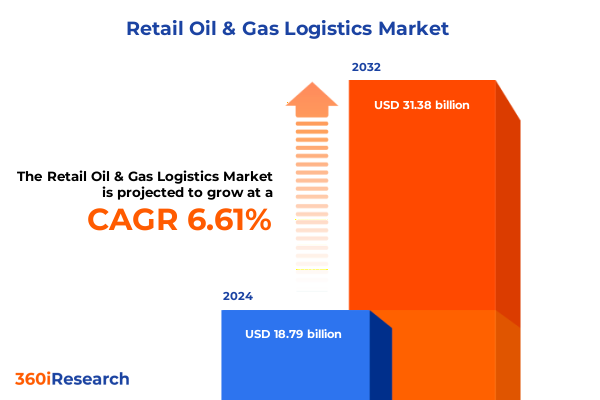

The Retail Oil & Gas Logistics Market size was estimated at USD 19.82 billion in 2025 and expected to reach USD 20.91 billion in 2026, at a CAGR of 6.78% to reach USD 31.38 billion by 2032.

Exploring the Complex Dynamics of Retail Oil and Gas Logistics Amid Global Energy Demand Volatility, Supply Chain Disruptions, and Infrastructure Evolution

The retail oil and gas logistics landscape is increasingly shaped by a confluence of global forces, from surging energy demand and tightening decarbonization mandates to the rapid digitization of supply chains. Stakeholders are navigating an environment where infrastructure complexity and regulatory volatility demand greater agility and foresight. As operators contend with aging pipelines, expanding marine transport networks, and the integration of advanced tracking technologies, the need for a cohesive strategic framework has never been more pronounced.

Meanwhile, the sector grapples with rising supply chain disruptions triggered by geopolitical tensions and new trade barriers, which have driven equipment costs upward and stretched lead times for critical assets. Oilfield service firms have reported revenue pressures due to tariff-induced cost increases on pipes, valves, and specialized steel components, underscoring the importance of margins optimization and cost containment measures.

Against this backdrop, companies are accelerating investments in predictive maintenance, digital twins, and Internet of Things (IoT) sensors to enhance real-time visibility and minimize unplanned downtime. These technological advances are enabling proactive asset management and improved safety outcomes, reflecting a broader industry shift toward data-driven operations.

Uncovering Transformative Shifts in Oil and Gas Logistics Driven by Decarbonization Mandates, Geopolitical Realignments, and Emerging Trade Policy Pressures

The industry is experiencing transformative shifts driven by decarbonization imperatives and tightening emissions regulations, compelling fleet operators and logistics providers to reimagine traditional marine and land-based transport models. New IMO policies and regional carbon pricing frameworks are accelerating the adoption of alternative fuels such as green ammonia, bio-methanol, and liquefied natural gas, reshaping vessel specifications and cargo handling protocols.

At the same time, sweeping trade policy changes and renewed Section 232 tariffs on steel and aluminum are redefining supply chain routes, compelling companies to reassess procurement strategies and localize manufacturing. The evolution of U.S. trade relations has prompted many global partners to explore alternative sourcing arrangements, spurring supply chain realignment and novel distribution partnerships across the Americas, Europe, and Asia.

Analyzing the Cumulative Impact of 2025 United States Steel and Aluminum Tariffs on the Cost Structure and Supply Chains of Oil and Gas Logistics

In early 2025, the reinstatement and expansion of Section 232 tariffs restored a 25% duty on steel and aluminum imports, followed by an increase to a 50% levy on June 4, heightening the cost base for pipelines, tank cars, trailers, and storage tanks. These sequential policy moves have effectively doubled the tariff burden compared to the original 2018 measures, amplifying equipment and maintenance expenses across the logistics chain.

The tangible repercussions are evident in beyond-industry data showing a 21% surge in domestic steel costs within weeks of the tariff expansions, alongside border delays and customs documentation challenges that have disrupted just-in-time operations. Logistics providers are reporting extended vessel laytimes, backlog at distribution terminals, and re-routed freight corridors, underscoring the cumulative drag on both capital expenditure and operational agility.

