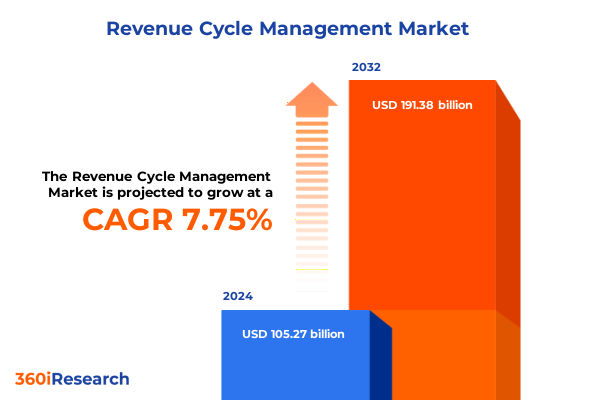

The Revenue Cycle Management Market size was estimated at USD 112.89 billion in 2025 and expected to reach USD 121.24 billion in 2026, at a CAGR of 7.83% to reach USD 191.38 billion by 2032.

Unveiling the Imperative Role of Revenue Cycle Management in Healthcare Organizations Amidst Evolving Financial and Technological Landscapes

Revenue cycle management has emerged as a cornerstone of operational and financial excellence within healthcare organizations of all sizes. As pressures around patient affordability, regulatory compliance, and technological integration intensify, an optimized revenue cycle serves not only as a profit driver but also as a patient satisfaction enhancer. In recent years, organizations have shifted away from legacy, decentralized billing processes toward unified, technology-enabled workflows. This transition has laid the groundwork for more reliable cash flows, reduced claim denials, and a clearer line of sight into the patient journey from point of registration to final reimbursement.

Against the backdrop of value-based care and consumer-driven healthcare, the imperative for streamlined, transparent, and patient-centric revenue cycle processes has never been stronger. Industry decision-makers are now required to align their financial operations with evolving regulatory requirements, leverage data analytics for proactive revenue recovery, and deploy automation that minimizes friction for end users. As the market continues to mature, stakeholders are recognizing that investment in revenue cycle platforms and services is not an optional expense but a strategic enabler for sustaining profitability and competitive differentiation.

This executive summary distills the key structural shifts, market dynamics, and actionable insights shaping the revenue cycle management landscape in 2025. By examining the interplay of policy reforms, emerging technologies, and segmentation-specific trends, this report equips leaders with a nuanced understanding of the factors driving performance and resilience.

Navigating Disruptive Innovations and Policy Reforms That Are Redefining Revenue Cycle Management Standards Across the Healthcare Ecosystem

Healthcare revenue cycle management is witnessing a profound evolution driven by digital disruption and regulatory reform. Organizations are increasingly adopting cloud-native architectures and artificial intelligence-powered tools to automate claims processing, detect coding anomalies, and forecast cash flows with unprecedented accuracy. These innovations not only reduce manual workload but also enhance the precision of billing and reimbursement activities, leading to lower denial rates and accelerated payment cycles. Moreover, the integration of patient engagement portals has shifted the focus from post-service collections to real-time financial transparency, empowering patients to manage their obligations proactively.

Concurrently, government initiatives aimed at improving interoperability and data security are reshaping vendor roadmaps. For instance, recent updates to healthcare data standards have compelled solution providers to embed more robust encryption protocols and streamlined data exchange capabilities within their platforms. The convergence of cybersecurity demands with patient-centric design principles has elevated user expectations, prompting organizations to seek unified systems that balance operational efficiency with stringent compliance.

Taken together, these transformative shifts in technology, policy, and consumer behavior are compelling healthcare leaders to rethink their revenue cycle strategies. The transition toward data-driven, automated, and patient-respectful models is not simply a trend but an imperative for organizations seeking to sustain financial health and deliver superior service quality in an increasingly competitive environment.

