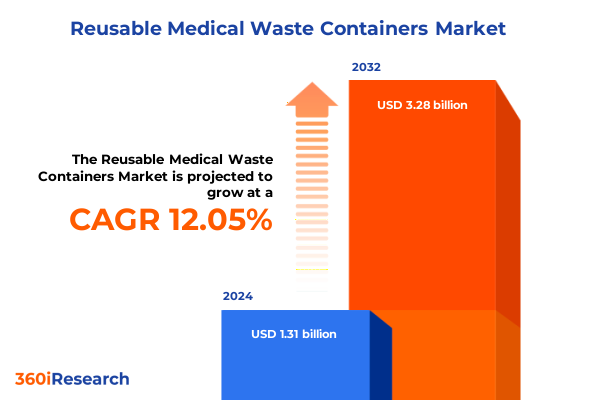

The Reusable Medical Waste Containers Market size was estimated at USD 1.45 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 12.28% to reach USD 3.28 billion by 2032.

Exploring the pivotal role of reusable medical waste containers in modern healthcare sustainability and setting the stage for strategic industry insights

In an era defined by heightened environmental accountability and stringent healthcare safety imperatives, reusable medical waste containers have emerged as a cornerstone of sustainable waste management for healthcare facilities. As organizations across the continuum of care intensify efforts to reduce environmental footprints, these containers fulfill both ecological and operational requirements by enabling repeated use under validated sterilization protocols. This introduction examines the context in which reusable solutions have gained traction, anchored by industry commitments to circular economy principles and evolving regulatory landscapes.

Drawing upon historical shifts in medical waste handling, this section underscores how healthcare stakeholders are navigating a complex matrix of safety standards, waste diversion targets, and cost containment pressures. Through an exploration of contemporary drivers-from plastic reduction mandates to enhanced infection prevention protocols-the reader gains a nuanced understanding of why reusable containers represent more than a compliance checkbox but are a strategic asset. The stage is thus set for a detailed executive summary that aligns market dynamics with actionable pathways for stakeholders in the reusable medical waste containment sector.

Illuminating the seismic shifts in regulatory frameworks advances and sustainability priorities transforming the reusable medical waste container landscape

Over recent years, the landscape of medical waste containment has been transformed by a confluence of regulatory innovations, technological breakthroughs, and mounting sustainability commitments. Notably, the advent of enhanced sterilization validation standards has elevated container design priorities, demanding materials and manufacturing processes capable of withstanding repeated high-temperature and chemical treatments. Concurrently, the integration of digital tracking mechanisms has enabled healthcare facilities to monitor container lifecycles, optimize return logistics, and verify sterilization efficacy, thus driving operational transparency and regulatory compliance.

Furthermore, the increasing emphasis on corporate environmental, social, and governance (ESG) mandates has spurred healthcare systems and waste management partners to adopt closed-loop models. These transformative shifts have accelerated collaborations between container manufacturers, sterilization service providers, and healthcare operators, fostering innovations such as modular container systems tailored to diverse waste streams. As a result, industry incumbents and new entrants alike are leveraging advanced polymer composites, antimicrobial additives, and ergonomic features to meet the dual imperatives of infection control and ecological stewardship.

Assessing the multifaceted repercussions of 2025 tariff escalations on reusable medical waste container imports and supply chain dynamics

The year 2025 has witnessed significant tariff escalations that collectively reshape the economics of importing reusable medical waste containers. In early March, an executive order raised additional duties on goods originating from China and Hong Kong, increasing ad valorem tariffs from 10% to 20% under new Chapter 99 HTSUS provisions for products loaded on or after March 4, 2025. This policy adjustment directly affects plastic containers classified under HS code 3923.50.00, which encompass many reusable medical waste containment solutions and now face tariff burdens that can exceed 50% when combined with base duties.

Simultaneously, in accordance with reciprocal IEEPA measures, all imports from Canada and Mexico have been subject to a uniform 25% additional tariff effective March 4, 2025. This expansion of tariffs beyond traditional Section 301 targets underscores a broader strategic posture aimed at diversifying sourcing decisions and incentivizing domestic production capacity. For manufacturers and distributors of reusable medical waste containers, these cumulative duties necessitate a reevaluation of supply chain configurations, as cost structures and landed prices rise markedly amid these regulatory headwinds.

Moreover, ongoing Section 301 adjustments scheduled for January 1, 2025 introduced elevated duties on various medical goods, including rubber medical gloves and consumables integral to waste management workflows. While reusable containers are not explicitly targeted in these lists, the broader tariff environment has generated ripple effects across logistics, warehousing, and contractual negotiations for service providers and end users alike. Consequently, stakeholders must navigate a complex nexus of tariff rates, origin-specific regulations, and customs enforcement protocols to sustain cost-competitive operations.

Uncovering critical segmentation perspectives across end users waste types container designs materials channels capacities and sterilization methods

Market segmentation in the reusable medical waste container sector encompasses a wide array of end users, demonstrating how distinct facility types drive design and service requirements. Ambulatory centers, which include specialized dialysis and surgical units, prioritize point-of-use ergonomics and rapid turnaround, while hospitals and clinics demand scalable solutions integrated into central sterile processing workflows. Laboratories, subdivided into diagnostic and research facilities, often require containers compatible with high-containment protocols, and long-term care settings focus on simplified disposal interfaces and infection risk reduction.

