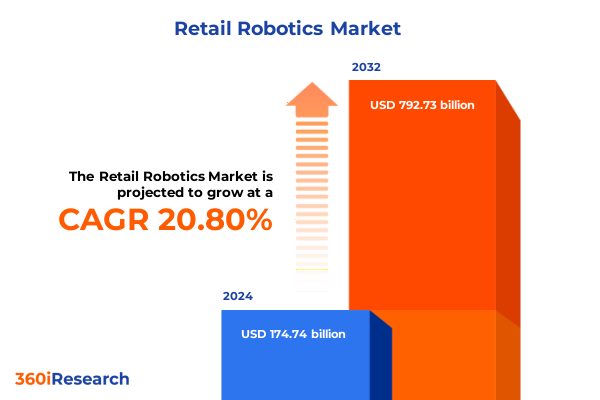

The Retail Robotics Market size was estimated at USD 209.81 billion in 2025 and expected to reach USD 251.92 billion in 2026, at a CAGR of 20.91% to reach USD 792.73 billion by 2032.

Exploring the Dawn of Intelligent Automation and Cutting-Edge Robotics Revolutionizing Retail Operations and Customer Experiences

The retail industry is undergoing a fundamental metamorphosis driven by the advent of intelligent automation and robotics technologies. Traditional brick-and-mortar environments are evolving into dynamic, data-driven ecosystems where robots augment human labor, enhance efficiency, and elevate customer experiences. This convergence of physical and digital realms is propelled by consumer demand for instant gratification, seamless omnichannel experiences, and personalized service. Amid labor shortages and cost pressures, robotics solutions-from autonomous mobile robots navigating store aisles to robotic arms handling delicate operations-offer retailers the means to optimize processes, reduce errors, and differentiate their brands in an increasingly competitive landscape.

Against this backdrop of rapid innovation, this analysis delves into the critical trends, structural shifts, and strategic considerations shaping the retail robotics market. It presents an in-depth exploration of the transformative forces at play, examines the ripple effects of newly imposed tariff regimes, and deciphers nuanced segmentation dynamics. Further, it highlights geographical variances, profiles leading industry players, offers targeted recommendations for decision-makers, and outlines the robust methodology underpinning the research. By synthesizing these insights, this executive summary equips stakeholders with a comprehensive understanding of the opportunities and challenges inherent in integrating robotics into modern retail operations.

Unveiling Monumental Technological and Consumer Behavior Shifts Reshaping the Future Landscape of Retail Robotics

The retail robotics landscape is being reshaped by multifaceted shifts that extend far beyond mere mechanization. Artificial intelligence, machine learning, and advanced sensor technologies are converging to create robots capable of context-aware interactions, real-time decision-making, and seamless integration with broader enterprise systems. As retailers digitize their supply chains and migrate critical workloads to the cloud, they gain unprecedented visibility into inventory flows and customer behaviors. This data-rich environment empowers autonomous robots to dynamically adjust tasks, such as shelf replenishment and order picking, in response to evolving store conditions and demand signals.

Moreover, the rise of micro-fulfillment centers within urban retail footprints underscores a fundamental pivot from centralized distribution to hyper-localized delivery models. Autonomous mobile robots are now traversing compact indoor environments, optimizing space utilization and accelerating last-mile fulfillment. Simultaneously, contactless retail experiences-bolstered by robotic cleaning solutions and automated checkout systems-are redefining in-store safety and convenience standards. Together, these technological and operational shifts are forging a new paradigm in which robotics drives both scale and personalization, positioning retailers to thrive amid changing consumer expectations and competitive pressures.

Analyzing the Compounding Effects of 2025 United States Tariff Policies on Supply Chains Component Costs and Competitive Strategies in Retail Robotics

The introduction of updated United States tariff measures in early 2025 has introduced a layer of complexity into the global retail robotics ecosystem. By imposing elevated duties on key imported components-ranging from high-precision sensors and specialized semiconductors to industrial drives-manufacturers and integrators have encountered increased procurement costs. These higher landed prices have prompted many stakeholders to reassess their sourcing strategies, with a growing emphasis on securing regional suppliers or investing in domestic manufacturing capabilities to mitigate exposure to foreign duties.

Consequently, robotics developers have accelerated efforts to diversify supply chains, forging partnerships with local electronics fabricators and component assemblers. This shift has catalyzed investments in nearshoring initiatives and collaborative R&D programs aimed at reducing reliance on tariff-impacted imports. In parallel, end users are weighing total cost of ownership more closely, factoring in the potential for future policy changes. Although some cost burdens have been partially absorbed through operational optimizations and yield improvements, the cumulative effect of these tariffs underscores the need for robust risk management and adaptive procurement frameworks within the retail robotics domain.

