 pandemic has accelerated investments in rapid testing platforms and remote monitoring solutions, intensifying focus on agile diagnostic workflows.

Transitioning from traditional laboratory-based assays to fully integrated diagnostic platforms, the landscape now encompasses a diverse array of testing approaches, ranging from molecular diagnostics through PCR and antigen assays to advanced imaging techniques such as low-dose CT. In parallel, regulatory authorities have introduced streamlined pathways that facilitate expedited approval for innovative respiratory diagnostic tools, without compromising patient safety. Consequently, stakeholders are presented with an evolving ecosystem in which collaboration among device manufacturers, software developers, and healthcare providers is paramount for driving clinical adoption and creating seamless patient journeys.

Furthermore, demographic shifts characterized by an aging population and rising environmental challenges, including increasing levels of air pollution and occupational exposures, continue to exert pressure on healthcare systems to adopt more sophisticated diagnostic protocols. As a result, providers and payers are reevaluating existing screening paradigms, seeking solutions that deliver both clinical efficacy and economic efficiency. This introduction frames the foundational trends and emerging opportunities that will guide strategic decision-making in the respiratory diagnostics arena.

How Technological Innovation and Patient-Centric Care Models Are Reshaping the Respiratory Diagnostics Sector into a New Era of Precision Medicine

Technological breakthroughs and a shift toward patient-centric care models are collectively transforming respiratory diagnostics into a precision medicine discipline. Artificial intelligence–driven algorithms now analyze high-resolution imaging and pulmonary function data to detect subtle pathophysiological changes, enabling clinicians to intervene earlier in disease progression. Simultaneously, miniaturized biosensors and wearable devices are extending diagnostic reach beyond clinical walls, allowing continuous monitoring of physiological parameters such as blood oxygen saturation and respiratory rate in real-time.

In addition, the integration of telehealth platforms with point-of-care diagnostic solutions has fostered new care pathways, particularly in rural and underserved communities where access to specialist services remains limited. This convergence of digital health and diagnostics not only enhances patient engagement but also supports value-based care by reducing hospital readmissions and enabling proactive disease management. Moreover, advancements in molecular testing-driven by innovations in antigen, biomarker, and PCR assays-are redefining standard diagnostic algorithms, allowing for multiplexed detection of pathogens and inflammatory markers within a single workflow.

Consequently, as stakeholders embrace these transformative shifts, they are compelled to rethink traditional business models, forge strategic partnerships, and invest in interoperable ecosystems that prioritize data security, regulatory compliance, and seamless user experience. These dynamics are heralding a new era in respiratory diagnostics, one in which precision, speed, and patient empowerment converge to improve clinical outcomes.

Assessing the Multifaceted Consequences of United States Tariff Adjustments in 2025 on Respiratory Diagnostics Supply Chains and Cost Structures

In 2025, alterations to United States tariff policy have introduced multifaceted repercussions for respiratory diagnostics supply chains and cost structures. New duties on imported diagnostic components, including imaging hardware and specialized gas analysis devices, have elevated procurement costs for manufacturers reliant on global sourcing. Consequently, production expenses have risen across the board, compelling device makers and diagnostic laboratories alike to reassess pricing strategies and seek cost mitigation measures.

Moreover, the ripple effects of these tariff adjustments have amplified logistical complexities, as companies navigate shifting customs regulations and recalibrate their supplier networks. Some organizations have accelerated initiatives to localize manufacturing of key equipment such as spirometry systems and body plethysmographs within North America. Others have consolidated orders to achieve economies of scale or pursued strategic partnerships with domestic suppliers to hedge against further regulatory uncertainty.

Furthermore, these cumulative policy changes have prompted a strategic realignment within the industry. Innovators are channeling resources into alternative materials and modular designs that reduce import dependency without compromising diagnostic accuracy. At the same time, healthcare providers are exploring collaborative procurement frameworks to distribute tariff-related cost pressures and safeguard continuity of patient services. These developments underscore the critical importance of adaptive strategies to weather ongoing policy fluctuations and preserve both operational resilience and affordability in respiratory diagnostics.

Critical Insights from Comprehensive Segmentation by Testing Modalities Demographics Offerings and End User Applications Across Respiratory Diagnostics

The respiratory diagnostics market comprises a rich tapestry of clinical modalities and service models, each catering to distinct diagnostic imperatives. Based on diagnostic tests, the field encompasses blood tests such as arterial blood gases and complete blood count analyses alongside imaging tests including chest X-rays, CT scans, and MRI scans. Lung function assessments span spirometry, diffusion capacity evaluations, and lung volume measurements, while molecular diagnostics leverage antigen assays, biomarker panels, and PCR-based workflows. Additionally, pulse oximetry and sputum analysis serve as critical adjuncts for rapid assessment and longitudinal monitoring.

Transitioning to patient demographics reveals tailored diagnostic pathways for adult cohorts, who often present with chronic obstructive profiles, versus pediatric populations that require minimally invasive and low–radiation techniques. Geriatric patients, by contrast, demand comprehensive evaluations that integrate comorbidity management, often blending molecular and functional assays to inform personalized therapeutic regimens.