Beyond end-user categories, waste-type segmentation reveals that chemical, pharmaceutical, radioactive, and sharps streams each impose unique material compatibility and regulatory constraints. Infectious waste further subdivides into microbiological and pathological variants, necessitating containers with reinforced seals and validated decontamination pathways. As such, manufacturers tailor containment products not only to universal biohazard requirements but also to the nuanced demands of each waste subtype.

Differences in container type and material composition introduce further granularity to the market. Bin, cart, hard shell, and soft bag designs serve distinct operational preferences, with hard shell solutions available in polyethylene or polypropylene robust enough for multiple sterilization cycles. Soft bag systems, constructed from high- or low-density polyethylene, offer flexible volume handling within modular frame assemblies. Composite, metal, and plastic materials-particularly high-density polyethylene and polypropylene-feature prominently, delivering durability, chemical resistance, and ease of cleaning.

Distribution channels also shape buyer behavior, spanning direct sales, distributor networks, and online retail platforms. Local and national distributors enable broad geographic reach and technical support, while company websites and third-party platforms facilitate digital procurement and rapid replenishment. When considering capacity needs, large, medium, and small container sizes align with facility throughput, and sterilization methods such as autoclave, chemical treatment, or irradiation determine compatibility requirements and material selection.

This comprehensive research report categorizes the Reusable Medical Waste Containers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Waste Type

- Container Type

- Material

- Distribution Channel

- Capacity

- Sterilization Method

Analyzing pivotal regional variances and strategic drivers shaping market dynamics across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on the adoption, regulation, and innovation of reusable medical waste containers. In the Americas, stringent U.S. Environmental Protection Agency guidelines and state-level diversion targets drive a robust market for life cycle-validated containment solutions, supported by government grants and sustainability initiatives. Latin American healthcare systems, while burgeoning, often prioritize cost-effective reuse models compatible with local sterilization infrastructures.

Europe, Middle East, and Africa collectively present diverse regulatory and infrastructural landscapes. The European Union’s Circular Economy Action Plan and Medical Device Regulation (MDR) emphasize design for reuse and comprehensive traceability, fostering widespread uptake of reusable containers across member states. In the Middle East, fast-growing healthcare infrastructure investments propel demand for turnkey solutions, whereas sub-Saharan Africa’s evolving healthcare networks adopt scalable reuse strategies in tandem with capacity-building partnerships.

The Asia-Pacific region showcases accelerated growth driven by population density, expanding hospital networks, and heightened focus on waste management reforms. Nations such as Japan and South Korea implement rigorous sterilization and material standards, while emerging markets in Southeast Asia pivot toward affordable reusable systems to reconcile economic and environmental objectives. Across these regions, collaborations between local sterilization service providers and container manufacturers further catalyze market penetration and technology localization.

This comprehensive research report examines key regions that drive the evolution of the Reusable Medical Waste Containers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading innovators partnership strategies and competitive differentiators shaping the reusable medical waste container industry

Leading companies in the reusable medical waste container sector demonstrate a blend of service integration, design innovation, and global footprint expansion. Stericycle, a market pioneer in regulated medical waste services, introduced its antimicrobial SafeShield™ container line to enhance bioburden control and streamline customer adoption; following its $7.2 billion acquisition by Waste Management in November 2024, the combined entity controls North America’s largest compliant disposal network.

Similarly, Becton Dickinson ramped up domestic manufacturing investments, pledging $2.5 billion in U.S. capacity enhancements in May 2025 to fortify supply chain resilience for sharps and containment systems. This capital injection underscores the strategic importance of nearshoring critical production and leveraging advanced polymer processing capabilities to mitigate tariff impacts and logistical constraints.

Daniels Health, the clinical-focused alternative since entering the U.S. market in 2003, has distinguished itself through advanced robotics-enabled washing processes and leakproof reusable containment systems. Peer-reviewed studies confirm Sharpsmart reusable sharps containers achieve up to an 84% reduction in CO2 equivalent emissions versus disposable alternatives, aligning with stringent ESG criteria and regulatory carbon reduction targets.

Other prominent participants include Thermo Fisher Scientific, which applies laboratory-grade polymer resin expertise to produce durable, autoclavable sharps and fluid waste containers compliant with ISO 13485 and USP Class VI standards. Bemis Manufacturing Company, with over five decades of medical product production experience, offers a diverse portfolio of injection-molded sharps containers and suction canisters, leveraging co-injection molding techniques for enhanced durability and recyclability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Reusable Medical Waste Containers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Clean Harbors, Inc.

- Daniels Health Australia Pty Ltd.

- McKesson Corporation

- Medline Industries, L.P.

- Owens & Minor, Inc.

- Sharps Compliance, Inc.

- Stericycle, Inc.

- Veolia Environnement S.A.

