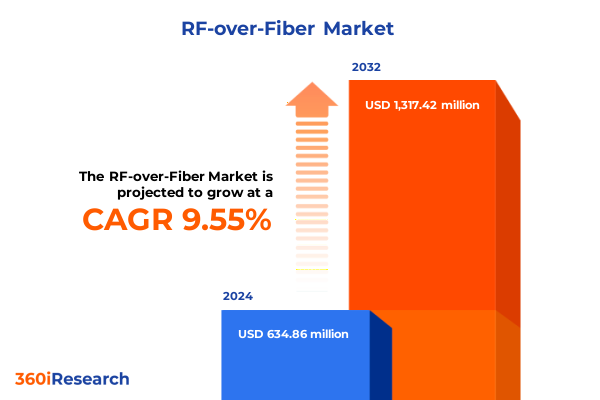

The RF-over-Fiber Market size was estimated at USD 719.44 million in 2025 and expected to reach USD 790.71 million in 2026, at a CAGR of 10.71% to reach USD 1,466.81 million by 2032.

Illuminating the Evolution and Strategic Imperatives of RF-over-Fiber Technologies for High-Fidelity Signal Transmission and Scalable Networks

To begin with, the introduction to RF-over-Fiber technologies sets the stage for understanding how radio frequency signals are converted into optical signals and transported over fiber optics to enable high-capacity, low-latency communications. As industries push toward digital transformation, the demand for robust connectivity solutions that can support wireless networks, satellite links, military systems, and emerging telecommunication infrastructures has never been more pressing. RF-over-Fiber converges the strengths of fiber optics-such as immunity to electromagnetic interference, long-distance transmission without repeaters, and vast bandwidth potential-with traditional RF architectures, thereby overcoming the limitations of conventional coaxial systems.

Furthermore, the growing global appetite for data-fueled by video streaming, cloud computing, and Internet of Things applications-places extraordinary pressure on network operators to innovate. In this context, RF-over-Fiber emerges as a pivotal enabler of next-generation fronthaul and backhaul networks, offering scalable solutions that adapt to both incremental upgrades and wholesale system overhauls. By embracing this technology, stakeholders can address connectivity challenges in dense urban environments, remote locations, and mission-critical deployments.

In essence, this executive summary provides a concise yet comprehensive overview of the current RF-over-Fiber ecosystem, its transformative shifts, tariff impacts, segmentation insights, regional nuances, leading companies, actionable recommendations, and methodological underpinnings. It aims to empower decision-makers with the clarity needed to navigate a rapidly evolving landscape and harness RF-over-Fiber solutions for sustained competitive advantage.

Uncovering the Paradigm Shifts Driving RF-over-Fiber Adoption Amidst Emerging Network Architectures and Industry Disruptions

Over the past decade, the RF-over-Fiber landscape has undergone profound changes driven by technological breakthroughs and evolving market demands. Initially adopted for niche applications such as cable TV distribution, the technology has now permeated diverse sectors, including satellite communications, test and measurement, and military communications. Converging factors-such as the rollout of 4G and 5G wireless fronthaul networks, the transition to low earth orbit satellite constellations, and the integration of advanced sensing systems-have collectively amplified the demand for robust RF-over-Fiber infrastructures.

Additionally, external conditions such as heightened cybersecurity concerns and the push for network virtualization have prompted innovation in optical modulators, amplifiers, and detectors. The advent of digital RF-over-Fiber with wavelength division multiplexing (DWDM) and orthogonal frequency division multiplexing (OFDM) has unlocked new performance benchmarks, enabling simultaneous transmission of multiple RF channels with minimal latency and distortion. At the same time, improvements in external modulation and intensity modulated direct detection architectures have strengthened analog RF-over-Fiber deployments for applications requiring real-time, high-fidelity signal reproduction.

Looking ahead, the convergence of RF-over-Fiber with emerging paradigms-such as software-defined networking and open radio access networks-promises to further reshape network architectures. As this transformation unfolds, stakeholders must remain vigilant to shifts in component design, application requirements, and integration methodologies, ensuring they capitalize on the expanding versatility and performance advantages of RF-over-Fiber solutions.

