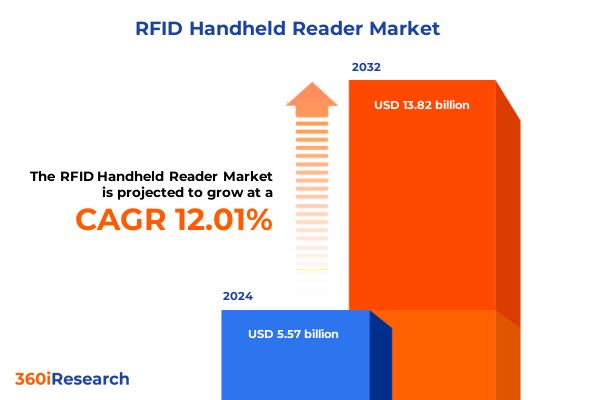

The RFID Handheld Reader Market size was estimated at USD 6.21 billion in 2025 and expected to reach USD 6.93 billion in 2026, at a CAGR of 12.10% to reach USD 13.82 billion by 2032.

Revolutionizing Asset Tracking: Unveiling the Strategic Role of RFID Handheld Readers in Modernizing Operations and Elevating Supply Chain Visibility

The evolution of asset tracking and inventory management has accelerated dramatically, driven by the need for real-time visibility and operational efficiency across industries. RFID handheld readers have emerged as pivotal tools in this transformation, offering portable solutions that facilitate rapid scanning of tags in dynamic environments such as warehouses, retail floors, and field service operations. By integrating advanced sensor modules, enhanced battery diagnostics, and robust microprocessors, these handheld devices have moved beyond mere data collectors to become intelligent nodes within the broader Internet of Things ecosystem. As enterprises seek to overcome challenges like labor shortages, counterfeiting, and logistical bottlenecks, RFID handheld readers are positioned to deliver significant returns through labor optimization and enhanced data accuracy.

As we stand at the convergence of digitalization and automation, the strategic importance of portable RFID readers cannot be overstated. Organizations deploying these readers gain immediate insights into asset locations, stock levels, and movement histories, enabling proactive decision-making and minimizing manual reconciliation errors. Moreover, ongoing enhancements in wireless protocols and multiprotocol interoperability ensure compatibility with varied tag formats, supporting enterprises in standardizing their operations across global supply chains. This introduction sets the stage for an in-depth examination of the transformative technologies, policy impacts, segmentation dynamics, and regional nuances that will define the future trajectory of RFID handheld reader adoption.

Harnessing the Convergence of AI, Edge Computing, and 5G to Propel RFID Handheld Readers into Intelligent, Resilient, and Agile Supply Chain Solutions

The RFID handheld reader landscape is being redefined as artificial intelligence algorithms and edge computing capabilities merge with advanced wireless standards and rugged design features. Manufacturers are embedding machine learning inference engines directly into handheld units, enabling real-time analytics on serialized tag data to identify anomalies, predict maintenance needs, and streamline workflows. This shift is evident in recent developments where modular firmware development kits empower integrators to customize filtering algorithms that operate locally on devices, reducing latency and network dependency. Additionally, the rollout of industrial 5G networks is enabling uninterrupted connectivity in sprawling facilities, allowing handheld readers to transmit data instantly to cloud platforms for further analysis.

In parallel, sensor fusion advancements have introduced environmental and motion sensors that contextualize tag reads, distinguishing intentional scans from accidental proximity detections. Power management innovations-such as adaptive sleep modes and intelligent battery diagnostics-have extended operational windows, while ruggedized enclosures ensure reliable performance across temperature extremes and harsh industrial conditions. Software platform providers now offer end-to-end frameworks, including secure over-the-air updates and integration with enterprise resource planning systems, dramatically accelerating deployment timelines. Collectively, these technological convergences are transforming RFID handheld readers into proactive agents that drive efficiency, accountability, and agility across modern supply chains.

