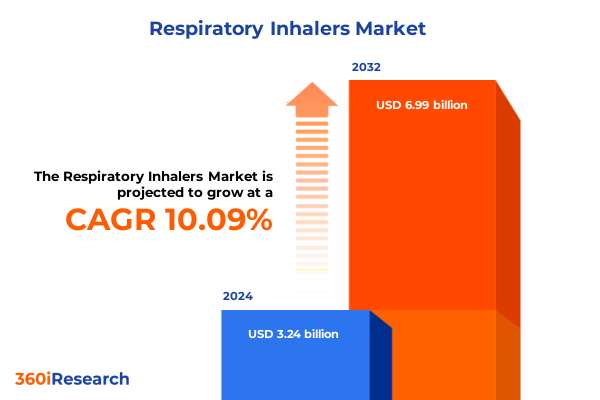

The Respiratory Inhalers Market size was estimated at USD 3.56 billion in 2025 and expected to reach USD 3.91 billion in 2026, at a CAGR of 10.12% to reach USD 6.99 billion by 2032.

Charting the Evolution of Respiratory Inhaler Therapies and Market Dynamics to Illuminate Opportunities in Patient-Centric Treatment Pathways

The respiratory inhaler market is at a pivotal juncture, shaped by escalating disease prevalence, evolving patient expectations, and accelerating technological innovation. Chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease remain among the leading causes of morbidity worldwide. This persistent disease burden has heightened demand for more efficient, patient-friendly inhalation devices that can improve adherence, optimize drug delivery, and ultimately enhance clinical outcomes.

Simultaneously, regulatory agencies and payers are imposing stricter performance and environmental requirements. Health systems are seeking cost-effective therapeutic solutions that also align with broader sustainability objectives. Manufacturers are responding by integrating advanced formulation technologies, novel propellant systems, and digital connectivity features that can track usage and provide real-time feedback to patients and providers.

Against this backdrop, competition is intensifying across established pharmaceutical giants, emerging biotech firms, and specialized device manufacturers. Differentiation now hinges on a patient-centric approach that combines therapeutic efficacy with seamless usability. In the sections that follow, we explore the transformative shifts reshaping this landscape, examine the cumulative impact of recent policy actions, and identify the segmentation and regional insights that will inform tomorrow’s strategic decisions.

Unveiling Disruptive Technological and Regulatory Transformations Reshaping Respiratory Inhaler Development and Patient Engagement Strategies

Recent years have witnessed an unprecedented convergence of technological, regulatory, and consumer-driven disruptors in the inhaler arena. On the technological front, smart inhalers embedded with sensors and wireless modules enable remote monitoring of dose administration and adherence patterns. These devices not only empower patients with personalized feedback but also generate real-world data that can guide clinicians in optimizing treatment plans.

Regulatory bodies around the globe are mandating lower global warming potential propellants, propelling device redesign and reformulation efforts. This shift towards eco-friendly inhaler options is further amplified by sustainability targets adopted by industries and governments alike. In parallel, the digital health revolution and the rapid expansion of telemedicine services have elevated the importance of inhalers capable of integrating into remote care ecosystems.

Moreover, the heightened focus on precision medicine is encouraging the development of targeted drug-delivery platforms that can address patient heterogeneity. Advanced formulation techniques are enabling the co-delivery of multiple active ingredients, paving the way for combination therapies that offer synergistic benefits. Together, these transformative forces are redefining what it means to deliver effective, user-friendly respiratory treatments in an increasingly connected world.

Assessing the Far-Reaching Consequences of United States Tariff Measures on Respiratory Inhaler Supply Chains and Cost Structures in 2025

In 2025, the introduction of tariff measures targeting inhaler components and active pharmaceutical ingredients imported into the United States has introduced new challenges for manufacturers and supply chain operators. These measures have raised input costs, prompting stakeholders to reevaluate sourcing strategies and negotiate more resilient supplier contracts. In some cases, component manufacturers have relocated production closer to end markets to mitigate duty burdens and reduce lead times.

The ripple effects of these tariffs extend beyond direct cost increases. Distributors and contract manufacturers face inventory valuation uncertainties, as raw material acquisitions must now factor in potential duty escalations. This environment has accelerated the adoption of just-in-time inventory models, though such approaches also heighten vulnerability to unforeseen disruptions. To counterbalance these pressures, several inhaler producers have diversified their supply bases, engaging alternative suppliers in regions with preferential trade arrangements or domestic production capabilities.

Looking ahead, companies that leverage data-driven demand forecasting and embrace flexible manufacturing setups are better poised to absorb tariff-related shocks. Strategic alliances with logistics providers that offer bonded warehousing and tariff mitigation services also provide a buffer against cost volatility. By adopting a holistic, supply-chainwide perspective, inhaler stakeholders can transform tariff-related constraints into opportunities for operational optimization and competitive differentiation.