Analyzing How 2025 United States Tariff Adjustments Are Reshaping RF-over-Fiber Cost Structures and Supply Chain Dynamics

The introduction of new United States tariff measures in 2025 has added complexity to the RF-over-Fiber supply chain, affecting sourcing costs, manufacturing strategies, and pricing models. With duties levied on specific optical components and fiber optic cables, original equipment manufacturers (OEMs) and system integrators are recalibrating their procurement frameworks to mitigate margin pressures. This has led to the exploration of alternative suppliers, diversification of regional production footprints, and leveraging trade compliance expertise to navigate evolving tariff schedules.

Moreover, increased tariffs on key components such as erbium-doped fiber amplifiers and high-precision optical modulators have driven up the total landed cost for end users. In response, vendors are intensifying efforts to optimize designs, consolidate component counts, and enhance in-house testing capabilities to reduce reliance on imported modules. As a result, some forward-thinking enterprises have accelerated partnerships with domestic producers, seeking to balance cost, quality, and delivery timelines while also addressing regulatory compliance and national security considerations.

Ultimately, the cumulative effect of these tariff adjustments extends beyond immediate cost implications. It has catalyzed a strategic realignment of global supply chains, prompting stakeholders to prioritize resilience, transparency, and agility. In doing so, the industry is laying the groundwork for more robust RF-over-Fiber ecosystems that can thrive amid geopolitical flux and protect against future trade disruptions.

Distilling Essential Segment-Level Perspectives to Guide Stakeholder Strategies Across RF-over-Fiber Application, Component, and Technology Categories

Exploring the market through the prism of application reveals diverse demand profiles. In cable TV distribution, RF-over-Fiber continues to support legacy infrastructure modernization, while military communications leverages the technology’s secure, interference-immune attributes for electronic warfare and radar systems. Satellite communications spans geostationary, medium earth orbit, and low earth orbit constellations, each with unique latency and link-budget considerations. In test and measurement environments, high-fidelity signal replication is critical for accurate diagnostics, whereas wireless fronthaul deployments bifurcate between 4G and 5G architectures, requiring distinct performance and bandwidth parameters.

From a component perspective, fiber optical cables remain the foundational medium, but optical amplifiers-encompassing erbium-doped fiber amplifiers and Raman amplifiers-drive reach extension and signal integrity. Optical detectors and modulators form the active heart of RF-to-optical conversion, with innovations in material science and photonic integration continuously enhancing sensitivity and linearity. The dichotomy between analog and digital RF-over-Fiber underscores differing end-user needs: analog solutions rely on external modulation and intensity modulated direct detection for real-time analog signal transmission, while digital approaches employ DWDM or OFDM techniques to maximize channel density and spectral efficiency.

Further segmentation by end-user highlights cross-industry trajectories. Broadcast and media companies seek bandwidth for high-definition content delivery over fiber, while defense applications must meet rigorous reliability standards for electronic warfare and radar systems. In healthcare, medical imaging and remote patient monitoring drive demand for low-latency, high-precision links. Oil and gas sectors, segmented into exploration and refining operations, rely on robust fiber-based communications for real-time sensor data across remote and hazardous sites. Telecom operators prioritize scalable infrastructure to accommodate exponential data growth, balancing point-to-point and point-to-multipoint topologies with bidirectional and unidirectional link types to best fit network design constraints.

This comprehensive research report categorizes the RF-over-Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Topology

- Link Type

- Application

- End User

Revealing Critical Regional Trends and Adoption Drivers Shaping RF-over-Fiber Market Dynamics in Key Global Territories and Infrastructure Investments

The Americas exhibit strong momentum in fiber deployment, buoyed by extensive investment in next-generation wireless fronthaul and terrestrial military communications networks. United States policy incentives for critical infrastructure modernization, alongside Canada’s focus on broadband penetration in remote regions, underpin robust uptake. Conversely, Latin American operators are investing selectively, focusing on satellite ground stations and oil and gas exploration networks to address geographical challenges.

In Europe, Middle East and Africa, a heterogeneous landscape emerges. Western European countries leverage dense metropolitan networks for media distribution and 5G fronthaul, whereas Eastern Europe is gradually modernizing legacy coaxial links through public–private partnerships. The Middle East’s strategic pivot toward digital transformation has accelerated fiber-based military communications and remote patient monitoring in advanced healthcare facilities. Sub-Saharan Africa, while challenged by limited backbone connectivity, shows promise through satellite communications initiatives aimed at bridging the digital divide.

