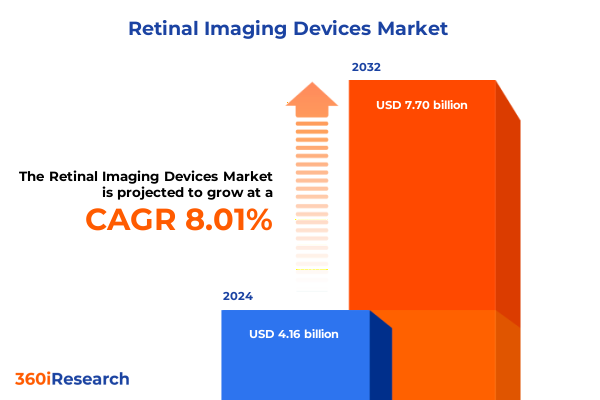

The Retinal Imaging Devices Market size was estimated at USD 4.16 billion in 2024 and expected to reach USD 4.47 billion in 2025, at a CAGR of 8.01% to reach USD 7.70 billion by 2032.

Exploring The Evolution and Critical Role of Retinal Imaging Devices in Modern Ophthalmology and Vision Research as Key Diagnostic Tools

Retinal imaging devices have undergone a remarkable evolution, transitioning from analogue fundus cameras to sophisticated digital platforms that offer unparalleled visualization of ocular structures. In the early days, clinicians relied on color fundus photography to document retinal health, but these systems were limited by manual processing and variable image quality. With the advent of digital fundus photography and the introduction of optical coherence tomography, practitioners gained access to real-time, high-resolution cross-sectional views of retinal layers, revolutionizing both diagnostic accuracy and patient management.

As these technologies have matured, their role in routine ophthalmic care has expanded dramatically. Today, devices such as scanning laser ophthalmoscopes and adaptive optics platforms enable detailed assessments of photoreceptor integrity and microvascular perfusion, enhancing early detection of conditions like diabetic retinopathy, age-related macular degeneration, and glaucoma. Moreover, ultrawide field imaging has broadened clinicians’ ability to capture peripheral pathology in a single shot, reducing the need for time-consuming montage techniques. Consequently, retinal imaging has become indispensable for both clinical decision-making and longitudinal disease monitoring in everyday practice.

Charting The Pivotal Technological Advancements and Market Dynamics Propelling Innovation in Retinal Imaging Over the Last Decade

Over the past decade, the retinal imaging landscape has been transformed by rapid technological innovation and shifting care paradigms. The transition from standalone fundus photography to integrated multimodal platforms has enabled clinicians to capture structural and functional data in a single session, driving more comprehensive diagnoses. In parallel, breakthroughs in optical coherence tomography, including swept source and spectral domain modalities, have pushed axial resolution below five microns, revealing new layers of retinal pathology that were previously invisible.

Beyond hardware advances, the integration of artificial intelligence and machine learning algorithms has accelerated diagnostic workflows by enabling automated detection of retinal lesions and quantification of anatomical changes. Teleophthalmology initiatives have leveraged portable imaging devices to bring diabetic retinopathy screening to underserved communities, demonstrating how connectivity and cloud-based analytics can overcome traditional geographic barriers. Furthermore, miniaturization efforts have yielded compact, handheld systems without compromising image quality, making point-of-care assessments more feasible in both primary care and emergency settings. Collectively, these shifts underline a broader trend toward precision, accessibility, and patient-centered retinal healthcare.

Assessing The Comprehensive Effects of New 2025 United States Tariffs on Retinal Imaging Device Supply Chains Costs and Patient Access

Beginning in early April 2025, new U.S. tariff measures introduced a baseline reciprocal import duty of 10 percent on most goods, while imposing elevated rates on imports from China that effectively reach 145 percent when including additional IEEPA levies. This multifaceted tariff regime has directly impacted manufacturers of retinal imaging systems, many of which rely on global supply chains for precision optics, semiconductors, and electronic components. As a result, suppliers have faced sharply increased input costs, creating pressure to pass expenses onto end users and potentially constraining access to advanced imaging modalities in critical care settings.