Assessing How Recent United States Tariff Adjustments Enacted in 2025 Are Reshaping Costs and Supply Chains Within Revenue Cycle Management Operations

The implementation of new United States tariffs in early 2025 has introduced a fresh set of challenges to revenue cycle management operations, particularly in relation to technology procurement and service outsourcing. These adjustments have led to an uptick in costs for imported hardware components used in on-premise system deployments, driving organizations to reevaluate their capital investment strategies. Simultaneously, software vendors sourcing development resources or hosted solutions from tariff-affected regions have navigated margin pressures that ripple through their pricing models.

In response, many healthcare providers and payers have accelerated their shift toward cloud-based platforms, mitigating the direct impact of hardware tariffs while benefiting from scalable infrastructure and predictable subscription fees. However, this pivot demands rigorous due diligence around data residency and service-level agreements to ensure compliance and performance continuity. Additionally, third-party billing firms have renegotiated contracts to offset increased operational costs, often passing a portion of expenses onto healthcare systems through revised fee structures.

Although these tariff changes have introduced short-term cost volatility, they have also spurred market participants to optimize vendor portfolios, consolidate procurement processes, and prioritize investment in automation that reduces the volume of physical infrastructure. As a result, the cumulative impact of the 2025 tariff revisions may well catalyze a broader migration toward agile, software-centric revenue cycle solutions, aligning cost management objectives with the industry’s long-term digital transformation goals.

Unlocking Targeted Strategies Through In-Depth Component, Process, Deployment, and End-User Segmentation to Enhance Revenue Cycle Management Success

Distinct segmentation lenses reveal how market opportunities and challenges manifest across various dimensions of revenue cycle management. From the component perspective, service offerings encompass both managed and professional services that deliver advisory support, system integration, and ongoing optimization, while software solutions range from fully integrated platforms to specialized standalone modules designed for targeted tasks. By considering the process dimension, stakeholders can identify how analytics and reporting platforms provide visibility into financial performance, billing and invoicing systems automate patient statements, claims processing modules streamline insurer interactions, and medical coding tools ensure compliance with evolving coding standards.

Turning to deployment models, options span from cloud-hosted services that deliver rapid scalability and reduced upfront costs to on-premise installations that offer heightened data control and customization. The end-user dimension further illustrates the complexity of this space, as healthcare payers, providers, and third-party billing companies each bring unique requirements. Within healthcare providers, diagnostic laboratories and hospitals and clinics demand distinct workflow integrations and performance benchmarks, driving vendors to tailor their solutions accordingly.

By synthesizing insights across these segmentation approaches, decision-makers can pinpoint the precise solution archetypes that align with their operational maturity, regulatory demands, and growth aspirations. This segmentation framework not only clarifies the competitive landscape but also guides strategic investment decisions, ensuring organizations deploy the right combination of services and software to advance revenue cycle outcomes.

This comprehensive research report categorizes the Revenue Cycle Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Process

- Deployment Model

- End-user

Revealing Regional Dynamics and Priority Areas Across the Americas, Europe Middle East Africa, and Asia-Pacific for Revenue Cycle Management Excellence

Revenue cycle management dynamics vary significantly across global regions, shaped by regulatory environments, technological maturity, and healthcare delivery models. In the Americas, the convergence of consumer-driven healthcare and value-based reimbursement has driven rapid adoption of patient billing portals and AI-enhanced claims adjudication. Private and public payers alike are investing in end-to-end system integration to capture real-time data from point of care through payment reconciliation.

Across Europe, the Middle East, and Africa, the emphasis on unified health information exchanges and pan-regional interoperability initiatives is accelerating the uptake of cloud-native revenue cycle platforms. Government-led efforts to harmonize data privacy regulations are prompting vendors to embed advanced encryption and consent-management features, ensuring secure cross-border data flows while preserving patient rights. Meanwhile, the maturation of private insurance markets in select EMEA countries is creating pockets of demand for specialized billing and analytics modules tailored to local reimbursement policies.