From an offerings perspective, equipment portfolios feature body plethysmographs, diagnostic imaging systems, gas analysis devices, and spirometry systems, all supported by data analytics, imaging analysis, and pulmonary function testing software platforms. Services range from routine operational support and preventive maintenance to advanced workflow optimization and training modules designed to maximize clinical throughput and quality assurance.

Finally, end users span academic institutions driving translational research, diagnostic laboratories executing high-throughput assays, hospitals and clinics delivering point-of-care testing, and research institutes pursuing novel biomarker discovery. Each segment presents unique value propositions and operational considerations, underscoring the importance of flexible solutions that accommodate diverse clinical environments.

This comprehensive research report categorizes the Respiratory Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Diagnostic Tests

- Patient Demographics

- Offerings

- End Users

Analyzing Regional Dynamics That Define Distinct Market Behaviors in the Americas Europe Middle East Africa and Asia Pacific for Respiratory Diagnostics

Regional dynamics in respiratory diagnostics are defined by distinct regulatory frameworks, reimbursement landscapes, and technological appetites. In the Americas, established healthcare infrastructure, centralized reimbursement models, and robust R&D investment have fostered widespread adoption of advanced imaging techniques and molecular assays, particularly in North America where value-based care initiatives reward diagnostic precision and efficiency. Latin American markets, while exhibiting variable access, are increasingly embracing point-of-care platforms to address gaps in specialist availability and enhance screening programs for chronic respiratory illnesses.

Meanwhile, the Europe, Middle East, and Africa region presents a mosaic of market behaviors. Western Europe’s stringent regulatory environment and harmonized CE marking processes have accelerated the rollout of combined diagnostic and digital health solutions, whereas emerging markets in the Middle East and Africa are poised for growth through targeted government programs that bolster local manufacturing and subsidize critical diagnostic services. Cross-border collaborations and public–private partnerships are instrumental in expanding access to spirometry and imaging across underserved areas.

In Asia-Pacific, rapid urbanization, heightened environmental pollution, and escalating healthcare expenditure are driving unprecedented demand for respiratory diagnostic technologies. Government-led initiatives in China, India, Japan, and Southeast Asia promote early disease detection through community screening and telehealth integration. As a result, the region is witnessing significant growth in portable devices, AI-driven diagnostic algorithms, and integrated software platforms tailored to large patient populations. These unique regional profiles underscore the need for customized market entry strategies and locally attuned value propositions.

This comprehensive research report examines key regions that drive the evolution of the Respiratory Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Organizations Driving Strategic Innovation Competitive Differentiation and Collaboration in the Evolving Respiratory Diagnostics Domain

Leading organizations in the respiratory diagnostics space are leveraging strategic innovation, competitive differentiation, and synergistic partnerships to cement their market positions. One global manufacturer expanded its portfolio with a next-generation spirometry system equipped with cloud-native analytics, while another introduced an AI-enabled imaging platform that automatically flags potential pulmonary nodules for radiologist review. A prominent diagnostics company pursued vertical integration by acquiring a molecular testing startup, thereby broadening its antigen and PCR assay offerings and strengthening its presence in high-throughput laboratory settings.

In parallel, a mid-sized technology provider forged alliances with telehealth platforms to deliver remote monitoring services that combine pulse oximetry data with patient symptom tracking, enabling proactive management of chronic respiratory conditions. Another key player differentiated itself by offering comprehensive turnkey solutions, bundling equipment, software, and managed services under long-term service agreements designed to optimize uptime and total cost of ownership. These initiatives reflect an industry-wide shift toward interoperable ecosystems that deliver end-to-end diagnostic workflows.

Furthermore, several companies are investing heavily in collaborative research with academic institutions and contract research organizations to validate novel biomarkers and refine diagnostic algorithms. This collaborative approach accelerates time to clinical adoption and enhances regulatory compliance by generating real-world evidence. Collectively, these strategies underscore a competitive landscape in which adaptability, technological foresight, and customer-centric service models drive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Respiratory Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adaltis S.r.l.

- Altona Diagnostics GmbH

- Becton, Dickinson, and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux S.A.

- Bioneer Corporation

- CerTest Biotec S.L.

- Daan Gene Co., Ltd.

- Diatech Pharmacogenetics srl

- Drägerwerk AG & Co. KGaA

- F. Hoffmann-La Roche Ltd.

- GE HealthCare Technologies, Inc.

- Hologic, Inc.

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic PLC

- Merck KGaA

- ProAxsis by NetScientific PLC

- Quest Diagnostics Incorporated

- Quidel Corporation

- ResMed Corp.

- Sansure Biotech Inc.

- SDI Diagnostics, Inc.

- Seegene Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Vitalograph Ltd.

