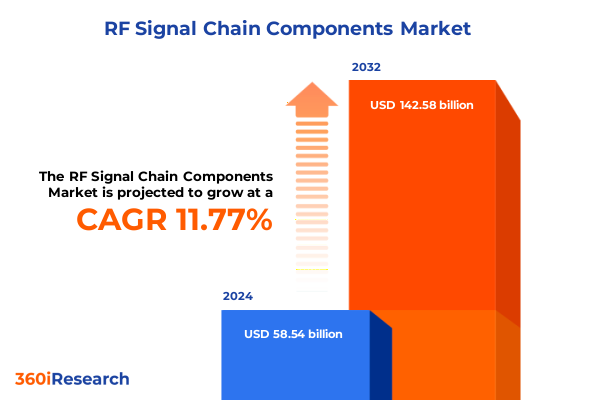

The RF Signal Chain Components Market size was estimated at USD 65.44 billion in 2025 and expected to reach USD 72.12 billion in 2026, at a CAGR of 11.76% to reach USD 142.58 billion by 2032.

A Comprehensive Overview of RF Signal Chain Dynamics Shaping Technology Advancements and Market Strategies Across Industries

The RF signal chain represents the critical pathway through which signals are generated, processed, amplified, and transmitted across a multitude of electronic systems. At the heart of modern wireless communication, radar, satellite links, and defense applications, these chains underpin functionality from mobile broadband to advanced sensing solutions. Over the past decade, the relentless demand for higher data rates, greater spectral efficiency, and enhanced link reliability has propelled the evolution of RF front-end modules and subsystem architectures. As a result, industry leaders and emerging entrants alike are reevaluating traditional design paradigms in favor of more integrated and software-driven approaches.

In this environment, a strategic understanding of the RF signal chain’s component layer-from power amplifiers to low noise amplifiers, filters, mixers, oscillators, attenuators, duplexers, and switches-becomes essential. Each element contributes to overall performance benchmarks such as noise figure, linearity, and bandwidth, which in turn dictate system-level capabilities. Moreover, the interplay between component-level innovation and end-market requirements for automotive radar, telecommunications infrastructure, healthcare telemetry, industrial automation, and aerospace systems underscores the multifaceted nature of this market. By framing the RF signal chain’s significance across both current deployments and emerging opportunities, decision-makers can prioritize investments and partnerships that align with the broader technology roadmap.

Identifying Key Technological Transformations and Industry Shifts That Are Driving the Next Generation of RF Signal Chain Solutions

The RF signal chain landscape is undergoing a profound transformation driven by technological breakthroughs and shifting market imperatives. The rollout of 5G and the push toward 6G prototypes have intensified the need for components capable of operating at millimeter-wave frequencies, necessitating novel material platforms and advanced packaging solutions. Furthermore, the convergence of software-defined radios and cloud-native architectures has enabled more flexible and reconfigurable front-end modules, accelerating time-to-market for next-generation wireless systems.

Simultaneously, the proliferation of Internet of Things (IoT) devices has extended RF signal chain applications into previously untapped sectors such as smart manufacturing and connected healthcare. This has heightened requirements for miniaturization, power efficiency, and integrated multi-band functionality, inspiring innovators to leverage silicon photonics, GaN on SiC semiconductors, and advanced substrate technologies. Against this backdrop, the competitive ecosystem is shifting toward strategic collaborations that bridge semiconductor fabrication, module assembly, and software toolchains. Consequently, companies that can cohesively align cross-domain expertise are positioned to lead the next wave of RF signal chain innovation.

Assessing the Strategic Consequences of United States 2025 Tariff Measures on the RF Signal Chain Supply Ecosystem

In 2025, the United States implemented a series of revised tariff measures targeting a spectrum of electronic components, including semiconductors integral to RF signal chains. These measures, introduced under existing trade authorities, imposed additional duties on selected sub-assemblies and raw materials to motivate onshore production and diversify supply origins. The immediate impact on import costs has been significant, compelling manufacturers to reassess supplier contracts and price negotiations across the value chain.

As companies navigate increased raw material and component prices, many have accelerated efforts to qualify alternative sources in allied regions or to establish domestic fabrication partnerships. While short-term margin pressure has been evident in the telecommunications sector, longer-term strategic realignments are fostering nearshoring and collaborative R&D investments. Firms that adopt agile procurement frameworks and invest in localized manufacturing capabilities will be better positioned to mitigate tariff-driven cost escalation and maintain continuity of supply amid evolving trade policies.