In Asia-Pacific, rapid digital transformation is underway as healthcare systems expand capacity and pursue quality benchmarks. Nations with large rural populations are leveraging mobile-first billing solutions to extend financial services to underbanked patients, while urban hospitals adopt modular software suites to manage high patient volumes and complex payer mix. Collectively, these regional trends underscore the importance of aligning deployment and functional priorities with local market drivers, enabling organizations to harness regional innovations and mitigate compliance risks.

This comprehensive research report examines key regions that drive the evolution of the Revenue Cycle Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Leadership and Differentiation Among Leading Players Driving Innovation and Efficiency in Revenue Cycle Management Solutions

Leading vendors and service providers are carving out competitive advantages through platform innovation, strategic partnerships, and mergers and acquisitions. Established incumbents have concentrated on deepening their analytics capabilities, integrating predictive models that forecast denial risk and revenue leakage with high degrees of accuracy. Meanwhile, nimble disruptors have captured market attention by offering modular, API-first architectures that allow clients to assemble bespoke revenue cycle solutions without committing to monolithic systems.

Partnership ecosystems are also expanding, with technology firms collaborating to embed robotic process automation and natural language processing engines directly into billing and coding workflows. This convergence of best-of-breed technologies not only accelerates time to value but also reduces vendor lock-in, giving healthcare organizations greater flexibility in managing evolving requirements. Some providers are even establishing incubators and innovation labs to co-develop use cases, driving continuous improvement cycles and co-creating features that reflect real-world operational needs.

These competitive dynamics are reshaping value propositions across the vendor landscape. Organizations seeking turnkey implementations may gravitate toward full-stack incumbents with proven integration roadmaps, while those focused on rapid deployment and customization may partner with specialist firms offering targeted solutions. Ultimately, the interplay between established players and emerging challengers is fostering an environment of creativity, choice, and value-driven differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Revenue Cycle Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apaana Healthcare Pvt. Ltd.

- athenahealth, Inc.

- Centaur Billing, LLC

- Centauri Health Solutions, Inc.

- Change Healthcare LLC

- Cognizant Technology Solutions Corporation

- Conifer Health Solutions, LLC

- CureMD Healthcare

- eClinicalWorks, LLC

- Ensemble Health Partners, LLC

- Epic Systems Corporation

- GeBBS Healthcare Solutions, Inc.

- Greenway Health, LLC

- Huron Consulting Group Inc.

- NextGen Healthcare, Inc.

- Nexus IO, LLC

- Optum, Inc.

- Oracle Cerner Corporation

- R1 RCM Inc.

- Waystar, Inc.

Formulating Strategic Priorities and Operational Roadmaps to Empower Industry Leaders in Elevating Revenue Cycle Management Performance and Resilience

Industry leaders aiming to elevate revenue cycle performance should prioritize a strategic roadmap that balances quick wins with sustainable, long-term resilience. Immediate actions include deploying AI-driven automation for high-volume, low-complexity tasks such as claim scrubbing and remittance posting, reducing manual error rates and freeing specialist staff for value-added activities. At the same time, organizations should integrate predictive analytics that surface denial trends before claims submission, enabling proactive remediation and better resource allocation.

Over the mid-term horizon, executives must cultivate cross-functional collaboration between IT, finance, and clinical teams to ensure system configurations and workflows align with care delivery patterns. This collaborative approach fosters ownership of revenue-related metrics and accelerates change management, driving user adoption and continuous improvement. In parallel, procurement teams should adopt a vendor diversification strategy that mitigates risk by blending cloud-native and on-premise solutions, ensuring business continuity in the face of tariff disruptions or service-level fluctuations.

Looking further ahead, leadership should invest in patient engagement initiatives that improve payment transparency and self-service capabilities. By empowering patients with real-time cost estimates and digital payment options, organizations can reduce billing inquiries and enhance satisfaction. Complementary investments in data governance and compliance frameworks will solidify trust, supporting the agile rollout of new features while maintaining audit readiness and regulatory alignment.

