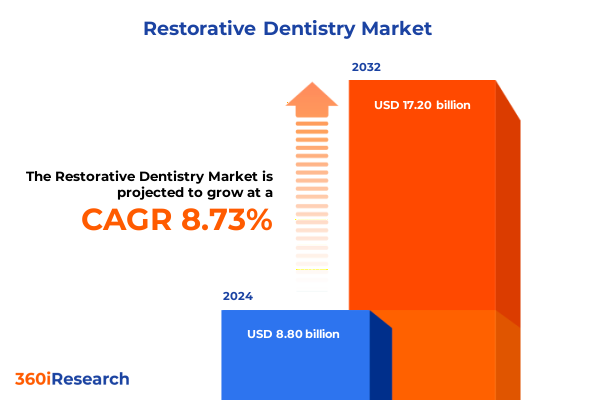

The Restorative Dentistry Market size was estimated at USD 9.51 billion in 2025 and expected to reach USD 10.27 billion in 2026, at a CAGR of 8.83% to reach USD 17.20 billion by 2032.

Comprehensive Introduction to the Evolution and Strategic Importance of Restorative Dentistry in Clinical and Commercial Landscapes

Restorative dentistry has undergone a remarkable journey from its foundational roots in mechanical tooth repair to its current status as a cornerstone of comprehensive oral health management. The focus on preserving natural tooth structure, combined with growing patient expectations for both functionality and aesthetics, has propelled restorative treatments into the mainstream of dental practice. As clinicians strive to balance evidence-based protocols with patient-centric outcomes, the restorative segment has emerged as one of the most dynamic areas within dentistry.

Transitioning into a period of rapid technological integration, restorative procedures now leverage advanced biomaterials, digital design tools, and minimally invasive techniques to deliver predictable and long-lasting results. This evolution reflects a broader commitment within the dental community to improve procedural efficiency, reduce chair time, and enhance patient comfort. Concurrently, the influence of demographic shifts, including an aging population and rising prevalence of chronic diseases, underscores the critical role of restorative interventions in maintaining overall health and quality of life.

In this executive summary, we embark on an exploration of the restorative dentistry landscape, examining the strategic drivers behind market growth, the disruptive trends reshaping clinical practice, and the supply chain factors influencing cost and availability. By establishing a clear understanding of these foundational elements, stakeholders can make informed decisions that align clinical excellence with commercial strategy.

In-Depth Examination of Transformative Trends and Technological Advancements Reshaping Restorative Dentistry Markets and Clinical Practice Worldwide

Over the past decade, restorative dentistry has experienced transformative shifts driven by innovations in digital workflows, materials science, and patient engagement models. The integration of chairside CAD/CAM systems has redefined the production of crowns and bridges, enabling same-day restorations and reducing reliance on external laboratories. In parallel, the emergence of artificial intelligence-enabled diagnostic tools and predictive analytics has empowered clinicians to personalize treatment plans and anticipate restorative failures before they occur.

Meanwhile, developments in nanohybrid and bulk-fill composites have enhanced the physical properties and handling characteristics of direct restorations, paving the way for minimally invasive procedures and extended longevity. These material advancements are complemented by progress in universal adhesives that simplify bonding protocols and improve marginal integrity. Furthermore, the convergence of 3D printing and bioceramic materials promises to introduce new possibilities for custom scaffolds and regenerative applications.

As sustainability gains prominence, manufacturers and practitioners are increasingly adopting greener production processes and exploring recycled or bioresorbable materials. This eco-conscious approach not only aligns with global environmental objectives but also resonates with a growing segment of patients seeking responsible healthcare providers. Taken together, these trends underscore a pivotal moment in restorative dentistry, where technological prowess and environmental stewardship coalesce to shape the future of oral rehabilitation.

Comprehensive Assessment of 2025 United States Tariffs and Their Far-Reaching Cumulative Effects on Restorative Dentistry Supply Chains

In 2025, the introduction of new tariff policies on imported dental materials and equipment in the United States has ushered in a period of adjustment for manufacturers, suppliers, and clinicians alike. With increased duties on ceramics, composite resins, and specialized metals, procurement costs have risen, leading many practices to reevaluate their supply chains and vendor partnerships. As a result, several key players have accelerated the localization of production facilities to mitigate exposure to import levies.

Moreover, the pass-through effect of higher input costs has prompted downstream stakeholders to reassess treatment pricing models and operating margins. Some practices have leveraged bulk purchasing agreements and alternative material formulations to balance cost efficiency with clinical performance. Concurrently, distributors have diversified their portfolios to include tariff-exempt or domestically manufactured products, thereby preserving accessibility to critical restorative solutions.

Looking ahead, these tariff-driven dynamics have catalyzed a broader conversation around supply chain resilience and strategic sourcing. Companies that swiftly realign their manufacturing footprints and invest in alternative material research stand to gain competitive advantage. In contrast, those reliant on traditional import-dependent models may face ongoing margin pressure and inventory uncertainty. Ultimately, the cumulative impact of 2025 tariffs underscores the imperative for agility and foresight in navigating a reshaped restorative dentistry ecosystem.

