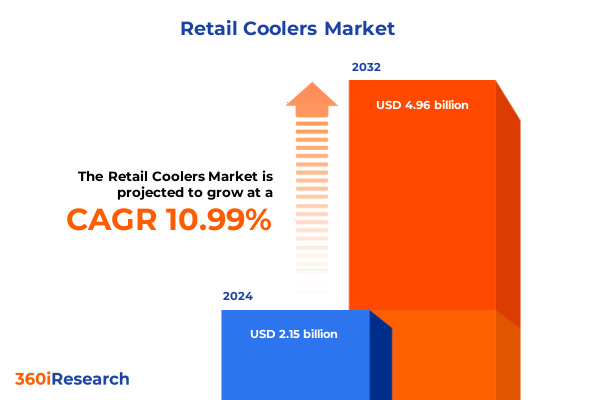

The Retail Coolers Market size was estimated at USD 2.37 billion in 2025 and expected to reach USD 2.61 billion in 2026, at a CAGR of 11.13% to reach USD 4.96 billion by 2032.

Unveiling the Strategic Foundations and Emerging Dynamics Shaping the Retail Cooler Landscape for Informed Decision-Making and Stakeholder Alignment

The retail cooler environment stands at the forefront of technological innovation and consumer-driven transformation, demanding a nuanced understanding of structural drivers and emerging forces. As cooling solutions evolve to meet stringent energy regulations and heightened expectations for food safety and product visibility, industry participants must align on a cohesive narrative that encapsulates shifting stakeholder priorities and capital investment imperatives. Within this context, suppliers, distributors, and end users seek a common framework for navigating the convergence of digital integration, environmental stewardship, and operational resilience.

Transitioning from traditional refrigeration models, the market now embraces smart cooling systems that integrate real-time monitoring, predictive maintenance algorithms, and data analytics to optimize uptime and energy efficiency. This holistic perspective not only addresses total cost of ownership concerns but also enhances the consumer experience through personalized temperature settings and transparent display capabilities. By establishing this foundation, decision makers can identify synergies between technological adoption and sustainability commitments, ensuring that strategic plans remain agile in a rapidly evolving ecosystem.

Furthermore, consumer expectations for transparency and traceability are reshaping retailer assortments and in-store layouts, elevating the importance of merchandise visibility and convenience. Seamless integration of refrigerated units with omnichannel retail strategies is becoming a core competency, as mobility solutions and last-mile delivery models increase demand for specialized cooling containers. This introduction lays the groundwork for a comprehensive exploration of the forces driving innovation, segmentation dynamics, and regional nuances in the retail cooler landscape.

By articulating the intersection of performance, sustainability, and consumer engagement, industry leaders can craft informed strategies that balance short-term operational gains with long-term brand equity objectives. This introductory section serves as a compass for navigating complex market dynamics and sets the stage for deeper analysis of transformative shifts, regulatory impacts, and actionable insights that follow.

Examining the Intersection of Digital Integration, Sustainability Mandates, and Consumer Engagement Redefining Retail Cooling Solutions

A confluence of technological advancement, regulatory evolution, and consumer behavior is propelling transformative shifts within the retail cooler industry. Rapid integration of Internet of Things (IoT) sensors and cloud-based controls has elevated cooling systems from standalone appliances to interconnected nodes in an ecosystem focused on efficiency, uptime, and data-driven decision-making. As a result, maintenance cycles are optimized through predictive analytics, reducing unplanned downtimes and extending equipment lifespans. Moreover, smart diagnostics are enabling service providers to transition toward outcome-based models, simplifying budgeting and operational planning across the value chain.

In parallel, escalating energy regulations and corporate sustainability initiatives are driving the development of next-generation refrigerants and high-efficiency compressors. Manufacturers are leveraging advanced materials and digital twin simulations to lower greenhouse gas emissions and comply with stringent regional and global standards. Consequently, companies that embrace proactive environmental strategies are gaining preference among multinational retailers seeking to align their supply chains with broader net-zero commitments. This confluence of regulatory demand and technological readiness is redefining competitive benchmarks across product portfolios.

Consumer preferences for freshness, transparency, and experiential retail are reshaping store formats and merchandising practices. Digital display integration, connected shelving, and dynamic pricing controls are transforming refrigerated units into interactive consumer touchpoints. Consequently, stakeholders are exploring modular designs that support rapid store resets and cross-category promotions, while guaranteeing temperature consistency. Such innovations foster enhanced shopper engagement and drive incremental sales, further solidifying the retail cooler’s role as a strategic asset rather than a cost center.