Dissecting Core Market Segments Reveals Product Types Applications End Users Components Deployment Models and Integration Trends Driving Robotics Adoption

A granular examination of product type segmentation reveals a varied array of robotics solutions catering to distinct operational needs. Automated Guided Vehicles form a foundational category, with Laser Guided Vehicles and Magnetic Tape Guided Vehicles representing two core navigation approaches. In parallel, Automated Storage and Retrieval Systems address high-density inventory management, while Autonomous Mobile Robots span indoor and outdoor applications to optimize both warehouse and storefront workflows. Complementing these are specialized cleaning robots designed for sanitary maintenance, packaging robots that streamline order consolidation, robust robot arms for intricate assembly tasks, and robotic picking systems that enhance order accuracy and throughput.

Beyond hardware classifications, application segmentation dissects use cases across cleaning, packaging, palletizing, picking, sorting, and transportation functions. This lens illuminates how retailers prioritize process automation based on operational bottlenecks and service-level goals. End user segmentation highlights how e-commerce fulfillment centers, healthcare environments, manufacturing plants, retail storefronts, and warehouse & distribution hubs each leverage robotics differently to align with volume demands, regulatory requirements, and spatial constraints. Furthermore, component-level insights differentiate between hardware, service, and software offerings, underscoring the critical role of integrated solutions and lifecycle support in sustaining long-term performance.

The analysis also incorporates deployment mode segmentation, contrasting cloud-based platforms that deliver real-time fleet orchestration and analytics with on-premises solutions favored for data sovereignty and customizability. Finally, integration type segmentation distinguishes between fully integrated robotics ecosystems and standalone units, reflecting varying degrees of interoperability and modularity. Together, these layered perspectives provide a holistic framework for evaluating competitive positioning and growth opportunities within the retail robotics market.

This comprehensive research report categorizes the Retail Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Integration Type

- Application

- End User

- Deployment Mode

Examining Regional Dynamics Highlights Divergent Growth Drivers and Strategic Priorities Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping retail robotics adoption, with distinct market drivers and maturation curves across key geographies. In the Americas, large-scale retail chains and third-party logistics providers are at the forefront of deploying robotics to address labor scarcity and accelerate order fulfillment. The United States, in particular, has witnessed widespread piloting of autonomous mobile robots and robotic picking systems in fulfillment centers, while Latin American markets are gradually embracing automation to modernize distribution networks and enhance service efficiency.

Across Europe, the Middle East, and Africa, regulatory harmonization and cross-border trade agreements are fostering investments in robotics solutions that comply with stringent safety and data protection standards. Western European retailers have prioritized flexible robots capable of rapid redeployment between store and warehouse contexts, whereas Middle Eastern markets are investing in state-of-the-art robotics for high-end retail experiences. In Africa, select urban centers are adopting containerized micro-fulfillment modules equipped with integrated robotics to meet the demands of burgeoning e-commerce segments.

Asia-Pacific stands out as a rapidly advancing region, driven by government-sponsored innovation programs and supportive industrial policies. Leading economies such as China, Japan, and South Korea have established robotics clusters and incentivized domestic manufacturers, fueling continuous breakthroughs in autonomous systems. Southeast Asian nations are similarly exploring cloud-based orchestration platforms to manage mixed fleets of indoor and outdoor mobile robots. Collectively, these regional narratives underscore the importance of tailored strategies that account for local infrastructure, regulatory landscapes, and consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Retail Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Robotics Innovators and Strategic Collaborations Powering Breakthroughs in Automation Across Diverse Retail Settings

The retail robotics arena is increasingly defined by strategic alliances and technology-driven differentiators among key industry participants. Established automation giants are broadening their product portfolios through targeted acquisitions of specialized startups, integrating advanced vision systems, AI-driven analytics, and modular robotics into their core offerings. At the same time, emerging disruptors are partnering with cloud platform providers to deliver seamless fleet management solutions, emphasizing subscription-based business models that democratize access to sophisticated automation tools.

Furthermore, trilateral collaborations between technology vendors, logistics operators, and retail chains are accelerating the development of bespoke robotics applications. These consortia facilitate knowledge exchange, expedite pilot deployments, and refine best practices for integration and maintenance. Software companies are also stepping into the spotlight, equipping hardware-centric firms with intuitive user interfaces and predictive maintenance capabilities. As a result, the competitive landscape is evolving into an ecosystem of interoperable solutions, where the ability to unify diverse robotics assets under a single operational framework is emerging as a critical determinant of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Retail Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AiFi, Inc.

- Amazon Robotics, Inc.

- AutoStore AS

- Badger Technologies, Inc.

- Bossa Nova Robotics, Inc.

