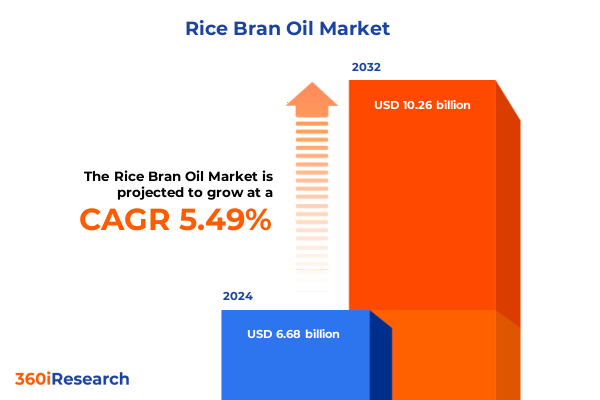

The Rice Bran Oil Market size was estimated at USD 7.03 billion in 2025 and expected to reach USD 7.40 billion in 2026, at a CAGR of 5.53% to reach USD 10.26 billion by 2032.

Introducing Rice Bran Oil’s Emergence as a Nutrient-Rich Versatile Ingredient Driving Sustainability and Innovation Across Multiple Global Industries

Rice bran oil is rapidly emerging as a pivotal ingredient celebrated for its rich nutritional profile, oxidative stability, and versatile applicability across numerous sectors. As global priorities shift toward healthier alternatives and renewable resources, this oil has transcended its traditional culinary roots to assume a strategic role in animal nutrition, cosmetic formulations, industrial applications, and pharmaceutical innovations. Driven by a confluence of consumer health consciousness and corporate sustainability commitments, rice bran oil serves as a model for how agri-based commodities can align with circular economy principles while delivering premium performance.

Moreover, the unique chemical composition of rice bran oil, featuring high levels of oryzanol and balanced fatty acid ratios, offers manufacturers a compelling combination of functional benefits and marketing appeal. In cosmetic and personal care products, its antioxidant properties enhance skin and hair formulations, whereas in industrial contexts its stability under high temperatures makes it a reliable raw material for biodiesel and lubricant production. Transitioning from niche usage to mainstream adoption, rice bran oil now commands attention as a multifaceted resource poised to redefine best practices within processing and application landscapes worldwide.

Uncover the Disruptive Shifts Transforming the Rice Bran Oil Landscape as Sustainability and Innovation Propel Market Evolution

Global momentum toward sustainability and transparency has catalyzed transformative shifts in the rice bran oil landscape, ushering in advanced extraction technologies and heightened consumer demands for clean-label offerings. In recent years, industry leaders have integrated cold-pressing techniques that preserve bioactive compounds and eliminate the need for harsh solvents, marking a departure from conventional hot-extraction processes. Concurrently, digital supply-chain traceability solutions have gained traction, enabling brands to validate origin claims and reinforce trust among discerning buyers.

In parallel, evolving consumer preferences are reshaping product pipelines. Health-focused audiences now seek oils with demonstrable functional properties, prompting manufacturers to innovate specialty blends tailored for nutraceutical and supplement use. Meanwhile, the cosmetic sector has witnessed a surge in formulations featuring rice bran derivatives, with personal care brands touting its antioxidant potency across hair, skin, and body care lines. As these trends converge, strategic partnerships between rice millers, technology providers, and end-use companies are becoming instrumental in unlocking next-generation product offerings and capturing greater value across the value chain.

Examine the Cumulative Effects of United States Rice Bran Oil Tariff Measures on Supply Chains, Cost Structures, and Strategic Sourcing Decisions

Throughout 2025, United States tariff measures targeting imported edible oils have exerted a pronounced influence on rice bran oil supply chains and cost structures. These cumulative duties, introduced in successive phases over the past two years, have incrementally elevated landed costs for processors and end-users alike. As procurement teams grapple with increased import levies, many stakeholders have reevaluated their sourcing strategies, diversifying supplier portfolios to mitigate risk and leveraging long-term contracts to achieve greater price stability.

These dynamics have also prompted ripple effects across downstream product pricing and margin architectures. Manufacturers of food and personal care items have been compelled to absorb portions of higher input costs, while others have selectively passed through incremental charges to consumers, testing elasticity in markets already sensitive to premium positioning. In response, vertically integrated firms have accelerated investments in domestic refining capacities, seeking to curtail exposure to import tariffs. Meanwhile, agile mid-stream operators have optimized inventory timing and freight consolidation, thereby softening the tariff impact and preserving competitiveness in key segments.