Ultimately, the industry’s future will hinge on its ability to merge digital excellence with sustainability imperatives and consumer-centric experiences. These transformative shifts underscore the importance of agile innovation roadmaps and robust collaboration between equipment providers, software developers, and retail operators. Subsequent sections will delve into specific regulatory impacts, segmentation nuances, and regional differentiators that collectively shape the market trajectory.

Assessing How 2025 United States Tariffs on Refrigeration Components Have Catalyzed Supply Chain Resilience and Strategic Near-Shoring Initiatives

The introduction of updated tariff measures by the United States in early 2025 has had far-reaching implications for the retail cooler supply chain and procurement strategies. Faced with increased duties on imported refrigeration components, original equipment manufacturers have witnessed a recalibration of cost structures that extends from compressor assemblies to electronic control modules. Raw material expenses have risen as tariffs cascade through multi-tiered vendor networks, compelling stakeholders to reassess sourcing geographies and supplier collaborations.

In response, several cooling equipment producers have initiated near-shoring and localization efforts, relocating assembly operations to domestic contract manufacturers. This strategic pivot not only mitigates tariff exposure but also accelerates lead times, reducing transport-related emissions and inventory carrying costs. Consequently, distributors and end-user assemblers are witnessing enhanced responsiveness and reliability, although initial capital outlays for facility reconfiguration and workforce training remain significant.

Furthermore, the tariff-driven cost inflation has catalyzed negotiations on long-term supplier agreements, fostering deeper partnerships with domestic component vendors. These alliances are translating into co-development projects for next-generation modules and shared investments in advanced extrusion and molding capabilities. In effect, the industry is moving toward a more integrated value chain characterized by collaborative product development and risk-sharing frameworks.

Despite short-term margin pressures, the cumulative impact of 2025 tariffs has ultimately spurred innovation and supply chain resilience. Manufacturers and distributors that proactively adapted to the new trade landscape are now well positioned to capitalize on emerging market opportunities. The following sections will explore how these macroeconomic shifts interact with segment-specific demand drivers and regional growth vectors.

Uncovering How Distinct Product, Temperature, and End-User Segments Shape Tailored Strategies Across the Retail Cooler Ecosystem

Insightful segmentation of the retail cooler market reveals distinct product categories and end-use scenarios that shape strategic priorities for manufacturers and operators. On the basis of product type, Chest Coolers deliver flexible, low-footprint solutions for high-traffic convenience formats, while Glass Door Coolers offer enhanced visibility for allergen-sensitive or specialty items in grocery and hospitality environments. Undercounter Coolers, often deployed in food service settings, optimize back-of-house workflows by integrating seamlessly into prep stations. Upright Coolers, with adjustable shelving and customizable branding, are favored in hypermarkets and event venues for merchandising high-volume beverage assortments.

In terms of temperature differentiation, Frozen units support specialty dessert and ready-to-eat categories, driving cross-sell opportunities in quick-service restaurants and concession stands. Heated modules address supply chain gaps for hot-held items, increasingly prevalent in grab-and-go retail concepts. Refrigerated equipment remains the workhorse for perishable goods, balancing energy efficiency and temperature uniformity in everyday use.

End-user industry analysis further enriches this framework. Convenience store operators leverage both C-Store Chains and Independent C-Store formats to cater to impulse purchases and core essentials, requiring a mix of compact chest configurations and digitally enabled coolers. Food Service segments spanning cafeterias, catering services, and restaurant chains prioritize undercounter and mobile cooling carts for operational agility. Grocery retailers, across convenience grocery, hypermarket, and supermarket formats, demand a broad range of upright and glass door designs to support category differentiation. Healthcare settings such as clinics and hospitals focus on reliable refrigerated units with precise temperature compliance for pharmaceuticals and nutritional items. Hospitality venues including event centers, hotels, and resorts emphasize premium aesthetics and modular flexibility to complement curated guest experiences.

Finally, distribution channels and installation types influence go-to-market strategies. Offline channels relying on direct sales, retail chains, and specialty stores necessitate robust local support networks, while online platforms and manufacturer websites are driving digital configurators and virtual showroom capabilities. Built-in solutions, especially undercounter installations, require early design collaboration, whereas freestanding models-ranging from countertop to floor-standing configurations-offer rapid deployment in pilot programs and pop-up activations. This comprehensive segmentation insight serves as a strategic blueprint for tailored product development and market entry initiatives.