Extracting Actionable Insights from Comprehensive Segmentation Analysis Spanning Product Types, Drug Classes, Distribution Channels, Indications, and Age Groups

A granular segmentation analysis reveals nuanced drivers across product types, drug classes, distribution channels, indications, and patient age groups. Dry powder inhalers have gained favor for patients seeking propellant-free options, while metered dose inhalers remain ubiquitous due to their established performance and familiarity among prescribers. Nebulizers continue to serve severe and critical care populations, enabling high-dose aerosol delivery, whereas soft mist inhalers are carving out a niche for their fine, slow-moving spray that enhances deep lung deposition.

In terms of drug classes, single-entity corticosteroids lay the foundation for maintenance regimens, but the momentum has shifted decisively toward combination therapies. Dual and triple formulations-encompassing ICS/LABA, ICS/LABA/LAMA, ICS/LAMA, and LABA/LAMA approaches-address multiple pathophysiological pathways in a single device, reducing regimen complexity and improving patient adherence. Meanwhile, short-acting beta agonists maintain their critical role in rescue therapy during acute exacerbations.

Distribution channels exhibit their own dynamics. Hospital pharmacies remain the gateway for acute and inpatient care, yet online pharmacies are growing rapidly, particularly among tech-savvy and younger patients who value home delivery. Retail pharmacies continue to balance walk-in demand with counseling services, leveraging their physical footprint to engage directly with patients. Finally, patient age group considerations underscore that adult users typically favor convenience and multisession portability, whereas pediatric inhaler solutions prioritize dose accuracy, ease of handling, and engaging device design.

This comprehensive research report categorizes the Respiratory Inhalers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Drug Class

- Indication

- Patient Age Group

- Distribution Channel

Illuminating Divergent Growth Drivers and Regulatory Landscapes across the Americas, EMEA, and Asia-Pacific Regions for Respiratory Inhalers

Geographic regions present distinct landscapes that shape respiratory inhaler strategies. In the Americas, advanced reimbursement frameworks and high per-capita healthcare spending accelerate the adoption of premium devices, including digital inhalers that deliver closed-loop feedback. The United States, in particular, serves as a bellwether market, where payer incentives and outcome-based contracting are driving the uptake of connected therapies.

By contrast, Europe, the Middle East and Africa contend with a mosaic of regulatory standards and cost containment initiatives. Western European nations lead in establishing low-GWP propellant mandates, compelling manufacturers to deploy eco-friendly alternatives. In the Middle East, government-backed public health programs are expanding access, while African markets exhibit emerging potential hindered by fragmented distribution networks and affordability challenges.

In Asia-Pacific, a combination of rising air pollution, urbanization, and an expanding middle class is lifting the profile of chronic respiratory conditions. Market participants are responding with localized product offerings and strategic joint ventures to penetrate high-growth pockets in China, India, Southeast Asia, and Australia. Government reimbursement reforms in key markets further catalyze innovation and broaden patient access to advanced inhaler therapies.

This comprehensive research report examines key regions that drive the evolution of the Respiratory Inhalers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves and Portfolio Innovations of Leading Pharmaceutical and Device Manufacturers in the Respiratory Inhaler Segment

Industry frontrunners are redefining competition through targeted portfolio expansion and strategic collaborations. AstraZeneca continues to build upon its extensive combination therapy lineup, integrating novel LABA/LAMA dual modalities to extend patient treatment pathways. Meanwhile, GlaxoSmithKline is capitalizing on its digital health unit to embed connectivity modules in metered dose inhalers, offering prescribers and payers enhanced adherence data.

Boehringer Ingelheim has prioritized strategic acquisitions to bolster its soft mist inhaler franchise, enhancing its capacity to deliver high-precision aerosol mist without propellants. Teva Pharmaceutical Industries is reinforcing its generics leadership by streamlining manufacturing processes to offset tariff-induced cost pressures, ensuring continuity in metered dose and dry powder inhaler supply. Simultaneously, Novartis is exploring modular device platforms that can accommodate both mono-therapies and multi-component combinations.

The competitive landscape also features nimble medtech startups and contract development organizations that specialize in next-generation propellant formulations, sensor integration, and patient engagement solutions. By forging alliances, incumbents and new entrants alike can accelerate time-to-market and co-develop differentiated inhaler offerings that align with evolving clinical and payer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Respiratory Inhalers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AptarGroup, Inc.

- AstraZeneca plc

- Beximco Pharmaceuticals PLC

- Boehringer Ingelheim International GmbH

- Chiesi Farmaceutici S.p.A.

- Cipla Ltd.

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Limited

- H&T Presspart Manufacturing Ltd

- Koninklijke Philips N.V.

- Lupin Limited

- Mankind Pharma Limited

- MannKind Corporation

- Merck & Co., Inc.

- Mundipharma International Limited

- Novartis AG

- Omron Healthcare, Inc.

- OPKO Health, Inc.

- Orion Corporation

- PARI Medical Holding GmbH

- ResMed Inc.

- Sandoz International GmbH

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Vectura Group Limited

- Viatrix Inc.