Detailed Insights into Product Type Material End User Segmentation Revealing Strategic Opportunities for Restorative Dentistry Market

An in-depth segmentation of the restorative dentistry market reveals distinct opportunities and considerations across the dimensions of product type, material type, and end user. Within the product type spectrum, composite restorations encompass formulations such as bulk fill composites, hybrid blends, microfilled options, and nanohybrid compositions, each tailored to specific clinical indications and handling preferences. Crowns and bridges further diversify this landscape with all-ceramic, metal alloy, and porcelain fused to metal variants, reflecting a balance between aesthetic demands and structural requirements.

Turning to material type, the market spans traditional amalgam, advanced ceramics, glass ionomer systems based on acid-base reactions, and metals such as gold alloy and titanium, alongside a range of resin based composites that include hybrid, microfilled, nanofilled, and bulk fill options. This variety underscores the necessity for practitioners to align material characteristics-such as strength, wear resistance, and biocompatibility-with patient-specific needs and procedural workflows.

At the end user level, restorative interventions are predominantly administered within dental hospitals and clinics, while academic and research institutes continue to drive innovation through preclinical studies and material testing. Dental laboratories play a crucial role in fabricating indirect restorations, leveraging both traditional techniques and digital milling platforms. Recognizing the interplay among these segments allows stakeholders to tailor product development, marketing strategies, and distribution models for maximal impact.

This comprehensive research report categorizes the Restorative Dentistry market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

Comprehensive Regional Analysis Highlighting Growth Drivers Challenges and Unique Characteristics across Americas EMEA and Asia-Pacific Markets

A regional lens on restorative dentistry highlights divergent growth trajectories shaped by economic conditions, regulatory frameworks, and patient demographics. In the Americas, mature markets benefit from well-established insurance models and high adoption rates of digital equipment, fostering ongoing investments in practice modernization. Conversely, emerging economies in Latin America are experiencing a surge in demand for affordable restorative solutions, driven by expanding middle-class populations and increased awareness of oral health.

Within Europe, the Middle East, and Africa region, regulatory harmonization efforts in the European Union facilitate cross-border trade of dental materials, while Middle Eastern markets invest heavily in healthcare infrastructure and state-of-the-art dental clinics. African markets, though still nascent, present considerable potential as non-communicable disease prevalence rises and access to care improves through public-private partnerships.

In the Asia-Pacific arena, rapid urbanization and rising disposable incomes are fueling demand for aesthetic restorative treatments, particularly in urban centers across China, India, and Southeast Asia. Local manufacturers are enhancing competitiveness through cost-effective solutions and domestic supply chains, while international players continue to pursue strategic alliances to navigate regulatory complexities. This mosaic of regional nuances underscores the importance of tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Restorative Dentistry market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Profiles of Leading Restorative Dentistry Companies Showcasing Innovation Portfolios Partnerships and Strategic Market Positioning

An examination of leading entities in the restorative dentistry sphere reveals a competitive landscape characterized by innovation, strategic partnerships, and targeted acquisitions. Several major manufacturers have expanded their materials portfolios to include next-generation composites and adhesive systems, while simultaneously investing in digital integration through partnerships with technology providers. These collaborations have enabled the embedding of software-driven diagnostics and design tools directly into restorative workflows.

In parallel, a cohort of specialized enterprises has emerged to focus exclusively on bioceramics and 3D printable restorative materials, challenging incumbents to accelerate their research pipelines. This specialization is supported by growing venture capital interest in dental technology startups that promise shorter lead times for product commercialization and enhanced customization capabilities.

Moreover, strategic acquisitions have allowed diversified healthcare conglomerates to consolidate market share and broaden their service offerings. By incorporating laboratory services, digital scanning solutions, and continuing education platforms, these integrated organizations are positioning themselves as one-stop providers. Meanwhile, nimble regional players leverage localized distribution networks and cost-competitive manufacturing to secure footholds in high-growth markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Restorative Dentistry market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Align Technology, Inc.

- BISCO, Inc.

- Coltene Holding AG

- Den-Mat Holdings, LLC

- Denbur, Inc.

- Dentsply Sirona Inc.

- DMG Chemisch‑Pharmazeutische Fabrik GmbH

- Doxa Dental GmbH

- Envista Holdings Corporation

- GC Corporation

- Henry Schein, Inc.

- Heraeus Kulzer GmbH

- Ivoclar Vivadent AG

- Kerr Corporation

- Keystone Dental, Inc.

- Kuraray Noritake Dental Inc.

- Nobel Biocare Services AG

- Patterson Companies, Inc.

- Septodont Holding

- Shofu Dental GmbH

- Straumann Holding AG

- Ultradent Products, Inc.

- VOCO GmbH

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Recommendations for Industry Leaders to Unlock Value Drive Innovation and Strengthen Market Resilience in Restorative Dentistry

To maintain a leadership position within the dynamic restorative dentistry market, companies should prioritize investments in digital transformation initiatives that enhance clinical efficiency and patient engagement. Embracing interoperable CAD/CAM systems and AI-enabled diagnostics can streamline workflows, reduce errors, and differentiate service offerings in a crowded marketplace. Equally important is the expansion of research and development efforts toward sustainable materials that address environmental concerns without compromising performance.