Gaining Key Segmentation Insights to Navigate Transportation Modes, Service Types, Fuel Variants, Provider Models, and Infrastructure Assets in Oil and Gas Logistics

A nuanced understanding of the sector emerges when dissecting the market through multiple segmentation lenses. Transportation modes span marine networks, pipelines, rail, and road, each presenting unique operational challenges and capital requirements. Marine freight relies on specialized chemical tankers, LNG carriers, and oil tankers, while pipeline operators balance the complexities of offshore and onshore networks. Rail logistics distinguish between hopper cars and tank cars, and road transport utilizes both tank trailers and tank trucks, highlighting diverse asset classes and maintenance regimes.

Service offerings further refine market dynamics into distribution, storage, and tank storage, with each category embedding additional layers of specialization. Distribution networks bifurcate into bulk and direct channels, storage solutions include sphere terminals with pressurized and refrigerated capacities, and tank storage facilities may be configured above ground or underground. Likewise, fuel type segmentation contrasts gaseous fuels-such as CNG and LPG (including butane and propane)-against liquid fuels including diesel, gasoline, and kerosene. Provider models also influence value propositions, with in-house logistics operations juxtaposed against third-party 3PL and 4PL services. Infrastructure assets complete the picture, encompassing collection and distribution terminals alongside ambient and temperature-controlled warehouses, the latter often relying on cold storage or insulated environments to preserve fuel integrity.

This comprehensive research report categorizes the Retail Oil & Gas Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transportation Mode

- Fuel Type

- Logistics Provider Type

- Infrastructure Type

Highlighting Regional Distinctions Across the Americas, Europe Middle East Africa, and Asia-Pacific in Shaping Trends and Investment in Oil and Gas Logistics

Regional dynamics play a pivotal role in shaping growth trajectories and investment priorities. In the Americas, mature downstream networks and extensive pipeline grids benefit from advanced regulatory frameworks but must contend with aging infrastructure and incremental decarbonization requirements. Investment trends in North America emphasize digital modernization and capacity expansion, while Latin American markets focus on infrastructure rehabilitation and cross-border connectivity.

Across Europe, the Middle East, and Africa, established shipping lanes and export hubs intersect with emerging onshore pipeline projects in Eastern Europe and significant midstream developments in the Gulf. Regulatory harmonization efforts in the European Union contrast with expansive export ambitions in the Middle East, and sub-Saharan markets continue to attract interest for storage terminal build-outs and rail enhancements. In Asia-Pacific, surging energy demand and strategic drive for energy security underpin a wave of investments in LNG carriers, pipeline extensions, and state-of-the-art storage facilities. These regional nuances underscore the charted course for global operators and investors alike.

This comprehensive research report examines key regions that drive the evolution of the Retail Oil & Gas Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Responses to Tariffs, Decarbonization, and Digitalization in the Retail Oil and Gas Logistics Sector

Several leading players exemplify the strategic adaptations unfolding across the sector. A.P. Moller-Maersk has notably expanded its fleet with dual-fuel container vessels, committing to methanol and LNG propulsion systems to meet stringent emissions targets and provide deployment flexibility across diverse trade routes. This move reflects a broader industry commitment to lower-carbon maritime transport and positions the company at the forefront of net-zero ambitions.

In the oilfield services domain, Halliburton has publicly detailed the financial toll of trade tariffs on its drilling and completions operations, expecting a multi-million dollar impact on quarterly earnings and proactively seeking mitigation through supply chain diversification and procurement efficiencies. Its competitors, including SLB and Baker Hughes, similarly forecast revenue headwinds from imported equipment duties and are calibrating their service offerings to maintain profitability under evolving trade regimes.

Meanwhile, pipeline operators such as Kinder Morgan and Enbridge are leveraging digital twins and IoT-enabled sensors to enhance predictive maintenance, reduce leak risks, and optimize throughput. Rail carriers and trucking firms have embraced automated scheduling platforms and telematics to smooth transit corridors, while 3PL and 4PL providers are rolling out end-to-end supply chain orchestration tools to deliver real-time visibility and dynamic routing under fluctuating market conditions. These collective moves highlight a competitive landscape defined by technological innovation, regulatory adaptation, and collaborative partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Retail Oil & Gas Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agility Public Warehousing Co. K.S.C.P.

- Bharat Petroleum Corporation Limited

- BP p.l.c.