Uncovering Critical Component and Application Segmentation Insights Fueling Optimized Approaches in RF Signal Chain Technologies

Diving into component-level segmentation reveals distinct trajectories across attenuators, duplexers, filters, low noise amplifiers, mixers, oscillators, power amplifiers, and switches. Filters and power amplifiers are witnessing heightened demand due to stringent performance requirements in millimeter-wave 5G deployments, while low noise amplifiers and mixers remain vital for high-sensitivity receiver chains in aerospace and defense applications. Oscillators, valued for frequency stability, are increasingly integrated within transceiver modules to reduce board footprint and improve thermal performance. Attenuators and switches, once ancillary, now play pivotal roles in programmable front-end architectures that enable dynamic spectrum management and beamforming.

Application segmentation across automotive, consumer electronics, defense and aerospace, healthcare, industrial, and telecommunications markets further illustrates divergent growth patterns. The automotive industry’s shift to autonomous driving and vehicle-to-everything communication has elevated radar transceiver requirements, whereas consumer electronics applications emphasize cost-effective miniaturization for wearables and smart home devices. Defense and aerospace maintain rigorous qualification standards, driving demand for radiation-hardened and high-reliability components, while healthcare leverages RF telemetry in patient monitoring and diagnostic imaging. Industrial automation, with its emphasis on connectivity in harsh environments, underscores the need for robust front-end modules, and telecommunications networks continue to invest in capacity expansion and densification.

Frequency band segmentation paints an equally nuanced picture: EHF and SHF ranges are at the forefront of high-frequency 5G and satellite communications, while UHF and VHF bands sustain critical legacy and IoT applications. Distribution channels are also evolving as direct sales models enable OEMs to collaborate closely with vendors on customized solutions, distributor networks ensure rapid fulfillment and technical support, and online sales platforms democratize access for emerging enterprises.

This comprehensive research report categorizes the RF Signal Chain Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Application

- Frequency Band

- Distribution Channel

Examining Regional Market Variations to Unlock Growth Opportunities Across Americas, EMEA, and Asia Pacific RF Signal Chain Sectors

Regional dynamics have emerged as a defining factor in strategic planning for RF signal chain providers, with each geography presenting unique market drivers and supply chain considerations. In the Americas, robust investment in telecommunications infrastructure and defense modernization initiatives underpin sustained procurement of advanced RF modules, while an emphasis on innovation hubs in Silicon Valley and Boston sustains a vibrant R&D ecosystem. During this period, local content requirements have incentivized onshore partnerships and fabrication facilities, enhancing supply chain resilience.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and spectrum allocations challenge suppliers to deliver flexible multi-band platforms. European Union funding for next-generation connectivity research complements defense procurements in the Gulf region, catalyzing specialized component demand. Meanwhile, African markets, though still emerging, are beginning to adopt IoT and rural connectivity initiatives, stimulating interest in cost-effective, ruggedized RF front-ends.

In Asia Pacific, the interplay between large-scale 5G rollouts, semiconductor manufacturing in China, Taiwan, and South Korea, and national strategies in Japan has created a dense network of collaborative ventures. This region’s rapid adoption of new frequency bands and the concentration of tier-1 OEMs position Asia Pacific as both a key demand center and a critical manufacturing hub for RF signal chain components.

This comprehensive research report examines key regions that drive the evolution of the RF Signal Chain Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Pioneering Corporate Strategies and Competitive Landscapes Among Leading RF Signal Chain Technology Providers

Leading RF signal chain technology providers have adopted diverse strategies to secure their competitive positions. Companies at the forefront of power amplifier and filter innovation are forging alliances with leading telecom equipment manufacturers to co-develop modules optimized for millimeter-wave base stations. Meanwhile, front-end specialists offering low noise amplifiers and mixers are expanding their footprint into adjacent industries such as satellite communications and electronic warfare by leveraging defense-grade qualification credentials.

Some firms have prioritized strategic acquisitions to fill portfolio gaps in oscillators and switch matrices, enabling turnkey front-end solutions that reduce integration complexity for customers. Others have invested heavily in proprietary semiconductor processes-such as GaN on silicon carbide-to deliver higher efficiency and thermal robustness. Across the board, alliances between semiconductor fabs, packaging specialists, and test-and-measurement equipment vendors are enabling a more seamless value chain, accelerating innovation cycles, and driving down total system costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the RF Signal Chain Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices Inc.

