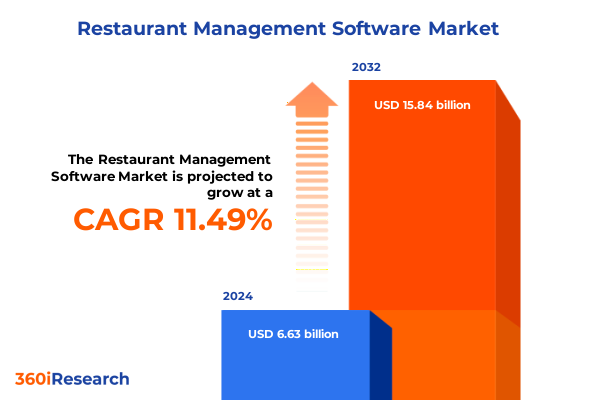

The Restaurant Management Software Market size was estimated at USD 7.33 billion in 2025 and expected to reach USD 8.11 billion in 2026, at a CAGR of 11.62% to reach USD 15.84 billion by 2032.

Navigating the Next Wave of Digital Innovation and Operational Efficiency Driving Restaurant Management Software Transformation Nationwide

The contemporary restaurant industry faces unprecedented complexity as shifting consumer expectations, labor shortages, and supply chain disruptions converge to redefine operational imperatives. In this environment, sophisticated technology solutions have moved from being optional enhancements to foundational elements that determine competitive viability. Rapidly evolving guest preferences for seamless digital interactions are compelling operators to adopt integrated software platforms that unify front-of-house, back-of-house, and third-party services under a single operational umbrella.

Recent research underscores the strategic value placed on restaurant technology investments. According to a leading industry association survey, 76 percent of operators acknowledge that utilizing technology grants them a significant competitive edge in today’s market. At the same time, 70 percent of limited-service patrons indicate a strong preference for placing orders through smartphone applications, highlighting the necessity for mobile-first management tools that cater directly to consumer habits.

As digitization accelerates, operators are realizing that technology roadmaps must extend beyond basic point-of-sale capabilities to encompass data analytics, labor optimization, and omnichannel connectivity. Against this backdrop, the launch of comprehensive restaurant management software solutions offers a pathway to enhanced operational resilience, improved guest satisfaction, and sustainable cost control. Transitioning from fragmented, legacy systems to unified, cloud-enabled platforms is no longer a distant objective but an immediate requirement for any enterprise seeking growth and agility.

How Emerging Technologies and Consumer Expectations Are Redefining Restaurant Operations and Guest Experiences Through Software Solutions

Over the past year, transformative shifts in restaurant technology have redefined how operators engage with guests, manage workflows, and optimize resources. Contactless ordering and payment, once regarded as optional conveniences, have become standard expectations across service models. This migration toward digital self-service channels reflects broader consumer demand for speed, convenience, and personalization at every touchpoint.

Cloud adoption has emerged as a pivotal enabler of these transformations. Today, 63 percent of restaurant operators leverage cloud-based point-of-sale systems, harnessing the scalability, remote accessibility, and seamless integration capabilities that public, private, and hybrid infrastructures provide. By centralizing data in real time, multi-unit operators can ensure consistent menu updates, automated inventory synchronization, and uniform guest experiences across diverse locations.

Concurrently, artificial intelligence and machine learning have transitioned from experimental projects to core system functionalities. From demand forecasting to dynamic pricing recommendations, approximately 95 percent of restaurant operators report having implemented AI-driven tools within their establishments. These capabilities empower operators to reduce waste, enhance labor allocation, and deliver targeted promotions that resonate with individual preferences.

In parallel, exploratory investments in robotics for food preparation and drone delivery pilots signal the industry’s commitment to long-term innovation. Although still nascent, these emerging modalities underscore a broader strategic imperative: to continually elevate operational productivity and guest engagement through cutting-edge technology.

Understanding the Far-Reaching Consequences of 2025 U.S. Trade Tariffs on Technology Procurement and Operational Costs in Restaurants

On March 4, 2025, the U.S. government enacted reciprocal trade measures imposing a 20 percent tariff on Chinese imports alongside a 25 percent levy on goods from Canada and Mexico. These tariffs, aimed at addressing geopolitical and national security concerns, have had immediate cost implications for restaurant operators reliant on imported technology hardware.

Point-of-sale terminals, kitchen display systems, handheld ordering devices, and connected tablets-all essential components of modern restaurant infrastructures-often incorporate consumer electronics and semiconductor parts sourced from affected regions. As a result, manufacturers have passed through cost increases to end customers. Leading PC and hardware providers have reported unit cost hikes ranging from 10 to 25 percent, translating to an additional $200 to $500 per device, depending on configuration and supplier terms.

Compounding these challenges, a preexisting 50 percent tariff on older Chinese semiconductors has elevated the cost of embedded chips used in digital signage and IoT-enabled kitchen appliances. Such components are integral to the reliable operation of inventory management systems, digital menu boards, and predictive maintenance sensors.