- C.H. Robinson Worldwide, Inc.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- DB Schenker

- DHL International GmbH

- Exxon Mobil Corporation

- Gulf Agency Company (GAC) Limited

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Limited

- Kuehne + Nagel Management AG

- Marathon Petroleum Corporation

- Nayara Energy Limited

- PetroChina Company Limited

- Reliance Industries Limited

- Royal Dutch Shell plc

- TotalEnergies SE

- Valero Energy Corporation

Actionable Recommendations for Industry Leaders to Strengthen Resilience, Optimize Operations, and Enhance Sustainability in Oil and Gas Logistics

Industry decision-makers must pursue a multifaceted resilience strategy that encompasses accelerated investment in digital transformation, including predictive analytics and supply chain visibility platforms. By harnessing advanced data insights, operators can anticipate maintenance needs, optimize asset utilization, and reduce downtime, thereby safeguarding margins in a high-volatility environment.

Concurrently, logistics leaders should cultivate flexible procurement frameworks to mitigate tariff volatility, diversified sourcing channels to maintain continuity of supply, and collaborative partnerships across national and regional networks. Emphasizing sustainability through alternative fuel adoption and modular infrastructure development will not only align with emerging regulatory mandates but also unlock cost efficiencies and brand differentiation. These proactive measures can position organizations to thrive amid ongoing policy shifts and market disruptions.

Detailing a Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Analysis, and Qualitative Data Triangulation for Strategic Insights

This research integrates a rigorous methodology combining in-depth primary interviews with senior executives across logistics providers, infrastructure operators, and fuel producers, alongside comprehensive secondary data analysis from industry reports, regulatory filings, and market intelligence databases. Insights were triangulated through cross-referencing proprietary corporate announcements, trade association publications, and custom surveys to validate emerging trends and quantify operational impacts.

Qualitative findings were synthesized using thematic analysis to identify common challenges and strategic priorities, while quantitative data underwent statistical validation to ensure robustness. The result is a holistic framework that captures both macroeconomic drivers and granular operational variables, equipping stakeholders with actionable intelligence to inform strategic decision-making and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Retail Oil & Gas Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Retail Oil & Gas Logistics Market, by Transportation Mode

- Retail Oil & Gas Logistics Market, by Fuel Type

- Retail Oil & Gas Logistics Market, by Logistics Provider Type

- Retail Oil & Gas Logistics Market, by Infrastructure Type

- Retail Oil & Gas Logistics Market, by Region

- Retail Oil & Gas Logistics Market, by Group

- Retail Oil & Gas Logistics Market, by Country

- United States Retail Oil & Gas Logistics Market

- China Retail Oil & Gas Logistics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding Reflections on the Future Trajectory of Oil and Gas Logistics in the Face of Policy Shifts, Technological Advances, and Market Dynamics

The retail oil and gas logistics sector stands at an inflection point where policy realignments, technological breakthroughs, and evolving energy consumption patterns converge to redefine operational norms. Organizations that embrace adaptive strategies-blending digital innovation with supply chain flexibility-will be best positioned to capitalize on efficiency gains and sustainability mandates.

Looking forward, the interplay of regional dynamics, segmentation nuances, and major corporate initiatives will shape competitive differentiation. Those who proactively realign infrastructure investments, strengthen regional partnerships, and integrate cutting-edge digital tools can transform challenges into opportunities, laying the groundwork for resilient and future-proof logistics ecosystems.

Seize Exclusive Insights and Drive Strategic Advantage by Connecting with Ketan Rohom to Access the Comprehensive Oil and Gas Logistics Market Research Report

In today’s competitive environment, decision makers seeking a strategic edge are invited to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to gain exclusive access to an in-depth market research report that delivers unparalleled insights into retail oil and gas logistics. By securing this comprehensive analysis, stakeholders can equip their organizations with the critical intelligence needed to navigate policy shifts, capitalize on emergent trends, and fortify operational resilience. Connect with Ketan Rohom to unlock tailored support for procurement, ensure timely report delivery, and embark on a data-driven journey toward sustainable growth and market leadership.

- How big is the Retail Oil & Gas Logistics Market?

- What is the Retail Oil & Gas Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?