Asia-Pacific maintains a vigorous trajectory, driven by China’s extensive 5G rollouts, Japan’s advanced satellite communications programs, and India’s rural broadband missions. Within this region, demand for optical amplifiers and high-reliability modulators is particularly pronounced, stemming from the need to extend network reach across vast territories. Regional collaboration on undersea fiber-optic links further expands the addressable market, enabling cross-border data flows and reinforcing the backbone supporting RF-over-Fiber applications.

This comprehensive research report examines key regions that drive the evolution of the RF-over-Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Driving Growth and Technological Advancements in the RF-over-Fiber Ecosystem

A handful of innovators have cemented their leadership through technology differentiation and strategic alliances. Companies specializing in photonic integrated circuits have unveiled modulators with unprecedented linearity, enabling longer reach and higher channel counts. Concurrently, optical amplifier manufacturers are expanding production capacities to support custom erbium-doped and Raman modules tailored for defense and satellite applications. Collaborative partnerships between component vendors and system integrators have yielded turnkey solutions that simplify design cycles and accelerate time to deployment.

Strategic acquisitions have also reshaped the ecosystem. Large telecom equipment suppliers have integrated RF-over-Fiber modules into broader network portfolios, positioning them as critical enablers of open RAN architectures. Meanwhile, targeted investments by private equity and venture capital firms are fueling startups focused on miniaturized, high-performance optical transceivers for 5G fronthaul and emerging terahertz applications. This confluence of innovation and capital infusion underscores the growing recognition of RF-over-Fiber as a foundational technology for next-generation communications.

Looking ahead, competitive positioning will hinge on intellectual property portfolios, manufacturing scalability, and the ability to tailor solutions to stringent industry standards. Firms that excel at fostering cross-sector alliances-bridging defense, healthcare, telecom, and energy markets-will be uniquely positioned to capture incremental opportunities as the technology continues to permeate new application domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the RF-over-Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- APIC Corporation

- Broadcom Inc.

- CommScope Holding Company, Inc

- DEV Systemtechnik GmbH

- Elkay Electromech India Private Limited

- Emcore Corporation

- ETL Systems Ltd.

- Glenair, Inc.

- Global Foxcom

- Global Invacom Group Limited

- Gooch & Housego PLC

- HUBER+SUHNER AG

- Intelibs, Inc.

- MicroComp Nordic AB

- Microwave Photonic Systems, Inc.

- OFS Fitel, LLC

- Olabs Technology Company Limited

- Optical Zonu Corporation

- RFOptic Ltd.

- Seikoh Giken Co., Ltd.

- Sumitomo Electric Industries, Ltd

- TE Connectivity Ltd

Formulating Pragmatic Industry Actions to Leverage RF-over-Fiber Innovations and Mitigate Operational and Financial Challenges Effectively

Industry leaders must adopt a multi-pronged approach to leverage RF-over-Fiber innovations effectively. First, establishing cross-functional teams that align RF, optical, and network engineering expertise ensures seamless integration of analog and digital RF-over-Fiber modules into existing infrastructures. By fostering collaboration early in the design phase, organizations can preempt compatibility issues and optimize system-level performance.

Second, it is imperative to develop supply chain resilience strategies. Engaging a diversified supplier base for fiber optical cables, amplifiers, modulators, and detectors mitigates exposure to tariff fluctuations and geopolitical disruptions. Additionally, implementing advanced inventory management and demand forecasting tools can help balance cost efficiency with readiness for sudden demand spikes, particularly in mission-critical applications.

Third, stakeholders should invest in continuous validation and certification processes. Rigorous in-house testing of external modulation schemes, DWDM channels, and OFDM configurations will uphold signal integrity standards and reduce time to market. Complementary training programs for operations teams will further reinforce best practices in installation, maintenance, and troubleshooting.

Finally, aligning R&D roadmaps with emerging trends such as open RAN, software-defined photonics, and integrated sensing networks will position organizations to capitalize on future growth avenues. By remaining proactive in pilot deployments and industry consortiums, leaders can shape standards, influence ecosystems, and secure early access to transformative technologies.