In response, many operators have accelerated hardware procurement schedules, stockpiling essential devices to lock in pre-tariff pricing. Others are diversifying supplier networks, exploring regional manufacturing alternatives, and negotiating long-term service agreements with technology vendors. Despite these mitigations, supply chain disruptions and elevated import costs continue to exert upward pressure on capital budgets and total cost of ownership calculations.

Uncovering Critical Perspectives on Business Models Deployment Strategies Applications and End Users Shaping the Restaurant Management Software Market

Analysis based on business model segmentation reveals two primary licensing approaches: perpetual and subscription-based. The subscription model further bifurcates into annual commitments that balance predictable outlays with lower upfront capital requirements, and monthly options that grant operators maximum cash-flow flexibility. This layering of payment structures addresses the differing financial strategies and scale objectives of independent operators versus enterprise chains.

Deployment type segmentation differentiates on-premise solutions hosted within an operator’s physical infrastructure from cloud-native offerings that reside on remote servers. Cloud solutions further subdivide into public environments that maximize cost-efficiency, private clouds that emphasize security and compliance, and hybrid arrangements that blend the strengths of both models to deliver tailored performance and governance controls.

From an application standpoint, comprehensive suites encompass billing and invoicing modules, customer relationship management platforms, inventory oversight tools, advanced reporting and analytics engines, staff management systems, and table reservation interfaces. By integrating these functional domains, operators can streamline data flows, eliminate manual reconciliation, and unlock holistic operational visibility across all facets of the customer journey.

End-user segmentation highlights the distinct requirements of cafes and bistros, chain restaurant operators, hotels and resorts, and independent eateries. While smaller venues often prioritize turnkey simplicity and rapid deployment, larger multi-unit organizations demand advanced customization, enterprise-grade security, and professional services support to align technology ecosystems with complex corporate standards.

This comprehensive research report categorizes the Restaurant Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Business Model

- Deployment Type

- Application

- End User

Assessing Diverse Regional Dynamics and Adoption Patterns Across the Americas EMEA and Asia-Pacific in the Restaurant Management Software Sector

In the Americas, particularly the United States and Canada, operators have moved beyond experimentation to mainstream adoption of digital ordering platforms and loyalty program integrations. Mature markets emphasize artificial intelligence–driven analytics, enabling chains to refine menu offerings and promotional tactics based on granular consumer data. Meanwhile, independent and emerging operators across Latin America are increasingly drawn to cost-effective SaaS subscriptions that eliminate large upfront investments and simplify maintenance.

Throughout Europe, Middle East and Africa, diverse regulatory landscapes and infrastructural realities shape cloud migration trajectories. Western European chains frequently deploy hybrid clouds to reconcile strict data privacy mandates with the operational agility of public services. In contrast, markets within the Middle East and Africa often lean toward on-premise deployments where reliable connectivity remains a constraint, ensuring uninterrupted operation in the face of intermittent network access.

Asia-Pacific continues to exhibit the fastest pace of digital transformation, driven by widespread mobile connectivity and government-backed smart hospitality initiatives. Urban centers in Australia, Japan, and South Korea lead in public cloud adoption, while private and hybrid cloud models gain traction among pan-regional franchise operators seeking centralized management of distributed locations. This region’s appetite for mobile payments, super-app integrations, and advanced guest engagement tools underscores its role as a bellwether for emerging technology trends.

This comprehensive research report examines key regions that drive the evolution of the Restaurant Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Revolutionizing Restaurant Management Software Offerings and Market Competition

Leading vendors differentiate through strategic ecosystem plays and relentless feature innovation. One provider has distinguished itself by bundling digital ordering, loyalty management, and integrated labor scheduling into a unified platform, driving strong uptake among independent restaurants and multi-unit franchisees.

Another prominent competitor focuses on simplicity of deployment and transparent subscription pricing, catering to smaller venues and nascent operators. Its modular architecture supports rapid feature rollouts and seamless integrations with payment gateways, payroll systems, and accounting suites.

Established enterprise software houses continue to secure large chain and hospitality group accounts by offering customizable, scalable solutions backed by robust professional services. Their depth of integration expertise, global support networks, and compliance-focused offerings position them as reliable partners for operations with complex multi-brand portfolios.

Meanwhile, nimble upstarts concentrate on specialized vertical segments with developer-friendly APIs that foster vibrant partner ecosystems. These challengers frequently accelerate time to market for new capabilities-such as contactless delivery integrations or AI-enabled ingredient procurement modules-challenging incumbents to match their agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Restaurant Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilysys, Inc.

- Block, Inc.

- Fidelity National Information Services, Inc.

- HotSchedules, Inc.

- Lightspeed POS Inc.

- NCR Corporation

- Oracle Corporation

- PAR Technology Corporation

- Shift4 Payments, Inc.

- Toast, Inc.

- TouchBistro Inc.

Actionable Strategies for Restaurant Technology Leaders to Enhance Resilience Agility and Growth in a Competitive Digital Landscape

Industry leaders should transition to a composable technology strategy, leveraging open APIs and microservices architectures to dismantle data silos between point-of-sale, inventory control, CRM, and financial reporting functions. This modular approach supports rapid adaptation to new service models and reduces dependency on monolithic platforms.