Empowering industry leaders with strategic actionable recommendations to optimize operations drive sustainable growth and maximize value creation

To optimize their positioning and drive sustainable growth, industry leaders should invest in modular container designs that facilitate seamless integration with diverse sterilization platforms. By standardizing connections and frame dimensions, organizations can reduce inventory complexity while enhancing throughput in central processing units.

Next, companies must develop strategic partnerships with regional sterilization service providers to ensure compatibility and performance validation. Establishing co-branded validation protocols will bolster market confidence and simplify procurement for end users navigating complex compliance requirements. Concurrently, firms should pursue material science collaborations to incorporate next-generation antimicrobial additives and high-strength composites, thus extending container service life and reducing life cycle costs.

Furthermore, supply chain diversification is imperative in the current tariff environment. Industry participants ought to identify alternative manufacturing bases within tariff-exempt zones or vertically integrate critical components to mitigate landed cost pressures. Digital platforms for container tracking and performance analytics will also deliver actionable insights that inform maintenance schedules and reuse thresholds, enhancing utilization and reducing total cost of ownership.

Lastly, a focused commitment to end-user education and training will elevate adoption rates and maximize value realization. Tailored programs that demonstrate proper handling, compliance protocols, and environmental benefits will foster stakeholder buy-in, ensuring that reusable medical waste containers become an integral component of sustainable healthcare operations.

Detailing the rigorous research methodology data sources analytical frameworks and validation processes underpinning the report's authoritative insights

This report’s insights rest on a meticulously structured research methodology combining primary and secondary data collection. Primary research involved in-depth interviews with waste management directors at hospitals, ambulatory centers, and laboratories, supplemented by discussions with container manufacturing executives and sterilization service specialists. These engagements provided firsthand perspectives on operational challenges, adoption drivers, and innovation priorities across end-user segments.

Secondary research encompassed a comprehensive review of regulatory frameworks, patent databases, and customs data, alongside analysis of trade publications and technical white papers. The information was triangulated against industry association reports, harmonized commodity descriptions, and corporate financial disclosures to ensure both breadth and depth of understanding.

Quantitative insights were further validated through consultation with an expert advisory panel comprising healthcare sustainability officers and logistics professionals. Analytical frameworks including SWOT analysis, Porter's Five Forces, and adoption diffusion models were employed to contextualize findings and identify strategic inflection points for stakeholders. This robust methodology underpins the report’s authoritative conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Reusable Medical Waste Containers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Reusable Medical Waste Containers Market, by End User

- Reusable Medical Waste Containers Market, by Waste Type

- Reusable Medical Waste Containers Market, by Container Type

- Reusable Medical Waste Containers Market, by Material

- Reusable Medical Waste Containers Market, by Distribution Channel

- Reusable Medical Waste Containers Market, by Capacity

- Reusable Medical Waste Containers Market, by Sterilization Method

- Reusable Medical Waste Containers Market, by Region

- Reusable Medical Waste Containers Market, by Group

- Reusable Medical Waste Containers Market, by Country

- United States Reusable Medical Waste Containers Market

- China Reusable Medical Waste Containers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Concluding insights that synthesize key findings underscore strategic priorities and frame the way forward for reusable medical waste container stakeholders

The convergence of sustainability mandates, technological innovation, and evolving regulatory structures has positioned reusable medical waste containers as a pivotal element in modern healthcare operations. By synthesizing key findings-from tariff-driven supply chain recalibrations to segmentation insights and regional dynamics-this report underscores critical areas where industry stakeholders can gain competitive advantage.

Strategic priorities include aligning container designs with standardized sterilization protocols, diversifying manufacturing footprints to navigate tariff complexities, and leveraging digital tracking to optimize reuse lifecycles. Additionally, sector leaders must forge partnerships that facilitate localized validation services and material enhancements, thereby addressing both infection control and environmental objectives.

The pathway forward involves a balanced focus on operational excellence, innovation adoption, and stakeholder engagement, ensuring that reusable medical waste containers deliver measurable cost savings and environmental benefits. As healthcare organizations and solution providers navigate this landscape, the actionable insights and recommendations herein offer a clear framework to drive sustainable growth and resilient performance.

Take decisive action today to secure unparalleled market intelligence and drive strategic growth with expert guidance from our lead Associate Director

To secure access to the most comprehensive and actionable insights on reusable medical waste containers, reach out today to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. A conversation with Ketan will provide clarity on how this market intelligence can drive your strategic initiatives and operational excellence.

Engaging directly with Ketan ensures you receive a tailored brief on report highlights, customized data extracts, and priority support for your specific business needs. By investing in this research, your organization will gain a decisive advantage in optimizing procurement strategies, navigating regulatory environments, and capitalizing on emerging growth corridors.

Connect with Ketan Rohom to initiate a seamless purchasing process and unlock the full value of this authoritative market research report on reusable medical waste containers. Secure your copy and empower your team with data-driven intelligence that underpins confident decision-making and sustainable competitive performance.

- How big is the Reusable Medical Waste Containers Market?

- What is the Reusable Medical Waste Containers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?