Industry leaders have publicly acknowledged the financial ramifications of these trade policies. A prominent imaging equipment company revised its 2025 earnings guidance, projecting that tariffs could decrease profit margins by over two percentage points and absorb roughly $375 million in additional costs as higher-cost inventory moved through its balance sheet during the second half of the year. Hospitals and clinics have also warned of delayed procedures and potential equipment shortages, with professional associations urging policymakers to consider exemptions or phased implementations to safeguard patient access and avoid disruptions to critical diagnostic services.

In response, several manufacturers are accelerating localization strategies by expanding on-shore production and diversifying supplier networks to mitigate tariff risk. These efforts aim to reduce reliance on high-tariff imports and preserve competitive pricing, yet they require substantial capital investments and extended lead times. Consequently, the full impact of these tariffs will unfold over multiple quarters as companies reconfigure their supply chains and realign distribution strategies.

Uncovering Distinct Technology End User and Application Segment Performance Shaping the Retinal Imaging Device Market Landscape

Technology segmentation reveals a diverse ecosystem where adaptive optics imaging delivers cellular-level resolution, while classic fundus imaging remains a mainstay for routine examinations. Within the fundus imaging category, color fundus photography continues to serve as the diagnostic workhorse, even as digital fundus systems gain traction through enhanced image processing and seamless integration with electronic health records. Optical coherence tomography dominates the landscape with its ability to generate volumetric maps of retinal layers, and the emergence of swept source and spectral domain platforms has further sharpened structural clarity. Time domain OCT, though less prevalent, still finds niche applications in cost-sensitive environments. Complementing these systems, scanning laser ophthalmoscopes and ultrawide field devices facilitate targeted assessment of peripheral retinal pathologies, driving demand among specialists and general ophthalmologists alike.

When considering end users, hospitals and clinics stand at the forefront of adoption, supported by extensive reimbursement frameworks and multidisciplinary care delivery models. Ambulatory surgery centers, meanwhile, are capitalizing on outpatient procedures by integrating compact imaging units that expedite preoperative diagnostics and postoperative monitoring. Research institutions harness the full spectrum of imaging modalities to push the boundaries of neuro-ophthalmology and genetic retinal disorder studies, leveraging high-resolution systems to validate novel therapeutics and biomarkers.

Across applications, diagnostic use remains the principal driver, as clinicians rely heavily on imaging data to inform treatment pathways and measure disease progression. Screening initiatives have expanded under public health programs targeting diabetic populations, and research applications continue to evolve through collaborations with pharmaceutical and biotech firms. This layered segmentation landscape underscores the importance of tailoring product development and go-to-market strategies to specific technology preferences, user settings, and clinical objectives.

This comprehensive research report categorizes the Retinal Imaging Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Connectivity

- Portability

- Application

- End User

- Indication

- Distribution Channel

Comparative Regional Dynamics Revealing How Americas Europe Middle East and Africa and Asia Pacific Are Driving Retinal Imaging Device Adoption

In the Americas, advanced healthcare infrastructure and robust reimbursement programs have established this region as a premier market for retinal imaging investments. North American providers benefit from integrated care networks that prioritize early detection of vision-threatening conditions, driving widespread adoption of both conventional fundus cameras and high-end OCT platforms. Latin American countries are seeing a gradual uptick in screening initiatives, supported by local partnerships and mobile imaging programs aimed at bridging access gaps.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and economic conditions that shape technology uptake. Western Europe’s mature healthcare systems emphasize quality and interoperability, fostering adoption of digital and AI-enabled imaging solutions. In contrast, emerging markets within EMEA are prioritizing cost-effective models, often integrating refurbished or portable devices to extend diagnostic capabilities into rural and underserved areas. Regulatory harmonization efforts, such as the EU Medical Device Regulation, are prompting manufacturers to streamline compliance pathways and update legacy product lines.

