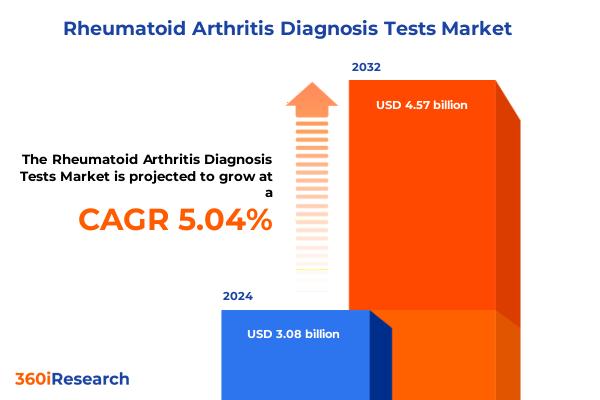

The Rheumatoid Arthritis Diagnosis Tests Market size was estimated at USD 3.23 billion in 2025 and expected to reach USD 3.40 billion in 2026, at a CAGR of 5.05% to reach USD 4.57 billion by 2032.

Overview of Rheumatoid Arthritis Diagnostics: Unveiling the Complexities and Imperatives Driving Market Evolution Beyond Traditional Testing Approaches

Rheumatoid arthritis (RA) represents a complex autoimmune disease characterized by chronic inflammation, progressive joint damage, and systemic involvement. Affecting approximately 1.3 million adults in the United States, RA poses significant clinical and socioeconomic challenges for patients, healthcare providers, and payers alike. Early and accurate diagnosis is critical to slowing disease progression, optimizing therapeutic interventions, and improving long-term patient outcomes. Despite advances in imaging and immunoassay technologies, the heterogeneous presentation of RA-ranging from mild joint stiffness to severe deformities and extra-articular manifestations-continues to complicate timely identification and intervention.

Over the past decade, the diagnostic landscape for RA has expanded to include a diverse array of laboratory and imaging modalities. Traditional tests, such as rheumatoid factor assays and erythrocyte sedimentation rate measurements, have been complemented by more specific anti-citrullinated protein antibody (anti-CCP) evaluations across multiple generations and formats. Concurrently, high-resolution imaging techniques-including ultrasound, magnetic resonance imaging, and advanced CT modalities-provide deeper insights into synovial inflammation and structural changes at early disease stages. These developments underscore the imperative for an integrated diagnostic strategy that combines serological, molecular, and imaging data to ensure precise classification and risk stratification of RA patients.

Emerging Technological Innovations and Regulatory Paradigm Shifts Catalyzing a New Era in Rheumatoid Arthritis Diagnostic Testing Globally

The rheumatoid arthritis diagnostic space is undergoing transformative change driven by both technological innovation and shifting regulatory frameworks. Novel immunoassay platforms, such as multiplex chemiluminescent and fluorescence-based lateral flow assays, are enabling multi-analyte detection with improved sensitivity for early disease markers. Advances in assay automation and digital workflow solutions have further streamlined laboratory operations, reducing turnaround times and unlocking the potential for near-patient testing in specialty clinics and ambulatory settings.

Simultaneously, regulatory agencies worldwide have introduced more stringent guidelines for in vitro diagnostics, mandating comprehensive analytical and clinical performance evaluations under updated IVDR and FDA requirements. These reforms are reshaping market entry pathways and driving consolidation among manufacturers with the resources to navigate complex approval processes. As a result, companies are forging strategic partnerships and investing in robust post-market surveillance capabilities to maintain compliance and respond dynamically to emerging safety and efficacy data.

Assessing the Cumulative Impact of 2025 U.S. Import Tariffs on Rheumatoid Arthritis Diagnostic Reagents, Kits, and Equipment Supply Chains

In 2025, U.S. trade policy implemented a universal 10% tariff on imported goods, followed by country-specific escalations that have cumulatively impacted diagnostic reagents and equipment integral to rheumatoid arthritis testing. Chinese imports now face effective duties approaching 145% on lab-related items, while non-USMCA goods from Canada and Mexico incur 25% tariffs, substantially elevating the cost basis for anti-CCP kits, CRP reagents, and automated immunoassay consumables.

These tariffs have disrupted global supply chains, prompting U.S. laboratories and manufacturers to reevaluate sourcing strategies. Many have shifted toward domestic distributors or alternative low-tariff jurisdictions, yet legacy agreements with European and Asian suppliers continue to expose stakeholders to elevated duty structures. The resultant price pressures threaten diagnostic affordability and may slow adoption of next-generation assays, underscoring the need for proactive supply chain resilience measures and advocacy for targeted tariff exemptions on critical healthcare goods.