This comprehensive research report categorizes the Retail Coolers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity Range

- Installation Mode

- Distribution Channel

- Application

- End User

Highlighting Regional Regulatory Drivers, Consumer Preferences, and Infrastructure Challenges Shaping Retail Cooler Deployment Around the World

Regional dynamics exert a profound influence on product preferences, regulatory frameworks, and deployment models across the global retail cooler landscape. In the Americas, energy efficiency standards promulgated at the federal and state levels have accelerated adoption of high-SEER designs and low-GWP refrigerants. Retailers in urban centers prioritize smart display units that integrate with loyalty platforms, while rural and suburban convenience channels favor durable chest and upright configurations for cost-effective operations.

Across Europe, Middle East & Africa, sustainability and digital connectivity converge to drive innovation. The European Union’s F-gas regulations have encouraged accelerated phase-outs of legacy refrigerants, pushing manufacturers toward CO2 and hydrocarbon-based solutions. Meanwhile, the Middle East’s rapid retail growth and high ambient temperatures create demand for robust, high-capex cooling systems, often paired with renewable energy microgrids. In Africa, modular and off-grid units are gaining traction in areas with intermittent power supply, positioning portable refrigeration as a vital tool for cold-chain expansion.

In the Asia-Pacific region, diverse regulatory landscapes and retail formats underpin a multifaceted outlook. Developed markets in Japan and Australia are advancing connected monitoring systems and automated defrost cycles, enhancing maintenance efficiency. Southeast Asian economies exhibit strong growth in convenience store networks and quick-service outlets, favoring glass door and undercounter units with localized branding. Greater China’s massive retail footprint demands scalable solutions that optimize energy consumption amid rapid expansion, encouraging partnerships with leading HVAC and IoT providers.

Understanding these regional nuances is crucial for aligning product roadmaps with local compliance, consumer expectations, and infrastructure realities. Companies that tailor their portfolios to regional imperatives and leverage strategic alliances with local service partners will unlock differentiated value and sustainable growth across diverse markets.

This comprehensive research report examines key regions that drive the evolution of the Retail Coolers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Technological Partnerships, Service Innovations, and Sustainability Leadership Drive Competitive Differentiation in Retail Cooling

A diverse competitive milieu underpins innovation and operational excellence in the retail cooler industry, with several market leaders driving distinct technology and service propositions. Companies investing in advanced compressor technologies, intelligent controls, and eco-friendly refrigerants have differentiated themselves through lower total cost of ownership and accelerated return on investment. Others have carved niches by focusing on modular designs, rapid field deployment, and seamless integration with third-party energy management systems.

Strategic alliances between equipment providers and software developers have yielded comprehensive service platforms that encompass remote diagnostics, automated replenishment alerts, and warranty monitoring. Such end-to-end offerings enhance customer retention and unlock new revenue streams through subscription-based service contracts. Concurrently, manufacturing partnerships with component specialists have facilitated co-innovation in areas like transparent insulation, antimicrobial surfaces, and adaptive shelving systems, further elevating product quality and compliance.

Distribution-focused organizations are optimizing channel strategies to balance offline showroom networks with robust online configurators, enabling end users to tailor specifications and visualize cooling footprints before purchase. This omnichannel approach has proven especially effective in addressing the unique requirements of verticals such as healthcare, logistics, and hospitality, where customization and regulatory compliance are decisive factors.

Finally, corporate sustainability initiatives and ESG commitments are influencing product roadmaps and M&A activity. Leaders that proactively align with carbon reduction goals and circular economy principles are garnering preference among socially responsible retailers. These companies are also exploring end-of-life recycling and refurbishment programs to close loop supply chains and reinforce brand ethics. Such initiatives underscore the critical role of sustainability leadership in shaping future competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Retail Coolers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bison Coolers, LLC

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Electrolux AB

- Emerson Electric Co.

- GEA Group AG

- Grizzly Coolers, LLC

- Haier Smart Home Co., Ltd.

- Huntington Solutions LLC

- ICEE Containers Pty. Ltd.

- Johnson Controls International plc

- Lifoam Industries LLC

- Midea Group Co., Ltd.

- Mitsubishi Electric Corporation

- ORCA Coolers, LLC

- Panasonic Corporation

- Plastilite Corporation

- Polar Bear Coolers

- The Coleman Company, Inc.

- YETI Holdings, Inc.

Empowering Growth Through Integrated Ecosystems, Modular Architectures, and Circular Economy Strategies for Cooling Innovators

Industry leaders should prioritize building ecosystems that integrate hardware, software, and services to deliver holistic cooling solutions. By forging strategic partnerships with IoT specialists and energy management providers, organizations can unlock new value streams through outcome-based maintenance offerings and real-time performance guarantees. This ecosystem approach also accelerates innovation cycles, as cross-functional teams collaborate on co-development projects that address emerging customer pain points.