Outlining Rigorous Research Protocols and Analytical Frameworks Underpinning Comprehensive RF-over-Fiber Market Intelligence

The research methodology underpinning this analysis involves a combination of primary interviews and secondary data triangulation. Primary inputs were obtained through in-depth discussions with senior executives, optical network architects, defense program managers, and satellite ground station operators to capture firsthand perspectives on technology drivers and adoption barriers. Secondary sources included peer-reviewed journals, patent filings, regulatory filings, and technical white papers to ensure coverage of the latest scientific advancements and intellectual property trends.

Quantitative analysis incorporated component-level performance benchmarks, supply chain lead times, and integration costs, drawn from validated vendor data sheets and industry testing protocols. Qualitative assessment evaluated strategic initiatives, collaborative models, and geopolitical influences, informed by publicly available policy documents and trade reports.

The synthesis phase integrated both data streams within an analytical framework that segments the market by application, component, technology type, end user, topology, and link type. Regional dynamics were mapped against macroeconomic indicators, infrastructure spending data, and digital transformation indices. Competitor profiling leveraged a multi-criteria approach, assessing firms on technological capabilities, alliance networks, and market penetration.

This rigorous, multidimensional methodology ensures that the insights presented are both comprehensive and actionable, providing a robust foundation for strategic decision-making in the RF-over-Fiber domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RF-over-Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RF-over-Fiber Market, by Component

- RF-over-Fiber Market, by Technology Type

- RF-over-Fiber Market, by Topology

- RF-over-Fiber Market, by Link Type

- RF-over-Fiber Market, by Application

- RF-over-Fiber Market, by End User

- RF-over-Fiber Market, by Region

- RF-over-Fiber Market, by Group

- RF-over-Fiber Market, by Country

- United States RF-over-Fiber Market

- China RF-over-Fiber Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Core Insights to Illuminate Strategic Pathways and Future Trajectories for RF-over-Fiber Market Stakeholders and Collaborative Opportunities

In conclusion, RF-over-Fiber stands as a transformative pillar in the advancement of modern communication networks, offering unparalleled bandwidth, resilience, and scalability. The paradigm shifts originating from 5G fronthaul rollouts, satellite constellation expansions, and defense modernization programs underscore the technology’s expanding relevance. Tariff adjustments in 2025 have catalyzed strategic realignments, reinforcing the need for agile supply chain architectures and cost optimization measures.

Crucial segmentation insights reveal that a one-size-fits-all approach is untenable; stakeholders must tailor solutions to distinctive application requirements, component capabilities, and end-user demands. Regional analyses highlight differentiated growth trajectories, from the Americas’ infrastructure upgrades to the Asia-Pacific’s technology-intensive deployments and the diverse tapestry of the Europe, Middle East and Africa region. Leading companies are consolidating their positions through innovation, partnerships, and strategic investment, making it incumbent upon industry participants to anticipate emerging standards and foster collaborative ecosystems.

Looking forward, actionable recommendations emphasize cross-disciplinary alignment, resilience planning, rigorous validation, and proactive engagement with next-generation network paradigms. By synthesizing these core insights, market stakeholders are equipped to chart strategic pathways, unlock new value streams, and navigate the evolving landscape with confidence and foresight.

Empowering Decision-Makers with Personalized Engagement to Secure the Definitive RF-over-Fiber Market Research Report Today

For decision-makers seeking to stay ahead, the path forward begins with a single step: securing the comprehensive RF-over-Fiber market research report tailored to your strategic needs. By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, organizations gain personalized guidance to understand investment rationales and extract maximum value from the insights provided. Ketan will facilitate a detailed walkthrough of the report’s rich content, highlighting critical findings and contextualizing them within your specific business objectives.

This one-on-one consultation ensures that your team can expedite actionable plans, identify untapped opportunities, and mitigate risks effectively. With tailored support and expert advice, you can align your innovation roadmap with proven market trends and emerging technologies. Don’t miss the opportunity to leverage this definitive resource and position your organization at the forefront of RF-over-Fiber advancements. Contact Ketan Rohom today to transform data into strategic advantage and propel your initiatives toward measurable success.

- How big is the RF-over-Fiber Market?

- What is the RF-over-Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?