Deep-Dive Analysis of Critical Segmentation Dimensions Shaping the Rheumatoid Arthritis Diagnostics Landscape Across Test Types, Technologies, and End Users

A granular understanding of market segmentation is essential to navigating competitive dynamics and prioritizing investment areas within the rheumatoid arthritis diagnostics ecosystem. By test type, anticcp evaluations have evolved through first, second, and third-generation CCP formats, each offering progressively enhanced specificity and predictive value for early RA detection; traditional CRP assays now coexist with high-sensitivity methods capable of identifying low-level inflammatory signals, while ESR measurements have transitioned toward automated platforms that improve throughput and accuracy. Imaging modalities have diversified beyond X-ray to include ultrasound, MRI, and CT solutions, supporting multi-tissue assessment and quantification of synovial inflammation, and rheumatoid factor testing leverages IgA, IgG, and IgM subclasses to refine diagnostic granularity and risk profiling.

From a technology standpoint, chemiluminescent immunoassays-direct and indirect CLIA-lead in automation and analytical precision, while enzyme-linked immunosorbent assays, both competitive and sandwich formats, remain stalwarts in decentralized lab settings. Immunoturbidimetric assays, including fixed-time and rate-based approaches, enable rapid quantification in high-volume workflows, and lateral flow assays, spanning colloidal gold, fluorescent, and magnetic labels, are advancing point-of-care accessibility. End users range from hospitals and diagnostic laboratories to specialty clinics and ambulatory surgical centers, each with unique requirements for throughput, regulatory compliance, and integration with clinical workflows; sample types-serum, plasma, synovial fluid, and whole blood-drive platform selection and test logistics, highlighting the need for versatile solutions that address diverse specimen matrices.

This comprehensive research report categorizes the Rheumatoid Arthritis Diagnosis Tests market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Sample Type

- End User

Uncovering Regional Dynamics Influencing Adoption and Market Development of Rheumatoid Arthritis Diagnostic Solutions Across Americas, EMEA, and Asia-Pacific

Regional market dynamics in rheumatoid arthritis diagnostics reflect varying healthcare infrastructures, reimbursement environments, and prevalence patterns. In the Americas, robust adoption of anti-CCP and high-sensitivity CRP assays is supported by comprehensive insurance coverage and widespread laboratory automation, while innovations in point-of-care lateral flow formats are beginning to penetrate outpatient and remote care settings.

In Europe, Middle East & Africa, regulatory harmonization under IVDR and CE marking has accelerated the rollout of multiplex immunoassays and digital imaging solutions, though heterogeneous reimbursement frameworks and budget constraints in certain markets temper investment in advanced modalities. Meanwhile, Asia-Pacific is experiencing rapid diagnostic expansion driven by rising RA prevalence, government incentives to localize manufacturing, and growing investment in portable and low-cost testing platforms that address broad access objectives. Each region’s unique payer models and healthcare priorities necessitate tailored market entry strategies and strategic alliances with local distributors and clinical networks.

This comprehensive research report examines key regions that drive the evolution of the Rheumatoid Arthritis Diagnosis Tests market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Movements and Competitive Strategies of Leading Diagnostics Companies Transforming the Rheumatoid Arthritis Testing Arena with Innovative Solutions

Leading diagnostics companies are strategically expanding their portfolios and forging partnerships to capture growth in the RA testing market. Roche has sustained double-digit diagnostics momentum through its Elecsys immunoassay platforms and continuous upgrades to the cobas family of analyzers, reinforcing its position with high-throughput anti-CCP and CRP assays that address both routine and specialist lab settings. Abbott has secured FDA clearance for its ARCHITECT anti-CCP chemiluminescent microparticle immunoassay, enhancing its immunology suite on the i2000SR platform and tapping into volume-driven workflows with robust automation capabilities.

Danaher, through Beckman Coulter and Leica Biosystems, is integrating advanced imaging and immunoturbidimetric solutions, while Siemens Healthineers is pioneering AI-enabled ultrasound and CT modalities tailored to musculoskeletal assessment. Thermo Fisher Scientific and Bio-Rad have broadened reagent offerings across ELISA and lateral flow formats, targeting decentralized laboratories and point-of-care providers. Together, these companies leverage global distribution networks, R&D investments, and service infrastructures to drive both incremental and transformative advances in RA diagnosis.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rheumatoid Arthritis Diagnosis Tests market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Augurex Life Sciences Corp.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Boditech Med Inc.