In addition, adopting modular design principles will enhance the ability to scale product offerings across diverse retail footprints. Companies can establish configurable platforms that accommodate variable temperature zones, custom branding elements, and plug-and-play connectivity options. Such modular architectures reduce time to market and support pilot programs, enabling end users to validate concepts before committing to large-scale rollouts. Consequently, adoption barriers are lowered and stakeholder confidence is fostered.

Furthermore, executives should align go-to-market strategies with regional regulatory roadmaps and infrastructure realities. Investing in local manufacturing or assembly can mitigate tariff risks and support rapid product customization. Meanwhile, cultivating close relationships with certified service partners ensures compliance with regional standards and responsive maintenance support.

Finally, embedding circular economy principles into product life cycles-through reusable packaging, end-of-life refurbishment programs, and refrigerant recovery initiatives-will resonate with sustainability-minded customers and regulators alike. By adopting these actionable strategies, industry leaders can secure operational resilience, enhance customer loyalty, and accelerate profitability in an increasingly competitive landscape.

Outlining the Mixed-Methods Framework Combining Primary Stakeholder Interviews, Secondary Research, and Statistical Analysis for Robust Insights

This analysis is grounded in a rigorous mixed-methods research framework combining primary and secondary data sources. Primary research included qualitative interviews with key stakeholders across the value chain, encompassing equipment manufacturers, distributors, end users, and regulatory authorities. These conversations provided firsthand insights into procurement drivers, technology adoption barriers, and service model preferences.

Complementing primary inputs, secondary research drew upon industry publications, white papers, academic journals, and regulatory databases to validate trends and contextualize regional legislation. Vendor financial reports and patent filings were reviewed to map R&D investments, competitive positioning, and technology roadmaps. Market advisory insights helped triangulate emerging patterns in digital integration and sustainability commitments.

Quantitative data collection involved structured surveys with facility managers and operations directors across convenience, grocery, hospitality, and healthcare verticals. Survey data was analyzed using statistical software to identify correlations between investment priorities, equipment performance outcomes, and total cost of ownership considerations. Cross-validation with installation records and service logs further enhanced data reliability.

Finally, all findings underwent peer review by independent industry experts to ensure objectivity and accuracy. Methodological rigor was maintained through transparent documentation of data sources, research protocols, and analytical procedures. This robust approach underpins the credibility of insights and recommendations presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Retail Coolers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Retail Coolers Market, by Product Type

- Retail Coolers Market, by Capacity Range

- Retail Coolers Market, by Installation Mode

- Retail Coolers Market, by Distribution Channel

- Retail Coolers Market, by Application

- Retail Coolers Market, by End User

- Retail Coolers Market, by Region

- Retail Coolers Market, by Group

- Retail Coolers Market, by Country

- United States Retail Coolers Market

- China Retail Coolers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Synthesizing the Convergence of Technology, Regulatory Impacts, and Regional Dynamics to Guide Strategic Priorities in Retail Cooling

The retail cooler market is experiencing a paradigm shift driven by digital integration, sustainability imperatives, and evolving consumer expectations. Strategic adoption of smart diagnostics and energy-efficient technologies is elevating the role of cooling solutions from utility assets to strategic enablers of brand differentiation. Moreover, recent tariff measures have catalyzed supply chain resilience and near-shoring initiatives, while segmentation insights emphasize the importance of tailored product platforms for distinct temperature, application, and channel requirements.

Regional nuances further underscore the need for localized strategies that align with regulatory frameworks, infrastructure conditions, and consumer behaviors. The competitive landscape is being reshaped by technology partnerships, service innovations, and ESG commitments, highlighting the imperatives for ecosystem integration and circular economy approaches. By synthesizing these multifaceted drivers, industry leaders can chart a clear path forward, leveraging modular product architectures and collaborative business models to maximize value realization.

Ultimately, success in this dynamic landscape hinges on proactive alignment of product development, go-to-market execution, and sustainability roadmaps. Decision makers equipped with the insights and recommendations contained in this report will be well positioned to accelerate growth, enhance operational resilience, and unlock new revenue streams through differentiated cooling solutions.

Seize Advanced Market Intelligence and Strategic Guidance Through Direct Partnership With Industry Sales Leadership

To explore a tailored solution that empowers your organization with unparalleled insights on the dynamic retail cooler market and secures a competitive edge, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to obtain the complete market research report and embark on a journey of strategic growth through data-driven intelligence

- How big is the Retail Coolers Market?

- What is the Retail Coolers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?