Navigating the Ripple Effects of 2025 U.S. Tariff Measures on RFID Handheld Reader Supply Chains, Cost Structures, and Strategic Sourcing Decisions

In 2025, the United States enacted a series of tariff measures targeting electronic components integral to RFID handheld readers, including antennas, microcontroller chips, memory modules, and transceiver assemblies. These new duties have introduced incremental costs throughout the supply chain, compelling manufacturers to reassess their sourcing strategies and production footprints. To counter the impact of elevated import levies, original equipment manufacturers are accelerating near-shoring initiatives and diversifying their supplier base across Asia-Pacific and Europe, thereby reducing reliance on any single manufacturing hub and mitigating exposure to future tariff fluctuations.

The cost pressures have reverberated across end-user verticals such as retail and logistics, where procurement cycles have lengthened and total cost of ownership considerations have become more pronounced. Many solution integrators have responded by bundling hardware with subscription-based software offerings, enabling customers to spread capital expenditures over operational budgets and maintain predictable cost structures. Industry associations are engaging with regulatory bodies to advocate for standardized component classifications, seeking to alleviate inadvertent tariff escalations. Until these dialogues yield definitive policy adjustments, stakeholders must remain agile in their supply chain configurations and prepared to optimize inventory practices in line with evolving trade regulations.

Decoding Market Dynamics Through Component, Frequency, Application, and Vertical Segmentation to Illuminate the Diverse Use Cases Shaping RFID Handheld Adoption

The RFID handheld reader market can be dissected through multiple lenses to reveal nuanced insights into product capabilities and end-use applications. When viewed by component, device architectures converge around five critical modules: antennas optimized for varying read ranges, central processors capable of on-device analytics, non-volatile memory for configuration profiles, power supply solutions balancing capacity and weight, and transceivers tuned for specific frequency protocols. These elements jointly determine a reader’s performance envelope and suitability for distinct environments.

Examining the landscape by frequency band highlights the roles of low-frequency readers in animal tagging and access control, high-frequency devices in secure payments and transit systems, and ultra-high-frequency solutions in high-speed inventory counting and end-to-end product tracking. The versatility of UHF handheld readers enables real-time logistics applications, including fleet management and cold chain monitoring, underscoring the importance of frequency selection in matching hardware to operational requirements.

Application-based segmentation further illustrates how handheld readers facilitate access control and staff management within secure facilities, streamline inventory management across distribution centers, and underpin supply chain management initiatives that encompass both end-to-end product tracking and real-time logistics optimization. Lastly, vertical segmentation underscores the breadth of the market, spanning aerospace and defense, agriculture, automotive and transportation, BFSI, consumer goods and retail, education, energy and utilities, government, healthcare and life sciences, manufacturing, media and entertainment, and travel and hospitality. This multidimensional segmentation framework equips stakeholders with a holistic understanding of device capabilities, ensuring that solution deployments are precisely aligned with the demands of each operational domain.

This comprehensive research report categorizes the RFID Handheld Reader market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Frequency Band

- Application Area

- Vertical

Unpacking Regional Growth Trajectories Across the Americas, EMEA, and Asia-Pacific to Reveal the Unique Drivers and Barriers Influencing RFID Handheld Deployment

Regional disparities in RFID handheld reader adoption stem from varying economic priorities, regulatory environments, and infrastructural readiness. In the Americas, the confluence of robust retail ecosystems and advanced logistics networks has driven substantial investments in handheld solutions. North American enterprises, in particular, are harnessing these devices to enhance inventory accuracy, accelerate warehouse throughput, and elevate customer service through expedited checkout and returns processes. Meanwhile, Latin American markets are gradually embracing portable readers, buoyed by expanding e-commerce and last-mile delivery demands that necessitate improved operational visibility.