Asia-Pacific stands out for its rapid growth trajectory, driven by expanding geriatric populations in Japan and China, rising diabetes prevalence in Southeast Asia, and government-led vision care initiatives in India. Local production hubs are scaling to meet domestic demand, and collaborations between global manufacturers and regional distributors are accelerating technology transfer. Together, these regional dynamics underscore the pivotal role of tailored market strategies that address local regulatory frameworks, reimbursement landscapes, and care delivery models.

This comprehensive research report examines key regions that drive the evolution of the Retinal Imaging Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives Product Innovations and Competitive Positioning Among Leading Retinal Imaging Device Manufacturers Worldwide

The competitive landscape is defined by leading manufacturers that have cultivated strong brand reputations, broad product portfolios, and global footprints. One prominent global player continues to expand its adaptive optics offerings and solidify cloud-based analytics partnerships, while another has intensified its focus on swept source OCT through recent technology licensing agreements. A third company has leveraged strategic acquisitions to broaden its ultrawide field imaging capabilities, enabling comprehensive peripheral screening solutions.

Mid-tier firms are differentiating through cost-optimized designs and modular platforms tailored to ambulatory centers and emerging markets, where capital constraints demand flexible financing options and scalable service models. In parallel, several established ophthalmic equipment vendors are integrating AI-driven software modules that automate lesion detection and quantify disease biomarkers, enhancing clinical workflow efficiency and generating new revenue streams through subscription-based software licenses.

Across all tiers, key players are strengthening distribution networks by forging alliances with regional healthcare groups and telemedicine providers. These collaborations not only enhance market penetration but also create feedback loops for continuous product refinement. Furthermore, strategic diversification of manufacturing footprints is underway, as companies seek to mitigate geopolitical risks and align production capacities with shifting tariff landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Retinal Imaging Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- Bausch Health Companies Inc.

- Canon Inc.

- Carl Zeiss AG

- EarlySight SA

- Epipole Ltd.

- EssilorLuxottica SA

- Eyenuk, Inc.

- Forus Health Pvt. Ltd.

- Haag-Streit Group

- Halma plc

- Heidelberg Engineering GmbH

- iCare Finland Oy by Revenio Group Corporation

- Ikerian AG

- Konan Medical, Inc.

- Kowa Company, Ltd.

- Natus Sensory, Inc.

- NeoLight, LLC

- NIDEK Co., Ltd.

- Nikon Corporation

- Olympus Corporation

- Optain Health

- Optomed Plc

- Remidio Inc.

- Robert Bosch GmbH

- Santec Corporation

- Sony Electronics Inc.

- Tomey Corporation

- Topcon Corporation

- TowardPi (Beijing) Medical Technology Ltd

- Visionix Group

Implementing Actionable Strategies To Enhance Innovation Diversify Supply Chains and Strengthen Stakeholder Partnerships in Retinal Imaging Sector

Industry leaders should prioritize investment in artificial intelligence and machine learning capabilities to enhance diagnostic precision and streamline workflow integration. By embedding advanced analytics into imaging platforms, manufacturers can deliver actionable insights that differentiate offerings and foster long-term partnerships with providers.

Second, diversifying supply chains is essential to mitigate the impact of trade policies and component shortages. Building regional manufacturing hubs and qualifying alternative suppliers will reduce tariff exposure and ensure business continuity in an increasingly volatile global trade environment.

Engaging proactively with regulatory bodies and healthcare policy stakeholders is also critical. Companies that collaborate on pilot programs for telemedicine and public-health screening initiatives can shape reimbursement frameworks and secure early adoption in both mature and emerging markets.

Additionally, forging alliances with teleophthalmology networks and digital health platforms will expand market reach. Integrating portable retinal imaging units with cloud-based portals enables remote diagnostics and population-level screening, aligning with value-based care models and addressing access disparities.