- Danaher Corporation

- Euro Diagnostica AB

- Eurofins Scientific SE

- Exagen, Inc.

- F. Hoffmann-La Roche Ltd.

- Fujirebio Inc.

- Grifols, S.A.

- Hologic, Inc.

- Luminex Corporation

- MitogenDx, Inc.

- Myriad Genetics, Inc.

- PerkinElmer, Inc.

- Qiagen N.V.

- Quest Diagnostics Incorporated

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Svar Life Science AB

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Tulip Diagnostics Private Limited

Actionable Strategies for Industry Leaders to Navigate Market Complexities, Enhance Diagnostic Capabilities, and Stay Ahead in Rheumatoid Arthritis Testing Innovation

Industry leaders should prioritize investments in agile supply chain models that minimize exposure to tariff risks and ensure continuity of reagent and instrument availability. Co-development partnerships with local manufacturers and strategic stockpiling arrangements can buffer against duty fluctuations while maintaining cost competitiveness. Simultaneously, companies must accelerate the validation and adoption of multiplex, near-patient testing formats to capture growing demand in outpatient and specialty clinic settings.

To navigate evolving regulatory landscapes, cross-functional teams should engage early with FDA and notified bodies to align on analytical and clinical performance requirements, leveraging real-world evidence programs to support post-market surveillance and iterative product enhancements. Strategic alliances with key opinion leaders and integration with digital health platforms will further differentiate offerings, enabling predictive analytics and personalized diagnostic pathways that elevate clinical decision-making and patient care.

Robust Multi-Modal Research Methodology Combining Primary Engagements and Secondary Intelligence to Illuminate Rheumatoid Arthritis Diagnostic Market Insights

The methodology underpinning this market analysis combines comprehensive secondary research with targeted primary engagements. Secondary sources include peer-reviewed literature, regulatory filings, and industry publications, as well as validated trade data and tariff schedules from USTR and the Federal Register. Key academic databases, including PubMed and CDC MMWR reports, were utilized to contextualize epidemiological trends and diagnostic performance metrics.

Primary research involved structured interviews with laboratory directors, rheumatology specialists, and procurement managers across major healthcare networks in North America, Europe, and Asia-Pacific. These dialogues provided actionable insights into purchasing criteria, adoption barriers, and technology preferences. Data triangulation and rigorous validation steps were employed to ensure consistency, accuracy, and objectivity of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rheumatoid Arthritis Diagnosis Tests market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rheumatoid Arthritis Diagnosis Tests Market, by Test Type

- Rheumatoid Arthritis Diagnosis Tests Market, by Technology

- Rheumatoid Arthritis Diagnosis Tests Market, by Sample Type

- Rheumatoid Arthritis Diagnosis Tests Market, by End User

- Rheumatoid Arthritis Diagnosis Tests Market, by Region

- Rheumatoid Arthritis Diagnosis Tests Market, by Group

- Rheumatoid Arthritis Diagnosis Tests Market, by Country

- United States Rheumatoid Arthritis Diagnosis Tests Market

- China Rheumatoid Arthritis Diagnosis Tests Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Conclusive Reflections on the Rheumatoid Arthritis Diagnostics Market Trajectory and Imperatives for Sustained Innovation and Stakeholder Collaboration

As the rheumatoid arthritis diagnostics market enters a phase defined by technological convergence, regulatory rigor, and supply chain volatility, stakeholders must adopt a holistic perspective that balances innovation with operational resilience. The integration of high-sensitivity immunoassays, advanced imaging techniques, and digital analytics presents a compelling roadmap for early and precise RA detection, yet success hinges on agile strategies that mitigate tariff headwinds and adapt to regional complexity.

Collaboration among test manufacturers, healthcare providers, and regulatory authorities will be essential to harmonize standards, expand access, and sustain investment in next-generation diagnostics. By aligning product development with clinical imperatives and market realities, organizations can drive meaningful progress in RA patient care, unlocking new value for payers and providers alike.

Engage with Ketan Rohom to Secure Comprehensive Rheumatoid Arthritis Diagnostics Market Intelligence and Propel Strategic Growth Initiatives Today

Are you ready to transform your strategic approach and gain a clear edge in the rapidly evolving rheumatoid arthritis diagnostics market Reach out to Ketan Rohom to secure comprehensive insights on emerging trends, competitive dynamics, and actionable intelligence that will drive your organization’s growth and innovation

- How big is the Rheumatoid Arthritis Diagnosis Tests Market?

- What is the Rheumatoid Arthritis Diagnosis Tests Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?