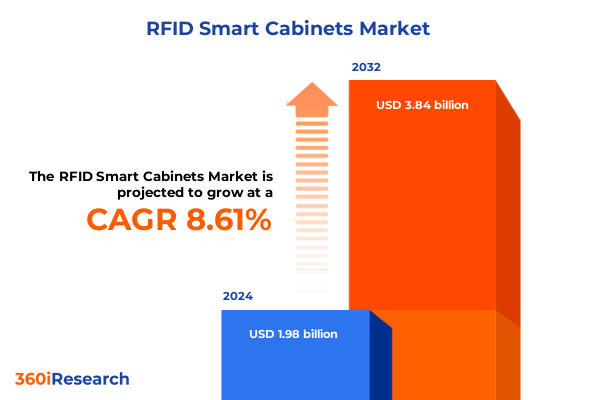

The RFID Smart Cabinets Market size was estimated at USD 2.15 billion in 2025 and expected to reach USD 2.34 billion in 2026, at a CAGR of 8.61% to reach USD 3.84 billion by 2032.

Revolutionizing Intelligent Storage: An Executive Overview of Smart Cabinet Technologies Reshaping Inventory and Asset Management

Intelligent storage solutions are transforming the way organizations manage inventory, secure assets, and deliver critical supplies across industries. RFID-enabled smart cabinets integrate radio frequency identification technology with cabinet hardware, software analytics, and secure access controls to provide end-to-end visibility into stored items. As operational complexity intensifies, executives increasingly recognize the value of real-time tracking to reduce shrinkage, eliminate manual audits, and enhance regulatory compliance. This foundational shift is driving a wave of digital modernization strategies that leverage data-driven insights to optimize workflows.

Against the backdrop of global supply chain disruptions and heightened security demands, the adoption of smart cabinet technologies has accelerated. Stakeholders now prioritize solutions that seamlessly integrate with existing enterprise resource planning systems and security infrastructures. Moreover, the convergence of edge computing and cloud platforms enables near-instantaneous data transmission and remote management. Consequently, organizations can respond more swiftly to inventory shortages, unauthorized access attempts, and maintenance needs. This report opens by mapping the critical drivers, technological enablers, and strategic imperatives shaping the evolution of RFID smart cabinets.

Emerging Convergence of IoT, AI, and Edge Computing Driving the Next Generation of Smart Cabinet Solutions for Enhanced Operational Visibility

The landscape of smart cabinet solutions is undergoing a profound transformation driven by the convergence of the Internet of Things, artificial intelligence, and edge computing. By embedding sensors and RFID readers within cabinet hardware, organizations gain granular visibility into item-level movements and environmental conditions. Simultaneously, analytics engines apply machine learning algorithms to historical utilization patterns, predicting replenishment needs and flagging anomalies. This fusion of connected devices and AI-driven intelligence is reshaping the foundational capabilities of storage systems.

In addition, advancements in low-power wireless communications and miniaturized electronics have enabled more flexible cabinet deployments, reducing installation complexity and total cost of ownership. Integration with enterprise cloud platforms ensures data centralization and secure remote monitoring, while on-premises options address stringent data sovereignty requirements. Strengthened cybersecurity protocols and end-to-end encryption guard against tampering and unauthorized data access. Ultimately, these transformative shifts are equipping organizations with proactive insights that drive continuous process improvement and operational resilience.

Evaluating the Far-Reaching Consequences of 2025 United States Tariffs on RFID Smart Cabinet Supply Chains and Cost Structures

In 2025, the United States government expanded tariff measures targeting electronic components and communications equipment, encompassing RFID readers, antennas, and related cabinet hardware. The aim of these duties is to protect domestic manufacturing and promote supply chain resilience. However, these measures have introduced additional cost layers for importers of smart cabinet components, prompting many solution providers to reevaluate sourcing strategies and negotiate revised agreements with regional suppliers.