Detailing Rigorous Research Frameworks and Methodical Approaches Supporting the Credibility and Depth of the Revenue Cycle Management Study

The research underpinning this study leverages a blend of primary and secondary methodologies to ensure rigor and relevance. Primary research consisted of in-depth interviews with senior revenue cycle executives, IT decision-makers, and third-party billing specialists across North America, Europe, and Asia-Pacific. These discussions provided qualitative insights into real-world challenges, investment drivers, and adoption barriers, anchoring the analysis in firsthand perspectives.

Secondary research drew upon a wide array of proprietary databases, peer-reviewed journals, trade publications, and regulatory filings to map technology roadmaps, policy shifts, and tariff schedules. Data validation involved triangulating findings across multiple sources, cross-referencing vendor press releases with financial reports and independent user surveys. Complementary quantitative analysis employed structured data sets to identify usage patterns across deployment models, process modules, and end-user segments, ensuring statistical robustness.

Finally, an advisory council composed of former revenue cycle leaders and healthcare consultants convened to review preliminary findings, challenge assumptions, and refine thematic insights. This multi-tiered research approach delivers a holistic, actionable view of the revenue cycle management landscape, grounded in empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Revenue Cycle Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Revenue Cycle Management Market, by Component

- Revenue Cycle Management Market, by Process

- Revenue Cycle Management Market, by Deployment Model

- Revenue Cycle Management Market, by End-user

- Revenue Cycle Management Market, by Region

- Revenue Cycle Management Market, by Group

- Revenue Cycle Management Market, by Country

- United States Revenue Cycle Management Market

- China Revenue Cycle Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Consolidating Core Insights and Forward-Looking Perspectives to Illuminate the Path Ahead for Revenue Cycle Management Transformation

The confluence of digital innovation, policy evolution, and market segmentation has established a new paradigm for revenue cycle management in 2025. Organizations that embrace automation and analytics while tailoring solutions to their unique operational contexts will be best positioned to navigate the pressures of reimbursement complexity and patient financial responsibility. Regional variations underscore the need for nuanced deployment strategies that marry global best practices with local regulatory and cultural requirements.

Key segmentation insights highlight how component, process, deployment, and end-user dimensions intersect to create differentiated solution profiles, while competitive dynamics reveal a landscape in flux, defined by strategic alliances, targeted acquisitions, and platform modularity. The short-term impact of United States tariff adjustments has accelerated the shift toward cloud-centric architectures, a trend that promises greater agility but demands vigilant attention to data compliance and service assurances.

In synthesizing these core findings, it becomes evident that a structured, evidence-based approach to revenue cycle transformation is critical. By following the strategic recommendations and leveraging the insights presented in this report, industry leaders can chart a path toward improved financial performance, enhanced patient experience, and sustainable operational excellence in the evolving healthcare ecosystem.

Engage Directly with Ketan Rohom to Unlock Comprehensive Market Intelligence and Tailored Solutions for Optimizing Your Revenue Cycle Management Report Purchase

To secure the full-scale market research report and propel your organization’s revenue cycle management capabilities to new heights, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan brings a wealth of expertise in translating complex industry data into actionable strategies tailored to your unique operational needs. Engaging with him ensures you receive personalized guidance on leveraging the report’s insights for maximum impact.

By collaborating with Ketan, you will gain a streamlined purchasing experience, access to exclusive add-ons such as customized data dashboards and private briefing sessions, and the opportunity to align report findings with your strategic imperatives. He can assist in structuring enterprise-wide deployments, advising on supplier selection criteria, and crafting implementation roadmaps that cater to both short-term milestones and long-term resilience.

Don’t miss the chance to transform analytical intelligence into competitive advantage. Connect with Ketan Rohom today to discuss pricing options, explore bespoke research extensions, and schedule your private consultation. Elevate your decision-making foundation with comprehensive analytics, hands-on support, and industry-leading expertise-starting with a single conversation.

- How big is the Revenue Cycle Management Market?

- What is the Revenue Cycle Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?