- Anokiwave Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Murata Manufacturing Co. Ltd.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Skyworks Solutions Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

Formulating Actionable Strategic Recommendations to Strengthen Supply Chains and Accelerate Innovation in RF Signal Chain Markets

To capitalize on emerging opportunities and mitigate risks, industry leaders should consider a multifaceted strategic approach. Diversifying the supply base across regions with favorable trade agreements can alleviate the impact of further tariff adjustments, while nearshore manufacturing partnerships can secure continuity for mission-critical components. Concurrently, directing R&D investment toward modular front-end architectures will enable faster customization for specific frequency bands and applications purposes.

Cultivating robust relationships with distribution partners, complemented by digital ordering platforms, will expedite market access for new entrants and long-tail segments. Embracing advanced digital twins and AI-driven design tools can further compress development cycles and enhance yield rates, particularly for high-frequency devices. Finally, establishing cross-industry consortiums to define interoperability standards will streamline integration efforts and reinforce customer confidence in multi-vendor RF signal chain solutions.

Detailing Robust Research Methodologies Underpinning Comprehensive Analysis of RF Signal Chain Components and Market Dynamics

This analysis is grounded in a rigorous, multi-stage research methodology designed to ensure comprehensive coverage and analytical integrity. Primary qualitative insights were obtained through structured interviews with senior executives, product managers, and R&D leaders across leading component manufacturers, OEMs, and system integrators. These conversations provided first-hand perspectives on technology roadmaps, procurement challenges, and application-specific requirements.

Secondary research drew upon a curated set of industry publications, patent filings, conference proceedings, and corporate financial reports, with careful triangulation against trade data and regulatory filings. The segmentation framework was developed by mapping component types against application demands, frequency allocations, and distribution models, then validating the findings through expert workshops. Competitive profiling and regional market assessments integrated quantitative indicators-such as shipment volumes and fab capacities-with qualitative factors, including geopolitical considerations and spectrum policy shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RF Signal Chain Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RF Signal Chain Components Market, by Component Type

- RF Signal Chain Components Market, by Application

- RF Signal Chain Components Market, by Frequency Band

- RF Signal Chain Components Market, by Distribution Channel

- RF Signal Chain Components Market, by Region

- RF Signal Chain Components Market, by Group

- RF Signal Chain Components Market, by Country

- United States RF Signal Chain Components Market

- China RF Signal Chain Components Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives for Stakeholders in the RF Signal Chain Ecosystem

In synthesizing these findings, it is clear that the RF signal chain market is at a pivotal juncture characterized by rapid technological evolution, shifting trade dynamics, and nuanced regional variations. The drive toward higher frequencies and tighter integration is reshaping component value propositions, while tariff-induced cost pressures are redefining supply chain strategies. Segmentation insights highlight differentiated growth pockets across automotive, aerospace, telecom, and emerging sectors, each with unique performance and qualification demands.

Regional analysis underscores the importance of localized partnerships and manufacturing footprints, particularly in the Americas and Asia Pacific, where investment incentives and capacity expansions are most pronounced. Competitive intelligence reveals that leading providers are leveraging strategic acquisitions, proprietary material platforms, and co-development models to maintain differentiation. As stakeholders navigate this complex ecosystem, the need for agile decision-making and proactive technology roadmapping has never been more critical.

Engaging with Expert Guidance to Secure In-Depth RF Signal Chain Market Research Insights Tailored for Strategic Decision-Making

For tailored guidance on navigating the intricate dynamics of RF signal chain components and leveraging the latest market intelligence, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will provide you with an in-depth understanding of component trends, tariff impacts, regional shifts, and competitive strategies critical to making informed decisions. By connecting directly, you can secure exclusive access to the full research report, obtain customized data extracts aligned with your strategic priorities, and arrange a personalized briefing to align insights with your organization’s goals. Take this opportunity to empower your team with actionable market knowledge and partner with an expert who can deliver the clarity and competitive edge needed in today’s fast-evolving RF signal chain landscape.

- How big is the RF Signal Chain Components Market?

- What is the RF Signal Chain Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?