In Europe, Middle East & Africa, regulatory mandates around data privacy and product traceability are spurring adoption within manufacturing, healthcare, and public sector applications. Germany and the United Kingdom are spearheading Industry 4.0 initiatives, integrating handheld readers into smart factory and quality assurance workflows. Gulf Cooperation Council countries are prioritizing rugged handheld units for field inspections in energy and utilities, while emerging economies in sub-Saharan Africa are exploring low-cost handheld deployments to support agricultural supply chains and healthcare outreach programs.

The Asia-Pacific region remains the fastest-growing market segment, driven by China’s large-scale retail digitization, Japan’s precision logistics investments, and India’s government-led supply chain modernization efforts. Local device vendors benefit from sizable domestic demand and scale advantages, yet multinational manufacturers are establishing regional R&D centers to customize solutions for diverse operational contexts. Southeast Asia is also witnessing a surge in handheld reader trials as logistics providers seek to optimize cross-border freight movements and cold chain integrity.

This comprehensive research report examines key regions that drive the evolution of the RFID Handheld Reader market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Competitive Landscape by Analyzing Key Industry Players Driving Innovation, Partnerships, and Market Penetration in the RFID Handheld Reader Sector

The competitive landscape for RFID handheld readers is characterized by a blend of established technology giants and agile regional players. Zebra Technologies remains a dominant force, leveraging its rugged mobility heritage to deliver devices tailored for industrial and harsh-environment applications. Its ecosystem approach, which integrates handheld hardware with comprehensive software suites and managed services, has fortified its market position.

Honeywell and Datalogic continue to compete fiercely in sectors such as manufacturing and transportation, differentiating their offerings through ergonomic form factors, extended battery lives, and advanced decoding algorithms that enhance read rates in densely tagged environments. Impinj, while principally known for its tag chip innovations, is collaborating with device OEMs to enable Gen2X-enabled handheld units that deliver up to 40% improvements in reading performance, unlocking new use cases in retail and cold chain operations.

Emerging Chinese manufacturers like Chainway and UROVO are gaining traction by offering cost-competitive solutions optimized for local supply chains and distribution channels. Their strategies often emphasize rapid product cycles and flexible customization, appealing to regional integrators that require localized support. Meanwhile, specialty players such as Avery Dennison focus on inlay and tag technologies but maintain strategic partnerships with reader OEMs to ensure end-to-end system compatibility and performance assurance. These varied competitive approaches underscore the dynamic and evolving nature of the RFID handheld reader sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the RFID Handheld Reader market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alien Technology LLC

- Avery Dennison Corporation

- Balluff GmbH

- Bluebird Inc. by TSC Auto ID Technology Co., Ltd.

- CAEN RFID S.r.l.

- Cipherlab Co.,Ltd.

- Convergence Systems Limited

- Datalogic S.p.A.

- Denso Corporation

- FEIG ELECTRONICS Inc.

- GAO RFID Inc.

- General Data Company, Inc.

- HID Global Corporation

- Honeywell International Inc

- ID Integration, Inc.

- IDRO Co,Ltd.

- Impinj, Inc.

- Invengo Information Technology Co., Ltd.

- Keonn Technologies, S.L.

- Merck & Co., Inc.

- Newland AIDC

- Nordic ID Oyj

- Orion Rfid Solutions

- RFID, Inc.

- RMS Omega Technologies

- SEUIC Technologies Co., Ltd.

- Shenzhen Chafon Technology Co.,Ltd.

- Shenzhen Chainway Information Technology Co., Ltd.

- Shenzhen Jietong Technology Co.,Ltd.

- Shenzhen Rakinda Technologies Co., Ltd.

- Technology Solutions (UK) Ltd.

- Terso Solutions

- Unitech Electronics Co., Ltd.

- UROVO PTE. LIMITED

- Zebra Technologies Corporation

Strategic Roadmap for Industry Leaders to Strengthen Supply Chain Resilience, Leverage Emerging Technologies, and Optimize Deployment of RFID Handheld Readers

Industry leaders must prioritize supply chain resilience by diversifying component sourcing and investing in dual-sourcing strategies that span multiple geographies. Establishing strategic partnerships with both established and emerging vendors can secure preferential access to critical modules while fostering collaborative innovation in firmware optimization and sensor integration. Equally, organizations should accelerate the adoption of edge AI capabilities within handheld readers to enable on-device analytics, anomaly detection, and predictive maintenance workflows that minimize downtime and optimize asset utilization.