- Brain Corporation

- Caper AI, Inc.

- Daifuku Co., Ltd.

- Geekplus Technology Co., Ltd.

- Honeywell International Inc.

- KUKA AG

- Nilfisk A/S

- Ocado Group plc

- Siemens AG

- Simbe Robotics, Inc.

- Swisslog Holding AG

- Symbotic Inc.

- Tennant Company

- Trigo Vision Ltd.

Empowering Industry Leaders with Strategic Roadmaps to Integrate Advanced Robotics Solutions Optimize Operations and Enhance Customer Engagement

Industry leaders seeking to capitalize on retail robotics innovations should prioritize the development of scalable and modular system architectures that accommodate evolving operational requirements. By selecting robotics platforms with open APIs and standardized communication protocols, organizations can ensure interoperability across various device types and software applications. Moreover, cultivating a culture of continuous learning through workforce upskilling programs will be essential to maximize the value of automation investments and foster effective human-robot collaboration.

In addition, retailers and solution providers should pursue strategic partnerships with regional component manufacturers to fortify supply chain resilience in the face of tariff volatility. Conducting pilot programs within micro-fulfillment or dark store environments can yield critical performance data, enabling iterative refinements prior to full-scale rollouts. Embracing comprehensive data analytics and remote monitoring tools will further facilitate proactive maintenance, reduce downtime, and drive incremental efficiency gains. Finally, aligning robotics initiatives with broader organizational sustainability goals-such as reducing energy consumption through optimized route planning and leveraging recyclable materials in robot design-can generate both cost savings and positive brand equity.

Outlining Rigorous Multi Faceted Research Framework Combining Qualitative Interviews Quantitative Data Analysis and Industry Benchmarking for Reliable Insights

This research integrates a robust, triangulated framework combining both qualitative and quantitative methodologies to ensure validity and actionable clarity. Primary research was conducted through in-depth interviews with senior executives, operations managers, and R&D specialists across leading retail chains, robotics vendors, and system integrators. These interactions were complemented by structured surveys capturing real-world deployment experiences, pain points, and strategic priorities.

Secondary research encompassed a comprehensive review of industry publications, patent filings, corporate whitepapers, and regulatory documents to map technological roadmaps and competitive landscapes. Data points were normalized and cross-verified through multiple sources, while proprietary benchmarks were applied to assess solution maturity levels. The findings were further refined through expert panel workshops, where preliminary insights were stress-tested against evolving market scenarios and emerging policy frameworks. This rigorous approach ensures that the insights presented are both contextually grounded and forward-looking.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Retail Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Retail Robotics Market, by Product Type

- Retail Robotics Market, by Component

- Retail Robotics Market, by Integration Type

- Retail Robotics Market, by Application

- Retail Robotics Market, by End User

- Retail Robotics Market, by Deployment Mode

- Retail Robotics Market, by Region

- Retail Robotics Market, by Group

- Retail Robotics Market, by Country

- United States Retail Robotics Market

- China Retail Robotics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings That Illuminate the Evolving Retail Robotics Ecosystem and Chart a Path for Strategic Innovation and Investment

As retail enterprises navigate the complexities of next-generation automation, the strategic integration of robotics solutions emerges as a critical lever for operational excellence and competitive differentiation. The interplay between advanced sensor technologies, AI-driven orchestration platforms, and evolving tariff landscapes necessitates a holistic perspective that encompasses product diversity, regional idiosyncrasies, and collaborative innovation. Through dissecting segmentation nuances and evaluating leading practitioners, this analysis illuminates pathways by which retailers can harness robotics to drive efficiency, agility, and customer satisfaction.

Ultimately, success in the retail robotics domain will hinge on an organization’s ability to balance technological ambition with pragmatic execution. By adopting best practices in supply chain diversification, interoperability, and workforce enablement, stakeholders can mitigate risks and unlock sustained value. The evolving market dynamics call for continuous engagement with emerging trends, making iterative experimentation and data-driven decision-making indispensable. This executive summary thus serves as both a mirror reflecting the current state of play and a compass guiding future strategic endeavors in the rapidly advancing field of retail robotics.

Empower Your Competitive Advantage with Direct Access to Exclusive Retail Robotics Market Intelligence via Ketan Rohom

Ready to elevate your strategic foresight and operational decision-making with deep insights into the competitive and technological forces shaping retail robotics. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore comprehensive research findings, gain tailored intelligence, and secure your organization’s edge in an evolving marketplace. Seize the opportunity to empower your leadership team with actionable data and scenario-based recommendations that align with your growth ambitions. Engage Ketan today to unlock unparalleled market analysis and position your enterprise at the forefront of the retail robotics revolution

- How big is the Retail Robotics Market?

- What is the Retail Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?