Embracing cloud-native SaaS deployments with both annual and monthly subscription options enables operators to align recurring expenses with cash-flow realities. When appropriate, hybrid cloud configurations can further address concerns around data residency, compliance, and performance latency.

To mitigate tariff-related cost volatility, operators must diversify hardware procurement channels by qualifying multiple global suppliers and negotiating multi-year contracts. Maintaining strategic inventory reserves of key devices-such as handheld terminals and digital display units-can preserve operational continuity in the face of supply chain disruptions.

Investing in AI-driven workforce management and predictive analytics tools empowers operators to streamline labor scheduling, minimize food and resource waste, and deliver personalized guest experiences through targeted offers. Cross-training staff to master digital platforms cultivates internal champions who drive continuous process improvement.

Finally, enhancing cybersecurity and data governance postures is imperative amid expanding regulatory scrutiny. Implementing proactive monitoring, incident response playbooks, and regular compliance audits fosters resilience against evolving cyber threats and protects both customer trust and brand reputation.

Rigorous Methodological Framework Employed to Deliver Unbiased and Comprehensive Insights into Restaurant Management Software Trends

This research was conducted using a mixed-methods framework that combined primary interviews and secondary data analysis to ensure a robust evidence base. Primary insights were gathered through structured interviews with senior technology stakeholders at diverse restaurant operations, including cafes, multi-unit chains, and hospitality groups, spanning the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Secondary research drew upon reputable trade association publications, leading industry surveys, and official governmental policy documents-particularly those detailing U.S. trade measures implemented in early 2025-to contextualize the analysis of tariff impacts and sectoral trends. Key statistics regarding technology adoption rates and consumer preferences were sourced from operator and consumer surveys conducted by a major restaurant association.

Data triangulation techniques were applied to validate findings by cross-referencing interview narratives with quantitative adoption metrics and published policy briefs. This approach minimized potential bias and enhanced the credibility of segmentation, regional, and vendor insights.

Limitations of the study include the deliberate exclusion of detailed market sizing or forecasting projections, in line with scope requirements, and reliance on English-language sources and interviews conducted in major global markets. Future research iterations may expand linguistic coverage and integrate operator-level performance data to deepen the granularity of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Restaurant Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Restaurant Management Software Market, by Business Model

- Restaurant Management Software Market, by Deployment Type

- Restaurant Management Software Market, by Application

- Restaurant Management Software Market, by End User

- Restaurant Management Software Market, by Region

- Restaurant Management Software Market, by Group

- Restaurant Management Software Market, by Country

- United States Restaurant Management Software Market

- China Restaurant Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications to Inform Decision Making in Restaurant Technology Investments and Partnerships

The convergence of cloud migration, AI-driven analytics, and modular software architectures is catalyzing a fundamental reimagining of restaurant operations. Unified platforms now underpin real-time decision-making, enabling operators to deliver consistent guest experiences, optimize resource allocation, and respond dynamically to market fluctuations.

Concurrently, the 2025 U.S. tariff environment has underscored the strategic importance of supply chain resilience and cost-mitigation strategies. Hardware procurement costs have risen for point-of-sale terminals, kitchen displays, and embedded IoT devices, compelling operators to diversify sourcing arrangements and adopt composable technology stacks.

Segmentation analyses confirm that flexible licensing models-from perpetual licenses to annual and monthly subscriptions-combined with hybrid and multi-cloud deployment options are essential to address the distinct needs of cafes, independent establishments, chain operators, and hospitality groups. Similarly, application portfolios spanning billing, CRM, inventory management, analytics, staff scheduling, and table reservations ensure comprehensive operational coverage.

Regional dynamics continue to diverge: mature markets in the Americas demand seamless omnichannel integration and advanced analytics, EMEA balances rigorous compliance requirements with innovation, and Asia-Pacific accelerates digital transformation through mobile-first service models and government-led smart hospitality initiatives.

Finally, vendor landscapes are evolving as leading providers differentiate through integrated ecosystems and professional services excellence, while emerging competitors leverage agile development cycles and open APIs to challenge incumbents. Collectively, these insights underscore the critical need for strategic technology planning, flexible procurement practices, and continuous innovation to thrive in the fast-evolving restaurant management software landscape.

Empower Your Organization with Expert Insights and Secure Personalized Support from Ketan Rohom to Unlock Restaurant Software Excellence

For organizations seeking deeper market insight and strategic guidance, our comprehensive restaurant management software report offers an unparalleled blend of qualitative analysis and practical best practices.

To explore tailored solutions or schedule a one-on-one consultation, reach out to Ketan Rohom, Associate Director of Sales & Marketing, whose expertise ensures personalized support in aligning your technology roadmap with evolving operational demands.

Secure your copy today and gain the strategic intelligence needed to anticipate geopolitical shifts, optimize procurement decisions, and harness transformative innovations that will drive efficiency and growth in your restaurant operations.

- How big is the Restaurant Management Software Market?

- What is the Restaurant Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?