To maximize return on investment, decision-makers should explore ‘hardware-as-a-service’ and subscription-based software models that convert capital expenditures into predictable operational costs, thereby aligning budgetary cycles with technology upgrade cadences. Embedding robust data security and compliance frameworks within handheld solutions will safeguard sensitive information and streamline adherence to regional privacy regulations. Finally, focused investment in workforce enablement-through hands-on training programs and certification tracks-will ensure that frontline staff can fully leverage advanced reader functionalities, from multiprotocol scanning to battery diagnostics.

Methodological Framework Combining Primary Interviews, Secondary Data, and Rigorous Triangulation to Ensure Comprehensive and Actionable RFID Market Insights

This research synthesizes both primary and secondary data sources to construct a comprehensive view of the RFID handheld reader market. Primary insights were derived from structured interviews with device manufacturers, system integrators, and end-user organizations, capturing qualitative perspectives on technology adoption, supply chain strategies, and operational challenges. Secondary research encompassed a thorough review of industry white papers, peer-reviewed journals, regulatory filings, and trade association publications to validate market trends and contextualize policy impacts.

Quantitative data was triangulated through analysis of publicly available shipment figures, import/export statistics, and historical adoption rates to ensure robustness and mitigate potential biases. Segmentation frameworks were developed based on component architecture, frequency band deployment, application area utilization, and vertical industry adoption to deliver actionable insights tailored to stakeholder requirements. The culmination of these methodologies ensures that the findings and recommendations presented herein are both credible and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RFID Handheld Reader market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RFID Handheld Reader Market, by Component

- RFID Handheld Reader Market, by Frequency Band

- RFID Handheld Reader Market, by Application Area

- RFID Handheld Reader Market, by Vertical

- RFID Handheld Reader Market, by Region

- RFID Handheld Reader Market, by Group

- RFID Handheld Reader Market, by Country

- United States RFID Handheld Reader Market

- China RFID Handheld Reader Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Insights Highlighting the Critical Interplay of Technological Innovation, Policy Dynamics, and Market Segments Driving Future RFID Handheld Reader Adoption

The RFID handheld reader market stands at a pivotal juncture where technological innovation, trade policy dynamics, and sector-specific demands converge to shape future trajectories. The infusion of AI and edge computing capabilities is elevating device intelligence, while tariff-driven supply chain adjustments underscore the importance of strategic sourcing and operational agility. Segmentation analyses reveal that device design choices-from component selection to frequency optimization-must be closely aligned with application objectives and vertical requirements to realize performance efficiencies.

Regional insights highlight the necessity of tailored deployment strategies that reflect local regulatory landscapes, infrastructure readiness, and end-user priorities. Competitive pressures among global leaders and regional challengers are fostering an environment of rapid iteration and partnership-driven innovation. For organizations seeking to capitalize on the benefits of real-time asset visibility and workflow automation, a proactive approach to technology integration, supplier collaboration, and workforce enablement will be critical. By leveraging the insights and recommendations outlined in this report, stakeholders can navigate complexity, mitigate risks, and unlock new avenues of growth in the evolving RFID handheld reader market.

Engage with Ketan Rohom to Secure Exclusive Access to In-Depth RFID Handheld Reader Market Report and Empower Your Strategic Decision-Making

To explore the full breadth of strategic insights and data-driven analysis on the RFID handheld reader market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through tailored packages, exclusive briefing options, and additional consulting services to align the research with your specific business needs. Empower your decision-making with direct access to the latest market intelligence and actionable recommendations designed to optimize your operational efficiency and competitive positioning.

- How big is the RFID Handheld Reader Market?

- What is the RFID Handheld Reader Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?