As a result of these cumulative duties, manufacturers and integrators have explored alternative production footprints in North America and allied regions to mitigate tariff exposure. Some have accelerated partnerships with domestic electronics assemblers, while others are investing in automated assembly lines to preserve margin structures. Meanwhile, cost pressures have driven innovation in component design, yielding more compact, energy-efficient readers and consolidated antenna arrays that reduce material usage. Consequently, organizations deploying smart cabinets are balancing initial acquisition expenses against long-term benefits in productivity, compliance, and total cost of ownership.

Holistic Examination of End Users, Applications, Components, Deployments, Technologies, and Enterprise Sizes Shaping the RFID Smart Cabinet Market

End user demand for RFID smart cabinets varies significantly by industry, with financial services institutions seeking secure storage for high-value instruments, healthcare providers prioritizing compliance with temperature-sensitive medical supplies, and retail enterprises emphasizing rapid inventory audits. Government and defense organizations leverage integrated authentication and surveillance capabilities to safeguard critical equipment, while manufacturing operations focus on real-time equipment and personnel tracking to maximize uptime and safety. These distinct requirements underscore the importance of tailored solutions that align with sector-specific workflows and regulatory mandates.

Smart cabinet applications span secure access control, asset tracking, cold chain management, and inventory management. Authentication systems and surveillance integration deliver tightly controlled access, while equipment and personnel tracking modules capture location data to optimize resource allocation on the factory floor. In cold chain environments, condition and temperature monitoring sensors ensure that perishable goods remain within strict thresholds, and automated alerts trigger corrective actions. Furthermore, reorder management algorithms and stock level monitoring dashboards streamline restocking processes, reducing stockouts and minimizing carrying costs.

Component selection and deployment mode further refine solution design. Hardware options include RFID antennas, cabinets, and readers calibrated for specific signal ranges and environmental conditions. Service offerings encompass consulting engagements to define requirements, integration services to align with existing IT landscapes, and ongoing support and maintenance contracts. Software suites deliver analytics and reporting functionality alongside inventory management modules. Deployment choices range from cloud-hosted platforms enabling scalable access to on-premises installations that cater to data sovereignty policies. Organizations may select active RFID technologies for long-range tracking or passive RFID for cost-effective item-level identification, with large enterprises typically prioritizing comprehensive, end-to-end managed systems while small and medium-sized enterprises opt for modular, pay-as-you-grow models.

This comprehensive research report categorizes the RFID Smart Cabinets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Mode

- End User Size

- End User Industry

- Application

Regional Dynamics Illuminating Adoption Patterns, Regulatory Considerations, and Strategic Priorities for RFID Smart Cabinets across Major Global Territories

In the Americas, the adoption of RFID smart cabinets has gained momentum across retail and healthcare verticals, where stringent regulatory standards and competitive dynamics drive investments in advanced inventory controls. Integration with supply chain management platforms is common, enabling multi-site visibility and efficient recall management. Moreover, cloud-based offerings have become the default choice for North American organizations seeking rapid scalability and reduced on-premises infrastructure demands, although certain sectors continue to deploy hybrid models to address data security concerns.

Within Europe, Middle East, and Africa, government and defense sectors are primary adopters, capitalizing on secure authentication and advanced surveillance integration. The region’s stringent data protection regulations have spurred demand for on-premises and private cloud deployments to maintain sovereignty over sensitive information. Manufacturing hubs in Germany and France utilize asset tracking and predictive maintenance integrations to uphold high standards of quality and uptime. Furthermore, regional initiatives promoting Industry 4.0 have accelerated the convergence of smart cabinets within broader digital factory ecosystems.

Asia-Pacific markets exhibit robust uptake driven by manufacturing and cold chain industries. Countries such as China, Japan, and South Korea lead in automating perishable goods storage and temperature-controlled pharmaceuticals, leveraging real-time condition monitoring to uphold product integrity. The region also demonstrates rapid adoption of active RFID solutions for long-range tracking in sprawling logistics operations. Cloud-native models have gained ground among domestic enterprises, supported by government incentives for smart logistics and digital transformation programs. Consequently, Asia-Pacific continues to shape global innovation patterns for RFID smart cabinet architectures.