Implementing Proactive Strategies and Collaborative Initiatives to Enhance Market Resilience, Patient Engagement, and Competitive Advantage in Respiratory Inhalers

To thrive in this evolving environment, industry leaders must adopt a multi-pronged strategy that aligns product innovation with operational agility. First, embracing digital integration will be crucial: partnering with technology platforms to embed sensors and analytics in inhaler devices can unlock real-time adherence insights and predictive models for exacerbation prevention. This approach not only differentiates offerings but also reinforces value propositions to payers and providers.

Second, strengthening supply chain resilience through supplier diversification and localized manufacturing will mitigate the impact of tariffs and geopolitical uncertainties. Establishing alternative sourcing corridors and leveraging contract manufacturing organizations with nearshore capabilities will reduce lead times and buffer cost fluctuations. Third, expanding combination therapy pipelines-particularly triple therapy formulations-can address multifaceted disease mechanisms while streamlining patient regimens, thereby enhancing compliance and therapeutic outcomes.

Finally, cultivating collaborative ventures with regulators and sustainability experts will prepare organizations for forthcoming environmental mandates. Engaging early in propellant phase-down discussions and investing in low-GWP delivery systems will safeguard market access and align with corporate social responsibility targets. By executing these initiatives in tandem, companies can secure a competitive edge and deliver on the promise of more effective, patient-centric respiratory care.

Applying Rigorous Mixed-Method Research Design Integrating Primary Expert Interviews and Secondary Data Validation to Ensure Comprehensive Insights

The research underpinning this analysis adheres to a structured, mixed-method approach designed to ensure depth, accuracy, and actionable relevance. The process began with exhaustive secondary research, drawing on peer-reviewed journals, regulatory filings, patent databases, and government health reports to map the historical and current landscape of inhaler technologies, disease prevalence, and policy frameworks.

Concurrently, primary research involved in-depth interviews with key opinion leaders, including pulmonologists, respiratory therapists, hospital procurement officers, and reimbursement specialists. These engagements provided firsthand insights into clinical adoption barriers, device usability preferences, and payer decision criteria. To validate and triangulate findings, data points from secondary sources were cross-referenced with primary feedback, ensuring consistency and identifying any discrepancies for further investigation.

Finally, the research team applied rigorous data analysis techniques, segmenting the market by product type, drug class, distribution channel, indication, and patient age group, and overlaying regional and company dimensions. This comprehensive methodology ensures that strategic recommendations are grounded in robust evidence, enabling stakeholders to pursue high-impact initiatives with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Respiratory Inhalers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Respiratory Inhalers Market, by Product Type

- Respiratory Inhalers Market, by Drug Class

- Respiratory Inhalers Market, by Indication

- Respiratory Inhalers Market, by Patient Age Group

- Respiratory Inhalers Market, by Distribution Channel

- Respiratory Inhalers Market, by Region

- Respiratory Inhalers Market, by Group

- Respiratory Inhalers Market, by Country

- United States Respiratory Inhalers Market

- China Respiratory Inhalers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Drive Strategic Decision-Making and Emphasize Opportunities in the Dynamic Respiratory Inhaler Ecosystem

The synthesis of evolving technologies, regulatory imperatives, and tariff-driven supply chain realignments underscores a pivotal moment in the respiratory inhaler market. Transformative advances in digital inhalers and eco-friendly propellants offer clear pathways to differentiate products, meet sustainability mandates, and enhance patient adherence. Meanwhile, the specter of increased input costs has galvanized manufacturers to fortify their operational frameworks and explore near-market production strategies.

Segmentation insights reveal that combination therapies and specialized device formats continue to drive clinical and commercial momentum, while distribution channels are evolving to embrace digital and retail hybrid models. Regionally, the Americas lead in adopting premium innovations, EMEA balances cost containment with environmental leadership, and Asia-Pacific emerges as a dynamic growth frontier propelled by rising disease prevalence and expanding reimbursement programs.

Collectively, these findings illuminate actionable strategies for industry participants: from embedding connectivity in inhaler platforms to forging alliances that streamline supply chains and preempt regulatory shifts. As the market continues its rapid transformation, stakeholders who align strategic investments with patient-centric innovation will be best positioned to capture the next wave of growth.

Connect with Ketan Rohom to Access a Detailed Market Research Report Delivering In-Depth Analysis and Actionable Intelligence for Respiratory Inhalers

For organizations seeking to stay ahead of the curve and capitalize on emerging trends in respiratory inhaler therapies, the next step is clear. Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to access a detailed market research report delivering in-depth analysis and actionable intelligence for respiratory inhalers. This report will equip your team with the strategic insights necessary to optimize product portfolios, refine go-to-market approaches, and navigate regulatory and tariff-related complexities. Reach out today to secure the comprehensive guidance that will drive growth and innovation in this dynamic sector.

- How big is the Respiratory Inhalers Market?

- What is the Respiratory Inhalers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?