Finally, focusing on scalable pricing models and service-oriented contracts can unlock new revenue streams while accommodating budgetary constraints across diverse end-user segments. Bundling hardware, software, and maintenance services in tailored packages will maximize customer retention and drive sustainable growth.

Detailing Research Methodology Combining Secondary Data Primary Interviews and Triangulation Techniques to Ensure Robust Retinal Imaging Market Analysis

This analysis was underpinned by a rigorous research methodology, commencing with an extensive review of secondary sources including peer-reviewed journals, regulatory filings, and company disclosures. Complementary to this desk research, primary interviews were conducted with ophthalmologists, imaging specialists, supply chain executives, and policy experts to capture nuanced perspectives on technology adoption and market dynamics.

Data triangulation techniques were employed to validate insights, cross-referencing interview findings with quantitative indicators such as installation base trends and device utilization rates. Qualitative inputs were further substantiated through regional case studies and end-user feedback sessions, ensuring that diverse clinical settings and geographical markets were appropriately represented.

To reinforce reliability, the study team applied a structured framework to map technology segments, end-user groups, and application categories, enabling consistent analysis across multiple dimensions. Regular peer reviews and scenario stress-testing exercises were conducted to assess the robustness of conclusions and to anticipate potential market disruptions. Collectively, these methodological steps ensured that the findings and recommendations presented are both evidence-based and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Retinal Imaging Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Retinal Imaging Devices Market, by Device Type

- Retinal Imaging Devices Market, by Connectivity

- Retinal Imaging Devices Market, by Portability

- Retinal Imaging Devices Market, by Application

- Retinal Imaging Devices Market, by End User

- Retinal Imaging Devices Market, by Indication

- Retinal Imaging Devices Market, by Distribution Channel

- Retinal Imaging Devices Market, by Region

- Retinal Imaging Devices Market, by Group

- Retinal Imaging Devices Market, by Country

- United States Retinal Imaging Devices Market

- China Retinal Imaging Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Future Trajectories Highlighting How Industry Stakeholders Can Navigate Challenges and Capitalize on Retinal Imaging Opportunities

The retinal imaging devices market stands at a pivotal juncture characterized by rapid innovation, evolving clinical demands, and an increasingly complex trade environment. Technological breakthroughs in optical coherence tomography and adaptive optics are expanding diagnostic capabilities, while AI-driven analytics are reshaping clinician workflows and accelerating disease detection. Simultaneously, global tariff measures have introduced new cost pressures, compelling manufacturers to reevaluate supply chain configurations and pursue local-for-local production strategies.

Segment insights underscore the importance of aligning product roadmaps with end-user needs-ranging from high-volume hospital settings to research institutions exploring novel therapeutic pathways. Regional dynamics further highlight growth opportunities in Asia-Pacific markets and underscore the need for differentiated approaches across mature and emerging healthcare systems.

Looking ahead, companies that effectively integrate advanced imaging modalities with intelligent software, diversify sourcing strategies, and engage in collaborative policy dialogues will be best positioned to navigate market uncertainties and capitalize on the substantial unmet needs in vision care. By embracing these imperatives, stakeholders can foster resilience, drive sustainable innovation, and ultimately improve patient outcomes worldwide.

Drive Informed Decisions and Secure Expert Insights on the Retinal Imaging Devices Market by Engaging Ketan Rohom Associate Director Sales & Marketing

To gain unparalleled visibility into the evolving landscape of retinal imaging devices and make informed strategic decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Leveraging deep industry expertise and a track record of guiding leading healthcare stakeholders, Ketan can provide you with a tailored overview of our comprehensive market research report. This call will help you pinpoint critical trends, identify high-impact opportunities, and understand how the latest tariff developments and regional dynamics affect your strategic objectives. Secure your competitive edge by scheduling a consultation with Ketan to explore how this research can support your growth initiatives and investment priorities in the retinal imaging sector.

- How big is the Retinal Imaging Devices Market?

- What is the Retinal Imaging Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?