This comprehensive research report examines key regions that drive the evolution of the RFID Smart Cabinets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Strategies Advancing the Evolution of RFID Smart Cabinet Solutions in a Rapidly Changing Industry

A core group of solution providers leads innovation in RFID smart cabinet technologies, with each firm differentiating through unique combinations of hardware performance, software intelligence, and service capabilities. One prominent provider distinguishes its offerings by embedding advanced edge analytics within cabinet enclosures, enabling offline decision-making and reducing reliance on central servers. Another key player offers a comprehensive managed service model, combining 24/7 remote monitoring with proactive maintenance and on-site support to guarantee uptime for mission-critical deployments.

Several market leaders have forged strategic partnerships with enterprise resource planning vendors to deliver pre-integrated solutions that streamline implementations and accelerate time to value. These alliances extend to global system integrators that tailor smart cabinet ecosystems to complex IT architectures in highly regulated sectors. Competition also hinges on software sophistication, with analytics and reporting modules evolving to incorporate machine learning-driven usage forecasting and automated workflow orchestration.

Emerging entrants focus on disruptive pricing models and modular architectures, enabling smaller organizations to adopt advanced features in incremental phases. Meanwhile, established incumbents leverage their global service networks to support large-scale rollouts and multi-geography management. As the industry matures, competitive advantage will increasingly be determined by the ability to deliver seamless interoperability, intuitive user experiences, and value-added professional services.

This comprehensive research report delivers an in-depth overview of the principal market players in the RFID Smart Cabinets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arc Healthcare Technologies

- ASSA ABLOY AB

- Avery Dennison Corporation

- Becton, Dickinson and Company

- Biolog Id

- Cardinal Health, Inc.

- Cencora, Inc.

- ChipCard Solutions GmbH

- Datelka

- Feig Electronic GmbH

- Grifols, S.A.

- Impinj, Inc.

- Lantronix, Inc.

- LogiTag Systems Ltd.

- Mckesson Corporation

- Medical Modular System S.A.

- Mobile Aspects, Inc.

- Omnicell, Inc.

- Palex Medical SA

- SATO Holdings Corporation

- SATO Vicinity Pty Ltd.

- Skytron LLC

- SML Group

- SoluM Co., Ltd.

- Spacecode

- Spacesaver Corporation

- Stanley Black & Decker, Inc.

- Terso Solutions LLC

- Terso Solutions, Inc.

- Turck Group

- Zebra Technologies Corporation

Actionable Strategic Priorities and Implementation Tactics to Maximize the Value of RFID Smart Cabinets for Organizational Transformation

Industry leaders should prioritize modular solution architectures that enable rapid customization to diverse operational requirements, ensuring that core functionality can be extended or scaled as needs evolve. By adopting open standards for RFID protocols and data exchange, organizations can integrate smart cabinets seamlessly with warehouse management systems, security platforms, and analytics engines. Furthermore, establishing strategic alliances with component suppliers and systems integrators will mitigate supply chain disruptions and accelerate deployment timelines.

Organizations must cultivate internal expertise through targeted training programs that cover RFID fundamentals, data analytics, and change management practices. Equipping facility managers and IT teams with hands-on experience ensures a smooth transition from proof-of-concept to enterprise-wide implementation. Additionally, piloting smart cabinet use cases in controlled environments allows teams to validate performance metrics, refine configuration parameters, and measure return on investment before broader rollouts.

To maximize the strategic impact of smart cabinets, decision-makers should leverage data-driven insights to inform cross-functional process improvements. By analyzing usage patterns, access logs, and environmental condition data, organizations can identify inefficiencies, automate replenishment workflows, and proactively address compliance gaps. Moreover, embedding predictive analytics into maintenance schedules extends equipment lifespan and reduces unplanned downtime.

Finally, stakeholders should monitor evolving regulatory frameworks and cybersecurity best practices, collaborating with legal and IT security teams to update governance policies. Implementing multi-factor authentication, role-based access controls, and continuous monitoring mechanisms safeguards against unauthorized access and data breaches. Through these actionable tactics, industry leaders will unlock the full potential of RFID smart cabinets as strategic enablers of operational excellence.