Understand Critical Segmentation Insights Revealing How Applications, Types, Forms, Extraction Methods, Distribution Channels, and Packaging Formats Shape Rice Bran Oil Market Dynamics

Insight into rice bran oil segmentation reveals a multifaceted market shaped by nuanced application, type, form, extraction, distribution, and packaging considerations. Within animal feed, refined rice bran oil supports both livestock feed and poultry feed formulations, delivering enhanced energy density and feed conversion efficiencies. In cosmetics, organic cold-pressed variants have gained traction in hair care blends, personal care serums, and skin care creams due to their clean-label credentials and bioactive oryzanol content. The food sector further diversifies usage across bakery operations, culinary applications in home kitchens and restaurant settings, and snack production where stability under baking and frying conditions is essential.

Industrial users favor crude, hot-extracted oil for biodiesel conversion and lubricant manufacturing, where cost optimization and heat resilience rank high on procurement priorities. In pharmaceuticals, refined rice bran oil forms the backbone of numerous nutraceutical and supplement products, providing carriers for fat-soluble vitamins and antioxidants. Distribution channels span offline venues such as convenience outlets, grocery and specialty stores, as well as supermarket and hypermarket environments where shelf presence and product assortment impact purchase behavior. Online, direct sales models and eCommerce platforms facilitate targeted outreach and subscription offerings, unlocking new customer segments.

Packaging formats further influence market reach and operational efficiency. Glass and plastic bottles offer premium positioning for retail consumer goods, while drums and Intermediate Bulk Containers (IBCs) serve bulk buyers in feed, industrial, and pharmaceutical sectors. Sachet and stand-up pouch options accommodate single-serve snack applications and portable personal care kits. These intertwined segmentation dynamics underpin strategic decision-making, as industry participants balance performance attributes, sustainability goals, and cost imperatives to tailor offerings for diverse end-use landscapes.

This comprehensive research report categorizes the Rice Bran Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Extraction Process

- Packaging

- Application

- Distribution Channel

Gain Key Regional Perspectives Illustrating How the Americas Europe Middle East and Africa and Asia Pacific Regions Distinctively Influence Rice Bran Oil Demand and Innovation Patterns

Regional dynamics underscore varied drivers of rice bran oil demand and innovation across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, sustained interest in heart-healthy cooking oils and the burgeoning biodiesel sector have elevated rice bran oil within both culinary and industrial portfolios. Leading food manufacturers and renewable energy firms in North and South America have forged collaborative agreements with Asian producers to secure consistent supply, while research grants in key countries support localized studies on dietary benefits and fuel performance.

Across Europe, the Middle East and Africa, stringent regulatory frameworks and consumer expectations around product provenance and organic certification have spurred premium positioning of organically sourced rice bran oil. Cosmetic brands headquartered in Europe prioritize traceable cold-pressed variants, integrating them into luxury skincare collections. Simultaneously, Middle Eastern markets leverage rice bran oil’s stability and neutral flavor in large-scale catering and food processing applications, and African biodiesel ventures explore its viability as a cost-effective feedstock.

The Asia Pacific region remains the primary hub for production, with several countries leading global rice milling capacities and refining infrastructure. Governments within this region actively encourage value-added processing through subsidies and export incentives, fostering downstream investments and technology transfers. Domestic consumption trends mirror global patterns toward health and wellness, underpinning strong uptake in nutraceutical, personal care, and home cooking segments. These regional nuances collectively illustrate the imperative for tailored market approaches that align with localized regulations, consumer preferences, and supply chain realities.

This comprehensive research report examines key regions that drive the evolution of the Rice Bran Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore Leading Competitive Strategies of Key Industry Players Driving Innovation Partnership and Value Creation Within the Rice Bran Oil Market Ecosystem

Leading industry participants differentiate themselves through strategic integration of upstream sourcing and downstream innovation, forging partnerships that span the rice cultivation to end-use spectrum. Several major players have secured exclusive supply agreements with rice millers to guarantee steady throughput of feedstock, while simultaneously expanding refining capacities to accommodate organic and cold-pressed product lines. In tandem, collaborative research ventures with academic institutions and technology providers have yielded advanced fractionation methods, enabling enriched oryzanol concentrates for premium cosmetic and supplement applications.

Furthermore, top companies are leveraging digital platforms and data analytics to refine demand forecasting and optimize inventory management. Embracing direct-to-consumer eCommerce models, they target health-conscious consumers with personalized product assortments and subscription offerings. Concurrently, multinational food and biofuel firms integrate rice bran oil into broader sustainability agendas, obtaining certifications that validate responsible sourcing and support corporate ESG disclosures. These multifaceted strategies underscore a competitive landscape where innovation, strategic alliances, and operational agility define leadership trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rice Bran Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Wilmar Limited

- Applied Food Sciences, Inc.