Furthermore, establishing flexible manufacturing models-such as modular production lines and onshore facilities-will bolster supply chain resilience in the face of geopolitical shifts and tariff fluctuations. Firms should also cultivate robust channel partnerships and explore strategic alliances with laboratories and academic institutions to accelerate technology adoption and foster co-innovation.

Finally, engaging with regulatory bodies and professional associations to anticipate policy changes and shape standards can create competitive barriers and safeguard market positions. By aligning product roadmaps with emerging clinical guidelines and reimbursement trends, organizations can ensure their portfolios remain both compliant and compelling. These recommendations collectively form a roadmap for industry leaders to navigate complexities and seize growth opportunities.

Comprehensive Explanation of Research Methodology Data Triangulation and Validation Approaches Underpinning Restorative Dentistry Market Insights

This report is underpinned by a rigorous methodology that combines comprehensive secondary research with primary data collection and validation processes. Initially, a thorough review of publicly available sources, including peer-reviewed journals, regulatory filings, corporate presentations, and patent databases, established a foundational understanding of market dynamics and technological advancements. This secondary research phase informed the development of segment definitions and key thematic areas for further exploration.

Subsequently, primary research was conducted through structured interviews with senior executives, clinical practitioners, and supply chain experts to capture firsthand perspectives on market drivers, challenges, and future outlooks. These insights were triangulated with quantitative data obtained from industry associations, governmental health agencies, and proprietary databases to ensure accuracy and reliability.

Data synthesis involved cross-referencing findings from multiple sources and applying statistical techniques to identify trends and correlations. The segmentation framework, encompassing product type, material type, and end user, was validated through iterative consultations with domain specialists, ensuring that the taxonomy reflects practical use cases and market realities. Quality assurance procedures, including peer reviews and editorial checks, were implemented to uphold the report’s integrity and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Restorative Dentistry market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Restorative Dentistry Market, by Product Type

- Restorative Dentistry Market, by Material Type

- Restorative Dentistry Market, by Application

- Restorative Dentistry Market, by End User

- Restorative Dentistry Market, by Region

- Restorative Dentistry Market, by Group

- Restorative Dentistry Market, by Country

- United States Restorative Dentistry Market

- China Restorative Dentistry Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Conclusive Synthesis of Key Findings Emerging Trends and Strategic Imperatives Shaping Future Trajectories in Restorative Dentistry

The restorative dentistry landscape is characterized by rapid technological progress, evolving patient expectations, and shifting economic forces that collectively define a complex and competitive market. Key findings reveal that digital integration, material innovation, and supply chain agility serve as the primary pillars shaping current and future growth trajectories. Meanwhile, external factors such as regulatory adjustments, tariff impacts, and sustainability imperatives continue to introduce both challenges and opportunities for stakeholders.

Emerging trends, including the adoption of AI-driven diagnostics and the exploration of bio-based restorative materials, underscore the sector’s commitment to advancing clinical outcomes while responding to global environmental concerns. At the same time, regional variations in market maturity, reimbursement frameworks, and consumer preferences necessitate tailored strategies to capture incremental value across diverse geographies.

Strategic imperatives for industry participants involve a dual focus on innovation and resilience: investing in next-generation technologies, reinforcing localized production capabilities, and fostering partnerships that share risk and amplify expertise. By synthesizing these insights, decision-makers can chart a course that leverages emerging trends, mitigates systemic vulnerabilities, and drives sustained success in restorative dentistry.

Compelling Call To Action Encouraging Collaboration with Ketan Rohom to Secure Comprehensive Restorative Dentistry Market Research for Strategic Decision Making

For organizations seeking to gain an edge through in-depth analysis of restorative dentistry market dynamics, an opportunity awaits to partner with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive market research report designed for strategic decision making. Engaging in a tailored briefing with Ketan will enable stakeholders to explore custom data sets, understand granular market drivers, and leverage actionable insights that align with organizational growth objectives and innovation roadmaps.

By collaborating directly with Ketan, industry leaders can access exclusive add-on services such as detailed competitive landscaping, bespoke regional deep dives, and expert interviews with key opinion leaders. This personalized approach ensures that the final report not only addresses core market questions but also provides nuanced perspectives on emerging technologies, supply chain resilience, and regulatory trends across critical geographies.

Scheduling a consultation with Ketan will equip executive teams and strategic planners with the necessary tools to navigate market complexities, optimize investment decisions, and unlock new opportunities in restorative dentistry. With his expertise in aligning research outputs with commercial imperatives, Ketan can facilitate a seamless process from data acquisition to strategic implementation. Contact Ketan Rohom today to initiate a partnership that will drive competitive advantage and inform long-term success in the restorative dentistry landscape.

- How big is the Restorative Dentistry Market?

- What is the Restorative Dentistry Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?