Comprehensive Research Design and Methodological Framework Underpinning the Analysis of RFID Smart Cabinet Market Dynamics

This research combines comprehensive secondary analysis with targeted primary engagement to ensure rigor and relevance. The methodological framework began with an extensive review of industry publications, technical white papers, and regulatory guidelines to establish the foundational context for smart cabinet technologies. Subsequently, a series of structured interviews was conducted with senior executives, technology architects, and end-user professionals across key industries to capture qualitative insights and real-world use cases.

Quantitative data were gathered through vendor surveys and supply chain performance reports, facilitating the triangulation of stakeholder perspectives and vendor claims. Data validation protocols included cross-referencing component specifications, warranty terms, and service level agreements to confirm alignment between reported capabilities and observed deployments. Additionally, an advisory panel of independent subject matter experts reviewed preliminary findings to identify potential blind spots and ensure balanced interpretations.

The research scope encompasses hardware components such as RFID antennas, cabinets, and readers; software modules covering analytics and inventory management; and service categories including consulting, integration, and support. Deployment modes and technology types were evaluated against criteria for scalability, security, and total cost of ownership. Regional market dynamics were assessed through macroeconomic indicators, trade policies, and digital transformation programs.

By adhering to this rigorous research process, the analysis delivers actionable intelligence grounded in empirical evidence and expert validation. The methodology ensures that insights reflect current market dynamics and strategic imperatives for organizations seeking to implement or optimize RFID smart cabinet solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our RFID Smart Cabinets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- RFID Smart Cabinets Market, by Component

- RFID Smart Cabinets Market, by Technology

- RFID Smart Cabinets Market, by Deployment Mode

- RFID Smart Cabinets Market, by End User Size

- RFID Smart Cabinets Market, by End User Industry

- RFID Smart Cabinets Market, by Application

- RFID Smart Cabinets Market, by Region

- RFID Smart Cabinets Market, by Group

- RFID Smart Cabinets Market, by Country

- United States RFID Smart Cabinets Market

- China RFID Smart Cabinets Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Conclusive Perspectives Synthesizing Key Findings to Guide Strategic Decision Making around RFID Smart Cabinet Deployments

The adoption of RFID smart cabinets stands at the intersection of digital transformation, supply chain optimization, and regulatory compliance. Throughout this report, we have examined the pivotal shifts in technology integration, the ramifications of new tariff structures, and the nuanced requirements of varied end user industries. Segmentation analysis highlighted the distinct value propositions for financial services, healthcare, manufacturing, and retail, while regional insights underscored the divergent approaches to deployment in the Americas, EMEA, and Asia-Pacific.

Competitive profiling revealed that success in this market hinges on delivering seamless interoperability, robust analytics capabilities, and comprehensive service offerings. Industry leaders distinguish themselves through strategic partnerships, advanced edge-to-cloud architectures, and a relentless focus on user experience. Actionable recommendations emphasize the need for modularity, open standards, workforce enablement, data-driven process optimization, and vigilant security governance.

In closing, RFID smart cabinets represent a strategic asset for organizations intent on achieving operational excellence, reducing total cost of ownership, and enhancing compliance regimes. The insights presented herein equip decision-makers with the knowledge necessary to navigate supply chain complexities, select best-fit technologies, and implement solutions that deliver measurable business outcomes. With this holistic understanding, stakeholders are well positioned to capitalize on the next wave of intelligent storage innovations.

Explore How Expert Insight from Ketan Rohom Can Empower Your Enterprise to Leverage RFID Smart Cabinets for Unparalleled Operational Efficiency

To explore how this comprehensive intelligence can elevate your strategic initiatives and operational workflows, reach out to Ketan Rohom, Associate Director of Sales and Marketing. He can guide you through the report’s detailed insights and demonstrate how implementing advanced cabinet solutions will drive measurable gains in asset visibility, process efficiency, and regulatory compliance. By engaging directly with Ketan Rohom, you gain a dedicated partner committed to aligning research findings with your organization’s unique objectives and challenges. Connect today to secure your copy of the in-depth market research report and position your enterprise at the forefront of the smart cabinet revolution.

- How big is the RFID Smart Cabinets Market?

- What is the RFID Smart Cabinets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?