- BASF SE

- BCL Industries Limited

- Bunge Limited

- Cargill, Incorporated

- ITC Limited

- Kaleesuwari Refinery

- Kirti Gold

- Marico Limited

- Mr. Gold Oils

- Oryza Oil & Fat Chemical Co., Ltd.

- Patanjali Ayurved Limited

- Raj Oil Mills Ltd.

- RCMDEAL

- Ricela Organics LLP

- Sun River Foods, LLC

- Surinbranoil

- Vaghai Agro Products Ltd.

- Zama Organics

Actionable Strategies for Industry Leaders to Optimize Operations Navigate Regulatory Shifts and Leverage Emerging Consumer and Sustainability Trends in Rice Bran Oil

To thrive in the evolving rice bran oil arena, industry leaders should prioritize adoption of advanced cold-pressing technologies that preserve bioactive constituents and align with clean-label trends. Organizations can further bolster differentiation by pursuing rigorous organic and sustainability certifications, reinforcing consumer trust and unlocking premium pricing opportunities. Moreover, establishing strategic supply partnerships and fostering transparent supplier relationships can mitigate exposure to tariff fluctuations and feedstock shortages, while collaborative R&D initiatives can accelerate development of niche products tailored to high-value cosmetics and nutraceutical segments.

In parallel, decision-makers should optimize distribution strategies by enhancing direct sales channels and leveraging eCommerce platforms for targeted outreach. Tailoring packaging innovations, such as stand-up pouches and single-serve sachets, can address emerging usage occasions and convenience demands. Additionally, implementing integrated digital traceability across the supply chain cultivates resilience and facilitates compliance with evolving regulatory standards. Through these concerted efforts, leadership teams can fortify operational efficiencies, reinforce brand equity, and secure sustainable growth trajectories amid dynamic market conditions.

Delve into a Robust Research Methodology Integrating Comprehensive Primary Interviews Secondary Data Analysis and Expert Validation Procedures

This analysis applies a robust multi-stage research methodology combining comprehensive primary and secondary data collection with qualitative expert validation. Primary research involved in-depth interviews with a cross-section of stakeholders, including rice mill operators, oil processors, end-use manufacturers across food, cosmetics, industrial, and pharmaceutical sectors, and regulatory experts. These dialogues yielded firsthand insights into technology adoption, supply-chain constraints, and innovation priorities.

Secondary research encompassed rigorous review of government trade data, industry publications, and peer-reviewed scientific literature to contextualize market dynamics and validate emerging trends. Key metrics and thematic findings were triangulated across multiple sources to ensure consistency and reliability. Qualitative analyses, including SWOT and PESTLE frameworks, provided structured evaluations of competitive landscapes and macro-environmental influences. Throughout the process, an advisory panel of sector specialists conducted ongoing reviews to refine assumptions and uphold methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rice Bran Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rice Bran Oil Market, by Type

- Rice Bran Oil Market, by Form

- Rice Bran Oil Market, by Extraction Process

- Rice Bran Oil Market, by Packaging

- Rice Bran Oil Market, by Application

- Rice Bran Oil Market, by Distribution Channel

- Rice Bran Oil Market, by Region

- Rice Bran Oil Market, by Group

- Rice Bran Oil Market, by Country

- United States Rice Bran Oil Market

- China Rice Bran Oil Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Reflections Synthesizing How Health Sustainability and Trade Dynamics Shape Future Strategies in the Growing Rice Bran Oil Industry

In summary, rice bran oil has transcended niche applications to become a cornerstone ingredient across diverse sectors, propelled by health-driven consumption, sustainability imperatives, and technological advancements. Segmentation insights highlight how application-specific requirements, product typologies, and distribution modalities intersect to inform strategic positioning, while regional perspectives reveal distinct drivers in the Americas, Europe Middle East and Africa, and Asia Pacific.

Tariff developments in the United States have underscored the importance of agile sourcing and vertical integration, with cumulative duties prompting supply chain realignments and cost management initiatives. Competitive intelligence further illustrates how leading players leverage partnerships, digital platforms, and R&D investments to secure market leadership. Together, these findings equip stakeholders with the analytical foundation necessary to navigate emerging opportunities, mitigate risks, and craft forward-looking strategies in the dynamic rice bran oil sector.

Engage with Ketan Rohom Associate Director of Sales and Marketing to Secure Your Comprehensive Rice Bran Oil Market Research Report and Unlock Growth Opportunities

Ready to elevate your strategic approach with unparalleled market insights, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full rice bran oil market research report and open doors to new growth opportunities

- How big is the Rice Bran Oil Market?

- What is the Rice Bran Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?