- ZeptoMetrix LLC

Strategic Recommendations for Industry Leaders to Navigate Disruptive Market Forces Advance Technological Integration and Enhance Patient Outcomes in Respiratory Diagnostics

To navigate the complex respiratory diagnostics landscape, industry leaders should prioritize supply chain diversification by cultivating relationships with multiple tier-one and regional suppliers, thereby mitigating the risks associated with tariff volatility and logistical disruptions. Concurrently, investing in localized manufacturing capabilities and lean production methodologies will enhance operational resilience and reduce time-to-market for critical diagnostic products.

In parallel, organizations must accelerate the integration of digital health and artificial intelligence into diagnostic workflows, focusing on scalable software platforms that support remote monitoring, predictive analytics, and seamless data exchange with electronic health record systems. By co-developing solutions with clinical end users, developers can ensure that new tools align with real-world workflows and deliver tangible improvements in patient outcomes.

Engagement with policymakers is equally critical; proactive advocacy for balanced regulatory frameworks and tariff policies can help shape an environment conducive to innovation while safeguarding patient access. Additionally, companies should embrace patient-centric service models by offering comprehensive training modules, tele-support services, and outcome-based reimbursement programs that align incentives across the care continuum.

Finally, forging strategic alliances with technology startups, academic consortia, and healthcare providers will accelerate product development cycles and facilitate market entry, particularly in high-growth regions. This collaborative philosophy will position industry leaders to capture emerging opportunities and drive sustainable growth.

Rigorous Research Methodology Ensuring Data Integrity Expert Validation and Holistic Analysis to Support Robust Conclusions in Respiratory Diagnostics

Our research methodology combined robust primary and secondary data collection with rigorous validation processes to ensure the highest standard of data integrity. Primary research included in-depth interviews with key opinion leaders, clinical practitioners, laboratory directors, and regulatory experts to capture firsthand insights into technology adoption, clinical workflows, and payer dynamics. These qualitative findings were complemented by quantitative surveys of diagnostic service providers across multiple geographies, enabling a nuanced understanding of utilization patterns and investment priorities.

Secondary research sources comprised peer-reviewed journals, public regulatory databases, valuation of patent filings, and analysis of financial disclosures from leading respiratory diagnostics firms. This comprehensive approach facilitated cross-verification of market trends and technological advancements. Data triangulation was employed to reconcile disparate findings, while a structured framework guided the classification of diagnostic modalities, patient demographics, solution offerings, and end-user segments.

Expert validation sessions convened a panel of clinical researchers, biomedical engineers, and health economists to review preliminary findings, refine assumptions, and verify methodological rigor. Statistical analyses of performance metrics, adoption rates, and service utilization trends further underpinned our conclusions, ensuring that the report reflects both empirical evidence and strategic foresight. This multi-tiered process guarantees a holistic and unbiased assessment of the respiratory diagnostics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Respiratory Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Respiratory Diagnostics Market, by Diagnostic Tests

- Respiratory Diagnostics Market, by Patient Demographics

- Respiratory Diagnostics Market, by Offerings

- Respiratory Diagnostics Market, by End Users

- Respiratory Diagnostics Market, by Region

- Respiratory Diagnostics Market, by Group

- Respiratory Diagnostics Market, by Country

- United States Respiratory Diagnostics Market

- China Respiratory Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Strategic Imperatives to Illuminate the Future Trajectory of Respiratory Diagnostics and Guide Informed Decision Making

Bringing together the critical insights from market dynamics, tariff impacts, segmentation analyses, regional behaviors, and competitive strategies provides a comprehensive view of the respiratory diagnostics domain. Technological innovation is leading to earlier, more accurate detection of respiratory conditions, while evolving care models emphasize patient engagement and remote monitoring. Meanwhile, tariff changes invite operational agility and strategic sourcing to maintain cost-effectiveness and supply chain stability.

Segment-based insights highlight the interplay between clinical modalities-from arterial blood gases to AI-enhanced imaging-and the diverse needs of adult, pediatric, and geriatric populations. Offerings have expanded to encompass integrated equipment, sophisticated software platforms, and value-added services, tailored to the unique requirements of academic institutions, diagnostic laboratories, hospitals, and research institutes.

Regionally, distinct market characteristics in the Americas, EMEA, and Asia-Pacific demand localized strategies that account for regulatory complexity, reimbursement pathways, and digital health readiness. Leading companies are differentiating through strategic acquisitions, platform integration, and collaborative research, forging the interoperable ecosystems of the future. Collectively, these findings illuminate a dynamic landscape where innovation, policy, and patient-centric care converge to shape the next chapter in respiratory diagnostics.

Empowering Stakeholders with Exclusive Access to the Full Market Research Report Through Direct Engagement with the Associate Director of Sales and Marketing

To gain a complete and nuanced understanding of the respiratory diagnostics market and unlock actionable intelligence tailored to your strategic priorities, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep domain expertise and will guide you through the rich insights, authenticated data, and strategic recommendations contained within the full research report. His personalized consultation will help align the report’s findings with your organization’s objectives, ensuring you derive maximum value from every section. Reach out today to secure your exclusive license to the report and position your team at the forefront of innovation, policy response, and market growth in respiratory diagnostics.

- How big is the Respiratory Diagnostics Market?

- What is the Respiratory Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?